South Korea Digital Rights Management Market Size, Share, Trends, Industry Analysis Report

By Enterprise Size (Large Enterprise, Small & Medium Enterprise), By Application – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6197

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

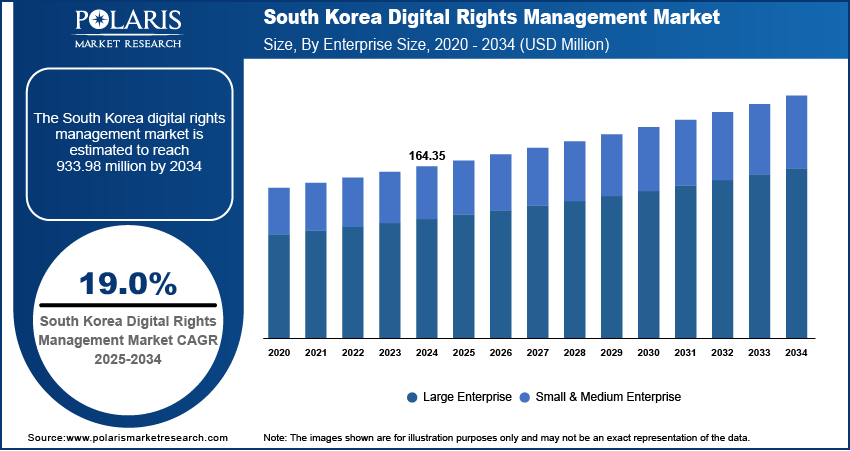

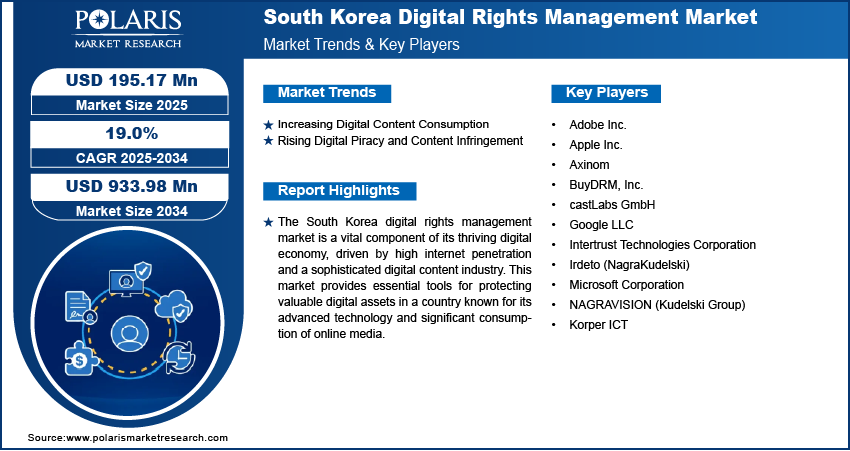

The South Korea digital rights management market size was valued at USD 164.35 million in 2024 and is anticipated to register a CAGR of 19.0% from 2025 to 2034. The market is primarily driven by the increasing consumption of online content and media and the rising concerns over digital piracy and the unauthorized sharing of content. Moreover, the growing shift toward cloud-based DRM solutions is contributing to the demand for these technologies.

Key Insights

- By enterprise size, the large enterprise segment held the largest share in 2024 due to the significant volume of digital content they manage and distribute. These major corporations and institutions have extensive intellectual property that requires robust protection against piracy and misuse.

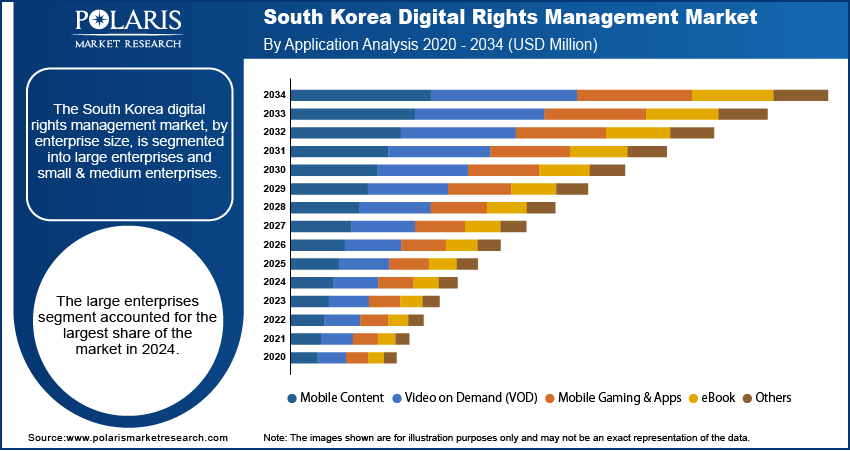

- By application, the video on demand (VOD) segment held the largest share in 2024, driven by South Korea's high internet penetration and the immense popularity of streaming services.

