Specialty Feed Additives Market Size, Share, Trends, Industry Analysis Report

By Livestock (Poultry, Swine, Ruminants), By Source, By Form, By Type, By Manufacturing Technology, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6393

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

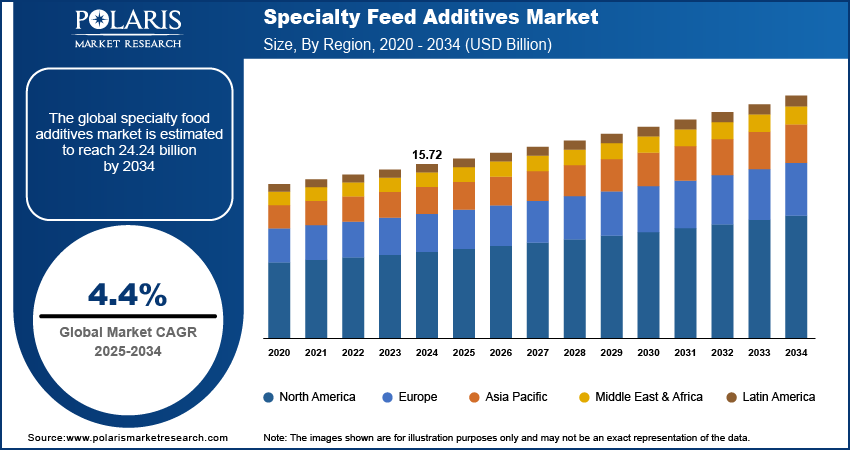

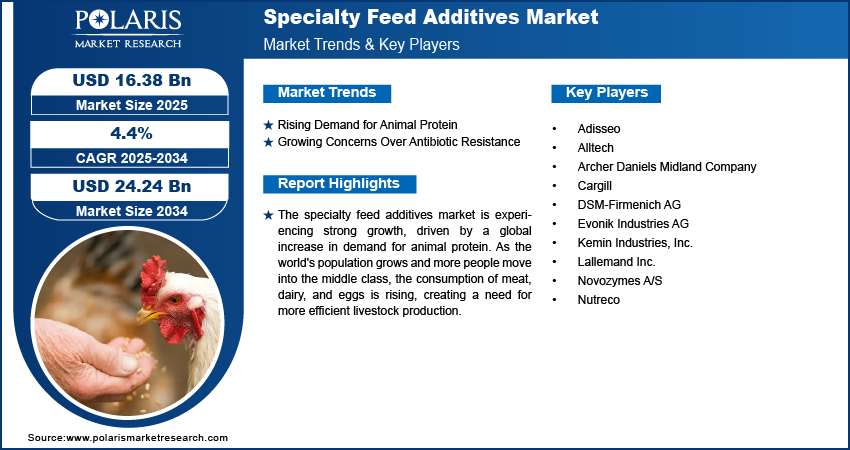

The global specialty feed additives market size was valued at USD 15.72 billion in 2024 and is anticipated to register a CAGR of 4.4% from 2025 to 2034. The increasing global demand for meat, dairy, and other animal products is a major driver. Additionally, there is a growing focus on improving animal health, which is pushing the demand for these additives. The move to replace antibiotics in animal feed with natural alternatives is another key growth factor.

Key Insights

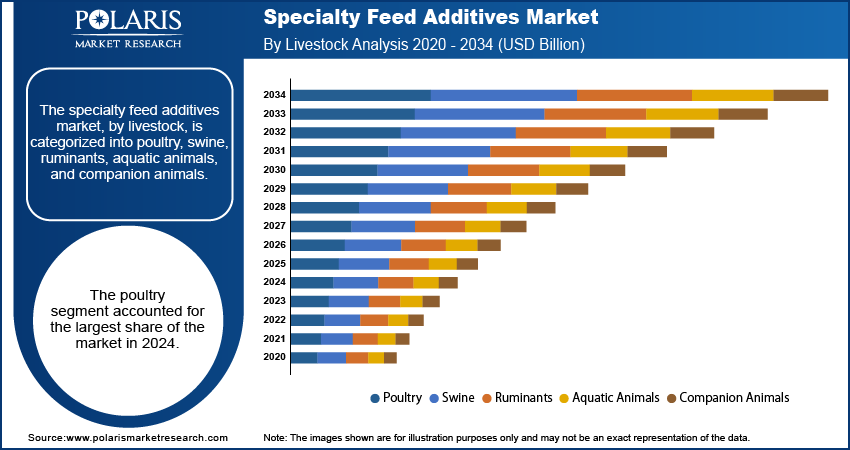

- By livestock, the poultry segment held the largest share in 2024, due to the immense global demand.

