RISC-V Tech Market Size, Share, Trends, & Industry Analysis Report

By Product Type (Microcontroller (MCU), Microprocessor (MPU), System-on-Chip (SoC)), By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 120

- Format: PDF

- Report ID: PM5967

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

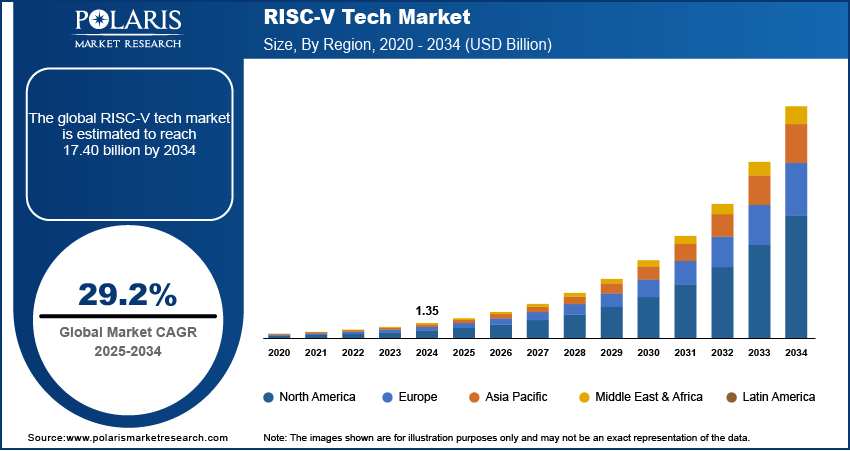

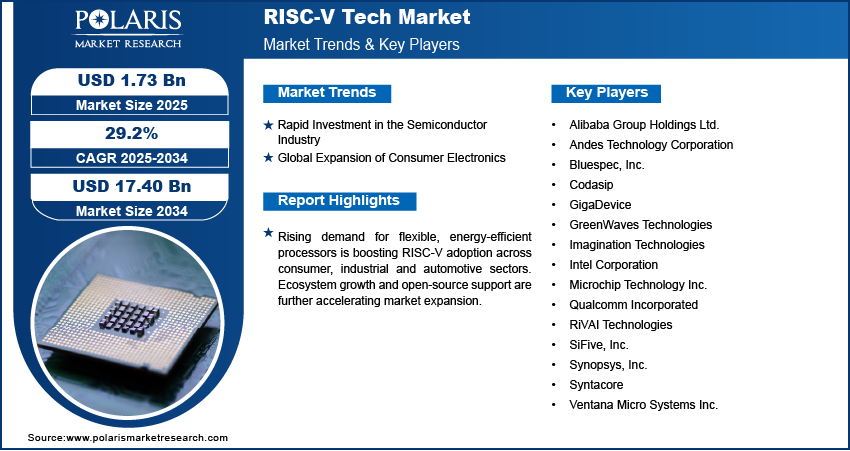

The global RISC-V tech market size was valued at USD 1.35 billion in 2024, growing at a CAGR of 29.2% from 2025–2034. Rapid investment in the semiconductor sector and expansion of consumer electronics worldwide is driving the demand for RISC-V technology.

RISC-V technology represents an open-standard instruction set architecture (ISA) that is driving a new wave of innovation in processor design. This architecture allows semiconductor companies and system developers to build customizable, scalable processors without licensing constraints, making it a cost-effective alternative to proprietary ISAs. Organizations across edge computing, embedded systems, and edge AI are increasingly integrating RISC-V cores to optimize performance, energy efficiency, and application-specific functionality. The flexibility of the architecture enables companies to tailor processors for diverse workloads while maintaining compatibility across tools and ecosystems.

Developers are opting for RISC-V solutions that provide comprehensive toolchains, advanced debugging features and smooth integration with hardware accelerators with the growing processor complexity. Technology providers are advancing development kits, simulation environments and open-source frameworks to support rapid prototyping and reduce design cycles. Companies are focusing on adding security extensions, real-time processing features and artificial intelligence (AI) inference capabilities to strengthen RISC-V adoption in segments such as automotive, industrial automation, and IoT technology. These developments are improving time-to-market outcomes and enabling broader commercialization of open computing platforms.

