Spring Market Share, Size, Trends, & Industry Analysis Report

By Product Type (Leaf Spring, Helical Spring, Others), By End-use, By Region, Segment Forecasts, 2025 - 2034

- Published Date:Aug-2025

- Pages: 135

- Format: PDF

- Report ID: PM4224

- Base Year: 2024

- Historical Data: 2020 – 2023

Industry Overview

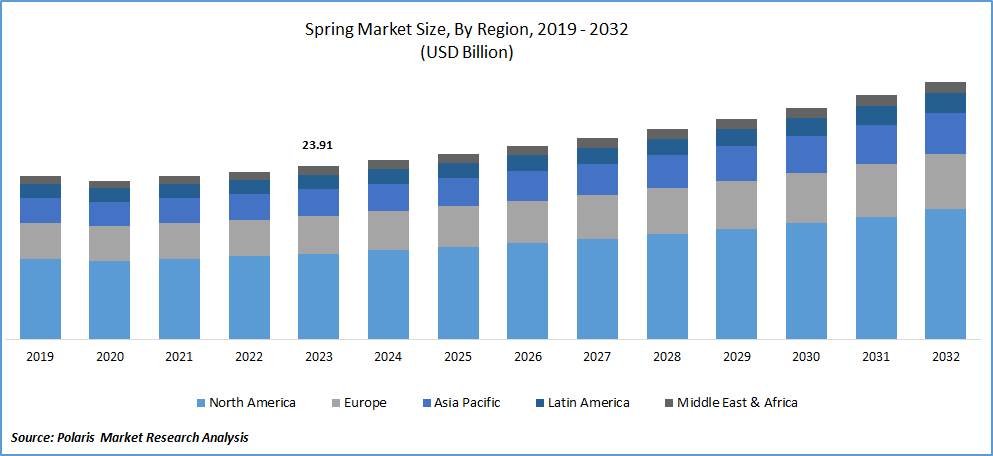

The global spring market size was valued at USD 11.70 billion in 2024, exhibiting a CAGR of 5.50% during 2025–2034. The market is driven by rising demand from automotive and industrial sectors, technological improvements in spring manufacturing, and growth in consumer electronics production.

Key Insights

- The helical spring segment held the largest share due to its wide usage across various industries for its excellent load-bearing and energy absorption capabilities.

- The leaf spring segment is projected to grow at the fastest rate, driven by increasing demand in heavy-duty vehicles and commercial transportation.

- The manufacturing segment accounted for the largest share, supported by the essential role springs play in machinery, tools, and industrial equipment.

- The automotive & transportation segment is expected to grow rapidly as vehicle production and demand for efficient suspension systems continue to rise.

- Europe dominates the global spring market, accounting for 35–40% of global production and value, due to its advanced automotive sector and robust industrial base.

Industry Dynamics

- The growing demand from the automotive industry and the increasing use of springs in industrial machinery are driving market growth.

- Rising demand for consumer electronics and medical devices further supports expansion.

- Volatile raw material prices, especially steel, hinder consistent cost management for manufacturers.

- Advancements in lightweight and corrosion-resistant spring materials present strong innovation opportunities.

Market Statistics

- 2024 Market Size: USD 11.70 billion

- 2034 Projected Market Size: USD 20.38 billion

- CAGR (2025-2034): 5.50%

- Europe: Largest market in 2024

To Understand More About this Research, Request a Free Sample Report

Springs play a crucial role in absorbing shocks and reducing the overall mass of assembled structures, making them essential components in automobiles. However, with the expanding application scope of springs, there is a growing demand for various types to meet different requirements. This has led to the manufacturing of specialized springs, including lightweight springs, corrosion-resistant springs, and springs with high fatigue life, tailored to the evolving needs of diverse industries and verticals. Recognizing the need for precision in designing such springs and meeting changing user requirements, spring manufacturers are increasingly adopting advanced, state-of-the-art technology.