- By source, the synthetic segment dominated in 2024 as synthetic additives have been used for a long time.

- By form, the dry form segment held the largest share in 2024 due to its ease of handling, storage, and transport.

- By type, the probiotics segment held the largest share in 2024. Rising awareness of gut health, increasing antibiotic restrictions, and the demand for natural growth promoters are driving the significant adoption of probiotics in animal nutrition.

- By manufacturing technology, fermentation is a key and dominant segment as it is widely used to produce many important feed additives.

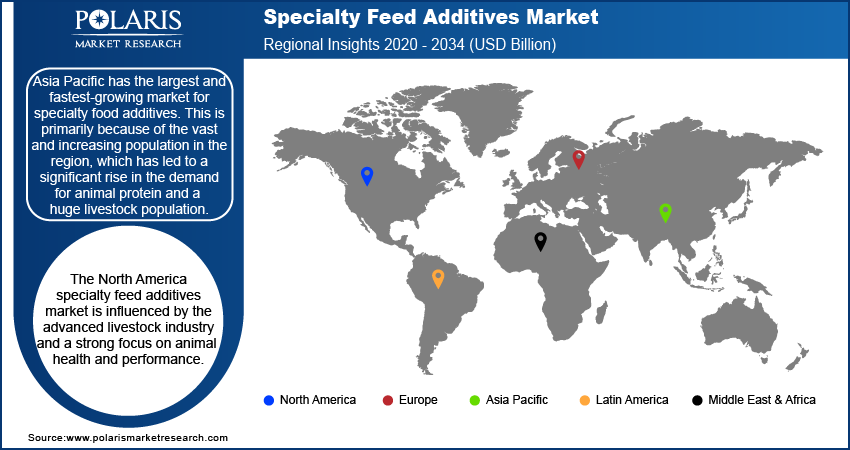

- By region, Asia Pacific held the largest market share in 2024. Rapid livestock industrialization, growing meat consumption, supportive government policies, and increasing investment in animal health are fueling the strong growth of the specialty feed additives market in Asia Pacific.

Industry Dynamics

- A key driver is the growing global demand for protein-rich animal products such as meat, eggs, and dairy. As the world population increases and disposable incomes rise, there is a greater need for efficient livestock production.

- The rising focus on improving animal health and well-being is another major factor. There is a growing push to find alternatives to antibiotics in animal feed, which has led to increased use of supplements that boost immunity and gut health.

- The need for improved feed efficiency and overall animal performance also drives. These additives help animals get more nutrients from their food, leading to better growth and health, which is a big benefit for farmers.

Market Statistics

- 2024 Market Size: USD 15.72 billion

- 2034 Projected Market Size: USD 24.24 billion

- CAGR (2025–2034): 4.4%9

- Asia Pacific: Largest market in 2024

AI Impact on Specialty Feed Additives Market

- AI tools analyze rumen microbiome data to predict the impact of specific additives such as essential oils and probiotics on digestion and methane emissions.

- AI algorithms help in designing feed blends that meet the nutritional needs of different livestock breeds, life stages, and farm conditions.

- The technology integrates data from animal health, feed intake, and productivity, which helps in planning additive strategies that boost performance and immunity.

- The integration of AI boosts biotech innovation. It enables the development of next-gen additives that are more effective, targeted, and environmentally friendly.

Specialty feed additives are products that are added to animal feed to enhance the health, nutrition, and performance of livestock. These additives include a wide range of ingredients such as probiotics, enzymes, amino acids, and vitamins. The additives help improve digestion, boost immunity, and increase the overall efficiency of animal production.

One of the drivers is the growing consumer preference for animal products that are produced using more natural and sustainable methods. As consumers become more aware of food safety and animal welfare, there is a push to use natural feed additives. This trend encourages the use of plant-based ingredients and other alternatives to traditional methods.

