Specialty Medical Chairs Market Share, Size, Trends, Industry Analysis Report

By Product (Examination Chairs, Treatment Chairs, Rehabilitation Chairs), By End-use (Hospitals, Clinics, Others), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Mar-2024

- Pages: 117

- Format: PDF

- Report ID: PM4790

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

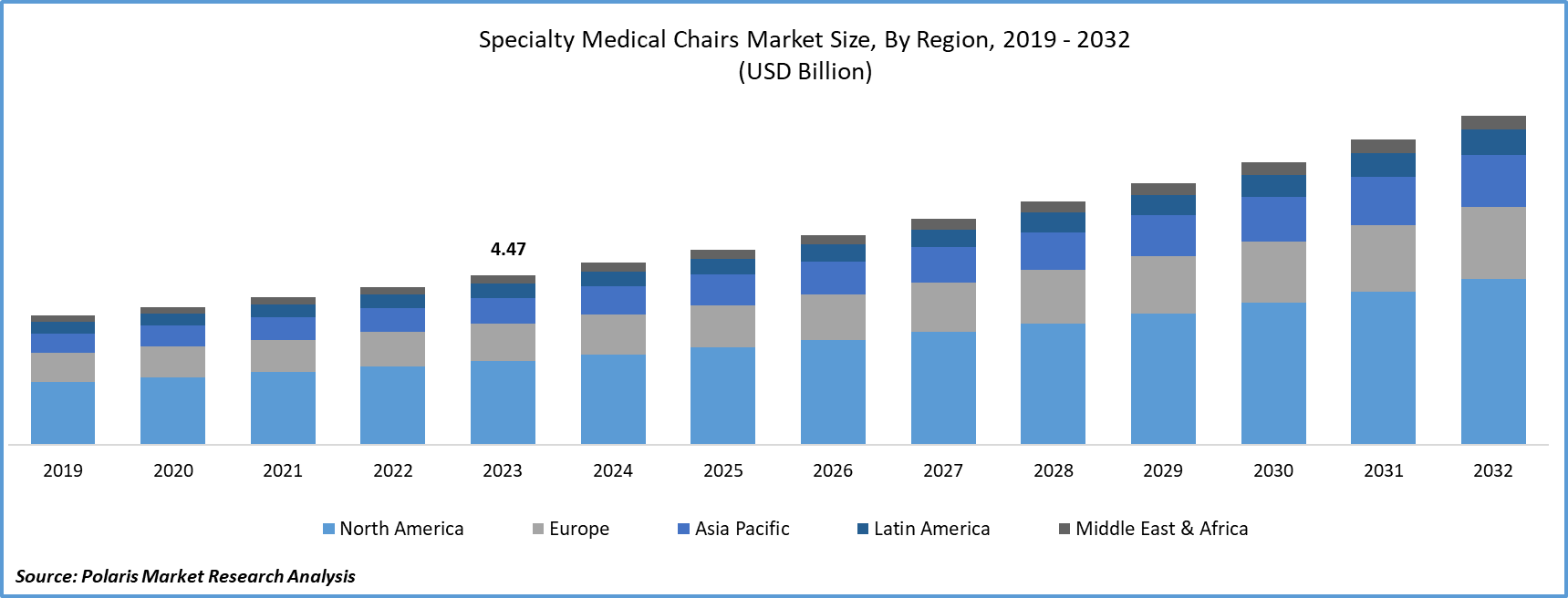

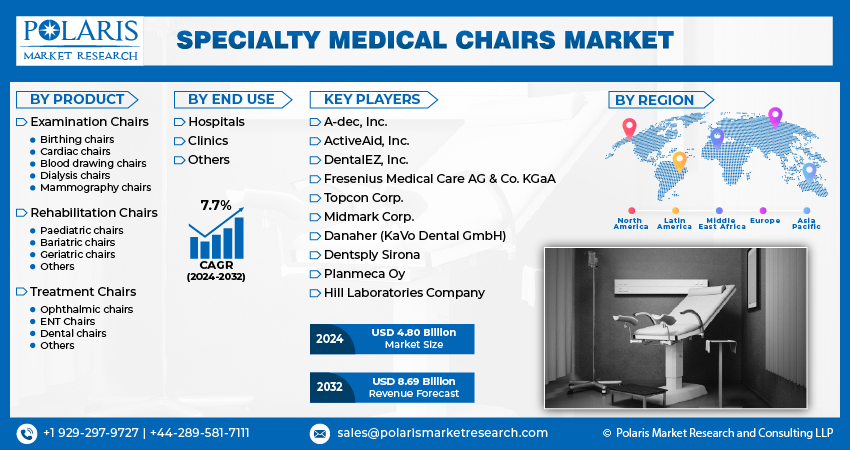

Global specialty medical chairs market size was valued at USD 4.47 billion in 2023. The market is anticipated to grow from USD 4.80 billion in 2024 to USD 8.69 billion by 2032, exhibiting the CAGR of 7.7% during the forecast period.

Market Overview

The specialty medical chairs market expansion is largely fueled by the expanding elderly demographic and the consequent rise in the patient population, driving the demand for specialty medical chairs. Moreover, advancements in technology, particularly the emergence of fully automated specialty medical chairs, are poised to create growth prospects in the market. Globally, the growing geriatric population has resulted in increased prevalence of various diseases such as cardiovascular conditions. These pivotal factors collectively are anticipated to propel the specialty medical chairs market's growth in the foreseeable future.

For instance, as per the estimates of the WHO, by 2024, projections suggest that the population of individuals aged 65 years and older will surpass the population under 15 years old in the WHO European Region. This shift in demographics poses new social, economic, and health challenges, emphasizing the need to prioritize healthy aging initiatives to address the impact of an aging population.

To Understand More About this Research: Request a Free Sample Report

The CARES Act (Coronavirus Aid, Relief, and Economic Security Act) introduced Section 506J into the Federal Food, Drug, and Cosmetic Act (FD&C Act), granting the FDA authority to address and minimize adverse public health effects arising from disruptions in the medical device supply chain during public health emergencies such as the pandemic. The proactive measures taken have resulted in improved prospects for market players, facilitated by smoother distribution systems following the relaxation of COVID-19 restrictions in various regions post-pandemic.

