Single-Use Bioprocessing Connectors Market Size, Share, Trends, Industry Analysis Report

: By Product (Aseptic Connectors and Conventional Connectors), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM5571

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

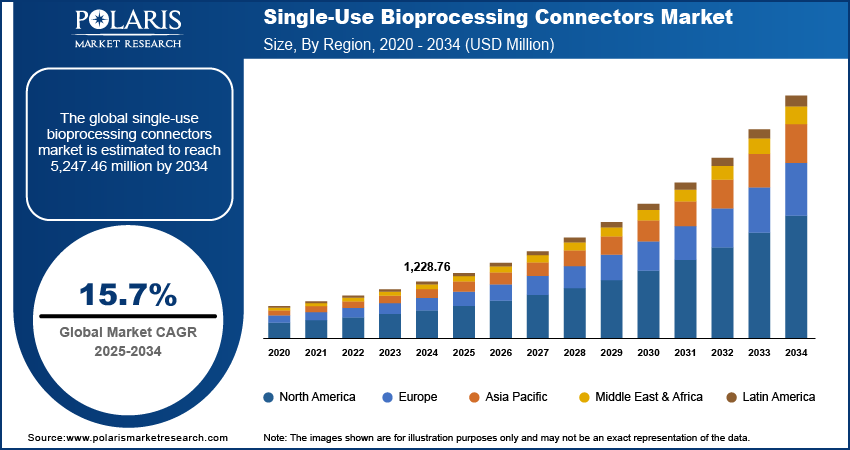

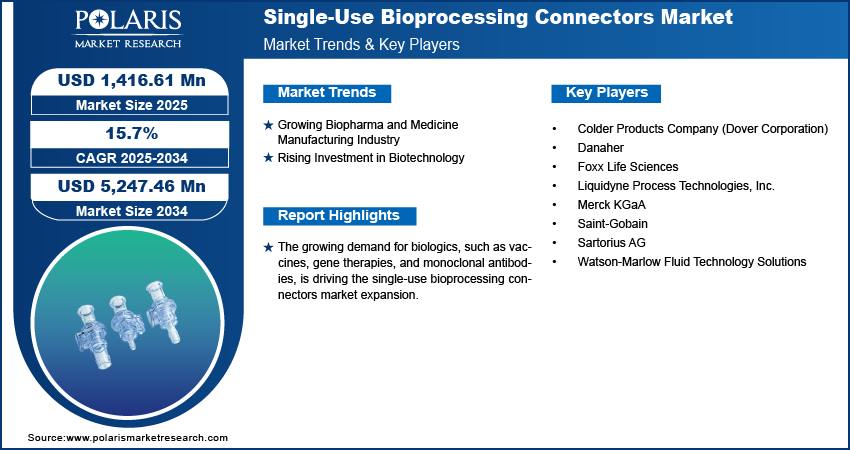

The global single-use bioprocessing connectors market size was valued at USD 1,228.76 million in 2024, growing at a CAGR of 15.7% from 2025 to 2034. Increased demand for biologics and the various benefits associated with single-use bioprocessing connectors are a few of the key factors driving market growth.

Key Insights

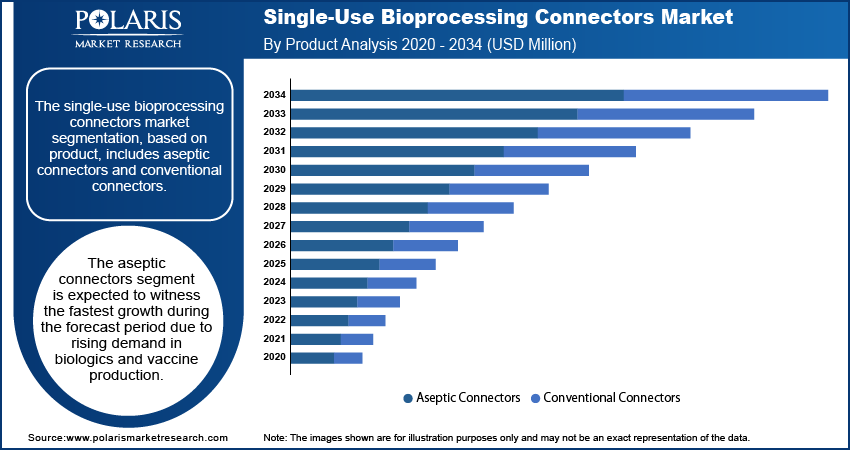

- The aseptic connectors segment is projected to witness the fastest growth. The segment’s growth is driven by the crucial role of these connectors in vaccine production and biologics.

