Propylene Glycol Market Size, Share, Trends, & Industry Analysis Report

By Grade (Pharmaceutical & Food Grade, Industrial Grade), By Source, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 130

- Format: PDF

- Report ID: PM1841

- Base Year: 2024

- Historical Data: 2020-2023

Overview

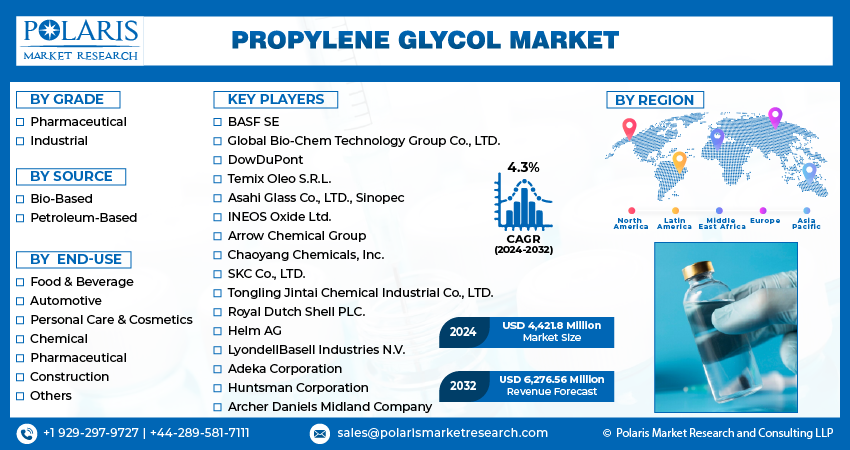

The global propylene glycol market size was valued at USD 4.81 billion in 2024, growing at a CAGR of 4.3% from 2025–2034. Key factors driving demand is rising use in food and beverage industry, and growing demand from the automotive industry.

Key Insights

- The pharmaceutical & food grade equipment segment is expected to grow at a CAGR of 4.2% during the forecast period, driven by increasing health consciousness, stringent safety regulations, and rising consumption of processed foods and personal care products.

- In 2024, the pharmaceutical segment captured a significant 10.68% share of global revenue, largely due to its vital role as a carrier for active pharmaceutical ingredients in drug formulations.

- The Asia Pacific propylene glycol market accounted for 37.29% of the global revenue in 2024, fueled by rapid industrialization, urban expansion, and increasing demand from key end-use sectors such as automotive, pharmaceuticals, and food & beverages.

- North America is projected to register a CAGR of 4.4% over the forecast period, driven by consistent demand from the region’s well-established automotive, pharmaceutical, and food industries.

- In the United States, market growth is being propelled by a robust industrial base and strict regulatory standards, with strong government support playing a key role in driving demand for high-quality propylene glycol across sectors.

Industry Dynamics

- Rising use in food and beverage industry are driving the demand for propylene glycol.

- Growing demand from the automotive industry is driving the propylene glycol market

- The growth in construction, manufacturing, and electronics sectors fuels the need for industrial-grade propylene glycol.

- Strict environmental regulations and health concerns related to excessive consumption or exposure to synthetic propylene glycol limits the growth.

Market Statistics

- 2024 Market Size: USD 4.81 Billion

- 2034 Projected Market Size: USD 7.31 Billion

- CAGR (2025-2034): 4.3%

- Asia Pacific: Largest Market Share

AI Impact on the Industry

- AI enhances production efficiency by optimizing chemical reaction parameters and real-time process control, leading to higher yield and reduced energy consumption in propylene glycol manufacturing.

- AI-powered supply chain analytics improve demand forecasting, inventory management, and logistics planning, enabling more resilient and cost-effective distribution of propylene glycol across industries.

- AI-driven quality control systems use machine learning and computer vision to detect impurities and ensure consistent purity levels, especially critical in pharmaceutical and food-grade propylene glycol.

- Predictive maintenance powered by AI helps monitor equipment used in glycol production, reducing unplanned downtime, lowering maintenance costs, and extending asset life.

- AI-supported market analysis tools assist manufacturers in identifying emerging trends, regulatory shifts, and consumer demand patterns, enabling faster, data-driven strategic decisions.

