Single-use Bioprocessing Market Share, Size, Trends, Industry Analysis Report

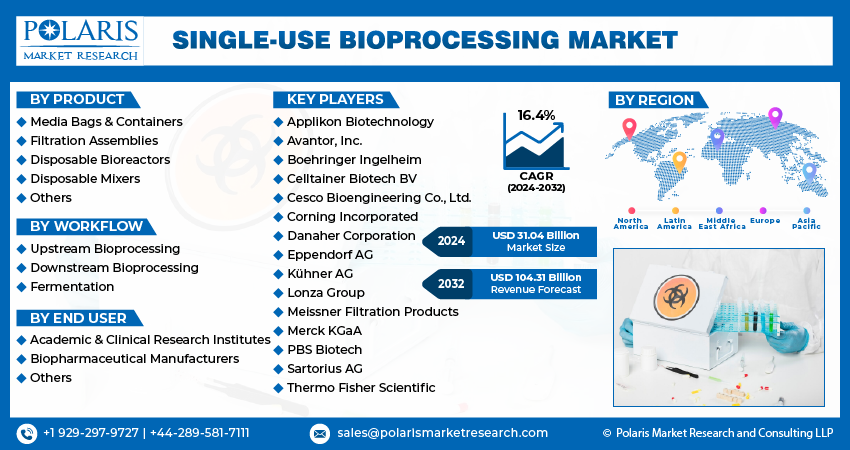

By Product (Media Bags & Containers, Filtration Assemblies, Disposable Bioreactors, Disposable Mixers, Others); By Workflow; By End User; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4618

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

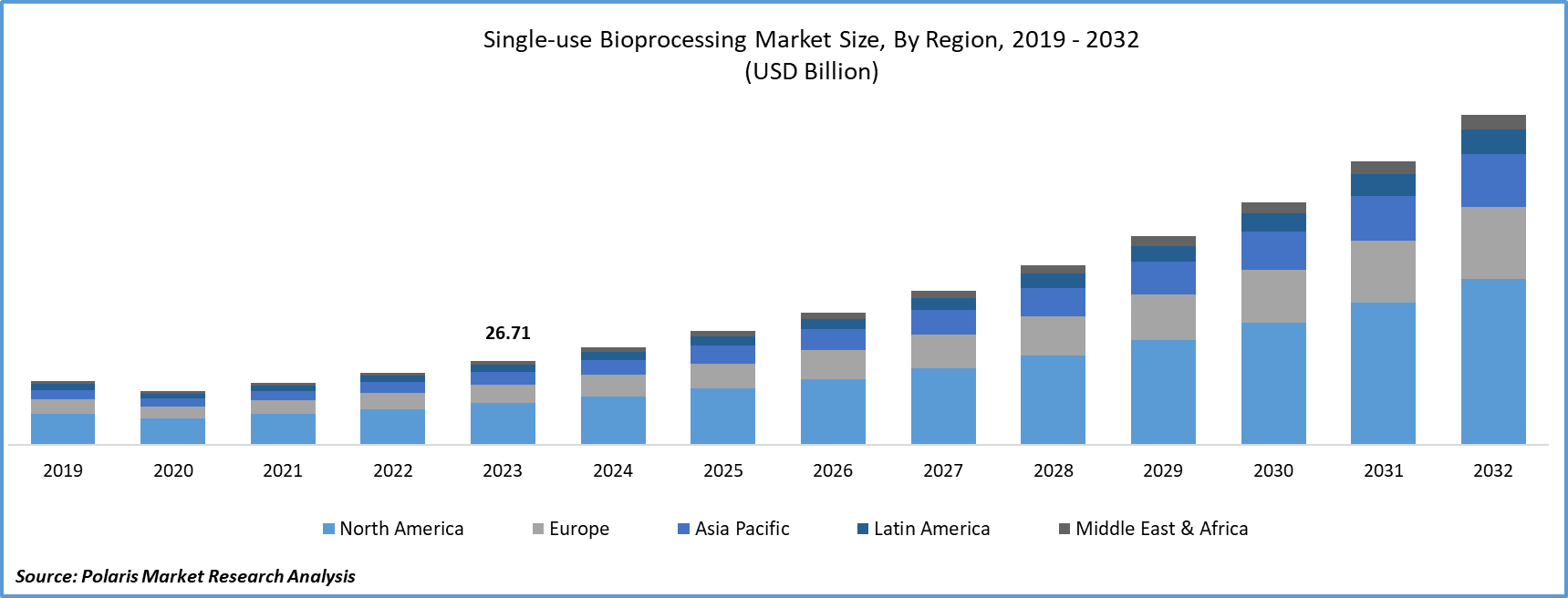

- Single-use Bioprocessing Market size was valued at USD 26.71 billion in 2023.

