Software Defined Vehicle Market Size, Share, Trends, Industry Analysis Report

By Deployment Mode [On-Board (Edge), Cloud-Based], By Type, By Application, By Vehicle Type By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6090

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

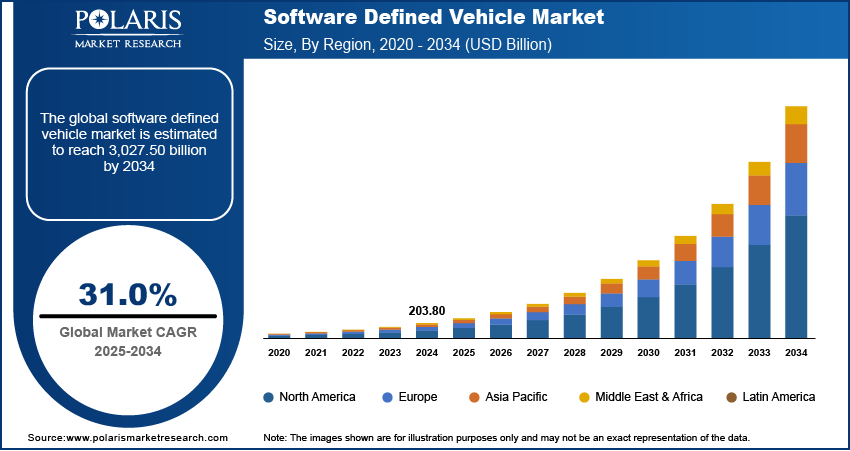

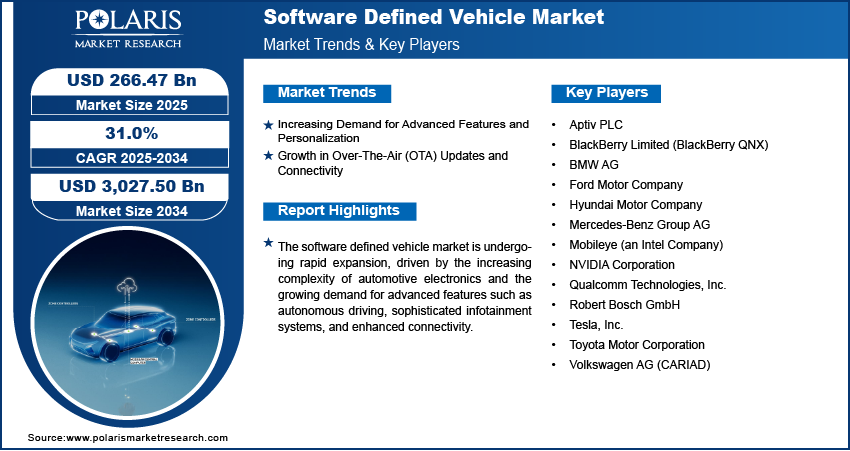

The global software defined vehicle (SDV) market size was valued at USD 203.80 billion in 2024 and is anticipated to register a CAGR of 31.0% from 2025 to 2034. The market growth is primarily driven by the increasing demand for advanced vehicle features, continuous over-the-air (OTA) updates, and enhanced connectivity.

