Respiratory Care Devices Market Share, Size, Trends, Industry Analysis Report

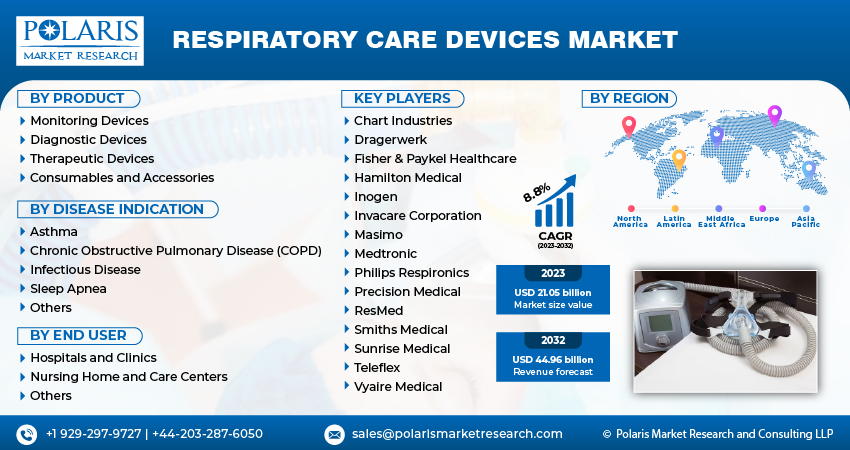

By Product (Monitoring Devices, Diagnostic Devices, Therapeutic Devices, Consumables and Accessories); By Disease Indication; By End User; By Region; Segment Forecast, 2023- 2032

- Published Date:Oct-2023

- Pages: 116

- Format: PDF

- Report ID: PM3881

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

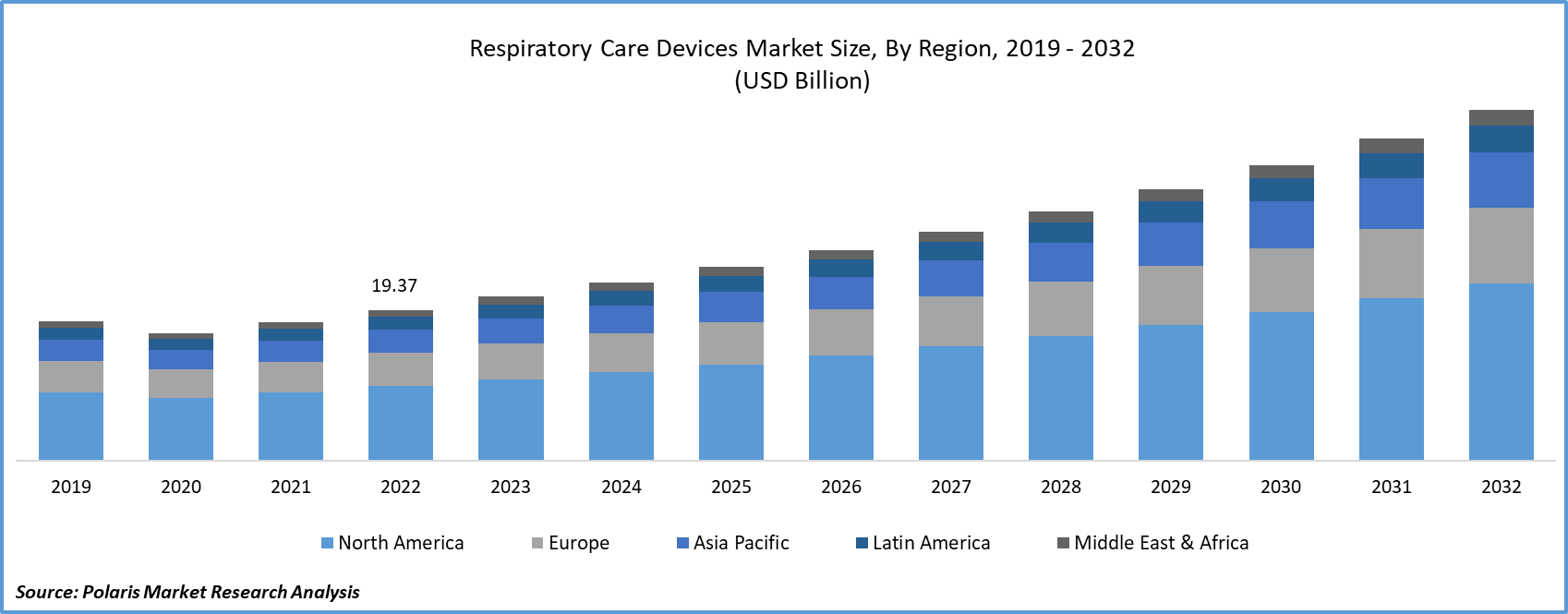

The global respiratory care devices market size and share was valued at USD 19.37 billion in 2022 and is expected to grow at a CAGR of 8.8% during the forecast period.