- The market is anticipated to grow from USD 31.04 billion in 2024 to USD 104.31 billion by 2032, exhibiting the CAGR of 16.4% during the forecast period.

Market Introduction

Flexibility and scalability are pivotal drivers fueling the expansion of the single-use bioprocessing market share. Single-use systems provide unparalleled flexibility, enabling swift adjustments to production processes and accommodating smaller batches. Their scalability facilitates a seamless transition from laboratory to commercial-scale manufacturing. Biopharmaceutical companies benefit from the capacity to scale production based on market demands, enhancing operational efficiency. Additionally, single-use bioprocessing minimizes the risk of cross-contamination, ensuring product integrity.

In addition, companies operating in the market are introducing new products to expand market reach and strengthen their presence.

- For instance, in September 2023, Getinge launched the AppliFlex ST GMP, an innovative single-use bioreactor system crafted to effectively connect research and clinical production in the fields of cell and gene therapy, along with mRNA production.

To Understand More About this Research: Request a Free Sample Report

Robust regulatory support, notably from agencies like the FDA, propels the growth of the single-use bioprocessing market trends. Guidelines ensure product safety and quality, fostering widespread adoption of single-use technologies. International standards harmonize practices globally, facilitating seamless integration. Essential components like validation processes, risk mitigation, and responsive frameworks for emerging technologies contribute to industry evolution.

Industry Growth Drivers

Rapid expansion of biopharmaceuticals is projected to spur the product demand

The rapid expansion of biopharmaceuticals has spurred the single-use bioprocessing market's growth. Essential in treating diseases, biopharmaceuticals demand flexible and efficient production solutions. Traditional stainless-steel systems face limitations, driving the adoption of single-use technologies. These systems offer versatility, reducing cross-contamination risks, streamlining processes, and requiring lower capital investments. The flexibility of single-use systems allows quick scale-up, catering to changing production demands and enabling swift responses to market needs.

Increasing biomanufacturing outsourcing is expected to drive single-use bioprocessing market growth

The surge in biomanufacturing outsourcing is fueling the rapid expansion of the market. Biopharmaceutical firms increasingly opt for outsourcing to enhance efficiency, reduce costs, and expedite production. Single-use bioprocessing technologies offer a flexible, cost-effective solution by eliminating the complexities associated with traditional stainless-steel systems. Outsourcing allows companies to tap into the specialized expertise of contract development and manufacturing organizations (CDMOs), promoting innovation and production streamlining. The scalability of single-use systems aligns with the variable manufacturing demands of outsourcing partners, propelling the growth of the single-use bioprocessing market size and fostering advancements in biomanufacturing capabilities.

Industry Challenges

Regulatory concerns are likely to impede the market growth

Regulatory concerns present a significant hurdle to the expansion of the single-use bioprocessing market report. Despite the advantages of flexibility and cost-effectiveness, regulatory bodies express reservations about integrating these technologies into crucial biopharmaceutical manufacturing processes. Rigorous regulatory scrutiny is essential for adherence to stringent quality standards. The need for standardized guidelines for evaluating single-use systems further complicates the regulatory landscape, necessitating collaborative efforts to establish universally accepted frameworks. Overcoming these concerns requires collaboration between industry stakeholders and regulatory bodies to ensure a regulatory environment supportive of the sustained growth of single-use bioprocessing technologies.

Report Segmentation

The single-use bioprocessing market analysis is primarily segmented based on product, workflow, end user, and region.

|

By Product |

By Workflow |

By End User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Media bags & containers segment held significant market revenue share in 2023

The media bags and containers segment held a significant revenue share in 2023. Essential in single-use bioprocessing, media bags, and containers are sterile, disposable solutions vital for storing and transporting biological materials in the biopharmaceutical industry. Specifically designed for aseptic environments, these containers facilitate cell cultivation, fermentation, and the storage of media and buffers. Media bags, suitable for various volumes, streamline workflows with their flexibility and scalability, eliminating the need for cleaning and reducing cross-contamination risks. Containers, available in different forms, meet diverse storage needs, ensuring compatibility with a range of biopharmaceutical processes while maintaining crucial sterile conditions.

