Radiation Hardened Electronics Market Size, Share, & Industry Analysis Report

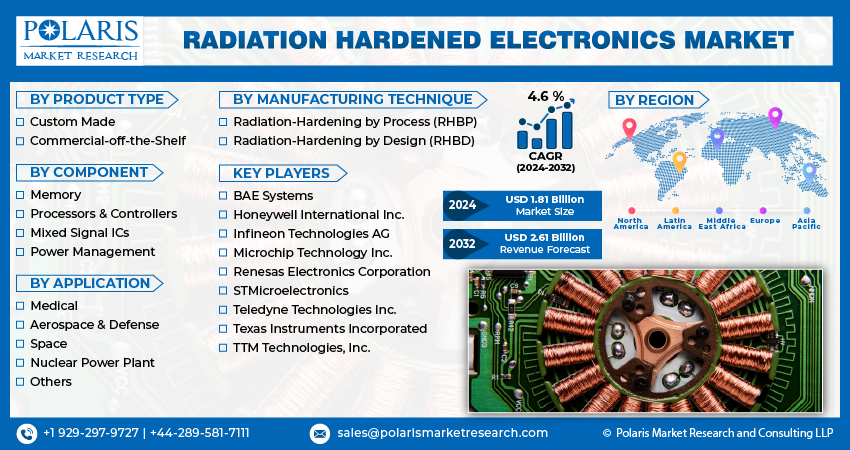

By Product [Custom Made and Commercial-off-the-Shelf (COTS)], By Component, By Manufacturing Technique, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM4718

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The global radiation hardened electronics market size was valued at USD 1,812.57 million in 2024, growing at a CAGR of 6.5% during 2025–2034. The growth is driven by the global expansion and emerging market opportunities.

Radiation-hardened electronics are specialized components designed to operate reliably in environments exposed to high levels of ionizing radiation, such as space, nuclear reactors, or military applications. These devices are engineered to resist damage or malfunction caused by radiation, ensuring consistent performance in mission-critical systems. The radiation hardened electronics market is expected to witness rapid growth in the future, owing to the rising application of communication satellites and the high frequency of modern smart surveillance and reconnaissance activities. In addition, an increasing number of commercial space launch services and the use of e-radiation exposure systems for the detection of space radiation are expected to fuel the industry share. According to a July 2024 Space Foundation report, global government expenditures on space initiatives increased by 11% year-over-year in 2023, reaching a total of USD 125 billion, reflecting increasing investment in both civil and defense-related space activities. Additionally, the current space exploration and satellite communications tendencies for respective hardware have created an enlarged requirement for radiation-hardened electronic devices that can send and receive signals from satellites.

To Understand More About this Research: Request a Free Sample Report

Emphasis on national security, defense modernization, and critical infrastructure protection contributes to the growth opportunities, as governments worldwide prioritize resilience in the face of evolving geopolitical threats and electronic warfare. These high-reliability components are essential for safeguarding mission-critical defense systems, such as satellites, missile guidance units, secure communication networks, and surveillance platforms, that operate in radiation-prone environments. Demand for electronics that withstand nuclear, cosmic, and solar radiation continues to grow as nations upgrade their defense capabilities and strategic technologies. Furthermore, the increasing digitalization of critical infrastructure, ranging from power grids to military command centers, requires embedded systems capable of maintaining functionality during radiation exposure or cyber-physical attacks. According to a February 2025 Ministry of Communications report, India’s digital infrastructure contributed 11.74% to GDP in 2022–2023, amounting to ~ USD 380 billion, and employed 14.67 million people. This focus on hardened, fault-tolerant systems reflects a broader commitment to maintaining national security readiness and technological superiority, thereby sustaining long-term demand for radiation-hardened electronics across military and strategic sectors.

Industry Dynamics

Convenience and Ease of Use

The increasing reliance on radiation hardened electronics in space exploration and defense applications is a major driving force behind the growth of this market. Space missions and military operations demand electronic components that can resist extreme radiation environments, high temperatures, and harsh operational conditions. The demand for reliable and durable radiation hardened electronic components continues to surge with the growing investments and launches in space programs and rising geopolitical tensions leading to increased defense budgets worldwide. For instance, in November 2024, Infineon Technologies AG launched radiation-hardened-by-design 512 Mbit QSPI NOR Flash memory for space and extreme environment applications. These factors are shaping the market, encouraging advancements in technology, and fostering partnerships among major players in the semiconductor, aerospace, and defense industries. Space exploration has witnessed substantial advancements in recent years, with government space agencies and private companies ramping up their efforts to explore deep space, establish lunar bases, and expand satellite constellations for communication and Earth observation.

