Research Department Explosives Market Share, Size, Trends, Industry Analysis Report

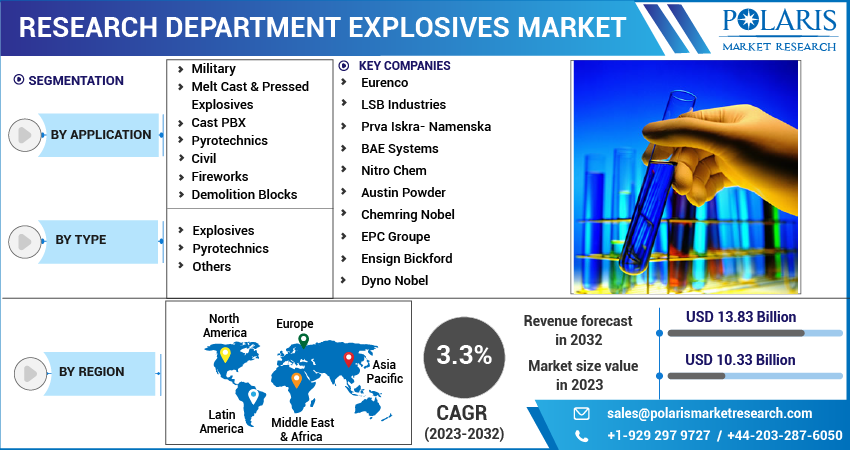

By Application (Military {Cast PBX, Pyrotechnics}, Civilian {Fireworks, Demolition Blocks}); By Type; By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Jul-2023

- Pages: 118

- Format: PDF

- Report ID: PM3591

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

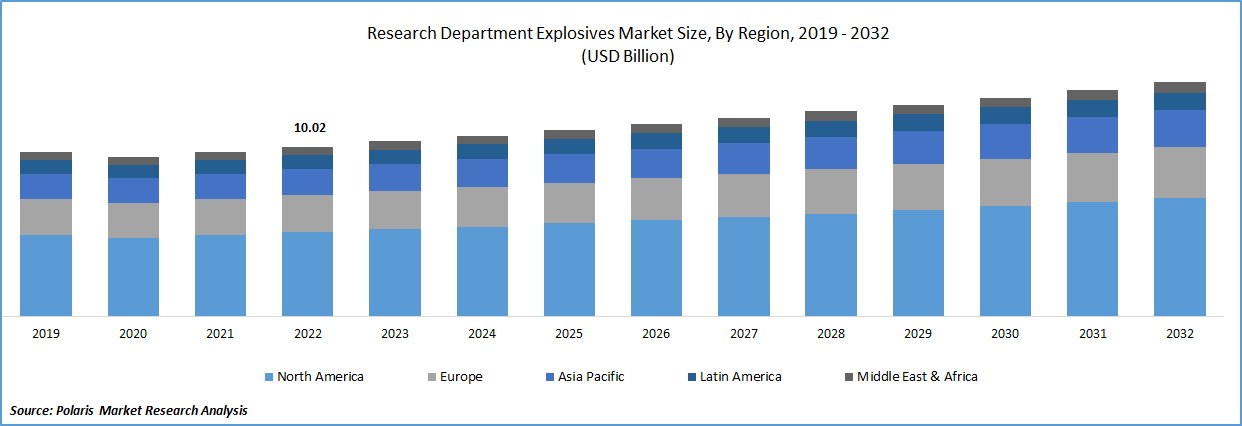

The global research department explosives market was valued at USD 10.02 billion in 2022 and is expected to grow at a CAGR of 3.3% during the forecast period. The versatility and power of RDX make it a valuable resource for a wide range of applications in both military and civilian sectors. RDX is a powerful and versatile explosive that is widely used in both military and civilian applications. In military applications, RDX is commonly used as the main component in plastic explosives and as a booster charge for other types of explosives.

To Understand More About this Research: Request a Free Sample Report

RDX is also used in pyrotechnics, such as flares and fireworks, as well as in cast PBX (plastic bonded explosive) charges used for demolition and mining. In civilian applications, RDX is used in a variety of industries, such as construction, mining, and oil and gas. RDX-based explosives are used in the construction and demolition of buildings and infrastructure, as well as in mining operations to extract minerals and ores. RDX is also used in the oil and gas industry for well completion and fracturing operations.

Hexamine, nitric acid, citric acid, acetic anhydride ammonium nitrate, & para-formaldehyde are raw materials used in the manufacturing process of RDX. These raw materials are combined in a specific process to produce RDX, which is a white crystalline solid with high energy content and high stability. Hexamine is used as a fuel in the manufacturing process, providing the energy needed to drive the reaction. Ammonium nitrate is used as an oxidizer, reacting with the fuel to release energy. Nitric acid is used to produce nitrocellulose, a component used in the manufacturing process. Acetic acid and acetic anhydride are used to produce acetylated compounds that are used in the synthesis of RDX. Paraformaldehyde is used as a formaldehyde source in the reaction.

Research Department Explosives (RDX) can be used alone as a base charge for detonators in a variety of applications, such as military and civilian demolition, mining, and construction. RDX is also commonly used as the main explosive component in plastic explosives, which are used extensively in military applications for their high power and versatility. In addition, RDX can be mixed with oils or waxes to create military ammunition, such as shaped charges used in armor-penetrating weapons. These types of charges are used in anti-tank weapons and other military applications where the goal is to penetrate heavily armored vehicles or structures.