Key Insights

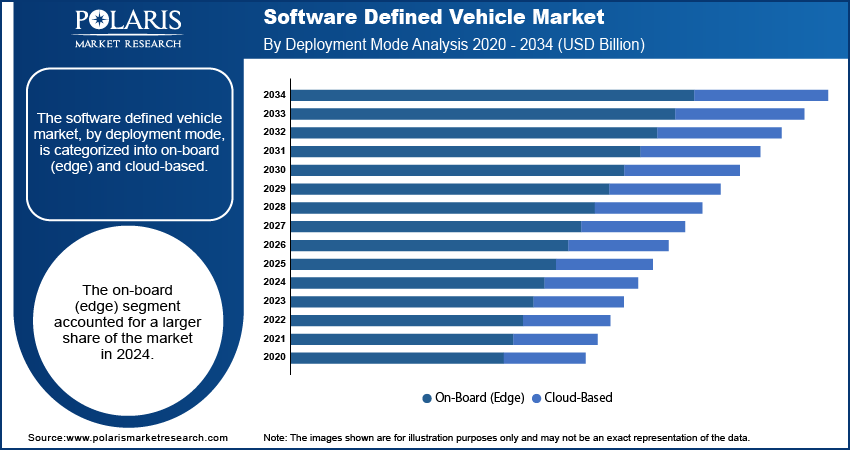

- By deployment mode, the on-board (edge) segment held the largest share in 2024. This is due to its critical role in processing real-time, safety-sensitive functions directly within the vehicle, ensuring immediate response times without relying on external connectivity.

- By type, the connected software-defined vehicles segment held the largest share in 2024. This is because modern vehicles widely integrate software for communication, navigation, and infotainment, making connectivity a foundational and broadly adopted element of software-defined capabilities.

- By application, the advanced driver-assistance systems (ADAS) segment held the largest share in 2024. Their widespread implementation across new vehicle models is driven by increasing safety regulations and consumer demand for features that enhance driving safety and convenience.

- By vehicle type, the passenger car segment held the largest share in 2024, due to the significant consumer demand for advanced features, personalization, and enhanced safety systems in everyday vehicles.

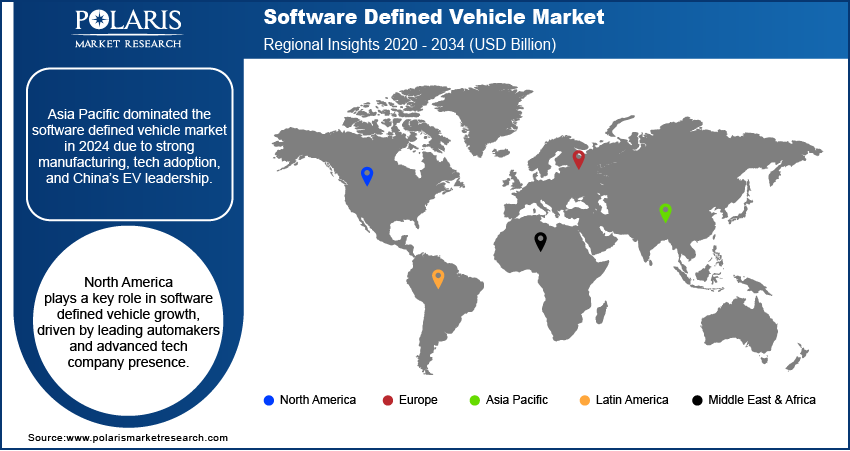

- By region, Asia Pacific held the largest share in 2024. The dominance is primarily driven by its vast consumer base, strong manufacturing infrastructure, and rapid adoption of advanced automotive technologies, particularly in countries such as China, which also leads in new energy vehicle integration.

Industry Dynamics

- The growing need for advanced features and functions in vehicles is a major driver.

- The ability to receive software updates wirelessly allows for continuous improvements and new services, which boosts market opportunities.

- Increasing demand for seamless connectivity and digital integration within vehicles also fuels growth.

- The shift toward electric and autonomous driving technologies relies heavily on advanced software systems, which propels the SDV market expansion.

Market Statistics

- 2024 Market Size: USD 203.80 billion

- 2034 Projected Market Size: USD 3,027.50 billion

- CAGR (2025–2034): 31.0%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

A software-defined vehicle, or SDV, is a vehicle where software plays a central role in managing its functions and features, rather than traditional hardware. This approach enables continuous updates and the addition of new capabilities throughout the vehicle's life.

The growth of the software defined vehicle industry is driven by evolving regulatory frameworks and the increasing complexity of vehicle software development. Regulatory bodies worldwide are working to establish new rules concerning vehicle cybersecurity and data privacy, which shapes how these advanced vehicles are designed and developed.