Another factor is the increasing awareness among farmers about the long-term benefits of these additives. While major drivers focus on immediate economic gains and animal health, a qualitative look reveals that producers are starting to see how these products improve the quality of their livestock and feed. This deeper understanding is leading to a steady, though less dramatic, increase in demand. The use of palatability enhancers improve the taste and smell of animal feed. This leads to higher feed intake and better performance of the animals. This is especially helpful for young or sick animals that might not eat enough otherwise. According to the WHO, proper nutrition is essential for animal health, and animal feed additives help ensure animals get the nutrients they need, reducing the risk of disease and improving overall welfare.

Drivers and Trends

Rising Demand for Animal Protein: The global population is growing, and so is the demand for meat, eggs, and dairy products. As people in developing nations experience a rise in their income, they tend to include more animal-based protein in their diet. This trend is a major reason for the increased focus on enhancing animal productivity and health. To meet this high demand, farmers and producers are looking for ways to get more out of their livestock, making specialty feed additives an essential part of the modern agricultural process.

This growing need for more efficient animal farming directly pushes the demand for products that can improve feed intake, nutrient absorption, and overall animal performance. According to the United Nations Food and Agriculture Organization (FAO) and the Organisation for Economic Cooperation and Development (OECD) in their July 2025 "Agricultural Outlook 2025-2034" report, global output of meat, dairy, and eggs is expected to grow by 17% over the next decade. The report also notes that consumption in lower-middle-income countries is expected to rise by 24%, showing a strong and direct link between rising incomes and increased demand for animal protein. This demand for more food drives the need for specialty feed additives that help farmers produce more efficiently.

Growing Concerns Over Antibiotic Resistance: There is an increasing global concern about the overuse of antibiotics in livestock, which contributes to antibiotic resistance in both animals and humans. Governments and health organizations are promoting the use of alternatives to traditional antibiotics for growth promotion and disease prevention in animals. This has created a significant opportunity for the specialty feed additives market, as these products, such as probiotics and animal feed enzymes, can improve animal health and performance without the use of antibiotics.

This shift away from antibiotics is creating a big demand for new and safer feed solutions. In their September 2023 report of WOAH titled "New report reveals global decrease in antimicrobial use in animals," it was stated that global antimicrobial use in animals had declined by 13% in three years. This shows a clear trend toward reducing antibiotic use and highlights the role of alternative products. This global effort to reduce antibiotics in animal farming is directly driving the growth.

Segmental Insights

Livestock Analysis

Based on livestock, the segmentation includes poultry, swine, ruminants, aquatic animals, and companion animals. The poultry segment held the largest share in 2024, due to the huge global demand for poultry meat and eggs. As one of the most widely consumed protein sources, the poultry sector operates on a large scale and relies on efficient farming practices to meet consumer needs. Specialty feed additives are crucial for improving the health and performance of chickens, ensuring better growth rates, and protecting them from diseases. The relatively short production cycle of poultry also makes it an ideal area for using these additives, as they can quickly show a positive return on investment by improving feed conversion and overall productivity. This continuous demand and emphasis on efficiency contribute to the segment's dominant position.

The aquatic animals segment is anticipated to register the highest growth rate during the forecast period. The aquaculture sector is expanding rapidly as a sustainable alternative to traditional fishing, especially with the rising demand for seafood worldwide. As fish and shellfish farming becomes more common, so does the need for specific aquafeed additives to ensure the health and high quality of the aquatic animals. These additives, such as probiotics and enzymes, are vital for improving gut health and immunity in aquatic species. They also help reduce the environmental impact of aquaculture by improving nutrient use and lessening waste. The growing adoption of modern farming techniques and the increasing focus on creating high-quality, safe seafood are key factors that are pushing this segment's growth at a high speed.

Source Analysis

Based on source, the segmentation includes natural and synthetic. The synthetic segment held the largest share in 2024. This is primarily because synthetic additives have been in use for a long time and are known for their high purity and consistent quality. They are often more cost-effective to produce and provide reliable results in terms of animal health and performance. The ability to precisely control the composition of synthetic ingredients allows for tailored nutritional solutions, which is a major benefit for large-scale animal production. Products such as synthetic amino acids, vitamins, and minerals are essential for creating balanced diets that support the rapid growth and health of livestock, particularly in intensive farming systems. The strong presence and trust in these products among feed manufacturers contribute to the segment's leading position.

