Silent Luxury Goods Market Size, Share, Trends, Industry Analysis Report

: By Product Type (Watches & Jewelry, Apparel, Leather Goods, Perfumes & Cosmetics, and Others), End User, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2025–2034

- Published Date:May-2025

- Pages: 128

- Format: PDF

- Report ID: PM5587

- Base Year: 2024

- Historical Data: 2020-2023

Silent Luxury Goods Market Overview

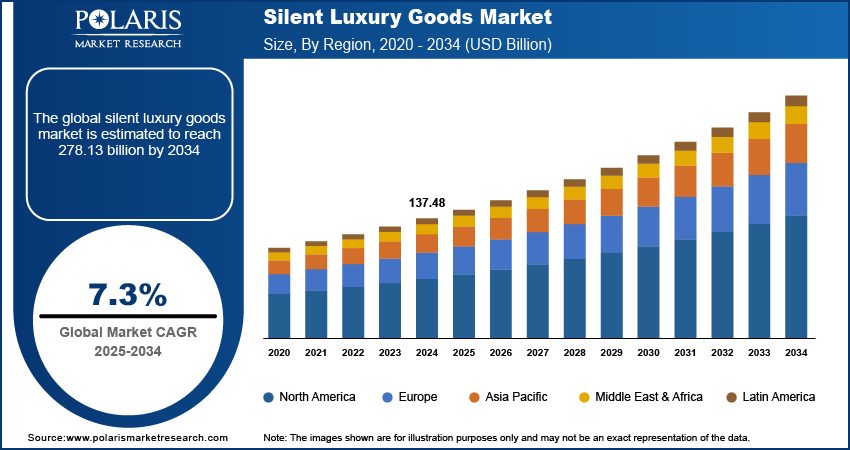

The global silent luxury goods market size was valued at USD 137.48 billion in 2024. The market is projected to grow from USD 147.52 billion in 2025 to USD 278.13 billion by 2034, exhibiting a CAGR of 7.3% during 2025–2034.

Silent luxury goods embody high-end products that prioritize quality, craftsmanship, and exclusivity without overt branding. The growing preference for understated elegance and timeless appeal is driving demand for these products. The silent luxury goods market demand is expanding as affluent buyers shift away from conspicuous logos toward refined sophistication. Brands such as Chanel, Dior, and Gucci have embraced this trend, with vintage luxury stores, including Preloved, offering pre-owned designer items that align with this discreet yet luxurious aesthetic.

To Understand More About this Research: Request a Free Sample Report

The silent luxury goods market development is strengthened by the integration of technology into premium accessories. Fashion-forward items embedded with advanced technology are captivating consumers by blending exclusivity with innovation. For instance, in March 2023, luxury brand Cathy Hackl introduced VerseLux in China, integrating NFC chips into high-end jewelry. Similarly, Coach launched Coachtopia, featuring luxury handbags, wallets, and apparel equipped with NFC chips across major global markets. These advancements enhance product desirability while unlocking new revenue streams, reinforcing the demand for silent luxury goods.

Affluent travelers seek premium, timeless products that reflect their lifestyles, prompting retailers to establish exclusive shopping experiences in major travel hubs. In January 2024, Aer Rianta International expanded its luxury vintage store to Lisbon Airport after its success in Montreal. This move highlights a growing trend in the accessibility of silent luxury goods at major travel destinations. As a result, the rise in international travel has significantly fueled the silent luxury goods market expansion.

Silent Luxury Goods Market Dynamics

Increasing Demand for Exclusivity and Rarity

The growing desire for exclusivity and rarity is fueling the silent luxury goods market growth. High-net-worth individuals seek unique experiences and products that set them apart, driving brands to create invite-only programs and personalized services. Luxury consumers nowadays prioritize subtle elegance over flashy logos, favoring refined craftsmanship and limited-edition offerings. For instance, in April 2023, Saks expanded its invite-only Limitless VIP program, offering exclusive experiences such as Fashion Week, luxury shopping trips, and private events. This initiative aligns with the rising demand for curated luxury, where exclusivity becomes a status symbol. Early access to premium products and bespoke services enhances the appeal of silent luxury, reinforcing a sense of privilege among affluent buyers. The shift toward understated luxury reflects a deeper appreciation for quality and heritage, making silent luxury an increasingly dominant force in the market.