The rising need for robust cybersecurity measures is a significant driver for the segment. As vehicles become more connected and software dependent, they also become potential targets for cyberattacks. The National Highway Traffic Safety Administration (NHTSA) in the U.S. actively works with the automotive sector to address cybersecurity risks in vehicles. Similarly, the United Nations Economic Commission for Europe (UNECE) adopted regulations such as UN R155, which focuses on cybersecurity management systems for vehicles, making it mandatory for new vehicle types in signatory countries to ensure measures are in place to manage cyber risks throughout the vehicle's lifecycle. These initiatives highlight the critical importance of secure software architecture to protect vehicle systems and user data.

Drivers and Trends

Increasing Demand for Advanced Features and Personalization: Consumers today desire sophisticated features and highly personalized experiences. This factor propels the demand for advanced driver-assistance systems (ADAS), in-car infotainment, and customizable user interfaces. As vehicles become extensions of digital lives, the ability to seamlessly integrate smartphones, access real-time information, and enjoy a tailored driving environment is becoming a standard expectation.

The push for enhanced safety features, often enabled by complex software, illustrates this demand. For instance, a report by the Government Accountability Office (GAO) in March 2024, titled "Driver Assistance Technologies NHTSA Should Take Action to Enhance Consumer Understanding of Capabilities and Limitations," highlighted that new vehicles are increasingly equipped with driver assistance technologies designed to prevent or lessen crashes. This consumer drive for more capable and adaptable vehicles is a strong impetus for the development of software-centric architectures. This growing consumer expectation for feature-rich and customizable vehicles significantly propels the expansion of the software defined vehicle segment.

Growth in Over-The-Air (OTA) Updates and Connectivity: The widespread adoption of over-the-air (OTA) updates and enhanced connectivity is another major driver for software defined vehicle. OTA updates allow manufacturers to deploy software improvements, bug fixes, and entirely new features directly to vehicles without the need for a physical service visit. This capability improves vehicle performance and safety over time, as well as enables automakers to introduce new revenue streams through subscription-based services and feature upgrades.

This trend is supported by the increasing connectivity of modern vehicles. Research published in the Engineering International Journal in June 2022, an article titled "Automotive Software Engineering: Real-World Necessity and Significance" noted that implementing effective OTA updates is essential as modern vehicles contain millions of lines of code across numerous electronic control units (ECUs), each requiring specific update protocols. Furthermore, a report from the Virginia Transportation Research Council, titled "Data and Methods to Estimate Connected and Automated Vehicle Penetration Rates," indicated that in 2022, 22% of the vehicle fleet was equipped with forward collision prevention and 25% with pedestrian automatic emergency braking, technologies that often benefit from OTA updates to refine their performance. The growing capability and acceptance of OTA updates and broad vehicle connectivity are key factors accelerating the adoption of software defined vehicles.

Segmental Insights

Deployment Mode Analysis

Based on deployment mode, the segmentation includes on-board (edge) and cloud-based. The on-board (edge) segment held a larger share in 2024. This is primarily because core vehicle functions, particularly those critical for safety and real-time operation, demand immediate processing capabilities without latency. Systems such as advanced driver-assistance systems (ADAS) comprising functions, including automatic emergency braking and lane-keeping assist, as well as fundamental vehicle control units, rely heavily on processing data directly at the vehicle's "edge." This localized processing ensures instantaneous responses, which are vital for safety and performance. Furthermore, existing automotive architectures have a strong foundation in embedded systems, making the transition to fully software-defined functionality often begin with enhancing these on-board capabilities.

The cloud-based segment is anticipated to register the highest growth rate during the forecast period. This accelerated growth is driven by the increasing need for scalable data management, remote software updates, and the delivery of new services throughout the vehicle's lifecycle. Cloud platforms enable manufacturers to collect vast amounts of telematics and diagnostic data for analysis, facilitating predictive maintenance and continuous improvement of vehicle features. They also support the seamless deployment of over-the-air (OTA) updates, which allows for feature upgrades, security patches, and bug fixes to be delivered to vehicles globally without physical intervention.