Propylene Glycol is a colorless, odorless, and slightly viscous liquid used as a solvent, humectant, and preservative in various industries. It is commonly found in food, pharmaceuticals, cosmetics, and industrial applications like antifreeze and de-icing solutions. Produced from petroleum or bio-based sources, it is generally recognized as safe (GRAS) when used appropriately.

There is a growing demand for eco-friendly and sustainable chemicals due to environmental concerns and stricter regulations on petrochemicals. This has led to increased interest in bio-based propylene glycol, which is produced from renewable resources such as corn and soy. Bio-based variants offer the same performance as petroleum-based glycol but with a lower carbon footprint. Companies and consumers are increasingly favoring products with sustainability certifications, which is pushing manufacturers to invest in bio-based production methods. This shift toward greener alternatives is creating new opportunities and driving the propylene glycol industry in a more environmentally responsible direction.

Propylene glycol is used in a wide range of industrial applications, from heat transfer fluids and hydraulic systems to plastic production and paint formulations. It helps improve product performance by acting as a lubricant, carrier fluid, or processing aid. The demand for reliable, safe, and cost-effective chemicals such as propylene glycol also increases as industrial activity continues to grow, especially in Asia-Pacific and other developing regions. Furthermore, the growth in construction, manufacturing, and electronics sectors fuels the need for industrial-grade propylene glycol, thereby fueling the growth.

Drivers & Opportunities

Rising Use in Food and Beverage Industry: Propylene glycol is commonly used in the food and beverage industry as a food additive, solvent, and preservative. It helps maintain moisture in food products and improves texture and shelf life. It is widely used in processed foods, baked goods, and flavorings because it is considered safe by food regulatory authorities like the FDA. The growing global demand for packaged and convenience foods especially in urban areas is driving the increased use of propylene glycol. According to the U.S. Census Bureau, in July 2025, an estimated retail food sales was worth USD 726.3 billion in U.S. alone. This consumer preferences shifting toward ready-to-eat and long-lasting food items is fueling the demand for propylene glycol, thereby driving the growth.

Growing Demand from the Automotive Industry: The automotive industry is expanding worldwide driven by rising disposable income and need for convivence. According to the Organization of Motor Vehicle Manufacturers, in 2024 the automotive production was 92,504,338 units globally. Propylene glycol is widely used in the production of antifreeze and coolant fluids, which help regulate engine temperature and prevent freezing or overheating. The need for such fluids increases as vehicle production continues to rise globally. Additionally, the growing demand for electric vehicle and hybrid vehicles is contributing to the use of thermal management fluids made from propylene glycol, thereby boosting the growth of the industry.

Segmental Insights

Grade Analysis

Based on grade, the segmentation includes pharmaceutical & food grade, and industrial grade. Pharmaceutical & food grade equipment segment is projected to grow at a CAGR of 4.2% over the forecast period due to growing health awareness, strict safety regulations, and increased consumption of processed foods and personal care products. In the pharmaceutical sector, its use as a solvent in oral, injectable, and topical drugs drives growth, especially with the global expansion of the healthcare industry. Meanwhile, in food and beverages, propylene glycol is widely used as a food additive and preservative. The consumption of ready-to-eat products is increasing with rising disposable incomes and urbanization, further boosting the demand for high-purity, safe-grade propylene glycol, thereby fueling the segment growth.

Source Analysis

Based on source, the segmentation includes petroleum-based propylene glycol, and bio-based propylene glycol. Bio-based propylene glycol segment is expected to witness a significant share over the forecast period due to increasing environmental concerns and the global shift toward sustainable and renewable chemical sources. Regulatory pressures to reduce carbon emissions and consumer demand for eco-friendly products are driving the demand. Industries are adopting greener alternatives to petroleum-based glycols to align with sustainability goals and improve brand perception. Technological advancements in bio-refining and the availability of agricultural feedstocks further make bio-based glycol more economically viable. Consequently, manufacturers are investing in bio-based production methods, thereby fueling the growth of this segment.

End User Analysis

In terms of end user, the segmentation includes food and beverage, automotive, personal care and cosmetics, chemical, pharmaceutical, construction, and others. The automotive held 24.63% of revenue share in 2024 as propylene glycol is extensively used as an antifreeze and coolant, which are essential for engine efficiency and temperature regulation. The growing global vehicle fleet, especially in emerging region fuels the demand. the demand for high-quality automotive fluids is on the rise with increased focus on vehicle maintenance, fuel efficiency, and performance. Additionally, as electric and hybrid vehicles become more common, the need for advanced thermal management systems is increasing, further boosting the use of propylene glycol in modern automotive applications.