The natural source segment is anticipated to register the highest growth rate during the forecast period. This growth is driven by a global shift toward more natural and sustainable farming practices, as well as increasing consumer demand for "clean label" animal products. There is a growing preference for products that are free from synthetic chemicals and antibiotics. Natural additives, such as probiotics, prebiotics, and phytogenics, are gaining popularity for their ability to improve gut health and boost the immune system of animals in a way that is perceived as more environmentally friendly. The push from consumers and regulations to reduce antibiotic use is a key factor, making natural alternatives a very attractive option for the future of animal nutrition. This trend is leading to more investments in research and development for new natural feed additives, which is set to boost this segment's growth.

Form Analysis

Based on form, the segmentation includes dry and liquid. The dry segment held the largest share in 2024 as dry additives are very convenient to handle, store, and transport. Their stability and long shelf life make them a practical choice for feed manufacturers and farmers, especially in large-scale operations. Dry additives are easy to mix uniformly into dry feed rations, which is the most common form of animal feed. Their widespread use in major livestock sectors such as poultry and swine farming, where large volumes of dry feed are used, solidifies their dominant position.

The liquid form segment is anticipated to register the highest growth rate during the forecast period. This is due to several benefits that liquid additives offer, especially in modern farming practices. They allow for very precise dosing and uniform application, which is important for delivering specific nutrients to animals. The liquid form also improves the palatability of the feed, encouraging higher intake, and can be added directly to the drinking water, which is an easy and effective way to give supplements to animals. As farming methods become more advanced and focused on precision nutrition, the demand for liquid additives is rising. This trend is particularly strong in certain applications where rapid absorption and targeted delivery are key.

Type Analysis

Based on type, the segmentation includes phytogenics, organic acids, mycotoxin binders & modifiers, algae omega-3, pellet binders, probiotics, antioxidants, water disinfectants, and flavors & sweeteners. The probiotics segment held the largest share in 2024. Probiotics are beneficial living microorganisms that are added to feed to improve the gut health and overall well-being of animals. With growing global concern over the overuse of antibiotics in livestock, probiotics have become a preferred and effective alternative. They work by helping to balance gut flora, which improves nutrient absorption, strengthens the immune system, and helps prevent diseases. This widespread adoption in major livestock industries such as poultry and swine, where gut health is critical for high productivity, has solidified the probiotics segment.

The phytogenics segment is anticipated to register the highest growth rate during the forecast period. This is driven by a strong trend toward more natural and plant-based solutions in animal nutrition. Phytogenics are derived from herbs, spices, and other plants and are valued for their ability to naturally improve digestion, boost the immune system, and enhance animal performance. As consumers increasingly demand meat and dairy products from animals raised without synthetic additives or antibiotics, the demand for phytogenics is rising. Their role as a safe and effective alternative to antibiotics and their natural origin make them a very attractive and quickly growing part.

Regional Analysis

The Asia Pacific specialty feed additives market accounted for the largest share in 2024. A huge and increasing population has led to a significant rise in the demand for animal protein. The region is home to some of the world's largest livestock populations, especially in poultry and swine. As incomes rise, so does meat consumption, pushing farmers to improve the efficiency of their operations. This has created a vast and growing need for feed additives that can help animals grow faster, stay healthier, and convert feed into muscle more effectively.

China Specialty Feed Additives Market Insights

In Asia Pacific, China plays a leading role. The country is the world's largest producer of animal feed and a major consumer of meat. China's government has implemented policies to modernize its farming sector and has also banned the use of some antibiotics as growth promoters. This has created a strong demand for alternative additives that can improve animal health and performance. As a result, China is the largest market for specialty feed additives and also a key driver of new product innovation and adoption in the region.

North America Specialty Feed Additives Market Trends

In North America, demand for specialty feed additives is influenced by the advanced livestock industry and a strong focus on animal health and performance. The region has well-established farming practices and a high demand for protein-rich foods, which drives the use of these additives to maximize feed efficiency and productivity. A key trend in this area is the move toward more natural and antibiotic-free animal products, which has created a strong demand for alternatives such as probiotics and phytogenics. Farmers are increasingly adopting these products to meet consumer expectations and adhere to evolving regulations, which is a major factor shaping the segment here.