Increasing Investments in Research and Development for Advanced Radiation-Hardened Electronics

Investments in R&D are fueling the continuous advancements in radiation-hardened electronics (RHE) from both government and private sector entities. For instance, in April 2025, Magics, a semiconductor firm, secured ~ USD 6.1 million in new funding to advance its radiation-hardened integrated circuit technology. This investment will support R&D initiatives and market expansion targeting space applications and nuclear energy infrastructure. These electronics are critical in applications exposed to high-radiation environments, such as space exploration, defense systems, nuclear power plants, and medical imaging equipment. The need for highly durable, efficient, and cost-effective radiation-resistant components is growing as technology becomes more refined. Governments, defense organizations, aerospace agencies, and commercial enterprises are heavily investing in R&D to improve the performance, reliability, and miniaturization of radiation-hardened electronics. These investments are contributing the way for next-generation materials, innovative hardening techniques, and AI-integrated designs, which are driving market expansion. The growth of radiation-hardened electronics in the space industry is expanding as governments and private companies push for deeper space exploration, and the demand for robust electronics capable of withstanding cosmic radiation has surged.

Segmental Insights

By Product Analysis

The global segmentation, based on product, includes custom made and commercial-off-the-shelf (COTS). The commercial-off-the-shelf (COTS) segment was valued at USD 1,613.20 million in 2024, as they offer a more affordable and widely available alternative to custom-made solutions. These components are based on standard commercial designs but go through additional testing and modifications to improve their radiation tolerance. They are increasingly used in applications where cost and quick deployment matter, such as low Earth orbit (LEO) satellites, autonomous systems, and some defense applications. COTS components can be mass-produced, making them more accessible and reducing development timelines. However, they often require extra shielding or redundancy to ensure long-term reliability in high-radiation environments. Companies such as Cobham Advanced Electronic Solutions, Xilinx (now part of AMD), Renesas Electronics, and Mercury Systems are at the forefront of developing radiation-tolerant COTS components, helping commercial space ventures and defense contractors balance performance and cost-effectiveness in demanding applications.

The custom made segment is projected to grow significantly during the forecast period, as they are specifically designed to withstand extreme radiation levels in environments such as deep space, military operations, and nuclear facilities. These components go through specialized manufacturing processes, such as radiation shielding, redundant circuit designs, and selective doping, to ensure they can handle exposure to high doses of radiation without failure. They offer unmatched reliability but come with high development costs, long qualification cycles, and a more limited supply chain as they are built for mission-critical applications.

By Component Analysis

The global segmentation, based on component, includes medical, aerospace & defense, space, nuclear power plant, and others. The aerospace & defense segment is projected to grow with a CAGR of 6.6% due to its reliability on radiation-hardened electronics for mission-critical applications in extreme environments. Military systems, such as radar, missile guidance, secure communications, and electronic warfare technologies, require resilient components that withstand exposure to nuclear radiation and high-energy particles. During combat or in high-altitude missions, radiation-induced failures could compromise national security, making rad-hard electronics a necessity. Additionally, advanced avionics in fighter jets, bombers, and surveillance aircraft rely on these components to ensure operational stability. The increasing adoption of unmanned aerial vehicles (UAVs) for reconnaissance and combat operations further drives the need for robust electronics that can function reliably in high-radiation or electronic warfare environments. According to a September 2021 ITA report, the UAV market in India reached USD 830 million in 2020, projecting 14.5% CAGR growth through 2026, driven by expanding commercial and defense applications.

The medical segment is estimated to hold a substantial market share in 2024, as radiation-hardened electronics are essential in the medical industry, particularly in imaging and radiation therapy systems, where exposure to ionizing radiation is common. Devices such as MRI machines, CT scanners, and X-ray systems require highly durable electronic components to ensure continuous operation without performance degradation. In radiation therapy, precision is critical, and the control systems within linear accelerators must remain reliable to administer accurate doses to patients. Any malfunction due to radiation exposure could lead to severe treatment errors, making radiation-resistant electronics a necessity in such applications. Additionally, electronic systems in sterilization equipment, which use radiation to eliminate bacteria and pathogens, benefit from rad-hard components to maintain efficiency and longevity.

