South Korea Vapor Recovery Units Market Size, Share, Trends, Industry Analysis Report

By Technology (Absorption, Condensation, Membrane Separation, Adsorption, Others), By Application, By End User – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 120

- Format: PDF

- Report ID: PM6361

- Base Year: 2024

- Historical Data: 2020-2023

Overview

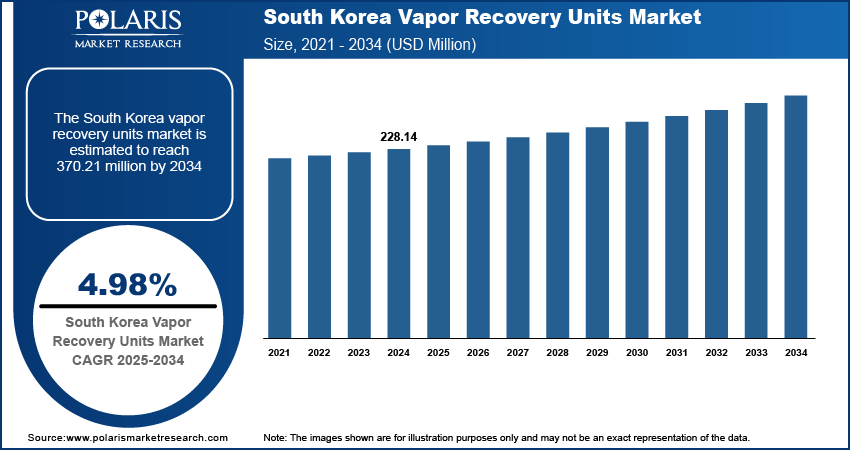

The South Korea vapor recovery units (VRUs) market size was valued at USD 228.14 million in 2024, growing at a CAGR of 4.98% from 2025 to 2034. Key factors driving demand for the vapor recovery units in South Korea include expanding gas consumption and rising investments in oil & gas infrastructure.

key insights

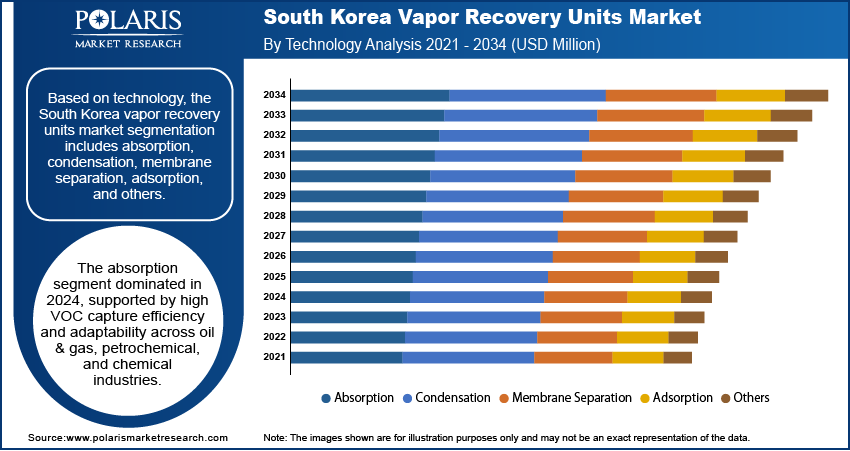

- The absorption segment accounted for a major South Korea vapor recovery units market share in 2024 due to its adaptability across multiple industrial applications, including oil and gas and chemical manufacturing facilities.

- The storage segment held the largest revenue share in 2024 due to the rising installation of recovery systems at oil refineries to control emissions during the storage of crude oil.

Industry Dynamics

- The expanding gas consumption in South Korea is fueling the demand for vapor recovery units by increasing production, storage, and transportation of petroleum products.

- The rising investments in oil & gas infrastructure is driving the South Korea vapor recovery units market by generating more hydrocarbon vapors during processing and handling.

- The stringent environmental regulations are creating a lucrative market opportunity by forcing oil and gas operators to minimize harmful emissions.

- The high initial investment and operating costs of vapor recovery units hinder the market growth.

Market Statistics

- 2024 Market Size: USD 228.14 Million

- 2034 Projected Market Size: USD 370.21 Million

- CAGR (2025–2034): 4.98%

Artificial Intelligence (AI) on South Korea Vapor Recovery Units Market

- AI algorithms analyze sensor data to predict equipment failures, minimizing downtime.