Type Analysis

Based on type, the segmentation includes autonomous software-defined vehicles, connected software-defined vehicles, electric software-defined vehicles, infotainment & comfort software-defined vehicles, and hybrid software-defined vehicles. The software-defined vehicles segment held the largest share in 2024. This dominance stems from the widespread integration of connectivity features across nearly all new vehicle models. Modern cars are increasingly equipped with software that enables robust communication, advanced navigation systems, and a rich array of infotainment options. These capabilities allow for services such as real-time traffic updates, remote diagnostics, and seamless smartphone integration, becoming standard expectations for consumers. The emphasis on providing a connected ecosystem within the vehicle, which enhances convenience and offers new digital services, has made this type of software-defined vehicle foundational to the modern automotive experience.

The autonomous software-defined vehicles segment is anticipated to register the highest growth rate during the forecast period. This accelerated expansion is fueled by continuous advancements in artificial intelligence, sensor technology, and sophisticated control algorithms necessary for self-driving capabilities. Although still in various stages of development and deployment, autonomous vehicles represent the long-term vision for future mobility, promising enhanced safety, efficiency, and new forms of transportation services. Significant investments in research and development are being channeled into perfecting the complex software stacks required for autonomous driving, including perception, decision-making, and execution modules.

Application Analysis

Based on application, the segmentation includes advanced driver-assistance systems (ADAS), autonomous driving, infotainment systems, electric vehicle (EV) management, vehicle-to-everything (V2X) communication, and personalization. The advanced driver-assistance systems (ADAS) segment held the largest share in 2024, due to the widespread adoption of safety-enhancing features across a broad spectrum of new vehicles, from entry-level to premium models. Functions such as automatic emergency braking, lane-keeping assistance, adaptive cruise control, and blind-spot detection are now commonly integrated, driven by both regulatory mandates and increasing consumer demand for safer driving experiences. The software powering these ADAS features often operates on dedicated electronic control units within the vehicle, performing real-time data processing from sensors to provide immediate feedback or interventions.

The autonomous driving application segment is anticipated to witness the highest growth rate during the forecast period. This segment involves the complex software and artificial intelligence required for vehicles to operate with minimal to no human intervention. Though still evolving, significant research and development investments are flowing into this area, pushing the boundaries of vehicle intelligence and decision-making capabilities. The long-term vision of fully self-driving cars, capable of navigating complex urban environments and highways, represents a transformative shift in mobility. As sensor technologies improve, software algorithms become more sophisticated, and regulatory frameworks mature, the deployment of higher levels of autonomous driving features will accelerate rapidly in the coming years.

Vehicle Type Analysis

Based on vehicle type, the segmentation includes passenger car and light commercial vehicle. The passenger car segment held a larger share in 2024, primarily driven by the significant consumer demand for advanced features, personalization, and enhanced safety systems in everyday vehicles. Modern passenger cars are increasingly equipped with sophisticated infotainment systems, advanced driver-assistance systems (ADAS), and advanced connectivity features, all of which are enabled by complex software. Automakers are heavily investing in software development for passenger vehicles to deliver unique brand experiences, facilitate over-the-air updates, and prepare for future autonomous driving capabilities. The sheer volume of passenger car sales globally, coupled with consumers' willingness to pay for innovative in-car technology, solidifies this segment's leading position in the software defined vehicle revolution.

The light commercial vehicle (LCV) segment is anticipated to witness a higher growth rate during the forecast period. This acceleration is largely attributed to the increasing emphasis on operational efficiency, logistics optimization, and fleet management in commercial applications. Businesses are recognizing the immense value that software-defined features bring to LCVs, such as real-time tracking, predictive maintenance, route optimization, and enhanced safety for drivers. The adoption of connected services and telematics in commercial fleets is expanding rapidly, driving the integration of sophisticated software. As companies seek to reduce operational costs, improve delivery times, and enhance the productivity of their vehicle fleets, the demand for software-enabled solutions in light commercial vehicles is surging, positioning this segment for dynamic expansion.