Industry Dynamics

- The rapid growth in digital content consumption across various platforms is a major factor. People are increasingly engaging with online movies, music, games, and e-books, which creates a greater need for effective solutions to protect intellectual property and ensure fair use.

- A significant increase in digital piracy and unauthorized distribution of content strongly drives the demand for protection. As more content becomes easily accessible online, the risk of illegal copying and sharing rises, leading to substantial revenue losses for creators and distributors.

- The increasing adoption of cloud-based solutions for content management and delivery is also a key driver. Businesses and content providers are moving toward cloud platforms for their scalability, flexibility, and cost-effectiveness. This shift makes it easier to implement and manage protective technologies, allowing for more streamlined content distribution.

Market Statistics

- 2024 Market Size: USD 164.35 million

- 2034 Projected Market Size: USD 933.98 million

- CAGR (2025–2034): 19.0%

AI Impact on South Korea Digital Rights Management Market

- AI integration in DRM enables real-time surveillance of digital content across websites, apps, and marketplaces.

- It uses pattern recognition to enhance the detection of copyright infringement.

- The adoption of AI helps streamline data analysis for rights holders and legal teams.

- The use of AI tools in DRM reduces manual review workload.

- The collaboration between AI developers and content creators is expected to rise in the coming years to boost innovation in copyright protection technologies.

Digital rights management, or DRM, refers to technologies used to control access to copyrighted digital content creation and devices. Its main goal is to protect intellectual property and ensure that digital media, such as music, movies, and e-books, are used according to the rights granted by their creators. This helps prevent unauthorized copying and distribution.

The South Korea digital rights management (DRM) market growth is driven by the increasing focus on data security and privacy. As more personal and sensitive information is shared and stored digitally, there is a growing need to protect this data from breaches and misuse. DRM solutions, with their ability to control access and track usage, can play a role in securing confidential documents and information, going beyond just media content.

The rising complexity of content licensing and distribution models propels the market expansion. With the rising availability of streaming services, subscription models, and varied consumption platforms, managing rights across different regions, devices, and user agreements has become a significant challenge. DRM provides the tools to enforce these complex licensing terms automatically, ensuring that content is only accessed by authorized users under specific conditions. For example, the World Health Organization (WHO) produces a vast amount of digital health information and publications. To ensure the proper use and distribution of this critical health data, especially when it might be licensed for specific purposes or audiences, robust digital rights management systems would be essential to control access and maintain data integrity.

Drivers and Trends

Increasing Digital Content Consumption: The widespread and growing adoption of digital platforms for entertainment, education, and work is a primary driver. As consumers increasingly access content such as streaming video, online music, digital games, and e-books, the volume of digital assets requiring protection against unauthorized use continues to expand. This shift toward digital consumption is further fueled by high internet penetration and smartphone usage in South Korea.

According to the Ministry of Science and ICT's "MSIT Unveils 2024 Internet Usage Trends" report published in April 2025, the internet usage rate among individuals aged three years and older in South Korea rose by 0.5% points to 94.5% in 2024. Among internet users, 90.5% reported going online at least once per day, and video streaming services were highly popular, with a usage rate of 95.4%. This high engagement with digital content directly drives the need for effective DRM solutions to secure valuable intellectual property.

Rising Digital Piracy and Content Infringement: The persistent and evolving threat of digital piracy and unauthorized content distribution remains a significant driver for the South Korea digital rights management market. Despite efforts to combat it, illegal sharing and copying of digital media lead to substantial revenue losses for content creators and distributors. The ease with which digital content can be replicated and disseminated online necessitates strong protective measures to uphold copyright and intellectual property rights.

A report by the World Intellectual Property Organization (WIPO) titled "Advisory Committee on Enforcement - Fifteenth Session" from August 2022, cited that the Korea Copyright Protection Agency reported Korean content was pirated 385,900 times on Korean websites and 2,268,721 times on overseas websites in 2021. Torrent sites and webtoon sites accounted for a large portion of overseas piracy cases. This ongoing challenge of widespread piracy strongly propels the demand for threat hunting and advanced DRM technologies to safeguard normal and 3D digital assets.

Segmental Insights

Enterprise Size Analysis

Based on enterprise size, the segmentation includes large enterprise and small & medium enterprise. The large enterprise segment held the largest share in 2024. This segment’s leadership is largely attributed to the sheer volume of digital content they produce, manage, and distribute. Large corporations, media conglomerates, and educational institutions have extensive libraries of intellectual property, ranging from proprietary software and confidential documents to high-value entertainment media. Protecting these vast assets from piracy, unauthorized access, and misuse is critical for their operations and revenue streams. Furthermore, large enterprises often possess the financial resources and sophisticated IT infrastructure necessary to invest in comprehensive, customized DRM solutions and integrate them seamlessly into their existing complex systems. Their adherence to stringent compliance regulations and global intellectual property laws also drives their robust adoption of advanced DRM technologies, ensuring the cybersecurity and integrity of their digital ecosystems.