By Manufacturing Technique Analysis

The global segmentation, based on manufacturing technique, includes radiation-hardening by process (RHBP) and radiation-hardening by design (RHBD). The radiation-hardening by design (RHBD) segment captured 58.96% market share in 2024 due to its focus on circuit-level and architectural modifications to improve a component’s resistance to radiation effects without altering the underlying manufacturing process. This technique involves implementing error correction codes (ECC), triple modular redundancy (TMR), latch-up protection, and hardened circuit layouts to minimize the impact of single-event effects (SEEs) and total ionizing dose (TID). RHBD improves the component’s resilience through intelligent circuit design and software-based fault tolerance. This makes RHBD a more cost-effective solution for applications where moderate radiation tolerance is sufficient, such as low Earth orbit (LEO) satellites, commercial space missions, and some defense electronics.

The radiation-hardening by process (RHBP) segment growth is driven by the modification of the semiconductor fabrication process to enhance a component’s resistance to radiation-induced damage. The method focuses on altering material properties, doping techniques, and insulation layers to minimize the effects of radiation exposure. Advanced techniques include the use of silicon-on-insulator (SOI) technology, hardened gate oxides, and selective doping to reduce leakage currents and mitigate total ionizing dose (TID) effects. RHBP is particularly effective in environments where prolonged radiation exposure is a concern, such as deep-space missions, nuclear power plants, and high-altitude defense applications. Components developed using this technique exhibit higher reliability and longevity in extreme radiation environments as RHBP enhances the physical properties of a semiconductor.

By Component Analysis

The global segmentation, based on component, includes memory, processors & controllers, mixed signal ICs, and power management. The power management segment was valued at USD 766.62 million in 2024. The growth is driven by their stable and efficient power distribution in high-radiation environments. These components, such as voltage regulators, power converters, and radiation-tolerant MOSFETs, are essential in satellites, spacecraft, military radar systems, and nuclear power plants. Rad-hard power management ICs are specifically designed to provide stable power delivery while mitigating the effects of total ionizing dose (TID) and single-event transients (SETs), as radiation exposure can cause voltage fluctuations, leakage currents, and degradation in semiconductor materials. These solutions play a vital role in maintaining the functionality of electronic systems operating in space, defense, and nuclear applications.

The processors & controllers segment is expected to witness robust growth during the forecast period due to their role as the computational backbone for critical systems operating in extreme environments. These components are designed to maintain functionality in high-radiation conditions, preventing errors caused by single-event effects (SEEs) and cumulative radiation exposure. Rad-hard processors are extensively used in space missions, military avionics, missile defense systems, and nuclear reactor controls, where real-time processing and high reliability are essential. The processors undergo specialized design enhancements, such as redundant architectures and hardened logic circuits, to ensure uninterrupted operation. The development of advanced rad-hard processors with higher clock speeds, AI capabilities, and lower power consumption is gaining traction, as modern space missions and defense applications demand more computing power.