By Workflow Analysis

Upstream bioprocessing segment held significant market revenue share in 2023

The upstream bioprocessing segment held a significant revenue share in 2023. In biopharmaceutical production, upstream bioprocessing encompasses vital stages like cell culture and fermentation. Adopting single-use technologies in this phase yields flexibility, efficiency, and cost-effectiveness. Disposable bioreactors, bags, and tubing systems create a sterile environment, eliminating the need for cleaning between batches and expediting production. The scalability of single-use systems seamlessly transitions from small-scale research to large-scale manufacturing, meeting diverse production needs. This approach aligns with the trend toward personalized medicine, accommodating smaller batches and reducing capital investments, making it especially attractive for emerging biopharmaceutical companies while responding rapidly to market demands.

By End User Analysis

Biopharmaceutical manufacturers segment held significant revenue share in 2023

The biopharmaceutical manufacturers segment held a significant revenue share in 2023. Leading biopharmaceutical manufacturers strategically implement single-use bioprocessing to optimize production efficiency. This approach spans cell culture to formulation, offering flexibility for dynamic production adjustments. The use of disposable bioreactors, bags, and tubing eliminates cleaning and validation needs, reducing cross-contamination risks and expediting production timelines. Aligned with industry trends, single-use bioprocessing supports flexible and modular manufacturing, which is especially advantageous for smaller batches and personalized medicines. These technologies are leveraged to enhance efficiency, cut costs, and adapt to the evolving biopharmaceutical landscape.

Regional Insights

Asia-Pacific is expected to experience significant growth during the forecast period

Asia-Pacific is expected to experience growth during the forecast period. The Asia-Pacific single-use bioprocessing industry is rapidly advancing. Countries like China, India, Japan, and South Korea are witnessing a surge in biomanufacturing activities driven by the cost-effectiveness and scalability of single-use technologies. These advancements align with the region's emphasis on efficiency and affordability.

In 2023, the North American region accounted for a significant market share. With well-established R&D activities and a favorable regulatory landscape, North America holds a significant share globally. Biopharmaceutical companies are increasingly opting for single-use bioprocessing systems, including disposable bioreactors and tubing, to enhance efficiency and flexibility. The region's focus on innovation and evolving bioprocessing techniques aligns with market expansion. As the industry shifts towards personalized medicine and smaller batch production, the continued adoption of single-use systems is anticipated, ensuring cost-effectiveness and compliance with stringent regulatory standards.

Key Market Players & Competitive Insights

The single-use bioprocessing market players encompasses a varied range of participants, and the anticipated influx of new entrants is set to heighten competitive dynamics. Key players in the market consistently refine their technologies, aiming to sustain a competitive edge through a focus on efficiency, dependability, and safety. These entities prioritize strategic initiatives, such as forging alliances, enhancing product portfolios, and engaging in collaborative ventures. Their main objective is to surpass industry rivals, ultimately securing a notable single-use bioprocessing market share.

Some of the major players operating in the global single-use bioprocessing market include:

- Applikon Biotechnology

- Avantor, Inc.

- Boehringer Ingelheim

- Celltainer Biotech BV

- Cesco Bioengineering Co., Ltd.

- Corning Incorporated

- Danaher Corporation

- Eppendorf AG

- Kühner AG

- Lonza Group

- Meissner Filtration Products

- Merck KGaA

- PBS Biotech

- Sartorius AG

- Thermo Fisher Scientific

Recent Developments

- In October 2022, Single Use Support GmbH broadened its range of products by introducing new single-use bioprocess containers named IRIS. The company utilizes its expertise to offer dependable process solutions for biopharmaceutical fluid management.

- In October 2022, PharmNXT Biotech inaugurated its integrated manufacturing facility to offer solutions for single-use bioprocessing. The establishment was introduced to tackle the unique challenges associated with biologics manufacturing in India.

- In April 2023, Merck revealed the introduction of its Ultimus Single-Use Process Container Film, crafted to offer exceptional durability and resistance to leaks in single-use assemblies utilized for liquid applications in bioprocessing.

Report Coverage

The single-use bioprocessing market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, products, workflows, end users, and their futuristic growth opportunities.

Single-use Bioprocessing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 31.04 billion |

|

Revenue forecast in 2032 |

USD 104.31 billion |

|

CAGR |

16.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global Single-use Bioprocessing market size is expected to reach USD 104.31 billion by 2032

Key players in the market are Applikon Biotechnology, Avantor, Inc., Corning Incorporated, Danaher Corporation, Lonza Group

Asia-Pacific contribute notably towards the global Single-use Bioprocessing Market

Single-use Bioprocessing Market exhibiting the CAGR of 16.4% during the forecast period.

The Single-use Bioprocessing Market report covering key segments are product, workflow, end user, and region.