The pharmaceutical segment held significant revenue share in 2024, holding 10.68% due to its role as a carrier for active pharmaceutical ingredients in medications. It is commonly used in syrups, tablets, creams, and injectables. The growing aging population, rising chronic disease rates, and expanding access to healthcare are boosting pharmaceutical production globally. Furthermore, the increase in generic drug manufacturing and demand for over-the-counter medicines contributes to the growing need for excipients such as propylene glycol. Moreover, its non-toxic nature and approval by global health authorities make it a preferred ingredient, further driving its use in pharmaceutical formulations.

Regional Analysis

Asia Pacific propylene glycol market accounted for 37.29% of global revenue share in 2024 due to rapid industrialization, urbanization, and rising demand from major end-use industries like automotive, pharmaceuticals, and food & beverage. Increasing disposable incomes and expanding middle-class populations are driving higher consumption of processed foods and personal care products, both of which use propylene glycol. Additionally, the region’s growing pharmaceutical manufacturing base and supportive government initiatives for healthcare and industrial development further support demand. The availability of raw materials and cost-effective manufacturing capabilities further fuels the growth in the Asia Pacific region.

China Propylene Glycol Market Insight

The China held 37.94% of the revenue share within Asia Pacific in 2024, due to its large manufacturing sector and high domestic demand across several industries. The country’s booming automotive industry, which requires large volumes of antifreeze and coolants, fuels significant consumption. In pharmaceuticals and cosmetics, rising health awareness and increasing consumer spending are boosting demand for high-purity propylene glycol. Additionally, government focus on environmental regulations is encouraging the adoption of bio-based alternatives, spurring innovation and investment in greener production. China's strategic role in global chemical supply chains further makes it a central player in both production and consumption of propylene glycol.

North America Propylene Glycol Market

The market in North America is expected to register a CAGR of 4.4% during the forecast period driven by strong demand from the automotive, pharmaceutical, and food industries. Technological advancements and a high emphasis on product safety and quality in manufacturing create stable growth conditions. Environmental regulations are pushing companies to invest in bio-based and sustainable alternatives, further expanding opportunities. The region’s robust pharmaceutical sector, coupled with high healthcare spending and R&D investments, further fuels demand. Additionally, well-developed logistics and supply chains support efficient distribution of propylene glycol across industries drives the growth in the region.

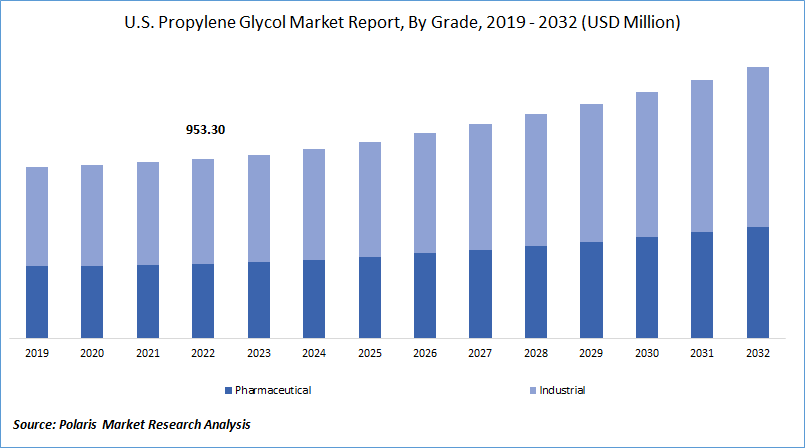

U.S. Propylene Glycol Market Overview

The demand in U.S. is rising driven by strong government driven by its advanced industrial base and strict safety standards. The country's strong pharmaceutical sector, supported by high healthcare spending and growing demand for OTC drugs, leads to consistent use of pharmaceutical-grade propylene glycol. The food and beverage industry also contributes significantly due to the popularity of processed and convenience foods. Moreover, increasing adoption of bio-based chemicals, supported by environmental policies and consumer awareness, is encouraging domestic production of sustainable propylene glycol, thereby boosting the growth.