Regional Analysis

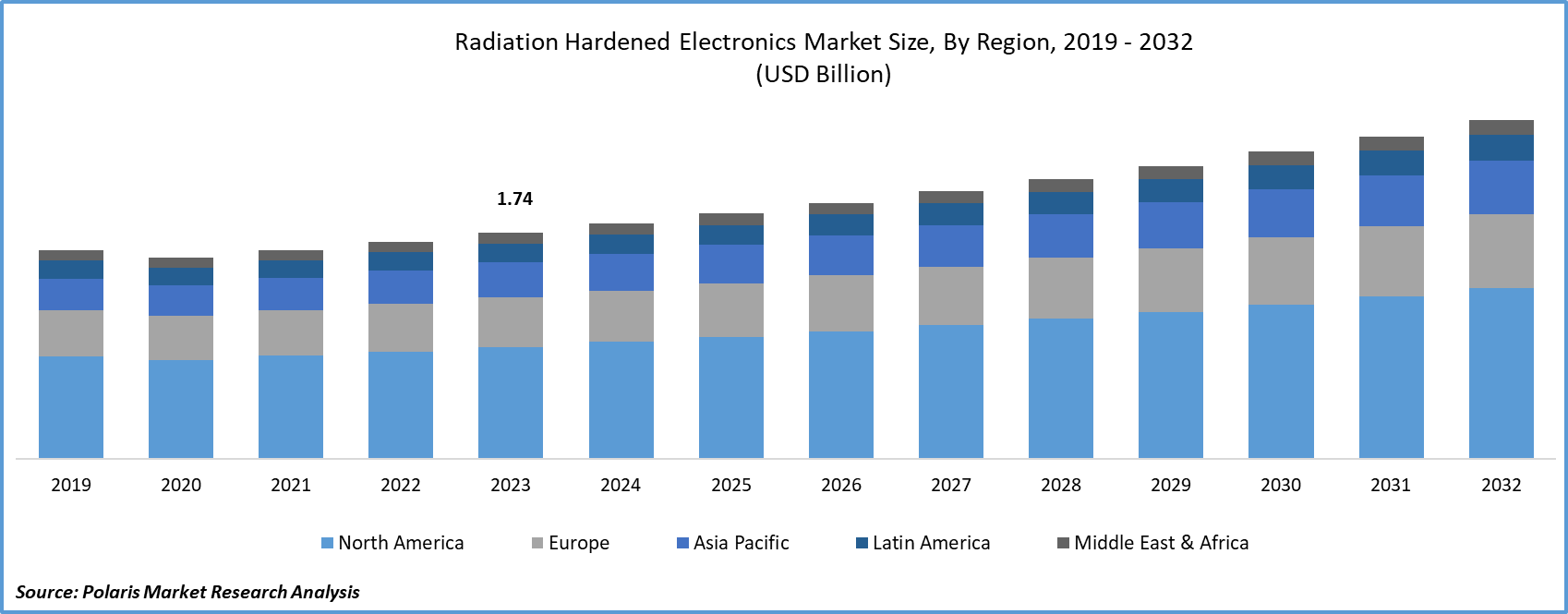

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America radiation hardened electronics market accounted for 41.54% share of the market in 2024, driven by the strong presence of aerospace, defense, and space exploration industries. According to an April 2025 Space Foundation report, the US Federal Aviation Administration (FAA) authorized 157 commercial space missions in 2024, with projections indicating potential growth to 172 launches in 2025, highlighting the expanding need for radiation-tolerant components. The US, in particular, is at the forefront of technological advancements in this sector, with major contributions from organizations such as NASA, the Department of Defense (DoD), and the Department of Energy (DoE). The country’s well-established military and space programs, such as satellite development, missile defense systems, and interplanetary exploration missions, fuel the demand for high-reliability radiation-hardened components. Companies such as BAE Systems, Honeywell Aerospace, Microchip Technology, and Northrop Grumman play a crucial role in manufacturing advanced rad-hard electronics to meet the strict requirements of defense and space applications.

The US radiation hardened electronics market, in particular, dominated in North America, capturing 93.71% regional share of the market largely due to its highly integrated supply chain and robust government support for high-reliability systems. The US has cultivated a deep ecosystem of research institutions, defense contractors, and semiconductor manufacturers dedicated to developing radiation-resistant components for extreme environments. This concentration of specialized expertise allows the US to respond rapidly to evolving mission demands, whether for deep space exploration or advanced defense technologies, maintaining its leadership in both innovation and production capacity.

The Asia Pacific radiation hardened electronics market was valued at USD 439.91 million in 2024. The growth is driven by expanding space programs, increasing defense expenditures, and advancements in nuclear energy. According to a February 2024 report by India's Department of Atomic Energy, the government has allocated ~ USD 2.4 billion to its Nuclear Energy Mission for R&D of Small Modular Reactors (SMRs), highlighting India's focus on advancing next-generation nuclear technologies to meet its clean energy goals. Countries such as China, India, and Japan are at the forefront of space exploration, with agencies such as the China National Space Administration (CNSA), the Indian Space Research Organization (ISRO), and the Japan Aerospace Exploration Agency (JAXA) investing in satellite launches, lunar missions, and interplanetary exploration. These initiatives require reliable, radiation-hardened electronics to ensure the longevity and performance of satellites and deep-space probes. Additionally, growing geopolitical tensions in the region have led to increased military spending, further fueling demand for rad-hard components in defense applications such as secure communications, missile guidance, and electronic warfare systems.

China radiation-hardened electronics market is experiencing steady growth, driven by the country’s expanding space, defense, and nuclear energy sectors. With increasing investments in satellite launches, military modernization, and nuclear infrastructure, the demand for durable and radiation-tolerant components has surged. Government initiatives supporting indigenous technology development and reduced reliance on foreign suppliers further propel the market. Domestic manufacturers are investing in R\&D to produce advanced microelectronics capable of withstanding harsh radiation environments, vital for aerospace and defense applications. Additionally, collaborations with research institutes are fostering innovation in semiconductor design and manufacturing. As China strengthens its strategic industries, the radiation-hardened electronics market is poised for robust growth, becoming a key component of the country’s technological and defense self-reliance goals.