RISC-V technology is experiencing rapid adoption, driven by its exceptional design flexibility, transparent licensing model and scalable performance across diverse hardware systems. The architecture empowers companies to implement customized instruction sets, accelerate silicon development and adapt to evolving workload demands in edge, embedded, and data-centric applications. This trend highlights the industry shift toward open-standard architectures, with RISC-V-based platforms adopted to achieve functional differentiation and cost efficiency in sectors focused on energy optimization, processor modularity and platform independence.

Moreover, manufacturers are advancing RISC-V adoption through robust toolchains, development kits and scalable frameworks to provide real-time simulation, AI-based verification and fast debugging tools that helps in reducing errors and shorten development cycles. Recently, in May 2025, Semidynamics launched Cervell, an all-in-one, fully programmable RISC-V NPU that delivers scalable AI performance for edge and datacenter applications, highlighting RISC-V’s growing role in advanced AI hardware solutions. At the same time, enterprises are focusing on improving supply continuity and architectural transparency by shifting toward open-source processor designs. As a result, this shift is accelerating the adoption of open architectures for next-generation semiconductor innovation, owing to the long-term planning in computing infrastructure, automation systems and AI accelerators.

Industry Dynamics

Rapid Investment in the Semiconductor Industry

Rising capital investments in the semiconductor sector to enhance chip design and expand fabrication infrastructure are driving greater adoption of open-standard architectures, including RISC-V technology. This funding trend is creating a favorable ecosystem for innovation, flexibility and long-term scalability in processor development. In June 2025, the Semiconductor Industry Association (SIA) reported that global semiconductor sales rose to USD 57.0 billion in April 2025, up 2.5% from March and 22.7% higher than the same month last year. Companies are focusing on developing application-specific processors that offer greater control over performance, cost, and integration. RISC-V’s license-free model allows firms to avoid royalty expenses while building custom cores suited to their specific needs. These benefits are drawing interest from startups and key players that are enhancing their competitive edge through design flexibility and long-term scalability.

At the same time, there is an increasing number of ecosystem partners are supporting RISC-V by providing development tools, silicon IP and design services. This collaboration is enabling companies to tackle technical challenges and accelerate product development. Moreover, rapid investment in research and commercial applications is driving the adoption of RISC-V for semiconductor innovation, enabling the development of advanced computing solutions across both industrial and consumer markets.

Global Expansion of Consumer Electronics

The steady growth of the global consumer electronics market is increasing the demand for RISC-V-based processors for adaptability, cost efficiency and high performance. For instance, in March 2024, Renesas launched the industry’s first general-purpose 32-bit RISC-V MCUs with an internally developed CPU core that offers a new low-power, high-performance option for consumer electronics for faster and cost-effective product development. Manufacturers are focusing on chip architectures that support a wide range of device functions, including connectivity, low-power consumption and real-time processing. Thus, RISC-V is emerging as a practical solution due to its modular structure that enables efficient customization for devices ranging from wearables to smart home systems.

Additionally, RISC-V technology is based on an open architecture that makes it easier to add security functions, machine learning and hardware accelerators without the restrictions of proprietary designs. This flexibility helps companies adjust to changing market needs, manage costs and maintain product uniqueness. RISC-V is becoming popular for building tailored and future-ready processor solutions, as electronics makers focus on new developments in IoT, portable devices and smart home systems.

Segmental Insights

Product Type Analysis

The segmentation, based on product type includes, microcontroller (MCU), microprocessor (MPU), system-on-chip (SoC), application-specific integrated circuit (ASIC), and other product type. The microcontrollers (MCU) segment is projected to reach at a significant share of the market by 2034, due to its widespread use in cost-sensitive and low-power applications. These processors are commonly integrated into smart home devices, wearables and industrial equipment, where compact design and energy efficiency are essential. RISC-V-based MCUs allow developers to tailor instruction sets to meet specific performance needs while minimizing development costs. The license-free model further enhances their appeal among startups and embedded solution providers. The demand for customizable and scalable MCU designs continues to support the MCU dominant position in the market, as more industries adopt automation and connected systems.

