Propolis Market Share, Size, Trends, Industry Analysis Report

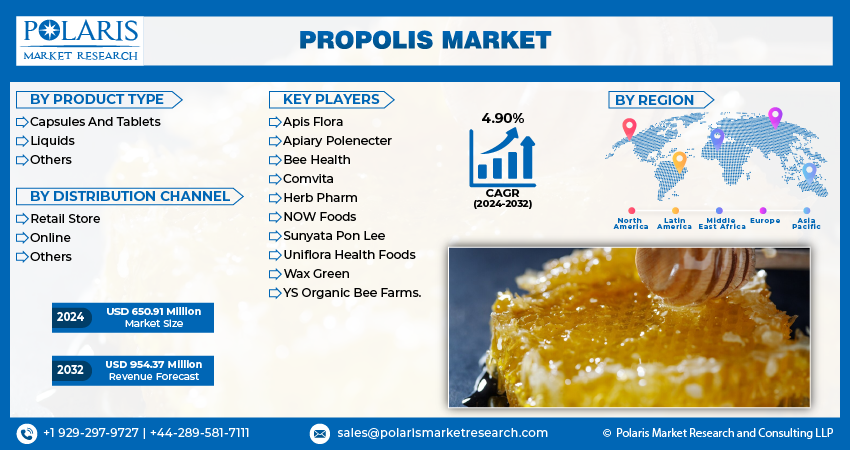

Product Type (Capsules and Tablets, Liquids, Others), By Distribution Channel (Retail Store, Online, Others), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3736

- Base Year: 2023

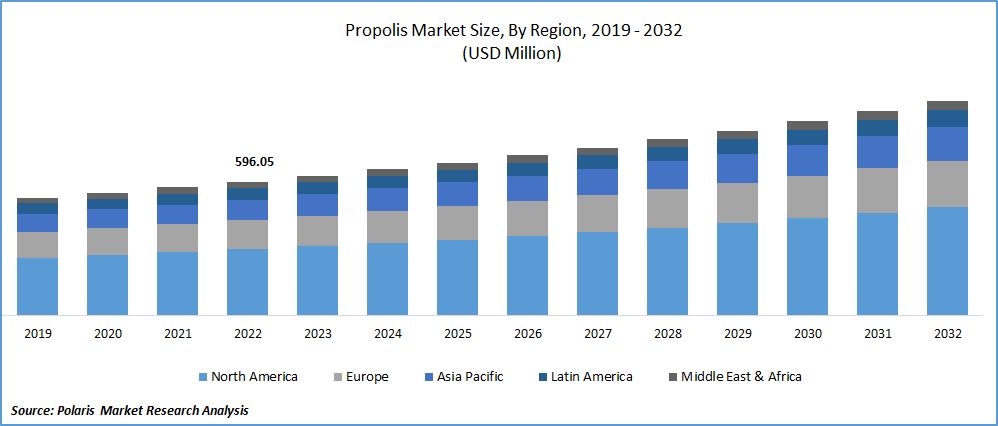

- Historical Data: 2019-2022

Report Outlook

The global propolis market was valued at USD 622.64 million in 2023 and is expected to grow at a CAGR of 4.90% during the forecast period.

Market is experiencing significant growth primarily due to its increasing demand in the pharmaceutical and healthcare industry. Its versatile applications in various dermatology products, such as treatments for burns, acne, fungal infections, & neuro-dermatitis, contribute to its expanding popularity. Moreover, propolis finds use in ointments & cancer treatments as it exhibits properties that can inhibit the growth and multiplication of the cancerous cells. Propolis, a substance made from bees from the buds of the cone-bearing & poplar trees, is generally obtained from beehives as it is rarely available in pure form. Its application extends to the treatment of cold sores, diabetes, & oral mucositis, further contributing to its rising demand in recent years.

To Understand More About this Research: Request a Free Sample Report

The increasing rate of herpes simplex virus type 1 and type 2 infections is a major driver propelling the growth of the propolis market. These infections are responsible for causing cold sores and painful blisters, which can significantly impact the quality of life for those affected. The World Health Organization (WHO) reported in 2020 that genital herpes infection plays a crucial role in the spread of HIV infection. This highlights the importance of addressing herpes infections to prevent further health complications.

In the United States, genital herpes is a significant health concern, with a large population affected by the condition. According to a survey conducted by the Centers for Disease Control and Prevention (CDC) in 2019, approximately 572,000 individuals were suffering with genital herpes. This high prevalence underscores the need for effective treatment options. Propolis ointment has been found to be effective in treating cold sores and blisters caused by herpes infections. Due to its potential therapeutic properties, the demand for propolis ointment is expected to witness significant gains over the forecast period as more people seek relief and treatment for their herpes-related symptoms.

Covid-19 pandemic had a detrimental impact on the supply chain, causing challenges for beekeepers and bees alike. With many countries implementing lockdowns, bee farmers faced difficulties in relocating their bees both within and across international borders. Therefore, numerous bees suffered from starvation and perished, leading to a reduction in propolis production. Moreover, the distribution channel of the propolis market was also negatively affected as specialty stores were forced to close, and restrictions were imposed on online deliveries during the lockdown period. These constraints further hindered the smooth flow of propolis products to consumers, exacerbating the challenges faced by the industry during the pandemic.