- The upstream bioprocessing segment led the market in 2024. The growing demand for biologics and other therapies has resulted in an increased need for scalable and efficient upstream processes.

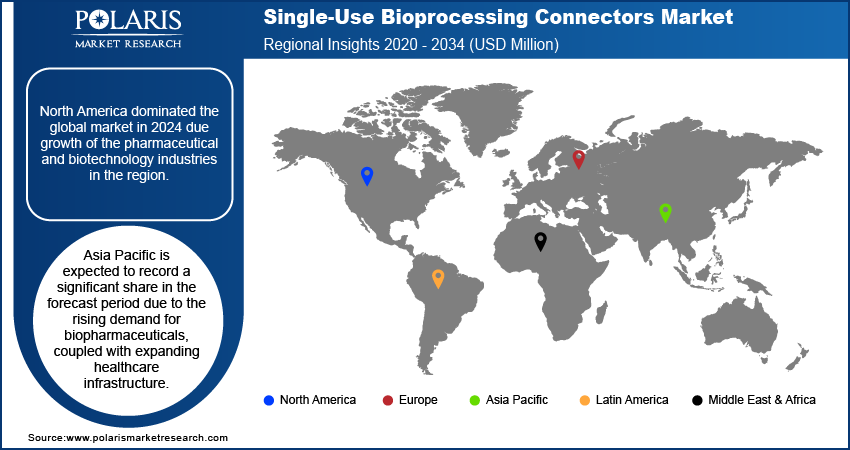

- North America accounted for the largest market share in 2024. The expanding biotechnology and pharmaceutical industries contribute to the region’s leading market share.

- Asia Pacific is expected to account for a significant market share. Expanding healthcare infrastructure and growing demand for biopharmaceuticals are driving the regional market expansion.

Industry Dynamics

- The rising need for advanced therapies due to the growth of the global biopharma and medicine industry is fueling market expansion.

- Increased investments by governments and private investors globally have led to increased demand for advanced bioprocess manufacturing components, including single-use bioprocessing connectors.

- Growing emphasis on flexibility and cost-efficiency is expected to create several market opportunities.

- The high initial investment associated with single-use bioprocessing connectors is hindering market growth.

Market Statistics

2024 Market Size: USD 1,228.76 million

2034 Projected Market Size: USD 5,247.46 million

CAGR (2025-2034): 15.7%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

Single-use bioprocessing connectors are sterile, disposable components used to link various parts of a bioprocessing system, such as tubing and containers. They eliminate the need for cleaning and sterilization between uses, enhancing efficiency and reducing the risk of contamination in biopharmaceutical production.

Traditional systems require cleaning, sterilization, and validation between batches, which are time-consuming and expensive. Single-use connectors eliminate the need for these processes, as they are disposable after one use. This reduces the costs associated with labor and cleaning materials while also minimizing the risk of errors or contamination during the cleaning process. Biopharmaceutical companies benefit from lower overall manufacturing costs, making single-use connectors a more economical and efficient choice compared to traditional reusable systems. This shift enables smoother operations and increased profitability, driving the adoption of single-use connectors across the biotechnology industry and fueling the single-use bioprocessing connectors market growth.

The growing demand for biologics, such as vaccines, gene therapies, and monoclonal antibodies, is driving the single-use bioprocessing connectors market expansion. Biologics are complex and require specialized manufacturing processes, making traditional systems less effective. Single-use connectors are ideal for biologics production because they can be easily adjusted to different production scales and eliminate the risk of cross-contamination. The rising use of biologics, coupled with the need for flexible, cost-effective, and scalable production systems, has led to the widespread implementation of single-use connectors in the biopharma industry.