Celebrity Endorsements Influence Luxury Purchasing Decisions

Consumers are increasingly drawn to high-profile figures who represent sophistication and exclusivity, which impacts their preferences for refined, logo-free luxury items. Discreet yet prestigious brands gain popularity as celebrities embrace a style of understated elegance, leading to a trend that prioritizes timeless craftsmanship over overt branding. Luxury brands often collaborate with influential personalities that promote quiet luxury, further enhancing the appeal of exclusivity.

Subtle endorsements such as red-carpet appearances or social media posts featuring minimalist luxury encourage affluent buyers to invest in high-quality, understated pieces. This shift increases brand desirability and fuels the demand for silent luxury, ultimately boosting market revenue as consumers seek exclusivity with an elite touch. Overall, celebrity endorsements substantially influence luxury purchasing decisions and contribute significantly to the silent luxury goods market revenue.

Silent Luxury Goods Market Segment Analysis

Silent Luxury Goods Market Assessment by Product Type

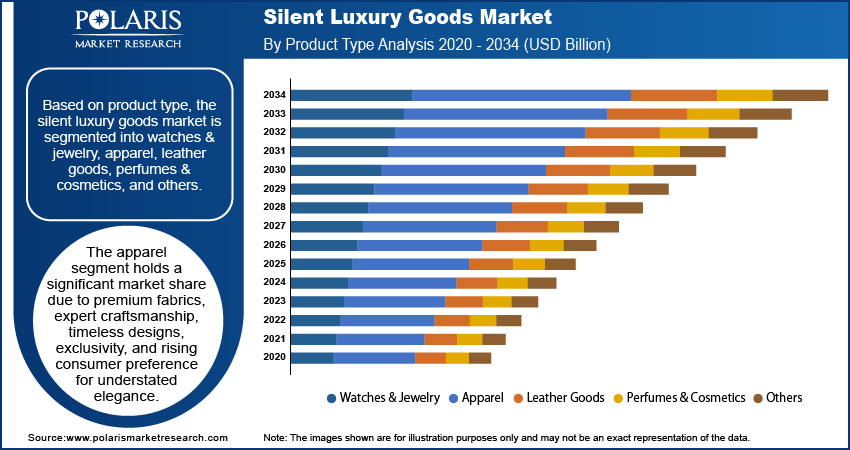

The global silent luxury goods market segmentation, based on product type, includes watches & jewelry, apparel, leather goods, perfumes & cosmetics, and others. The apparel segment holds a significant market share due to the growing preference for understated elegance over flashy branding. Discerning consumers value high-quality materials, expert craftsmanship, and timeless designs that reflect sophistication without overt logos. Luxury fashion brands focus on creating refined, minimalist clothing that appeals to those seeking exclusivity and authenticity.

Rising demand for premium fabrics and tailored fits strengthens the apparel segment’s dominance in the market. Affluent buyers invest in pieces that offer longevity and versatility, aligning with the principles of silent luxury. This shift in consumer behavior encourages brands to prioritize heritage, craftsmanship, and limited production, reinforcing the apparel segment’s strong position in the silent luxury goods market.

Silent Luxury Goods Market Evaluation by End User

The global silent luxury goods market segmentation, based on end user, includes male and female. The male segment is expected to witness significant growth due to rising disposable incomes and a growing preference for understated elegance. Men are increasingly investing in high-quality, logo-free luxury items that reflect sophistication without overt branding. This shift aligns with evolving fashion sensibilities that prioritize craftsmanship over conspicuous consumption. Male consumers now seek exclusivity and timeless appeal in their purchases, driving demand for silent luxury goods. Luxury brands are curating collections that reflect a refined aesthetic. This changing consumer behavior significantly contributes to the global market expansion.

Silent Luxury Goods Market Regional Analysis

By region, the study provides silent luxury goods market insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe holds a substantial goods market share due to its rich heritage of craftsmanship and renowned luxury houses. The region is home to iconic brands that emphasize quality, exclusivity, and timeless design, aligning perfectly with the silent luxury trend. Consumers in Europe appreciate refined aesthetics, driving demand for discreet yet premium products.