Prominent companies are offering tailored products to accommodate the diverse requirements of patients and clinicians, a factor expected to propel market expansion throughout the forecast period. At a broader scale, favorable reimbursement policies and adjustments in regulatory frameworks are poised to stimulate overall market growth.

Growth Factors

Favorable Government Policies Driving Market Forward

Government policies, such as favorable reimbursement programs, such as the Medicare reimbursement program for both purchased and rented medical devices, are anticipated to enhance the specialty medical chairs market development. Additionally, companies are implementing various strategic initiatives, such as altering their distribution footprints, to reduce transit times and freight charges. By strategically positioning distribution centers or warehouses closer to target markets or customers, companies can expedite delivery times and reduce expenses related to shipping and handling. These initiatives ultimately contribute to streamlining operations and enhancing competitiveness in the specialty medical chairs market.

Global Ageing Population

As the global elderly population continues to grow, there is a corresponding surge in the demand for healthcare services and infrastructure to cater to the evolving and unique healthcare requirements of older individuals. According to WHO data released in 2022, it is projected that by 2030, one out of every six people worldwide will be 60 years or older, with the number of individuals in this demographic increasing from nearly 1 billion in 2020 to around 1.4 billion by 2030. By 2050, the global population of those aged 60 and above is expected to double, reaching 2.1 billion. Consequently, this trend is anticipated to drive the demand for specialty medical chairs throughout the forecast period.

Restraining Factors

High Cost of Medical Chairs

High medical chairs are expected to hinder its adoption. In the price range of EUR 2,000 to EUR 3,000, chairs often offer greater adjustability and come equipped with features such as electric or battery operation, enhanced height adjustment, and higher-quality materials that facilitate easier and quicker cleaning. As the pricing escalates for intensive care chairs, particularly for top-specification models ranging between EUR 4,000 and EUR 8,000, the equipment's capabilities undergo significant transformation.

