Radar Simulator Market Share, Size, Trends, Industry Analysis Report

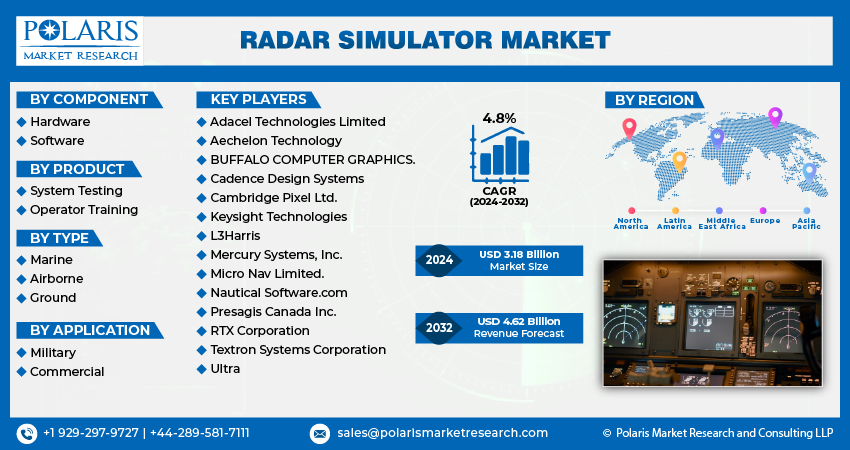

By Component (Hardware, Software), By Product (System Testing, Operator Training), By Type (Marine, Airborne, Ground), By Application (Military, Commercial), By Region Segment Forecasts, 2024 - 2032

- Published Date:Feb-2024

- Pages: 120

- Format: pdf

- Report ID: PM4261

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

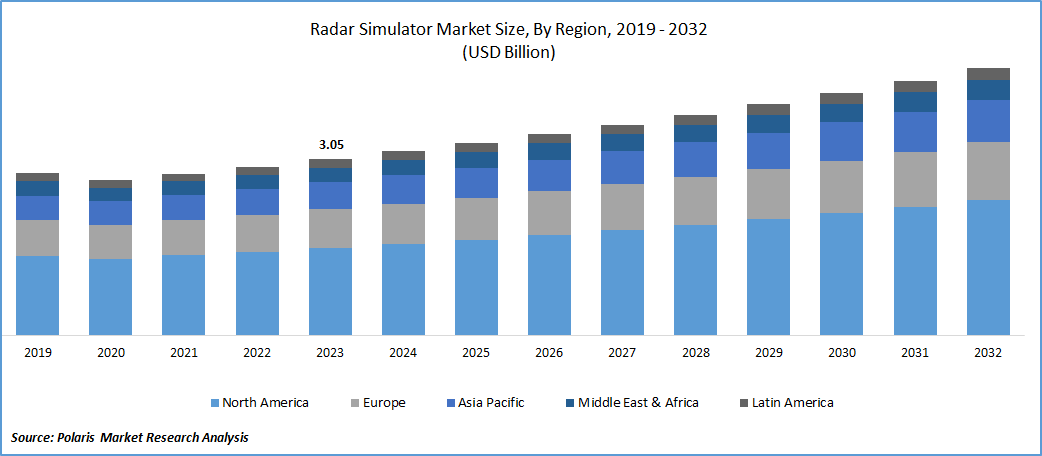

The global radar simulator market size and share was valued at USD 3.05 billion in 2023 and is expected to grow at a CAGR of 4.8% during the forecast period.

Growth is primarily due to the rise of modern warfare systems, the affordability of simulator training, increased defense expenditure in emerging economies, the demand for proficient operators, and heightened research and development activities in military simulation. The utilization of radar simulators proves to be a valuable resource for training operators in the intricacies of contemporary technologies, ensuring their adeptness in handling complex scenarios. These simulators play a crucial role in enhancing the skills of aviation professionals, allowing them to navigate through intricate airspaces and effectively respond to diverse scenarios. As a result, this contributes to an overall improvement in safety and operational efficiency within the aviation industry.