- AI-powered systems enable continuous emission tracking, ensuring compliance with environmental regulations.

- Automation reduces operational costs by streamlining workflows.

- Artificial Intelligence (AI) analyzes vast datasets to identify trends, aiding in better decision-making.

A vapor recovery unit (VRU) is a system designed to capture and recover vapors, such as volatile organic compounds (VOCs) or hydrocarbons, that are released during the storage, handling, or transfer of fuels and other volatile substances. These vapors, if released into the atmosphere, contribute to air pollution and pose safety hazards. VRUs use methods such as condensation, adsorption, or absorption to recover vapors and return them to the production process or storage tanks. They are widely used in industries such as oil and gas, petrochemicals, and fuel distribution, helping companies meet environmental regulations, reduce product losses, and improve operational safety while minimizing emissions that contribute to ozone formation and climate change.

In South Korea, vapor recovery units play a crucial role in supporting the nation’s strict environmental and air quality regulations. Growing industrial activity, coupled with increasing fuel storage and distribution infrastructure, has driven the adoption of VRUs in South Korea. The government’s commitment to reducing VOC emissions from refineries, chemical plants, and fuel stations is further encouraging the integration of advanced VRUs. The rising focus on sustainability, along with technological innovation in recovery efficiency, is helping South Korea emerge as a market for modern VRU systems across both industrial and transportation sectors.

Drivers & Opportunities

Expanding Gas Consumption: Increasing gas consumption in South Korea is leading to greater production, storage, and transportation of petroleum products, which release VOCs such as hydrocarbon vapors. This factor creates the need for a vapor recovery unit (VRU) to capture these VOCs to meet environmental regulations and reduce emissions. According to the Gas Exporting Countries Forum report, in November 2023, South Korea's gas consumption witnessed a 9% y-o-y increase. Additionally, growing gas consumption in industries and transportation in South Korea is driving the fuel evaporation losses, making VRUs essential for minimizing waste and maximizing operational efficiency.

Rising Investments in Oil & Gas Infrastructure: Expanding facilities such as refineries, storage terminals, and pipelines are generating more hydrocarbon vapors during processing and handling. It propels the requirement for the installation of VRUs to comply with stringent environmental regulations that mandate the capture of volatile organic compounds (VOCs) and reduce emissions. Modern infrastructure projects are also prioritizing sustainability, driving the adoption of VRUs to recover valuable vapors for reuse, improving efficiency and profitability. Additionally, as operators upgrade aging facilities or build new ones, they integrate advanced vapor recovery systems to minimize product loss, enhance safety, and meet corporate ESG (environmental, social, and governance) targets.

Segmental Insights

Technology Analysis

Based on technology, the segmentation includes absorption, condensation, membrane separation, adsorption, and others. The absorption segment accounted for a major South Korea vapor recovery units market share in 2024 due to its high efficiency in capturing volatile organic compounds (VOCs) and its adaptability across multiple industrial applications, including oil and gas, petrochemical, and chemical manufacturing facilities. Industries in the country increasingly adopted absorption systems as they offered strong performance in handling large volumes of gas streams with varying VOC concentrations, making them suitable for both fixed and mobile operations. The technology’s ability to integrate with existing infrastructure without significant modifications and its cost-effectiveness in long-term operations further encouraged widespread adoption. Additionally, stricter environmental regulations on VOC emissions and growing emphasis on workplace safety drove investments in advanced absorption systems, supporting their dominance in the market.

The membrane separation segment is projected to grow at a robust pace in the coming years owing to its energy-efficient operation, compact design, and lower maintenance requirements compared to traditional recovery methods. Rapid technological advancements have improved membrane durability, selectivity, and resistance to fouling, making the technology more practical for large-scale commercial use. Companies prefer membrane-based systems for applications requiring quick installation and minimal operational downtime, particularly in urban and space-constrained industrial areas. The combination of reduced operational costs, compliance with evolving environmental standards, and growing interest in innovative recovery methods positions this segment for strong growth in the forecast period.

Application Analysis

In terms of application, the segmentation includes processing, storage, transportation, railcar loading, and others. The storage segment held the largest South Korea VRUs market share in 2024. Oil refineries, fuel terminals, and petrochemical facilities increased the installation of recovery systems to control emissions during the storage of crude oil, gasoline, and other volatile fuels. Operators invested in advanced vapor control technologies to meet the country’s stringent air quality regulations and to prevent product loss from evaporation, which directly impacts profitability. The segment also benefited from the rising number of bulk storage facilities in industrial hubs and ports, where high throughput and frequent loading or unloading activities require continuous vapor recovery. The growing emphasis on environmental compliance, combined with the economic advantage of reclaiming valuable hydrocarbons from storage tanks, strengthened the dominance of the segment.