Europe Propylene Glycol Market

The industry in the Europe is projected to grow at a CAGR of 3.5% from 2025 to 2034, driven by strong environmental regulations, rising demand for sustainable products, and a mature industrial base. The European Union’s push for green chemistry and reduced carbon emissions is encouraging the shift from petroleum-based to bio-based propylene glycol. Additionally, Europe has a well-established pharmaceutical and cosmetics industry, both of which rely on high-purity propylene glycol as a key ingredient. Growing consumer preference for clean-label and eco-friendly products further supports expansion. Moreover, the region's advanced automotive sector, focused on efficiency and innovation drive demand for propylene glycol in coolants and lubricants, thereby boosting the growth.

Key Players & Competitive Analysis

The competitive landscape of the propylene glycol market is characterized by the presence of several global and regional players focusing on production efficiency, sustainability, and expansion of application areas. Key companies such as BASF SE, Dow Chemicals, and LyondellBasell lead the market with strong distribution networks and diversified product portfolios. Bio-based propylene glycol is gaining traction, driving innovation from players like Global Bio-Chem Technology Group and Archer-Daniels-Midland Company. Strategic collaborations, mergers, and capacity expansions are common as companies aim to strengthen their market positions. Asian manufacturers like Sinopec, Asahi Glass Co., LTD., and SKC are rapidly expanding their presence due to growing regional demand. Meanwhile, companies such as INEOS Oxide Ltd. and Royal Dutch Shell PLC leverage vertical integration for cost advantages. Sustainability, price volatility of raw materials, and regulatory compliance remain key competitive factors shaping industry dynamics.

Key Players

- Adeka Corporation

- Archer-Daniels-Midland Company

- Asahi Glass Co., LTD.

- BASF SE

- Chaoyang Chemicals, Inc.

- Dow Chemicals

- Global Bio-Chem Technology Group Co., LTD.

- Helm AG

- Huntsman International LLC

- INEOS Oxide Ltd.

- LyondellBasell Industries Holdings B.V.

- Royal Dutch Shell PLC

- Sinopec

- SKC

- Sumitomo Chemicals

- Temix Oleo S.R.L.

Industry Developments

April 2025, Platts, part of S&P Global Commodity Insights, launched weekly spot price assessments for propylene glycol in Northwest Europe, covering industrial, pharmaceutical, and fragrance grades to enhance market transparency and pricing accuracy.

March 2024, Dow launched two sustainable propylene glycol solutions Propylene Glycol CIR and REN in North America, using bio-circular and circular feedstocks. These ISCC PLUS-certified products support various industries with high-performance, environmentally friendly alternatives, reinforcing Dow’s commitment to sustainable innovation.

Propylene Glycol Market Segmentation

By Grade Outlook (Revenue - USD Billion; Volume – Kilotons; 2021–2034)

- Pharmaceutical & Food Grade

- Industrial Grade

By Source Outlook (Revenue - USD Billion; Volume – Kilotons; 2021–2034)

- Petroleum-Based Propylene Glycol

- Bio-Based Propylene Glycol

By End User Outlook (Revenue - USD Billion; Volume – Kilotons; 2021–2034)

- Food and Beverage

- Automotive

- Personal Care and Cosmetics

- Chemical

- Pharmaceutical

- Construction

- Others

By Regional Outlook (Revenue - USD Billion; Volume – Kilotons; 2021–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Propylene Glycol Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.81 Billion |

|

Market Size in 2025 |

USD 5.01 Billion |

|

Revenue Forecast by 2034 |

USD 7.31 Billion |

|

CAGR |

4.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.81 billion in 2024 and is projected to grow to USD 7.31 billion by 2034.

The global market is projected to register a CAGR of 4.3% during the forecast period.

Asia Pacific dominated the market in 2024

A few of the key players in the market are Adeka Corporation; Archer-Daniels-Midland Company; Asahi Glass Co., LTD.; BASF SE; Chaoyang Chemicals, Inc.; Dow Chemicals; Global Bio-Chem Technology Group Co., LTD.; Helm AG; Huntsman International LLC; INEOS Oxide Ltd.; LyondellBasell Industries Holdings B.V.; Royal Dutch Shell PLC; Sinopec; SKC; Sumitomo Chemicals; Temix Oleo S.R.L.

The pharmaceutical and food grade segment dominated the market revenue share in 2024.

The pharmaceutical segment is projected to witness the fastest growth during the forecast period.