Market Dynamics

Growing Biopharma and Medicine Manufacturing Industry

The global biopharma and medicine manufacturing industry has experienced rapid growth, driven by the increasing demand for advanced therapies, such as biologics, gene therapies, and vaccines. For instance, according to the International Trade Organization, the US alone employed 340,000 people in the medical manufacturing industry by mid-2024, highlighting the industry’s rapid expansion. The demand for efficient and flexible production processes is growing as the need for advanced therapies rises. Single-use connectors enable quick adjustments to production lines and help minimize costly downtime, making them an essential tool in production. This, in turn, is fueling the single-use bioprocessing connectors market development.

Rising Investment in Biotechnology

Governments and private investors worldwide are making significant investments in biotechnology to drive innovation and address global healthcare challenges. According to the International Trade Organization, foreign direct investment in the US biopharma and medicine manufacturing industry reached USD 503.4 billion in 2022. These investments in biotech infrastructure and research are fueling the growth of biopharmaceutical manufacturing, providing companies with the resources needed to implement advanced solutions. Additionally, they enable manufacturers to improve productivity, reduce costs, and accelerate the production of life-saving therapies. Thus, rising investment in biotechnology is driving the demand for advanced bioprocess manufacturing components and fueling the single-use bioprocessing connectors market demand.

Segment Insights

Market Assessment by Product Outlook

The single-use bioprocessing connectors market assessment, based on product, includes aseptic connectors and conventional connectors. The aseptic connectors segment is expected to witness the fastest growth from 2025 to 2034. Aseptic connectors are designed to ensure sterile connections between bioprocessing components, making them crucial in industries where contamination must be avoided, such as in biologics and vaccine production. Their growing popularity is attributed to the increasing demand for contamination-free environments in biomanufacturing processes. Biopharmaceutical companies are adopting single-use systems to improve efficiency and product safety, thereby driving segmental growth in the global market.

Market Evaluation by Application Outlook

The single-use bioprocessing connectors market evaluation, based on application, includes upstream bioprocessing, downstream bioprocessing, and fill-finish operations. The upstream bioprocessing segment dominated the market in 2024. Upstream bioprocessing involves the initial stages of biomanufacturing, such as cell culture and fermentation, where sterile conditions and flexibility are essential, making single-use connectors crucial at this stage. Additionally, the growing demand for biologics and other therapies has increased the need for efficient and scalable upstream processes. As a result, single-use connectors have become the preferred solution, contributing to the segment’s leading position in the market.

Regional Analysis

By region, the study provides the single-use bioprocessing connectors market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global market in 2024, driven by the growth in the pharmaceutical and biotechnology industries. This growth is fueled by significant investments in biomanufacturing and advanced healthcare technologies to meet the increasing demand for biologics, vaccines, and advanced therapies. The presence of major biopharma companies and research institutions further supports the market for single-use connectors. Additionally, regulatory frameworks, such as good manufacturing practices (GMP), push for high-quality production systems, making single-use connectors a preferred choice in North America’s biopharmaceutical sector.

Asia Pacific is expected to record a significant share during the forecast period. The region's growing demand for biopharmaceuticals, coupled with expanding healthcare infrastructure, is driving the adoption of single-use bioprocessing technologies. Emerging countries like China and Japan are increasing their biomanufacturing capabilities to meet both domestic and global healthcare needs. Additionally, lower production costs and a focus on biotechnological advancements in countries like South Korea and Singapore are boosting the demand for single-use connectors, driving the market growth in the region.

The India single-use bioprocessing connectors market is experiencing substantial growth due to its rapidly growing pharmaceutical industry and the expanding biomanufacturing sector. India is a major hub for specialty generic drug production and vaccine manufacturing, driving the need for more efficient and scalable production systems. Additionally, increased government support for biotechnology and rising healthcare demands are fueling growth in the pharmaceutical and biomanufacturing industries, thereby supporting market expansion in the country.

Key Players and Competitive Insights

The single-use bioprocessing connectors market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing innovative products to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the single-use bioprocessing connectors market include Sartorius AG; Merck KGaA; Danaher; Saint-Gobain; Colder Products Company (Dover Corporation); Liquidyne Process Technologies, Inc.; Foxx Life Sciences; and Watson-Marlow Fluid Technology Solutions.