Regional Analysis

The Asia Pacific software defined vehicle market accounted for the largest share in 2024, largely driven by burgeoning vehicle sales, increasing urbanization, and robust government support for advanced mobility solutions. Countries across this region are prioritizing the development of intelligent transportation systems, electric vehicles, and smart cities, all of which heavily rely on software-defined architectures. The region benefits from a large consumer base with a strong affinity for digital technologies and connectivity, leading to a high demand for feature-rich vehicles. Continuous investments in digital infrastructure and manufacturing capabilities position Asia Pacific as a powerful force in shaping the global software defined vehicle industry.

China Software Defined Vehicle Market Insights

China stands out as a dominant force in the industry landscape. The country is witnessing an explosive growth in new energy vehicles, many of which are inherently designed with software-centric architectures. Chinese automakers and technology companies are rapidly innovating in areas such as intelligent cockpits, advanced driver-assistance systems, and sophisticated vehicle operating systems. Government policies strongly encourage the development of smart and connected vehicles, fostering a competitive environment that accelerates technological advancements. This strong domestic market, combined with a willingness to integrate advanced digital solutions, makes China a key growth engine and a significant influencer in the global progression of software defined vehicles.

North America Software Defined Vehicle Market Trends

North America stands as a significant region in the adoption and development of SDVs, largely driven by a strong presence of both established automotive manufacturers and innovative technology companies. The region benefits from a robust research and development ecosystem, fostering rapid advancements in areas such as autonomous driving and advanced connectivity. Consumers in North America show a high willingness to embrace new vehicle technologies, including sophisticated infotainment systems, over-the-air updates, and advanced driver-assistance features. This demand is supported by well-developed digital infrastructure, which facilitates seamless integration of connected car services. The competitive landscape, characterized by continuous innovation and strategic collaborations, further propels the regional progress of software defined vehicles.

US Software Defined Vehicle Market Overview

In North America, the U.S. is a key driver for the software defined vehicle market. The country showcases a strong emphasis on integrating advanced software solutions into vehicles, supported by significant investments in technology companies specializing in automotive software, artificial intelligence, and autonomous driving. Consumer demand for personalized driving experiences and advanced safety features is particularly high here, pushing automakers to accelerate their software development efforts. Additionally, the regulatory environment, while evolving, is increasingly focusing on the safety and cybersecurity aspects of connected and autonomous vehicles, which influences the design and capabilities of software defined vehicle architectures. This combination of strong consumer pull, technological innovation, and a dynamic ecosystem positions the U.S. as a central hub for the future of software defined mobility.

Europe Software Defined Vehicle Market Assessment

Europe represents a mature automotive sector that is actively transitioning toward software defined vehicles, influenced by a blend of stringent regulations, a strong premium vehicle segment, and a push toward electrification. European manufacturers are heavily investing in re-architecting their vehicles to be more software-centric, aiming to offer enhanced digital services and meet evolving emission standards through optimized software. The region's focus on data privacy and cybersecurity also plays a critical role, shaping the development of secure and compliant software platforms. Furthermore, collaborative initiatives among industry players and research institutions are common, fostering an environment for innovation in connected and automated driving technologies across the region.

The Germany software defined vehicle market is at the forefront of the SDV transformation, as the country is a major automotive manufacturing hub in Europe. German automakers are renowned for their engineering excellence, and they are now channeling significant resources into software development to maintain their competitive edge. There is a strong emphasis on developing proprietary operating systems and advanced software stacks to power next-generation vehicles. The country also plays a key role in setting industry standards and is deeply involved in the development of regulations for autonomous and connected driving. This commitment to in-house software capabilities and a rich ecosystem of automotive suppliers and technology providers underscores Germany's pivotal contribution to the European software defined vehicles landscape.