For Specific Research Requirements, Speak With a Resaerch Analyst

Industry Dynamics

Growth Drivers

RDX is increasingly being used in the mining and construction industries for a variety of applications. In the mining industry, RDX is used for exploration and rock excavation activities, where its high performance and stability make it a valuable resource for blasting operations. RDX-based explosives are commonly used to fracture rock formations, making it easier to extract minerals and ores. Similarly, in the construction industry, RDX is used for rock excavation activities, such as tunnelling and drilling, where its high energy output makes it an effective tool for breaking through tough rock formations. RDX-based explosives are also used for demolition activities, where buildings and infrastructure need to be dismantled quickly and efficiently.

In military applications, RDX is also commonly used as a base charge for detonators in a wide range of explosive devices. Its high stability and energy content make it a valuable component in military-grade explosives, allowing for effective demolition and destruction of targets. In civilian applications, RDX has gained prominence in various industries. For example, it is sometimes used as a component in heating fuel, where its high energy content can help to increase the efficiency of the fuel. RDX is also used in the production of fireworks, where it provides a powerful and stable explosive effect. Occasionally, RDX has been used as a rodenticide to control rodent populations, although this use is not recommended due to the potential risks to non-target animals and the environment.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Application |

By Type |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Civilian segment growing at the fastest rate in global market

Civilian segment recorded steady growth rate over the study period. Segment’s growth is primarily due to increase in demand for the demolition blocks, fireworks, & civil pyrotechnic applications is driven by various factors. As infrastructure development and construction activities continue to grow, the demand for demolition blocks and other explosive materials is also expected to increase. Demolition blocks made using RDX and other high-energy explosives are a preferred choice for controlled demolition of buildings and other structures due to their high energy output and stability.

Similarly, the rising supply & demand for various types of fireworks such as nail guns, recreational fire-works, and other have potentially triggered demand in the civil applications. RDX is a key component in many types of fireworks, providing a stable and powerful explosive effect. As more people become interested in recreational fireworks, the demand for RDX and other explosive materials is expected to increase.

Military application garnered the largest revenue share, and is projected to maintain its dominance over the study period. Rapid surge in defense expenditure across the United States has boosted the growth of the RDX industry. RDX cyclonite is frequently used in bombs, ammunition, & missile warheads. Its high stability, energy content, and reliable performance make it a valuable component in military-grade explosives, allowing for effective demolition and destruction of targets. As the United States continues to invest in its military capabilities, the demand for RDX and other explosives is expected to increase. RDX's use in military applications is critical for national defense and security, and it is therefore likely to remain an important component in military-grade explosives for the foreseeable future.

North America is accounting the largest share in the global market

In the fiscal year 2022, North America is expected to lead the global research department explosives market. Capacity addition by airports and railways is also expected to drive the demand for RDX over the forecast period. Explosives such as RDX are used in the construction of runways, tunnels, and other infrastructure projects in the transportation sector. As airports and railways expand to meet growing demand, the demand for RDX and other high-performance explosives is likely to increase.

Favourable demographic trends in North America, such as a growing population, are expected to lead to increased construction of roads, bridges, and other infrastructure. This, in turn, is likely to fuel the demand for high-performance explosives such as RDX and TNT in the construction sector. RDX's stability and high energy content make it a valuable component in controlled demolition and excavation of rock and other materials.

Europe is second dominating region in the global market with significant revenue in the year of 2022. RDX is commonly used in mining operations for exploration and rock excavation activities. Its high energy content and stability make it an effective component in controlled blasting and excavation, allowing for efficient extraction of minerals from the earth. As extraction activities in Germany continue to increase, the demand for RDX and other high-performance explosives is expected to grow.

In addition to the mining industry, increasing military expenditures in Europe continue to drive the demand for explosives such as RDX. RDX is widely used in military applications. The increasing defense expenditure across Europe is expected to boost the demand for RDX in military applications over the forecast period. Europe has a significant mining industry and is a major producer of various minerals, including copper, nickel, coal, potash, and others. As extraction activities in the region continue to increase, the demand for high-performance explosives such as RDX is expected to grow.

Competitive Insight

The global players include Eurenco, LSB Industries, Prva Iskra- Namenska, BAE Systems, Nitro Chem, Austin Powder, Chemring Nobel, EPC Groupe, Ensign Bickford & Dyno Nobel

Recent Developments

- In May 2022, Orica successfully developed “Fortis Protect” bulk explosives to reduce the cases of nitrate leaching during controlled blasts. Leaching of nitrates in the open environment causes potential risks to flora and fauna of the region, also damaging the local water bodies.

Research Department Explosives Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 10.33 billion |

|

Revenue forecast in 2032 |

USD 13.83 billion |

|

CAGR |

3.3% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019– 2021 |

|

Forecast period |

2023– 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Application, By Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Eurenco, LSB Industries, Prva Iskra- Namenska, BAE Systems, Nitro Chem, Austin Powder, Chemring Nobel, EPC Groupe, Ensign Bickford & Dyno Nobel |

FAQ's

The research department explosives market report covering key segments are type, application, and region.

Research Department Explosives Market Size Worth $13.83 Billion By 2032.

The global research department explosives market is expected to grow at a CAGR of 3.3% during the forecast period.

North America is leading the global market.

key driving factors in research department explosives market are increasing spending on Défense & military applications.