Saint-Gobain, founded in 1665 in Paris, is a French multinational corporation that specializes in the production and distribution of construction materials and high-performance solutions. Initially established as a mirror manufacturer, the company has diversified its offerings over the centuries and now operates in 76 countries. Saint-Gobain's product range is organized into five main segments. The High-Performance Materials segment includes abrasives, ceramics, and plastics, which serve various industries such as automotive and industrial applications. The Construction Products segment offers insulation materials, drywall, roofing solutions, and pipes for both residential and commercial construction markets. The Building Distribution division focuses on distributing building materials through a network of more than 3,500 stores across multiple countries. The Flat Glass segment produces and processes flat glass for construction and automotive applications, including specialty glass products. Saint-Gobain manufactures glass containers for packaging purposes within its Packaging segment. In addition to these segments, Saint-Gobain biopharm offers single-use assemblies for biopharmaceutical applications. These assemblies are part of a broader product range that includes components, connection and flow control systems, filtration solutions, fluid transfer technologies, laboratory equipment, measurement tools, rigid fittings, adaptors, and piping. The company also offers overmolding capabilities, containment solutions, closure systems, and products tailored for fill/finish processes, cell therapy, cell culture, processing, cryopreservation, and custom applications. Saint-Gobain has a significant international presence with operations in North America, Europe, Latin America, Asia, and the Middle East.

Merck KGaA, headquartered in Darmstadt, Germany, is a global science and technology company with origins dating back to 1668. The company operates through three main business sectors: healthcare, life science, and electronics. In the healthcare segment, Merck KGaA focuses on the research, development, manufacturing, and marketing of prescription medications. Key therapeutic areas include oncology, neurology, immunology, and fertility, with several established products addressing conditions such as multiple sclerosis and various cancers. The life science segment provides laboratory materials, technologies, and services to academic institutions and biotechnology companies. This division encompasses tools for gene editing, microbiology products, and analytical reagents. In the electronics sector, Merck KGaA supplies materials essential for the semiconductor and display industries. This includes liquid crystal mixtures and organic light-emitting diode (OLED) materials used in various electronic devices. The company provides fluid transfer systems for bioprocessing, including Lynx connectors (CDR, S2S, ST) for sterile connections and disconnections. Its NovaSeal Crimping Tool is used for sterile disconnection of single-use assemblies. Merck KGaA operates in over 180 countries, with a strong presence in Europe, particularly in Germany. North America is another key region for both healthcare and life sciences.

List of Key Companies

- Colder Products Company (Dover Corporation)

- Danaher

- Foxx Life Sciences

- Liquidyne Process Technologies, Inc.

- Merck KGaA

- Saint-Gobain

- Sartorius AG

- Watson-Marlow Fluid Technology Solutions

Single-Use Bioprocessing Connectors Industry Developments

In January 2025, the MicroCNX Nano Series aseptic connectors were launched by CPC, revolutionizing cell and gene therapy sterile processing with a simpler, more efficient approach to creating closed sterile systems.

In September 2024, an aseptic micro-connector for cell and gene therapy cryopreservation was launched by CPC. The company stated that the micro-connector is designed to support sterility and withstand temperatures as low as -190°C, enhancing sterile connections in biopharma manufacturing.

Single-Use Bioprocessing Connectors Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Aseptic Connectors

- Conventional Connectors

By Application Outlook (Revenue, USD Million, 2020–2034)

- Upstream Bioprocessing

- Downstream Bioprocessing

- Fill-finish Operations

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Biopharmaceutical & Pharmaceutical Companies

- CROs & CMOs

- Academic & Research Institutes

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,228.76 million |

|

Market Size Value in 2025 |

USD 1,416.61 million |

|

Revenue Forecast by 2034 |

USD 5,247.46 million |

|

CAGR |

15.7% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The single-use bioprocessing connectors market size was valued at USD 1,228.76 million in 2024 and is projected to grow to USD 5,247.46 million by 2034.

The global market is projected to register a CAGR of 15.7% during the forecast period, 2025–2034.

North America had the largest share of the global market in 2024.

A few of the key players in the market are Sartorius AG; Merck KGaA; Danaher; Saint-Gobain; Colder Products Company (Dover Corporation); Liquidyne Process Technologies, Inc.; Foxx Life Sciences; and Watson-Marlow Fluid Technology Solutions.

The upstream bioprocessing segment dominated the market in 2024, as single-use connectors are primarily employed in upstream bioprocessing to avoid contamination at the initial stage.

The aseptic connectors segment is expected to witness the fastest growth during the forecast period due to rising demand in biologics and vaccine production.