Customization of springs to meet the specific requirements of diverse end-use industries and verticals is essential. The precision in manufacturing the springs is crucial, as the selection of improper materials, design flaws, or manufacturing errors can result in spring failures, especially when the springs are unable to withstand desired loads and fatigue. Parameters such as durability, strength-to-weight ratio, load-carrying capability, vibration & shock absorption abilities, & friction resistance must be carefully considered during the design & manufacturing processes.

The initial setup costs for spring manufacturing are low, requiring a moderate capital investment but offering a favorable return on investment due to substantial demand. This has attracted numerous vendors, facilitating easy entry for new players in the market. Additionally, the increasing automation in various industries has significantly elevated machining methods, optimizing production processes to enhance capacity and meet the growing demand for springs. Innovative machining techniques, including the use of Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM), now enable the production of springs with intricate geometries from different alloys. These alloy-based springs are not only lighter but also provide an extended lifespan compared to conventional springs.

Industry Dynamics

Growth Drivers

Construction and Infrastructure Development

The utilization of lightweight and high-strength metals and alloys in the manufacturing of springs has gained prominence, aiming to reduce weight and enhance strength. This trend has found increased application in the manufacturing of aircraft, satellites, and automobiles. Given the substantial usage of springs in these industries, a reduction in spring weight contributes to an overall decrease in the structure's weight, consequently improving its load-carrying capacity. Springs play integral roles in automotive and aircraft applications, being employed in suspension systems, brake systems, and interior mechanisms for functions like opening and closing doors and armrests. Additionally, springs find application in various critical components such as actuators, engines, and fuel pumps.

Report Segmentation

The market is primarily segmented based on product type, end use, and region.

|

By Product Type |

By End Use |

By Region |

|

|

|

To Understand the Scope of this Report, Speak to Analyst

By Product Type Analysis

Helical Spring Segment Held the Largest Share in 2024

The helical spring segment held the largest share. The heightened demand for helical springs can be attributed to their inherent advantages, particularly their coil structure. For instance, a specific type of helical structure is employed in shock absorbers, allowing for energy storage upon compression due to resilient force. Subsequently, this stored energy is released, providing comfort to passengers even on uneven surfaces. The versatility of helical springs is evident in their ability to resist pull forces between objects, making them suitable for various applications such as carburetors and drum brakes. Renowned for their exceptional shock absorption and impact resistance, helical springs play a crucial role in industries like automotive, aerospace, and railways.

The leaf spring segment is projected to grow at the fastest rate. Leaf springs play a crucial role in preserving the vehicle's well-being and ensuring passenger safety by isolating vibrations caused by road disturbances from reaching the driver and passengers. The increasing demand for automobiles in developing nations, coupled with the automotive original equipment manufacturers' heightened focus on enhancing passenger safety and comfort, is expected to propel the growth of this segment. Furthermore, the rising preference for electric vehicles among consumers has resulted in an increased demand for springs from electric vehicle manufacturers, contributing positively to the market dynamics over the forecast period.

By End Use Analysis

Manufacturing Segment Registered the Largest Market Share in 2024

Manufacturing segment accounted for the largest share. The manufacturing sector has witnessed rapid technological advancements, including the utilization of CNC (computer numerical control) machines, frequent innovations in spring design and materials, and a shift toward customized product manufacturing. Springs, known for their high flexibility, can be tailored to meet specific user requirements, further contributing to the segment's expansion.

The Automotive & transportation segment is expected to grow at the fastest rate. This surge is attributed to the substantial reliance of automobiles on springs to endure varying surface conditions, particularly rough and uneven terrains. Additionally, the growing demand for electric vehicles, driven by the need to address future energy requirements, is contributing to the segment's rapid expansion. Notably, according to the International Energy Agency's 2022 report, global electric vehicle car sales surpassed 10 million units, indicating significant growth from the 6 million units recorded in 2021.

Regional Insights

The spring market, encompassing products such as mechanical springs used in automotive, industrial machinery, electronics, and consumer goods, is witnessing steady growth globally, with Europe dominating the landscape due to its advanced manufacturing capabilities and strong industrial base. European manufacturers benefit from well-established automotive and aerospace sectors, driving demand for high-quality, customized springs that meet stringent safety and performance standards. The region’s focus on innovation and sustainability pushes companies to develop advanced materials and eco-friendly production processes, enhancing product durability and efficiency. Additionally, the presence of key spring manufacturers and a robust supply chain infrastructure supports Europe’s leading position in the market.