The system-on-chip (SoC) segment is projected to grow at a robust pace in the coming years. This growth is driven by rising demand for integrated solutions that combine processing, memory and connectivity on a single chip. RISC-V enables developers to optimize SoC architectures for specific use cases, such as AI inference, edge computing and mobile processing. The modular nature of RISC-V supports feature customization without increasing design complexity. SoCs offer a compact and efficient solution, as applications become more performance-intensive and space-constrained. This trend is fueling RISC-V adoption in advanced consumer electronics, data processing systems and automotive applications.

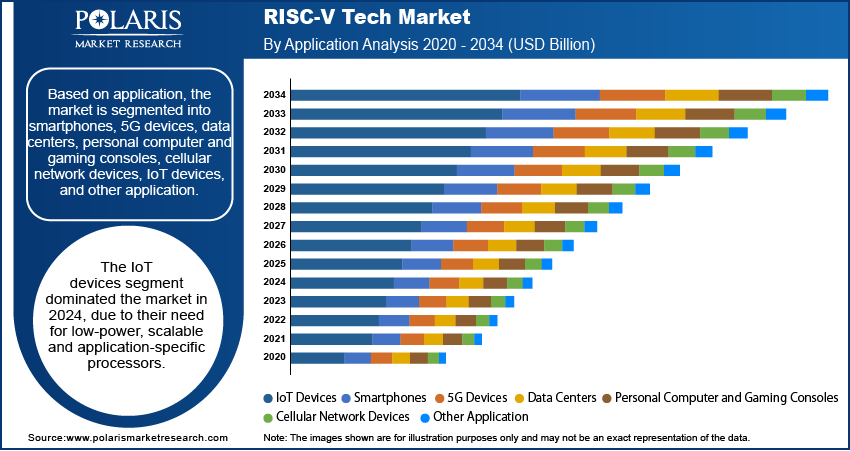

Application Analysis

The segmentation, based on application includes, smartphones, 5G devices, data centers, personal computer and gaming consoles, cellular network devices, IoT devices, and other application. The IoT devices segment dominated the market in 2024, due to their need for low-power, scalable and application-specific processors. RISC-V offers a flexible framework that supports tailored instruction sets, making it suitable for diverse IoT use cases including smart metering, industrial monitoring and home automation. Its open-source nature reduces licensing costs, which is beneficial for manufacturers deploying large volumes of connected devices. RISC-V's efficiency in real-time processing and edge analytics further supports its widespread use in IoT systems. These advantages continue to position IoT as the largest application segment driving RISC-V implementation.

The data centers segment is estimated to hold a significant market share in 2034, as companies seek alternatives to proprietary architectures. RISC-V supports high customization and workload-specific optimization, making it suitable for AI processing, storage management and cloud operations. Companies are exploring RISC-V to design processors that meet with internal performance needs, as demand rises for scalable infrastructure and energy-efficient data processing. For instance, in August 2024, SiFive launched the Performance P870-D, a new high-performance RISC-V datacenter processor designed for demanding AI, video streaming and storage workloads. Its compatibility with open-source software stacks also enables broader integration and innovation. These capabilities are positioning RISC-V-based processors as a viable choice for data center operators focused on flexibility, cost control and long-term scalability.

End User Analysis

The segmentation, based on end user includes, consumer electronics, automotive and transportation, computing and storage, communication infrastructure, healthcare, aerospace and defense, industrial, and other end user industries. The consumer electronics segment dominated the market, in 2024, due to the widespread use of processors in devices such as smartphones, wearables, smart TVs and tablets. RISC-V’s flexibility allows manufacturers to customize chip features to match specific device functions while maintaining cost efficiency. Its open architecture supports integration of AI, security and connectivity functions that helps to enhance user experience. RISC-V enables faster development and deployment, as product lifecycles shorten and design requirements evolve rapidly. These advantages continue to make it a preferred choice in high-volume consumer electronics manufacturing.