Industry Dynamics

Growth Drivers

Rising health awareness and increased disposable income

Growth driven by an increasing consumer focus on health and well-being. As people become more health-conscious, they are inclined to seek products that offer potential health benefits, which includes propolis due to its reported therapeutic properties. Improvement in living standards and an increase in health expenditure also play a role in driving market growth. As people's economic conditions improve, they are more willing to invest in products that can potentially enhance their health and quality of life. This includes spending on natural supplements and remedies like propolis.

Surge in disposable income is another contributing factor to the market's growth. With higher disposable income, consumers have greater purchasing power and are more likely to explore and invest in products that offer health and wellness benefits. Large-scale promotion of processed propolis has also had a positive impact on market growth. As the benefits of propolis become more widely known, and its applications in various products, such as dietary supplements and skincare products, are promoted, the demand for propolis is likely to increase.

Report Segmentation

The market is primarily segmented based on product type, distribution channel, and region.

|

By Product Type |

By Distribution Channel |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Type

Capsules & tablets segment accounted for the largest share in 2022

Capsules & tablets segment held the largest share in 2022. It is highly favored by customers due to its simplicity and ease of use. Capsules and tablets of propolis are widely used for treating various diseases and are known for their immune-boosting properties. Additionally, they serve as popular dietary supplements, further bolstering the sales in the industry.

Liquid segment will grow at rapid pace. Factors such as increasing consumer interest in liquid propolis products, rising disposable incomes, and evolving lifestyles contribute to the overall growth of the industry. Additionally, the benefits of liquid propolis in improving digestion issues further add to its appeal, resulting in a projected increase in demand soon. As a result, the segment is expected to experience substantial growth over the forecast period

By Distribution Channel

Retail stores segment held the largest shares in the market

Retail stores held the largest shares of the market. This segment's leading position is attributed to the growing demand for propolis products among customers, primarily due to the wide variety offered by retail stores compared to other distribution channels. Retail stores typically offer a diverse range of propolis products, including capsules, tablets, liquid extracts, creams, ointments, and other formulations. This variety caters to different customer preferences and requirements, making it convenient for consumers to find the specific propolis product that suits their needs.

Online channels will grow at rapid pace. This growth can be attributed to several factors that make online platforms an attractive option for purchasing propolis. One significant advantage of the online distribution channel is the availability of propolis products at a lower price compared to traditional retail stores. Online retailers often offer competitive prices due to reduced operational costs, allowing consumers to find propolis products at more affordable rates. Moreover, online platforms provide various benefits such as discounts, coupon benefits, and other promotional offers. These incentives further attract customers and encourage them to purchase propolis products online.

Regional Analysis

North America region dominated the global market in 2022

North America held the largest share and dominated the global market. This can be attributed to the high demand for propolis in countries like the U.S. and Canada. The increasing cases of the genital herpes in the U.S. have also contributed to the rising demand for propolis in this region. Country is among the leading countries with the highest number of genital herpes cases and other herpes viruses. Furthermore, the industry is expected to witness significant growth in the region due to the rising import demand for propolis. As consumers become more aware of the potential health benefits and therapeutic properties of propolis, the demand for the product is anticipated to grow steadily over the forecast period.

Asia Pacific will grow at rapid pace. The rise in disposable income among consumers is also contributing to the market's growth, as people are more willing to invest in products that offer potential health benefits like propolis. Moreover, the increasing cases of cancer in the region are expected to further accelerate the market's growth. As propolis is being explored for its potential applications in cancer treatment, the rising incidence of cancer is likely to boost the demand for propolis products.

Key Market Players & Competitive Insights

The propolis market is characterized by intense competition driven by a growing awareness of its diverse health benefits and applications across various industries. Key players in the market are vying for market share through strategies such as product innovation, extensive research and development activities, and strategic collaborations. The market's competitive landscape is influenced by sourcing quality raw materials, ensuring product authenticity, and maintaining sustainable harvesting practices. As consumer preferences shift towards natural and organic products, companies are focusing on effective marketing strategies to highlight propolis's unique antimicrobial, antioxidant, and anti-inflammatory properties, further intensifying the competition in the global market.

- Apis Flora

- Apiary Polenecter

- Bee Health

- Comvita

- Herb Pharm

- NOW Foods

- Sunyata Pon Lee

- Uniflora Health Foods

- Wax Green

- YS Organic Bee Farms.

Recent Developments

- In June 2023, Comvita, a renowned provider of authentic Manuka honey, has recently introduced Immune Bee Propolis, a new product with double the amount of active ingredients in a single daily dose.

- In January 2021, INW (Innovations in Nutrition + Wellness), a prominent player in custom research and development in the nutrition and wellness industry, has recently acquired Bee Health, a supplement manufacturer. This acquisition is aimed at enhancing INW's presence and expansion in the market.

- In September 2021, Comvita Ltd recently revealed a strategic partnership with the Caravan, collaborate with the Creative Artists Agency (CAA), an entertainment and sports agency. Through this new partnership, Comvita aims to raise consumer awareness about the advantageous qualities of Ma?nuka Honey & Propolis.

Propolis Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 650.91 million |

|

Revenue forecast in 2032 |

USD 954.37 million |

|

CAGR |

4.90% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Product Type, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in propolis market are Apiary Polenecter, Apis Flora, Herb Pharm, Uniflora Health Foods, Bee Health.

The global propolis market is expected to grow at a CAGR of 4.9% during the forecast period.

The propolis market report covering key segments are product type, distribution channel, and region.

key driving factors in industrial propolis market are growing use of propolis in functional food and beverages.

The global propolis market size is expected to reach USD 954.37 million by 2032.