Self-checkout Systems Market Share, Size, Trends, Industry Analysis Report

By Product (Fixed and Mobile-based); By Component; By End Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM3286

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

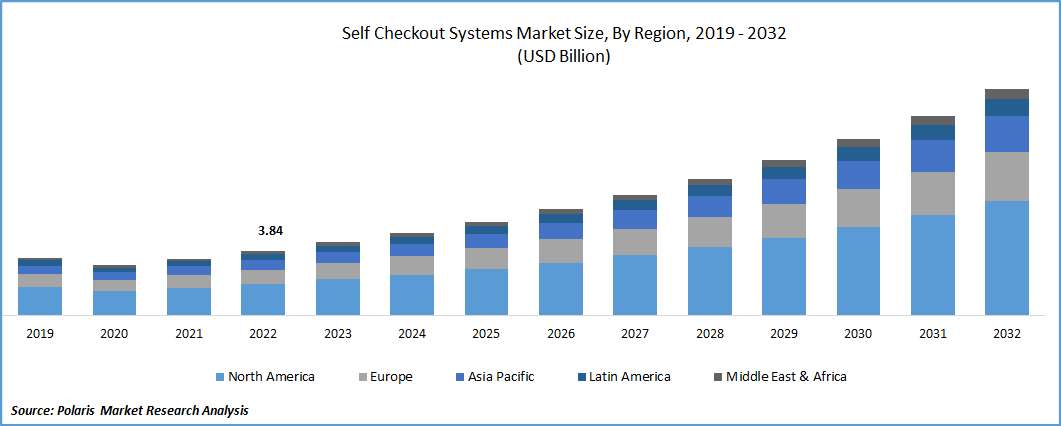

The global self-checkout systems market was valued at USD 4.35 billion in 2023 and is expected to grow at a CAGR of 13.4% during the forecast period. The global market is driven by the huge adoption of self-checkout systems in the retail sector. Retail is transforming self-checkout systems in various ways, which include leveraging the latest technology to enhance the customer experience, streamline the checkout process, and increase security.

To Understand More About this Research: Request a Free Sample Report

Retailers are investing in improved technology for self-checkout systems. For example, Sensormatic Solutions collaborated with Zliide to bring physical stores into the next era through digitalization and convenience. Similarly, Amazon and Walmart have already started using self-checkout solutions. Subsequently, the adoption of self-checkout solutions throughout the retail industry is escalating the self-checkout systems market growth.

Self-checkout systems are automated machines that allow customers to scan, bag, and pay for their purchases without the assistance of a cashier or other store personnel. Self-checkout systems are flexible technologies that are widely adopted throughout retail, healthcare, financial services, and other industries, providing customers with a more personalized and efficient experience. Self-checkout systems are becoming progressively popular as they offer a range of beneficial aspects such as improved efficiency, reduced labor costs, increased accuracy, an enhanced customer experience, and data collection. Overall, self-checkout is an innovative and convenient system that is transforming the way customers shop and pay for their purchases.

Automation is experiencing a significant progression, and it is now reliably present in several sectors. The evolution of artificial intelligence, robots, face recognition, and many other technologies is promoting the demand for self-checkout systems. However, digitalization is another trend playing a key role in shaping the market by integrating mobile payments, RFID, and barcode scanning in self-checkout systems. These technologies are driving innovations in the market, as retailers and technology providers seek to develop new and more advanced systems that offer even greater convenience and efficiency.

The COVID-19 pandemic has had a significant impact on the growth of the market for self-checkout systems. Augmented demand for contactless payment options has driven the adoption of self-checkout systems. Self-checkout systems have enabled social distancing by reducing the need for close interaction between customers and cashiers. This has aided in maintaining social distancing measures, which have seen a huge uplift in the adoption of self-checkout systems.

Industry Dynamics

Growth Drivers

Augmented adoption of self-checkouts systems in the retail industry is bolstering the growth of the market. The market for self-checkout systems after the pandemic has been an eye-opening time for the retail industry. Moreover, with the rapid development of digital technology, artificial intelligence, and machine learning, self-checkout systems are propelling the growth of the market. Spurs in demand for cloud-based self-checkout systems are accelerating the expansion of the market.

Many market participants are primarily contributing to cost and time efficiency in the retail sector. For example, Bed Bath received cloud-based self-checkout from NCR Corporation, allowing the company to offer in-store self-checkout. Bed Bath is a domestic merchandise retail store chain. By incorporating a cloud-based system into its checkout approach, NCR’s solutions aided the company's nationwide operations.

Report Segmentation

The market is primarily segmented based on product, component, end-use, and region.

|

By Product |

By Component |

By End-use |

By Region |

|

|

|

|

For Specific Research Requirements: Request for Customized Report

Mobile-based segment is expected to witness the fastest growth over the study period

Mobile based systems registered the fastest growth rate over the study period. Faster and more streamlined checkout experiences have enhanced the demand for mobile-based self-checkout systems. Mobile-based self-checkout systems allow customers to use their own smartphones to scan and pay for items, eliminating the need to use a traditional self-checkout kiosk.