The Europe radiation hardened electronics market is projected to reach USD 893.46 billion by 2034, with a strong focus on space exploration, defense, and nuclear energy. The European Space Agency (ESA) is investing heavily in satellite programs, deep-space missions, and planetary exploration projects, propelling the regional industry growth. Countries such as France, Germany, and the UK are leading contributors to the development of rad-hard components used in space applications. European semiconductor manufacturers, including STMicroelectronics and Infineon Technologies, play a vital role in producing high-reliability radiation-hardened processors, memory, and power management solutions for aerospace and defense applications. In addition to space exploration, Europe has a well-developed defense industry, with companies such as Airbus Defence and Space, Thales Group, and BAE Systems actively working on rad-hard technologies for military avionics, secure communications, and missile defense systems.

The UK radiation hardened electronics market growth is driven by its strategic investments in improving national security and defense resilience through advanced electronic systems. The UK is increasing its adoption of radiation-hardened components in military satellites, navigation systems, and surveillance technologies, with a growing focus on modernizing defense capabilities. These components are critical for ensuring uninterrupted functionality in high-radiation environments, such as during electronic warfare or in space-based defense operations. The UK’s Ministry of Defence continues to encourage the development of locally sourced, robust technologies to support mission-critical applications, thus driving steady demand for rad-hard electronics.

Key Players and Competitive Analysis Report

The radiation hardened electronics sector is experiencing significant transformation, driven by strategic investments in space exploration and defense modernization programs. Industry trends indicate a growing demand for reliable components in harsh environments, with technological advancements in semiconductor design allowing higher radiation tolerance. Competitive intelligence reveals that major players are focusing on future development strategies to address latent demand and opportunities in both the government and commercial space sectors. Economic and geopolitical shifts, such as increased defense budgets and private space ventures, are reshaping vendor strategies and regional footprints. Supply chain disruptions have prompted companies to adopt sustainable value chains. Emerging markets in satellite constellations create new expansion opportunities. The sector's total addressable market continues to grow, supported by expert insights predicting long-term demand for radiation-tolerant solutions. Industry-leading competitive intelligence highlights a focus on product offerings tailored to extreme environments, with joint ventures, mergers, and acquisitions accelerating innovation. Technological assessment shows progress in hardening techniques, positioning the industry for revenue growth as space and defense applications expand globally.

A few key players are BAE Systems; Honeywell International Inc.; Infineon Technologies AG; Microchip Technology Inc.; Renesas Electronics Corporation; STMicroelectronics; Teledyne Technologies Inc.; Texas Instruments Incorporated; TTM Technologies, Inc.; and VORAGO Technologies.

Key Players

- BAE Systems

- Honeywell International Inc.

- Infineon Technologies AG

- Microchip Technology Inc.

- Renesas Electronics Corporation

- STMicroelectronics

- Teledyne Technologies Inc.

- Texas Instruments Incorporated

- TTM Technologies, Inc.

- VORAGO Technologies

Industry Developments

September 2024: The U.S. Department of Defense (DoD) announced a USD 25.8 million contract to Honeywell in Plymouth, Minnesota, United States, to produce or acquire trusted strategic radiation-hardened microelectronics.

September 2024: Honeywell acquired CAES Systems Holdings LLC (CAES) from private equity firm Advent International for approximately USD 1.9 billion in an all-cash transaction. To boost capabilities in radiation-hardened integrated circuits for applications ranging from military nuclear forces to commercial new space uses.

June 2024: Infineon launched a radiation-hardened memory portfolio with the industry’s first space-qualified parallel interface 1 and 2 Mb F-RAMs.

Radiation Hardened Electronics Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Custom Made

- Commercial-off-the-Shelf (COTS)

By Component Outlook (Revenue, USD Million, 2020–2034)

- Memory

- Processors & Controllers

- Mixed Signal ICs

- Power Management

By Manufacturing Technique Outlook (Revenue, USD Million, 2020–2034)

- Radiation-Hardening by Process (RHBP)

- Radiation-Hardening by Design (RHBD)

By Application Outlook (Revenue, USD Million, 2020–2034)

- Medical

- Aerospace & Defense

- Space

- Nuclear Power Plant

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Radiation Hardened Electronics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1,812.57 million |

|

Market Size in 2025 |

USD 1,868.40 million |

|

Revenue Forecast by 2034 |

USD 3,302.42 million |

|

CAGR |

6.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,812.57 million in 2024 and is projected to grow to USD 3,302.42 million by 2034.

The global market is projected to register a CAGR of 6.5% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are BAE Systems; Honeywell International Inc.; Infineon Technologies AG; Microchip Technology Inc.; Renesas Electronics Corporation; STMicroelectronics; Teledyne Technologies Inc.; Texas Instruments Incorporated; TTM Technologies, Inc.; and VORAGO Technologies.

The commercial-off-the-shelf (COTS) segment dominated the market in 2024.

The aerospace & defense segment is expected to witness the fastest growth during the forecast period.