To Understand More About this Research, Request a Free Sample Report

The cost-effectiveness of simulator training has emerged as a pivotal factor propelling the target market. Conventional live training exercises, which involve the use of actual radio detection and ranging systems, can incur significant costs and pose logistical challenges. Radar simulators present a financially prudent alternative, offering realistic training scenarios without the requirement for expensive equipment and extensive resources. Additionally, the use of simulators minimizes the wear and tear on actual radio detection and ranging systems, thereby extending their operational lifespan.

With the continuous advancement of these systems, the necessity for operators who are skilled in utilizing these technologies effectively becomes increasingly crucial. Simulators provide a controlled and realistic environment wherein operators can hone and enhance their skills, guaranteeing optimal performance in actual operational scenarios. The global demand for proficient radar operators, fueled by geopolitical tensions and security considerations, generates a consistent requirement for advanced training solutions, thereby propelling growth.

The Radar Simulator Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Industry Dynamics

Growth Drivers

Growing Demand for Radar Systems

Within the defense sector, radar simulators play a crucial role in conducting realistic training exercises. These simulators provide personnel with the opportunity to engage in practice scenarios involving surveillance, target tracking, and electronic warfare tactics. This simulated yet authentic setting prepares military personnel for a range of operational challenges they may encounter. Furthermore, radar simulators serve as valuable tools for testing and validating new radar systems and tactics, ensuring that they perform optimally and are ready for deployment in real-world situations.

Countries like Russia and China are making substantial investments in their defense sectors. For instance, Russia's proposed budget for 2024, currently pending approval from the State Duma, outlines plan to allocate 6% of its GDP to military spending, surpassing social expenditure for the first time. This pattern underscores the significance of cultivating a highly trained and skilled defense workforce capable of addressing evolving security challenges.

Report Segmentation

The market is primarily segmented based on component, product, type, application, and region.

|

By Component |

By Product |

By Type |

By Application |

By Region |

|

|

|

|

|

To Understand More About this Research, Speak to Analyst

By component Analysis

Hardware segment accounted for the largest market share in 2023

Hardware segment accounted for the largest share. The increasing demand for training simulations that are both realistic and high-fidelity has driven organizations to make substantial investments in robust hardware components. These components encompass advanced signal processing units, antennas, and transmitters for radio detection and ranging, playing a critical role in establishing immersive and effective training environments.

Software segment will grow rapidly. Progress in software technologies has resulted in the creation of advanced and feature-rich radar simulation programs, providing exceptional realism in training scenarios. These software solutions excel in accurately replicating various radio detection and ranging environments, contributing to their extensive adoption across diverse industries.

By Product Analysis

Operator training segment held a significant market share in 2023

Operator training segment held a significant market share. The increasing acknowledgment of the crucial role played by well-trained operators in optimizing the efficiency and precision of radio detection and ranging systems is driving the adoption of radar simulators. Organizations are placing a priority on investing in operator training programs to elevate operational competence. Radio detection and ranging simulator systems enable military personnel to engage in practice scenarios, including missile tracking & aerial surveillance, contributing to preparedness & strategic readiness.

System testing segment is expected to gain a substantial growth rate. These simulators facilitate exhaustive testing of radio detection and ranging functionalities within a controlled environment, allowing developers to pinpoint and address potential issues before deployment. The growing intricacy of modern radar systems, incorporating technologies such as phased array and AESA (Active Electronically Scanned Array), emphasizes the need for sophisticated testing capabilities.

By Type Analysis

Airborne segment held a significant market share in 2023

Airborne segment held a significant market share. The growing intricacy of airborne radio detection and ranging systems underscores the necessity for thorough training simulations to guarantee the proficiency of operators and the optimal performance of the equipment. This need is particularly pronounced in the aviation industry, where radio detection and ranging systems play a pivotal role in navigation and safety.