The rise in respiratory diseases globally serves as a propellant for the respiratory care devices market. Elements like air pollution, tobacco use, and an aging populace collectively contribute to escalating respiratory conditions like COPD, asthma, and sleep apnea.

Respiratory care instruments are the medical tools used for monitoring, diagnosis, and care of patients suffering from different respiratory diseases. These devices include Other Pulmonary Function Testing (PFT) Equipment, Spirometers, Humidifiers, Ventilators, PAP (positive airway pressure) Devices, Nebulizers, Mask, Manual Resuscitators, Circuits & Disposables, and Oxygen Equipment. Also, increased adoption of innovative technology, the introduction of advanced product launches, and the integration of digital & sensor-based technologies for constructing a smart portfolio will further help the respiratory care devices market growth.

Moreover, since respiratory illnesses are among the most prevalent worldwide, particularly in light of the recent surge in infections, air pollution and disorders pertaining to the pulmonary canal are sadly very common. Therefore, having the appropriate tools and accessories is essential for either diagnosing or treating diseases. Particularly when babies are involved. Asthma and pneumonia are among the most common diseases in this age group. As a result, the respiratory care devices market demand is expanding.

To Understand More About this Research: Request a Free Sample Report

The burgeoning middle-class demographic in emerging markets offers an opportunity for the respiratory care devices market. These regions, spanning portions of Asia, Africa, and Latin America, are witnessing a rise in healthcare expenditure and infrastructure development. As healthcare accessibility progresses, the respiratory care devices market is poised to grow significantly.

In addition, companies operating in the market are introducing new products to cater to the growing demand.

For instance, in July 2020, OMRON Healthcare introduced OMRON NE C106, an addition to its their Compressor Nebulizer portfolio. The product offers ease of use, affordability, and efficient delivery of the drug.

The adoption of telehealth and remote monitoring technologies offers opportunities to the respiratory care devices market. Remote monitoring of individuals dealing with chronic respiratory conditions paves the way for timely interventions and diminished hospital readmissions. Integrating respiratory care devices into telehealth platforms and remote patient monitoring systems fosters enhanced patient care.

Product innovations, technological advancements, and the introduction of regulatory policies have been detailed in the report to enable businesses to make more informed decisions. Furthermore, the impact of the COVID-19 pandemic on the respiratory care devices market demand has been examined in the study. The report is a must-read for anyone looking to develop effective strategies and stay ahead of the curve.

For Specific Research Requirements: Request for Customized Report

The COVID-19 pandemic has had an impact on the respiratory care devices market. Severe COVID-19 cases were often characterized by acute respiratory distress syndrome (ARDS), necessitating a substantial increase in demand for ventilators and supplementary respiratory support apparatus. This crisis underscored the pivotal role of respiratory care devices in handling public health emergencies, catalyzing increased investments and research in this field.

Growth Drivers

Increased Prevalence of Respiratory Diseases is Projected to Spur the Market Demand

Aging demographics worldwide are particularly susceptible to respiratory afflictions and their associated comorbidities. With the rising geriatric population, there emerges an exponential demand for respiratory care devices. The elderly population seeks superior healthcare and improved quality of life, signifying a compelling need for respiratory devices capable of offering effective remedies and support for age-associated respiratory issues.

Increased awareness concerning respiratory health and its holistic significance has resulted in more timely diagnosis and intervention for respiratory conditions. Patients are becoming proactive toward respiratory well-being, propelling the demand for home-based respiratory care devices. This shift towards patient-centric healthcare fuels market growth.

Report Segmentation

The market is primarily segmented based on product, disease indication, end user, and region.

|

By Product |

By Disease Indication |

By End User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Therapeutic Devices Segment Emerged as the Largest Segment in 2022

The rising number of people suffering from illnesses and associated ailments has created a demand for therapeutic devices that cater to respiratory care. These ailments include conditions like pulmonary disease (COPD), asthma, sleep apnea, and respiratory infections. Machines such as Continuous Positive Airway Pressure (CPAP) and Bilevel Positive Airway Pressure (BiPAP) play a role in addressing sleep apnea and other breathing issues during sleep. Their purpose is to keep the air passages open and ensure breathing throughout the night. Nebulizers are used to convert medications into a mist, making it easier for patients to inhale them effortlessly.