In North America, the spring market is characterized by strong demand from the automotive and healthcare sectors, where precision and reliability are critical. The region emphasizes technological advancements such as smart springs and lightweight materials to cater to evolving industry needs. A mature industrial ecosystem, combined with investments in automation and smart manufacturing, contributes to steady market growth. North American manufacturers also focus on customization and rapid prototyping to meet the requirements of diverse applications.

The Asia Pacific spring market is growing rapidly, driven by expanding automotive production, industrialization, and increasing electronics manufacturing, particularly in countries such as China, India, and Japan. The region benefits from cost-effective manufacturing and a large workforce, attracting global companies to establish production hubs. However, compared to Europe and North America, the focus on advanced materials and innovation is still in its early stages. The growing infrastructure development and rising demand from emerging industries suggest strong future potential.

Key Market Players & Competitive Insights

Market participants are actively engaged in researching and developing innovative springs characterized by reduced weight and enhanced pressure resistance. This strategic focus aims to contribute to the overall reduction of automobile weight, lower emissions, and improve the efficiency of automotive systems. In May 2021, Hexion & Rassini joined forces to integrate composite leaf springs into Ford's upcoming F-150 pickup. Rassini designed a hybrid rear suspension featuring a composite assist and a parabolic primary steel leaf.

Some of the major players operating in the global market include:

- GALA GROUP

- Ace Wire Spring & Form Company

- Bal Seal Engineering.

- Barnes

- CARL HAAS GmbH

- EBSCO Spring Co.

- FRAUENTHAL HOLDING

- Hendrickson USA

- IFC Composite

- JAMNA AUTO INDUSTRIES LIMITED.

- John Evans’ Sons Inc.

- Muhr and Bender

- Rassini

- Sogefi

Recent Developments

- In April 2025, Hendrickson USA partnered with Voith US Inc. to advance spring and suspension systems for electric and zero-emission commercial vehicles. Combining Hendrickson’s century-long ride solution expertise with Voith’s electric-drive technologies, the collaboration targets next-gen spring-integrated suspensions, reinforcing sustainability and shaping future commercial transport.

- In February 2025, the Stumpp, Schuele & Somappa (5S) joint venture—backed by Mitsubishi Steel Group—opened a new coil spring factory in Chennai, India, featuring advanced hot-and-cold forming, proprietary shot‑peening, and enhanced coating capabilities to support India’s booming automotive demand .

- In May 2022, DONGFENG MOTOR introduced a new truck model in Russia. The DF6 is a robust pickup truck with a sturdy frame designed for comfort, reliability, and off-road capabilities. Its resilient undercarriage, featuring a rear-dependent leaf spring and a double-wishbone front suspension, is well-suited for navigating the diverse terrain of Russian roads.

Spring Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2025 |

USD 12.45 billion |

|

Revenue Forecast in 2034 |

USD 20.38 billion |

|

CAGR |

5.50% from 2025 – 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Product Type, By End Use, By Region |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Gain profound insights into the 2025 Spring Market with meticulously compiled statistics on market share, size, and revenue growth rate by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into historical trends but also unfolds a roadmap with a market forecast extending to 2034. Immerse yourself in the comprehensive nature of this industry analysis through a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Abrasive Blasting Nozzle Market Size, Share 2024 Research Report

Camping Coolers Market Size, Share 2024 Research Report

Clinical Communication and Collaboration Market Size, Share 2024 Research Report

Coin Operated Laundries Market Size, Share 2024 Research Report

Plastics in Electrical and Electronics Market Size, Share 2024 Research Report

FAQ's

The global spring market size is expected to reach USD 20.38 billion by 2034

The global players include GALA GROUP, Bal Seal Engineering, Barnes, CARL HAAS are the top market players in the market

APAC region contribute notably towards the global Spring Market

The market is expected to register a CAGR of 5.50% during the forecast period.

Product Type ,End Use are the key segments in the Spring Market