Report Segmentation

The market is primarily segmented based on product, end use, and region.

|

By Product |

By End Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Insights

Rehabilitation Chairs Segment Accounted for the Largest Market Share in 2023

The rehabilitation chairs segment accounted for the largest share of the market. This segment's share is primarily due to the rise in unhealthy lifestyles, a growing elderly population prone to neurological disorders, and an increase in various chronic conditions such as cardiovascular disease, cancer, Alzheimer's disease, and orthopedic disorders. Additionally, innovation has spurred heightened demand for smart-assisted devices such as rehabilitation chairs, which is expected to fuel specialty medical chairs market growth throughout the forecast period.

The treatment chairs segment will grow at the highest growth rate. Essential for various procedures, treatment chairs offer a significant advantage by enabling patients to achieve comfortable postures and granting doctors unrestricted access to different parts of the patient's body. This equipment enhances safety for both patients and caregivers while promoting patient relaxation. Therefore, the expanding benefits associated with treatment chairs are expected to drive market growth.

By End Use Insights

Hospitals Segment Held the Majority Share of the Market in 2023

The hospitals segment held the maximum market share in 2023. This is due to the rise in elderly patient volume originating from the global rise in chronic diseases and the enhanced financial and service capabilities of healthcare facilities. Moreover, the escalating number of patient admissions and the growing demand for specialty medical chairs in post-surgical procedures have additionally propelled market growth.

Numerous severe brain injuries, accidents, diseases, and congenital disorders are more effectively treated within a hospital setting. In cases of spinal injuries, a minimum hospital stay of nearly 11 days is necessary before transitioning the patient to a rehabilitation center. The primary objective of hospital services is to stabilize individuals rather than offer long-term care. Thus, individuals experiencing temporary or permanent disabilities must acquire a doctor's prescription to purchase a specialty medical chair and access the Medicare benefits.

Regional Insights

North America Region Dominated the Global Market in 2023

The North America region dominated the global market. This significant share is attributed to the growing geriatric population and the favorable reimbursement landscape in the region. The rise in lifestyle-associated diseases is expected to propel the regional market in the forecast period. Furthermore, the increasing number of ophthalmic, dental, and ENT chairs across the U.S. and Canada is driving product demand. Moreover, the presence of major market players, high levels of disposable income, and advanced healthcare infrastructure are facilitating the growth of regional markets.

According to a Population Reference Bureau article released in January 2024, projections suggest that the population of Americans aged 65 and older will increase from 58 million in 2022 to 82 million by 2050, indicating a 47% rise. Concurrently, the proportion of the total population accounted for by the 65-and-older age group is predicted to elevate from 17% to 23%.

Key Market Players & Competitive Insights

Strategic Partnerships to Drive the Competition

The specialty medical chair market is characterized by intense competition and is primarily dominated by a handful of key players in terms of market share. Additionally, several prominent players are actively engaging in collaborations, acquisitions, and the introduction of new products in partnership with other companies to strengthen their market positions worldwide.

Some of the major players operating in the global market include:

- A-dec, Inc.

- ActiveAid, Inc.

- DentalEZ, Inc.

- Fresenius Medical Care AG & Co. KGaA

- Topcon Corp.

- Midmark Corp.

- Danaher (KaVo Dental GmbH)

- Dentsply Sirona

- Planmeca Oy

- Hill Laboratories Company

Recent Developments in the Industry

- In August 2023, Nakanishi finalized an agreement to acquire DCI International, aiming to broaden its sales of dental chair units and instruments within the United States.

- In June 2023, A-dec introduced the A-dec 500 Pro and A-dec 300 delivery systems in North America, which feature digitally connected dental chairs.

Report Coverage

The specialty medical chairs market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, end user, and their futuristic growth opportunities.

Specialty Medical Chairs Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 4.80 billion |

|

Revenue forecast in 2032 |

USD 8.69 billion |

|

CAGR |

7.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The Specialty Medical Chairs Market report covering key segments are product, end use, and region.

Specialty Medical Chairs Market Size Worth $8.69 Billion By 2032

Specialty medical chairs market exhibiting the CAGR of 7.7% during the forecast period.

North America is leading the global market

key driving factors in Specialty Medical Chairs Market are Favorable government policies