Marine segment is expected to gain a substantial growth rate. The maritime industry's growing dependence on radar systems for tasks such as navigation, collision avoidance, and surveillance has intensified the need for efficient training solutions. Radar simulators play a pivotal role in readying marine personnel for intricate scenarios at sea, ultimately contributing to improved safety and operational efficiency. For example, within the shipping sector, radar simulators are indispensable for training ship navigators to accurately interpret radio detection and ranging data and make well-informed decisions in challenging maritime environments.

Regional Insights

North America dominated the global market in 2023

North America dominated the global market. The United States boasts a sizable defense budget, contributing to the widespread adoption of state-of-the-art radar simulators for military training purposes. The U.S. Department of Defense heavily relies on radio detection & ranging simulators to train military personnel, to improve their proficiency in radio detection & ranging operation, target tracking, & threat assessment.

For instance, in March 2023, the Biden-Harris Administration put forth a Fiscal Year 2024 budget request of USD 842 billion for the U.S. Department of Defense, marking a USD 26 billion increase from FY 2023 and a USD 100 billion surge from FY 2022. Furthermore, the flourishing aviation industry in the region, encompassing both commercial and general aviation, places a significant focus on safety and training.

The Asia Pacific will grow at a substantial pace. This growth can be attributed to the region's escalating defense expenditures, influenced by geopolitical factors and modernization initiatives, resulting in an augmented demand for advanced radar training solutions. Notably, countries have made substantial investments in military capabilities, consequently fostering the adoption of radio detection & ranging simulators for training purposes.

In the Union Budget for the Financial Year 2023-24, India allocated USD 72.6 billion to the Defense Research and Development Organization (DRDO), reflecting a 13.1% increase in defense Research and Development (R&D) expenditure. This increased spending is geared towards expediting the development of crucial defense technologies and systems, with the overarching goal of enhancing India's self-reliance in defense capabilities.

Key Market Players & Competitive Insights

The market exhibits a moderate level of innovation, influenced by technological advancements arising from factors like the incorporation of virtual reality (VR) and augmented reality (AR), high-fidelity graphics and visualization, artificial intelligence (AI) and machine learning (ML), and simulations based on cloud computing. There is also a necessity to acquire access to radio detection and ranging simulator technologies for personnel training, the imperative to enhance the efficiency of military personnel and operators for improved safety, and the growing strategic importance of radio detection and ranging simulators.

Some of the major players operating in the global market include:

- Adacel Technologies Limited

- Aechelon Technology

- BUFFALO COMPUTER GRAPHICS.

- Cadence Design Systems

- Cambridge Pixel Ltd.

- Keysight Technologies

- L3Harris

- Mercury Systems, Inc.

- Micro Nav Limited.

- Nautical Software.com

- Presagis Canada Inc.

- RTX Corporation

- Textron Systems Corporation

- Ultra

Recent Developments

- In September 2023, Cambridge Pixel introduced RadarLink, an inventive software solution crafted to enhance radar video transmission in scenarios with low bandwidth. The product incorporates intelligent data link monitoring & adaptive prioritization based on the significance of radio detection.

Radar Simulator Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.18 billion |

|

Revenue Forecast in 2032 |

USD 4.62 billion |

|

CAGR |

4.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Component, By Product, By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Delve into the intricacies of radar simulators in 2024 through the meticulously compiled market share, size, and revenue growth rate statistics by Polaris Market Research Industry Reports. Uncover a comprehensive analysis that not only projects market trends up to 2032 but also provides valuable insights into the historical landscape. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Razor Market Size, Share 2024 Research Report

Solid State Drive Market Size, Share 2024 Research Report

Red Yeast Rice Market Size, Share 2024 Research Report

Telehandler Market Size, Share 2024 Research Report

Pharmaceutical Excipients Market Size, Share 2024 Research Report

FAQ's

The global radar simulator market size is expected to reach USD 4.62 billion by 2032

Adacel Technologies Limited,Aechelon Technology,BUFFALO COMPUTER GRAPHICS are the top market players in the market

North America region contribute notably towards the global Radar Simulator Market.

Radar Simulator Market expected to grow at a CAGR of 4.8% during the forecast period.

component, product, type, application, and region are the key segments in the Radar Simulator Market