Key Players and Competitive Insights

The competitive landscape of the software defined vehicles sector is dynamic, featuring a blend of traditional automotive manufacturers, established Tier-1 suppliers, and innovative technology companies. Major players such as General Motors, Ford, Mercedes-Benz, Volkswagen Group, Bosch, Aptiv, and Qualcomm are actively shaping this evolving space. Competition revolves around securing top software engineering talent, developing advanced in-house software capabilities, creating scalable and flexible vehicle architectures, and establishing strategic partnerships across the value chain.

A few prominent companies in the industry include General Motors Company; Ford Motor Company; Volkswagen AG (CARIAD); Mercedes-Benz Group AG; BMW AG; Toyota Motor Corporation; Stellantis N.V.; Hyundai Motor Company; Robert Bosch GmbH; Continental AG; Aptiv PLC; Qualcomm Technologies, Inc.; NVIDIA Corporation; Mobileye (an Intel Company); and BlackBerry Limited (BlackBerry QNX).

Key Players

- Aptiv PLC

- BlackBerry Limited (BlackBerry QNX)

- BMW AG

- Ford Motor Company

- Hyundai Motor Company

- Mercedes-Benz Group AG

- Mobileye (an Intel Company)

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Robert Bosch GmbH

- Tesla, Inc.

- Toyota Motor Corporation

- Volkswagen AG (CARIAD)

Industry Developments

June 2025: Qualcomm Technologies acquired Autotalks, a company focused on vehicle-to-everything (V2X) communication. This acquisition aims to boost V2X deployments, enhance road safety, and improve automated driving and traffic efficiency by integrating Autotalks' specialized hardware and software into Qualcomm's Snapdragon Digital Chassis solutions.

May 2025: General Motors announced it is working on a next-generation vehicle software platform to enhance functionality, reduce costs, and create new revenue streams through faster, cloud-based over-the-air updates, similar to smartphone systems.

Software Defined Vehicle Market Segmentation

By Deployment Mode Outlook (Volume, Thousand Units; Revenue, USD Billion, 2020–2034)

- On-Board (Edge)

- Cloud-Based

By Type Outlook (Volume, Thousand Units; Revenue, USD Billion, 2020–2034)

- Autonomous SDV

- Connected SDV

- Electric SDV

- Infotainment & Comfort SDV

- Hybrid SDV

By Application Outlook (Volume, Thousand Units; Revenue, USD Billion, 2020–2034)

- Advanced Driver-Assistance Systems (ADAS)

- Autonomous Driving

- Infotainment Systems

- Electric Vehicle (EV) Management

- Vehicle-to-Everything (V2X) Communication

- Personalization

By Vehicle Type Outlook (Volume, Thousand Units; Revenue, USD Billion, 2020–2034)

- Passenger Car

- Light Commercial Vehicle

By Regional Outlook (Volume, Thousand Units; Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Software Defined Vehicle Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 203.80 billion |

|

Market Size in 2025 |

USD 266.47 billion |

|

Revenue Forecast by 2034 |

USD 3,027.50 billion |

|

CAGR |

31.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Tons; Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 203.80 billion in 2024 and is projected to grow to USD 3,027.50 billion by 2034.

The global market is projected to register a CAGR of 31.0% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few key players in the market include General Motors Company; Ford Motor Company; Volkswagen AG (CARIAD); Mercedes-Benz Group AG; BMW AG; Toyota Motor Corporation; Stellantis N.V.; Hyundai Motor Company; Robert Bosch GmbH; Continental AG; Aptiv PLC; Qualcomm Technologies, Inc.; NVIDIA Corporation; Mobileye (an Intel Company); and BlackBerry Limited (BlackBerry QNX).

The on-board (edge) segment accounted for the largest share of the market in 2024.

The autonomous software-defined vehicles segment is expected to witness the fastest growth during the forecast period.