By Disease Indication Analysis

COPD Accounted for a Significant Market Share in 2022

The COPD segment accounted for a significant share in 2022. There is a notable uptick in the prevalence of COPD, a chronic respiratory ailment characterized by airflow obstruction. This surge has led to a heightened demand for respiratory care devices to cater to affected individuals. With the global population aging, there is a higher occurrence of respiratory conditions like COPD, which tend to be more prevalent among older age groups. This demographic shift has intensified the need for respiratory care solutions. Healthcare providers are placing increased importance on early COPD diagnosis and proactive management. This approach necessitates a spectrum of respiratory care devices to effectively monitor, treat effectively, and support COPD patients. Many COPD patients prefer or require care within their homes. Consequently, there's a growing demand for portable oxygen concentrators, nebulizers, and similar devices that enable COPD management in a home environment.

By End User Analysis

Hospitals and Clinics Segment Held the Significant Market Revenue Share in 2022

The hospitals and clinics segment accounted for a significant share in 2022. Healthcare institutions are obligated to comply with regulatory standards and guidelines governing the availability and maintenance of respiratory care devices for patient safety and delivery of high-quality care. Improved diagnostic methods are enabling early detection of respiratory conditions, compelling healthcare institutions to procure a broader array of respiratory care devices for timely intervention and patient support. Hospitals and clinics are increasingly embracing preventive healthcare strategies. This includes the implementation of respiratory therapy programs for individuals at risk, such as smokers and those exposed to environmental pollutants, to mitigate the likelihood of respiratory diseases.

Regional Insights

Asia-Pacific is Expected to Experience Significant Growth During the Forecast Period

Asia-Pacific is expected to experience significant growth during the forecast period on account of the growing elderly population, increase in respiratory ailments, and improvements in healthcare infrastructure. A heightened awareness regarding the early detection and treatment of respiratory conditions contributes significantly to market growth. Notable international companies like Philips Respironics, ResMed, and Medtronic have established a significant presence in the region. Meanwhile, local manufacturers and distributors cater to specific regional needs and preferences, adding diversity to the market landscape. The respiratory care devices market in Asia-Pacific covers an extensive range of products, including ventilators, CPAP/BiPAP machines, oxygen concentrators, nebulizers, and respiratory masks. There is a growing interest in portable and home-based devices, particularly in regions with a burgeoning home healthcare sector.

North America emerged as the largest region in 2022. The region exhibits consistent expansion driven by factors such as the prevalence of respiratory ailments, an aging populace, and the steady demand for advanced respiratory equipment. This market features a mix of global industry leaders and specialized domestic enterprises. Prominent companies in the US respiratory care devices sector include Philips Respironics, ResMed, Medtronic, and Fisher & Paykel Healthcare. Factors such as a maturing population, lifestyle-related respiratory disorders, and ongoing technological innovations were expected to sustain growth. The amplification of telehealth adoption and remote patient monitoring is expected to play a more substantial role during the forecast period. Vigorous awareness campaigns and early diagnostic initiatives further fuel the market's growth.

Key Market Players & Competitive Insights

The respiratory care devices market is marked by its fragmented nature, anticipating increased rivalry owing to the abundance of industry participants. Key contenders in this market consistently introduce inventive offerings to strengthen their market foothold. These companies place significant emphasis on forming partnerships, improving products, and engaging in collaborative endeavors to establish a competitive edge over their peers and secure a substantial market share.

Some of the major players operating in the global market include:

- Chart Industries

- Dragerwerk

- Fisher & Paykel Healthcare

- Hamilton Medical

- Inogen

- Invacare Corporation

- Masimo

- Medtronic

- Philips Respironics

- Precision Medical

- ResMed

- Smiths Medical

- Sunrise Medical

- Teleflex

- Vyaire Medical

Recent Developments

- In March 2023, Vitalograph introduced VitaloPFT Pulmonary Function Testing Series. The product is developed to be used in secondary care. The new series provides advanced respiratory diagnostic solutions to hospitals and other secondary care units for complex pulmonary function testing.

Respiratory Care Devices Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 21.05 billion |

|

Revenue Forecast in 2032 |

USD 44.96 billion |

|

CAGR |

8.8% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019-2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Product, By Disease Indication, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Explore the 2024 market share, size, and revenue growth rate statistics in the field of respiratory care devices, meticulously compiled by Polaris Market Research Industry Reports. This comprehensive analysis encompasses a market forecast outlook extending to 2029, along with an insightful historical overview. Experience the depth of this industry analysis by obtaining a complimentary PDF download of the sample report.