The small and medium enterprise (SME) segment is anticipated to register the highest growth rate during the forecast period. This accelerated growth is primarily attributed to the increasing digitization of business operations across SMEs and rising awareness among these businesses regarding the importance of digital asset protection. Historically, SMEs might have been hesitant to adopt DRM solutions due to perceived high costs or complexity. However, the emergence of more affordable, cloud-based, and subscription-model DRM offerings has made these technologies more accessible. As SMEs increasingly engage in online content creation, e-commerce, and digital service delivery, the need to protect their unique content, customer data, and intellectual property from infringement becomes paramount, leading to a rapid expansion in their adoption of DRM solutions.

Application Analysis

Based on application, the segmentation includes mobile content, video on demand (VOD), mobile gaming & apps, ebook, and others. The video on demand (VOD) segment held the largest share in 2024. This dominance is driven by the country's highly connected population, significant smartphone penetration, and the immense popularity of streaming services. Consumers in South Korea extensively use VOD platforms for movies, TV shows, and other video content, leading to a massive volume of digital assets that require robust protection against piracy and unauthorized distribution. Content providers, ranging from global streaming giants to local broadcasters and independent studios, rely heavily on DRM to enforce licensing agreements, manage regional access, and secure their revenue streams from subscriptions and pay-per-view models. The continuous innovation in content production and the increasing demand for high-quality, exclusive video content further solidify VOD's leading position, making effective DRM solutions indispensable.

The mobile gaming & apps segment is anticipated to register the highest growth rate during the forecast period. The country is a global leader in mobile technology and gaming, with a highly engaged user base that consistently embraces new mobile games and applications. As the mobile gaming industry continues to expand with complex in-app purchases, virtual currencies, and exclusive content, the need for advanced DRM to protect these digital assets and prevent fraud becomes increasingly critical. Developers and publishers are adopting DRM to secure their intellectual property, prevent unauthorized modding or cracking of apps, and ensure fair monetization models. The rapid development of new mobile technologies, combined with the strong cultural phenomenon of mobile gaming in South Korea, contributes significantly to this segment's accelerated demand for sophisticated DRM solutions.

Key Players and Competitive Insights

The South Korea digital rights management market is characterized by a dynamic competitive landscape with several key players competing for market share. These companies continuously innovate to offer robust content protection solutions across various applications such as video on demand, mobile gaming, and e-books. The competition is intense, driven by the escalating need to combat digital piracy and secure intellectual property in a content-rich digital environment. Major players often differentiate themselves through the strength of their encryption technologies, multi-DRM support, scalability of their platforms, and the breadth of devices and business models they can accommodate. Strategic partnerships with content creators, distributors, and platform providers are also crucial for expanding their market reach and solidifying their position.

A few prominent companies in the industry include Irdeto (NagraKudelski), Verimatrix, Intertrust Technologies Corporation, Korper ICT, Apple Inc., Microsoft Corporation, Google LLC, Adobe Inc., NAGRAVISION (Kudelski Group), Axinom, castLabs GmbH, and BuyDRM, Inc.

Key Players

- Adobe Inc.

- Apple Inc.

- Axinom

- BuyDRM, Inc.

- castLabs GmbH

- Google LLC

- Intertrust Technologies Corporation

- Irdeto (NagraKudelski)

- Microsoft Corporation

- NAGRAVISION (Kudelski Group)

- Korper ICT

South Korea Digital Rights Management Industry Developments

July 2025: NAGRAVISION announced an extended partnership with Broadpeak to deliver a next-generation streaming security solution specifically designed to combat live sports piracy.

South Korea Digital Rights Management Market Segmentation

By Enterprise Size Outlook (Revenue – USD Million, 2020–2034)

- Large Enterprise

- Small & Medium Enterprise

By Application Outlook (Revenue – USD Million, 2020–2034)

- Mobile Content

- Video on Demand (VOD)

- Mobile Gaming & Apps

- eBook

- Others

South Korea Digital Rights Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 164.35 million |

|

Market Size in 2025 |

USD 195.17 million |

|

Revenue Forecast by 2034 |

USD 933.98 million |

|

CAGR |

19.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 164.35 million in 2024 and is projected to grow to USD 933.98 million by 2034.

The market is projected to register a CAGR of 19.0% during the forecast period.

A few key players in the market include Irdeto (NagraKudelski), Verimatrix, Intertrust Technologies Corporation, Vera (Korper ICT), Apple Inc., Microsoft Corporation, Google LLC, Adobe Inc., NAGRAVISION (Kudelski Group), Axinom, castLabs GmbH, and BuyDRM, Inc.

The large enterprise segment accounted for the largest share of the market in 2024.

The mobile gaming & apps segment is expected to witness the fastest growth during the forecast period.