The automotive and transportation segment is projected to grow at a robust pace during the forecast period. This growth is driven by the need for high-performance and customizable processors in modern vehicles. RISC-V enables tailored solutions for applications such as advanced driver assistance systems (ADAS), in-vehicle infotainment and electronic control units (ECUs) for performance, flexibility and cost efficiency. For instance, in March 2025, Infineon announced its first automotive microcontroller family based on RISC-V, expanding its AURIX brand and marking a significant step toward open-standard automotive computing; a virtual prototype and starter kit, developed with key ecosystem partners that will enable early software development ahead of hardware availability. The architecture supports functional safety and real-time processing requirements critical to automotive systems. Automakers are increasingly prioritizing flexible chip designs that comply with evolving vehicle technologies and RISC-V offers a cost-effective and adaptable alternative to proprietary IP.

Regional Analysis

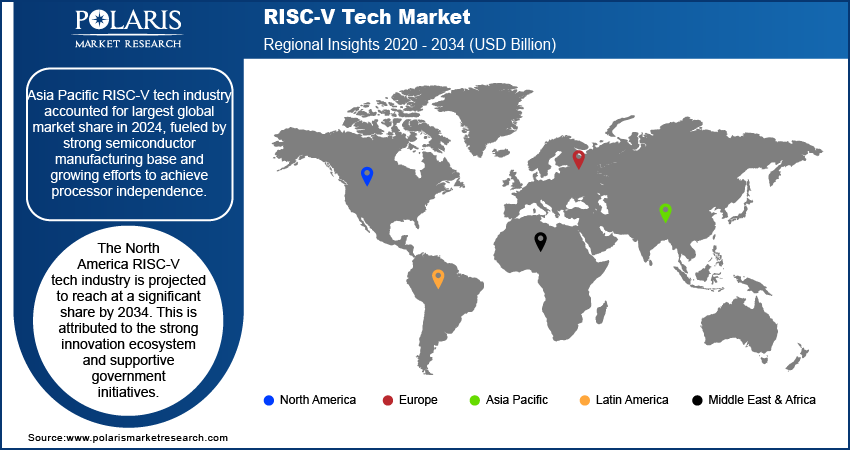

Asia Pacific RISC-V tech industry accounted for largest global market share in 2024, fueled by strong semiconductor manufacturing base and growing efforts to achieve processor independence. The rising efforts by the key countries such as China, Taiwan, and India to invest in open-source architectures to reduce licensing costs and develop customized processors. Thus, this regional push is accelerating RISC-V adoption across consumer electronics, industrial systems, and AI applications.

China RISC-V Tech Market Insight

The China dominated the regional market share in 2024, due to its strong domestic investment and strategic policy support for semiconductor self-reliance through initiatives such as "Made in China 2025," the country is accelerating open-source chip development to reduce dependence on foreign IP. Moreover, local firms are integrating RISC-V cores into smart devices and AI processors, advancing customized design control in key cities such as Beijing, Shanghai, and Shenzhen as innovation hubs. Recently, in April 2025, RiVAI Technologies introduced the Lingyu CPU, China’s first high-performance domestically designed RISC-V server processor in Qianhai, Shenzhen. It features 32 general-purpose cores and 8 specialized cores to efficiently support large language model inference while optimizing power use and reducing total cost of ownership.

North America RISC-V Tech Market

The North America RISC-V tech industry is projected to reach at a significant share by 2034. This is attributed to the strong innovation ecosystem and supportive government initiatives. This includes programs such as the CHIPS and Science Act that is accelerating RISC-V-based development in areas including AI, high-performance computing and secure edge applications. Major industry players are increasing investments in RISC-V cores, toolchains and custom silicon for data centers and automotive use. In December 2024, SiFive announced to reduce the price of its HiFive Premier P550 RISC-V board and added support for Ubuntu 24.04, making high-performance RISC-V development more accessible to a broader range of developers. These advancements are helping build a robust ecosystem that supports rapid adoption and advanced processor design across the region.