With the ongoing popularity of mobile-based systems, vendors are increasingly investing in self-checkout solutions. For instance, a mobile-based AI self-checkout solution landed around USD 2.6 million in funding for a Berlin-based retail startup. With mobile-based self-checkout solutions and smart cart solutions, the various startups are helping brick-and-mortar retail generate a personalized and data-driven customer experience. As a result, mobile-based self-checkout systems are supporting the growth of the market and are estimated to generate an absolute dollar opportunity in the forthcoming years.

Solution component segment held the largest market share in 2022

In 2022, the solution segment garnered the largest revenue share. With advancements in technology, the solution segment has become more sophisticated, enabling the development of more advanced and accurate self-checkout systems. The segment offers a wide range of options for retailers to customize their self-checkout systems based on their specific needs and requirements. In addition to this, the preference for cash and cashless payment is also enabling the vendors to adopt self-checkout solutions.

Further, flexibility, cost savings, scalability options, and many other key aspects are resulting in the huge adoption of self-checkout solutions across many supermarkets, department stores, and convenience stores. For example, Anker Kassensysteme, a transformational PoS hardware leader, & OneView Commerce, announced the availability of their self-checkout solution, in January 2023. Apart from this, many other players are also contributing to the self-checkout solution to improve their footprint in the market.

Retail industry garnered the largest revenue share in 2022

Retail segment accounted largest revenue share and is expected to maintain its dominance over the study period. Technology has played a noteworthy role in transforming the retail industry. With the widespread acceptance of e-commerce, mobile shopping, and self-checkout systems, retailers are increasingly using technologies to enhance operational efficiency and optimize their supply chains.

The retail industry is exceedingly competitive, with continuing innovations by the market players. The increased shift towards contactless payment options during the COVID-19 pandemic has further driven the market. As few as half of shoppers use self-checkouts in the United States of America. Large retailers like Walmart, Target, and Best Buy often have self-checkout systems available to customers.

Moreover, retailers like Walgreens and CVS have also started implementing self-checkout systems to help customers get in and out of the store quickly. As a result, the installation of self-checkout systems across grocery stores, supermarkets, big-box retailers, and drug stores has improved the roadmap of the market.

North America dominated the market share in 2022

North America garnered the largest revenue share. The growth is attributed to the enormous technological advancements and high demand for self-checkout systems due to the presence of large retail stores. Increasing competitiveness among leading players present in the region like NCR Corporation, Diebold Nixdorf, and others is a major factor fueling the market’s size. Implementation of market strategies like R&D activities, investments, partnerships, and many others is drastically enhancing the demand for self-checkout systems. For instance, NCR has held this leadership position in self-checkout for around 19 consecutive years. Besides, in January 2023, Diebold Nixdorf Inc. teamed with SeeChange Technologies to launch AI-powered self-checkout solutions. Such ongoing developments in the region account for the largest market share in self-checkout systems.

The regional market in Asia Pacific is anticipated to grow at a fast pace due to the rise in the integration of digital technologies by various end users, and the adoption of self-checkout solutions. The expansion of the retail and hotel sectors is predicted to hasten the trend toward automation and digitalization, as well as the growth of the regional market. For instance, Kyocera Group launched an AI-powered innovative self-checkout system, in July 2021. These factors are significantly heightening the growth in this region.

Competitive Insight

Some of the major players operating in the global self-checkout systems market include NCR Corporation, Diebold Nixdorf, Incorporated, ECR Software Corporation, Toshiba Global Commerce Solutions, ITAB Group, FUJITSU, Gilbarco Inc., Pan-Oston, PCMS Group Ltd., StrongPoint, and others.

Recent Developments

- In January 2023, PopID & Toshiba Commerce Solutions partnered to integrate PopPay into Toshiba's front-end PoS & self-services running on its ELERA Commerce Platform.

- In April 2021, Fujitsu Frontech revealed its 6th generation self-checkout system, the “U-Scan Elite”. The product is intended to provide a compact, high-capacity bill & coin recycling solution. It enables retailers to deploy a cash recycling platform across the entire retail environment, including self-service & the attended cashier lanes.

Self-checkout Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 4.93 billion |

|

Revenue Forecast in 2032 |

USD 13.43 billion |

|

CAGR |

13.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Component, By End-use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

NCR Corporation, Diebold Nixdorf, Incorporated, ECR Software Corporation, Toshiba Global Commerce Solutions, ITAB Group, FUJITSU, Gilbarco Inc., Pan-Oston, PCMS Group Ltd., StrongPoint, and others. |

FAQ's

The self-checkout systems market report covering key segments are product, component, end use, and region.

Self-checkout Systems Market Size Worth $13.43 Billion By 2032.

The global self-checkout systems market expected to grow at a CAGR of 13.3% during the forecast period.

North America is leading the global market.

key driving factors in self-checkout systems market are rising application of automated self-checkout systems.