End User Analysis

The segmentation, based on end user, includes oil & gas, chemicals & petrochemicals, landfills, and others. The chemicals & petrochemicals segment is expected to grow at a rapid pace in the coming years, owing to the sector’s rapid capacity expansion and its high VOC emission potential during production and handling processes. Manufacturers are increasingly adopting recovery systems to comply with evolving emission control standards and to enhance resource efficiency by capturing reusable vapors. The technology’s ability to integrate seamlessly with existing plant operations and its proven performance in handling diverse chemical streams make it highly attractive for this industry. Growing exports of petrochemical products, coupled with rising investments in modernizing manufacturing plants, are further projected to drive adoption. The combination of strict regulatory compliance requirements, operational cost savings, and sustainability targets positions the chemicals and petrochemicals segment for strong growth in the forecast period.

Key Players & Competitive Analysis

The South Korean vapor recovery unit (VRU) market is highly competitive, with a mix of global players and specialized regional suppliers driving innovation and efficiency. Major international companies such as John Zink Hamworthy and PSG Dover dominate with advanced technologies and strong aftermarket support, while Cimarron Energy, Inc. and Flogistix LP. provide specialized solutions for industrial and oil & gas applications. European firms such as Cool Sorption A/S and Aereon emphasize eco-friendly and energy-efficient systems, aligning with South Korea’s stringent emissions regulations. Local players such as Alma Group and Symex compete by offering cost-effective, customized VRUs tailored to domestic needs. Emerging innovators such as VOCZero Ltd are gaining traction with advanced adsorption and membrane-based recovery systems. Competition is intensifying with increasing environmental compliance demands, pushing manufacturers to enhance performance, reduce operational costs, and integrate smart monitoring solutions to capture market share in South Korea’s growing VRU sector.

A few major companies operating in the South Korea vapor recovery units market include Aereon; Alma Group; Borsig; Cimarron Energy, Inc.; Cool Sorption A/S; Flogistix LP.; John Zink Hamworthy; PSG Dover; Symex; and VOCZero Ltd.

Key Companies

- Aereon

- Alma Group

- Borsig

- Cimarron Energy, Inc.

- Cool Sorption A/S

- Flogistix LP.

- John Zink Hamworthy

- PSG Dover

- Symex

- VOCZero Ltd

South Korea Vapor Recovery Units Industry Developments

May 2023: Cimarron, Inc., a provider of BTEX environmental solutions for the oil and gas production and transportation sectors, announced a strategic alliance with JATCO, Inc. to deliver an integrated BTEX and emissions control solution. This collaboration combines the strengths and expertise of both organizations to offer cost-effective, reliable, and innovative systems that recover methane and return it to the value stream.

South Korea Vapor Recovery Units Market Segmentation

By Technology Outlook (Revenue, USD Million, 2021–2034)

- Absorption

- Condensation

- Membrane Separation

- Adsorption

- Others

By Application Capacity Outlook (Revenue, USD Million, 2021–2034)

- Processing

- Storage

- Transportation

- Railcar Loading

- Others

By End User Outlook (Revenue, USD Million, 2021–2034)

- Oil & Gas

- Upstream (Wellhead, Tank Batteries)

- Midstream

- Downstream

- Chemicals & Petrochemicals

- Landfills

- Others

South Korea Vapor Recovery Units Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 228.14 Million |

|

Market Size in 2025 |

USD 239.05 Million |

|

Revenue Forecast by 2034 |

USD 370.21 Million |

|

CAGR |

4.98% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 228.14 million in 2024 and is projected to grow to USD 370.21 million by 2034.

The market is projected to register a CAGR of 4.98% during the forecast period.

A few of the key players in the market are Aereon; Alma Group; Borsig; Cimarron Energy, Inc.; Cool Sorption A/S; Flogistix LP.; John Zink Hamworthy; PSG Dover; Symex; and VOCZero Ltd.

The absorption segment dominated the market share in 2024.

The chemicals & petrochemicals segment is expected to witness the fastest growth during the forecast period.