Europe RISC-V Tech Market Overview

Europe growth is driven, due to strong government-backed initiatives such as the European Processor Initiative (EPI) and the DARE project that aims to achieve processor sovereignty. As an example, in March 2025, European Union announced DARE project, with an investment of USD 280.9 million that aims to boost the development of high-performance RISC-V processors. These efforts reflect Europe's commitment to reducing dependency on external IP providers and strengthening its long-term position in advanced chip innovation.

Key Players & Competitive Analysis Report

The RISC-V tech industry is moderately fragmented, with companies competing on architectural flexibility, custom core design, and open-source toolchains. Key players are offering scalable processor IP and software platforms to support edge, embedded, and high-performance computing. Strategic efforts include AI integration, real-time processing, and support for safety-critical systems. Firms are investing in silicon validation, regional design centers, and ecosystem partnerships. Collaborations with fabless companies, foundries, and research institutions are helping strengthen market presence across industrial, automotive, and consumer applications.

Key companies in the RISC-V tech industry include SiFive, Inc., Codasip, Andes Technology Corporation, Ventana Micro Systems Inc., Imagination Technologies, Microchip Technology Inc., GreenWaves Technologies, Bluespec, Inc., GigaDevice, Syntacore, Synopsys, Inc., Intel Corporation, Qualcomm Incorporated, RiVAI Technologies, and Alibaba Group Holdings Ltd.

Key Players

- Alibaba Group Holdings Ltd.

- Andes Technology Corporation

- Bluespec, Inc.

- Codasip

- GigaDevice

- GreenWaves Technologies

- Imagination Technologies

- Intel Corporation

- Microchip Technology Inc.

- Qualcomm Incorporated

- RiVAI Technologies

- SiFive, Inc.

- Synopsys, Inc.

- Syntacore

- Ventana Micro Systems Inc.

Industry Developments

April 2025: Andes Technology partnered with Imagination Technologies to launch Android 15 running on a high-performance RISC-V-based platform. This launch highlights the growing capabilities of RISC-V architecture for supporting advanced operating systems in next-generation devices.

February 2025: Alibaba’s Damo Academy launched the C930, a new high-performance RISC-V processor designed for server applications. This launch aims to offer China’s chip self-sufficiency and building a robust RISC-V ecosystem amid ongoing US export restrictions.

April 2024: Imagination Technologies launched the APXM-6200, a high-performance RISC-V application processor in its Catapult CPU range, designed to accelerate RISC-V adoption in next-generation consumer and industrial devices. The new CPU delivers significant improvements in performance density, security, and AI capabilities, while offering flexible core configurations and seamless integration with established software ecosystems.

RISC-V Tech Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Microcontroller (MCU)

- Microprocessor (MPU)

- System-on-Chip (SoC)

- Application-Specific Integrated Circuit (ASIC)

- Other Product Type

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Smartphones

- 5G Devices

- Data Centers

- Personal Computer and Gaming Consoles

- Cellular Network Devices

- IoT Devices

- Other Application

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Consumer Electronics

- Automotive and Transportation

- Computing and Storage

- Communication Infrastructure

- Healthcare

- Aerospace and Defense

- Industrial

- Other End User Industries

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

RISC-V Tech Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.35 Billion |

|

Market Size in 2025 |

USD 1.73 Billion |

|

Revenue Forecast by 2034 |

USD 17.40 Billion |

|

CAGR |

29.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.35 billion in 2024 and is projected to grow to USD 17.40 billion by 2034.

The global market is projected to register a CAGR of 29.2% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are SiFive, Inc., Codasip, Andes Technology Corporation, Ventana Micro Systems Inc., Imagination Technologies, Microchip Technology Inc., GreenWaves Technologies, Bluespec, Inc., GigaDevice, Syntacore, Synopsys, Inc., Intel Corporation, Qualcomm Incorporated, and Alibaba Group Holdings Ltd.

The microcontroller (MCU) segment dominated the market share in 2024, owing to strong demand for low-power, customizable cores in IoT devices, consumer electronics and industrial applications.

The system-on-chip (SoC) segment is projected to grow at a robust pace in the coming years.