U.S. Specialty Feed Additives Market Analysis

The U.S. is a key part of the North American market, with a large and highly developed livestock industry. The country's demand for feed additives is driven by its massive scale of poultry, swine, and beef production. There is a continuous effort to improve animal nutrition and health to boost output and profitability. The focus on reducing antibiotic use in animal farming is a major trend in the U.S., with many producers turning to specialty additives to improve gut health and prevent diseases. This shift is a big growth factor, as companies work to provide effective and safe alternatives to traditional growth promoters.

Europe Specialty Feed Additives Market Outlook

The European market for specialty feed additives is shaped by strict regulations and a strong consumer focus on animal welfare and food safety. The European Union has implemented some of the world's most stringent rules on the use of antibiotics in animal feed, which has led to a major shift toward natural and plant-based additives. This has made the region a leader in the adoption of products like phytogenics, organic acids, and probiotics. The landscape is also driven by a high demand for high-quality, traceable animal products, pushing producers to use additives that improve the health and nutritional content of their livestock.

The Germany specialty feed additives market holds the largest revenue share in Europe. It has a large and advanced livestock sector, particularly in swine and poultry. The country's focus on sustainable and efficient farming practices, combined with its strict regulatory environment, makes it a key adopter of modern feed additive technologies. There is a rising demand for high-quality meat and dairy products, along with a strong push for animal welfare. Therefore, German farmers are heavily invested in using additives that promote health and productivity without the use of growth-promoting antibiotics.

Key Players and Competitive Insights

The competitive landscape for specialty feed additives is quite active, with major players such as Cargill, ADM, Evonik Industries, DSM-Firmenich, and Novozymes playing a significant role. These companies compete on various fronts, including product innovation, global reach, and strategic partnerships. The market is also seeing the rise of smaller, specialized companies that focus on niche products, such as specific types of probiotics or phytogenics.

A few prominent companies in the industry include Cargill, Archer Daniels Midland Company, Evonik Industries AG, DSM-Firmenich, Adisseo, Kemin Industries, Inc., Novozymes A/S, Lallemand Inc., Alltech, and Nutreco.

Key Players

- Adisseo

- Alltech

- Archer Daniels Midland Company

- Cargill

- DSM-Firmenich AG

- Evonik Industries AG

- Kemin Industries, Inc.

- Lallemand Inc.

- Novozymes A/S

- Nutreco

Specialty Feed Additives Industry Developments

June 2025: DSM-Firmenich announced the completion of the sale of its stake in the Feed Enzymes Alliance to its partner Novonesis for €1.5 billion (USD 1.7 billion).

April 2025: Cargill, Incorporated introduced a specialty feed additive that combines a postbiotic (XPC™) with a phytogenic to enhance gut health and immunity in poultry.

Specialty Feed Additives Market Segmentation

By Livestock Outlook (Revenue – USD Billion, 2020–2034)

- Poultry

- Swine

- Ruminants

- Aquatic Animals

- Companion Animals

By Source Outlook (Revenue – USD Billion, 2020–2034)

- Natural

- Synthetic

By Form Outlook (Revenue – USD Billion, 2020–2034)

- Dry

- Liquid

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Phytogenics

- Organic Acids

- Mycotoxin Binders & Modifiers

- Algae Omega-3

- Pellet Binders

- Probiotics

- Antioxidants

- Water Disinfectants

- Flavors & Sweeteners

By Manufacturing Technology Outlook (Revenue – USD Billion, 2020–2034)

- Fermentation

- Extraction & Purification

- Microencapsulation/Coating

- Granulation & Drying

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Specialty Feed Additives Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 15.72 billion |

|

Market Size in 2025 |

USD 16.38 billion |

|

Revenue Forecast by 2034 |

USD 24.24 billion |

|

CAGR |

4.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 15.72 billion in 2024 and is projected to grow to USD 24.24 billion by 2034.

The global market is projected to register a CAGR of 4.4% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few key players in the market include Cargill, Archer Daniels Midland Company, Evonik Industries AG, DSM-Firmenich, Adisseo, Kemin Industries, Inc., Novozymes A/S, Lallemand Inc., Alltech, and Nutreco.

The poultry segment accounted for the largest share of the market in 2024.

The natural segment is expected to witness the fastest growth during the forecast period.