A strong culture of sophistication and an affluent customer base contribute to silent luxury goods market growth. European brands continuously innovate while maintaining traditional artistry, attracting global consumers seeking authenticity. This deep-rooted luxury culture solidifies Europe’s position as a leader in the market.

The Asia Pacific silent luxury goods market is experiencing substantial growth due to rising disposable incomes and increasing demand for understated elegance. Wealthy consumers prefer subtle branding and high-quality craftsmanship over overt logos. Strong economic expansion in countries such as China and India fuels luxury spending, while younger generations embrace quiet luxury as a status symbol. Digital transformation and C2C (consumer-to-consumer) e-commerce further enhance accessibility. The market continues to expand as global brands adapt to regional preferences, offering exclusive designs that align with cultural values and refined aesthetics.

Silent Luxury Goods Market – Key Players and Competitive Analysis Report

The silent luxury goods market is witnessing intense competition as key players focus on exclusivity, heritage craftsmanship, and brand storytelling to reinforce their market positioning. Companies are investing in digital innovation, personalized experiences, and sustainable luxury to align with evolving consumer preferences. Strategic acquisitions, collaborations, and expansion into emerging markets are accelerating growth. Maintaining brand desirability through limited editions, artisanal quality, and subtle branding is crucial for competitive differentiation. Localized production and responsible sourcing help optimize supply chains and enhance sustainability efforts. A few leading market players driving competitive positioning include Burberry Group PLC, Chanel LTD, Estée Lauder Companies Inc., Hermes International, Inditex, Kering SA, LVMH Group, Max Mara S.r.l., Prada S.p.A, and Ralph Lauren. These companies dominate the silent luxury goods market competitive index by pioneering innovation, refining craftsmanship, and leveraging digital transformation to meet the rising demand for understated yet prestigious luxury worldwide.

LVMH Group, founded in 1987, is a global luxury leader operating across wines & spirits, fashion & leather goods, perfumes & deodorants, watches & jewelry, and selective retailing segments. It owns prestigious brands such as Louis Vuitton, Dior, Givenchy, and Guerlain, focusing on heritage, innovation, and exclusivity in luxury markets.

Kering SA, founded in 1963 and based in Paris, is a global luxury group managing renowned brands such as Gucci, Saint Laurent, Balenciaga, and Bottega Veneta. Specializing in fashion, leather goods, jewelry, eyewear, and beauty, Kering focuses on innovation, sustainability, and craftsmanship across key international markets.

List of Key Companies in Silent Luxury Goods Market

- Burberry Group PLC

- Chanel LTD

- Estée Lauder Companies Inc.

- Hermes International

- Inditex

- Kering SA

- LVMH Group

- Max Mara S.r.l.

- Prada S.p.A

- Ralph Lauren

Silent Luxury Goods Industry Development

In February 2025, Hermès announced to enter haute couture by 2026–2027, reinforcing its ultra-luxury status through artisanal mastery, exclusive craftsmanship, and strategic expansion into the prestigious world of bespoke fashion.

In September 2023, Ralph Lauren expanded in Canada with a luxury store at Toronto’s Yorkdale Shopping Centre and a dedicated digital commerce site, enhancing its omni-channel presence as part of its global growth strategy.

In June 2023, Kering Beauté acquired Creed, the largest independent luxury fragrance house, strengthening its beauty portfolio and expanding globally, with a focus on China, travel retail, and category growth while preserving Creed’s heritage.

Silent Luxury Goods Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Watches & Jewelry

- Apparel

- Leather Goods

- Perfumes & Cosmetics

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Male

- Female

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Online

- Offline

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Silent Luxury Goods Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 137.48 Billion |

|

Market Size Value in 2025 |

USD 147.52 Billion |

|

Revenue Forecast by 2034 |

USD 278.13 Billion |

|

CAGR |

7.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 137.48 billion in 2024 and is projected to grow to USD 278.13 billion by 2034.

The global market is projected to register a CAGR of 7.3% during the forecast period.

Europe held a substantial market share in 2024.

A few key players in the market are Burberry Group PLC, Chanel LTD, Estée Lauder Companies Inc., Hermes International, Inditex, Kering SA, LVMH Group, Max Mara S.r.l., Prada S.p.A, and Ralph Lauren.

The apparel segment held the significant market share in 2024.

The male segment is projected to significantly grow in the market during 2025–2034