Submarine Cables Market Share, Size, Trends, Industry Analysis Report

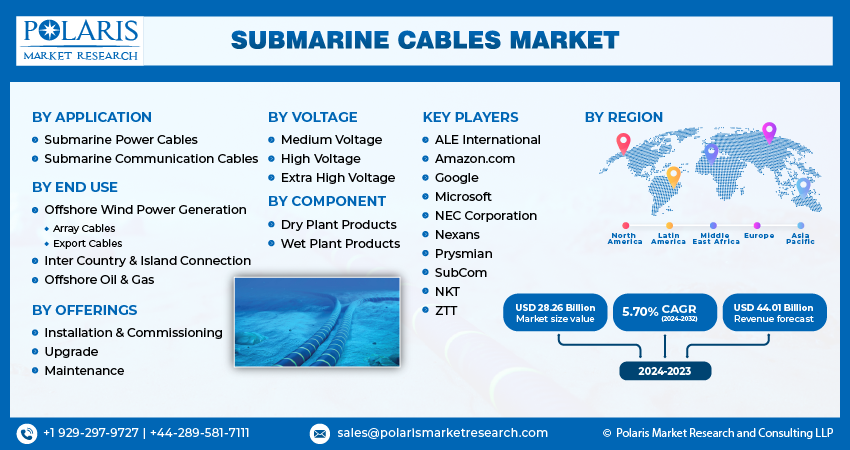

By Application (Submarine Power Cables, Submarine Communication Cables), By Voltage, By End-user, By Offerings, By Component, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3811

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

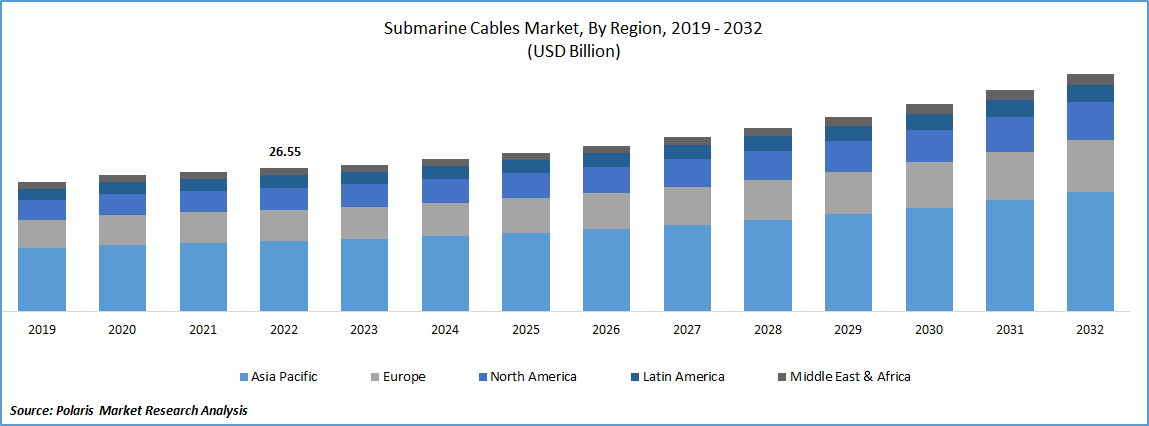

The global submarine cables market was valued at USD 27.27 billion in 2023 and is expected to grow at a CAGR of 5.70% during the forecast period.

Notable rise in investments in offshore wind farms, driving the need for reliable infrastructure such as submarine cables to support power transmission. Surge in data traffic, coupled with investments from Over-The-Top (OTT) providers to meet the growing demands, is further contributing to the market's expansion. Submarine cables play a crucial role in both power and communication applications. For power transmission, they are utilized to connect various locations, including oil rigs, offshore wind farms to onshore power stations, and inter-country and island connections. Moreover, there is a rising demand for low-power cables to facilitate the interconnection of power grids between countries, which is becoming a significant driving force behind the increased demand for such cables.

To Understand More About this Research: Request a Free Sample Report

Submarine cables are significantly influenced by major tech companies, including Google, Facebook, Amazon, & Microsoft. These companies have invested extensively in submarine cable infrastructure to bolster global connectivity. Google, for instance, possesses an impressive 10,433 miles of submarine cables across international routes. Moreover, in partnership with Facebook, Amazon, & Microsoft, they collectively own an extensive network of 63,605 miles of submarine cables. Facebook owns a substantial 57,709 miles of submarine cables, while Amazon and Microsoft also have significant ownership with 18,987 miles and 4,104 miles, respectively.

Development of efficient power distribution systems from renewable the energy sources, particularly the expansion of offshore wind farms. A notable example is the Government of Japan's initiative to construct a floating wind farm located 12 miles off the seacoast. This project aims to install around 140 floating wind turbines. With the increasing demand for submarine cables, manufacturers are actively involved in various aspects of the industry, including installation, commissioning, upgrades, and maintenance of these vital communication links.

An illustrative instance of this industry activity is the upgrade of The Europe India Gateway (EIG) submarine cable system, in February 2020. Ciena Corporation took the lead in this upgrade, which was aimed at fast-tracking and reinforcing connectivity among businesses. Such initiatives showcase the efforts to enhance and expand submarine cable networks to meet the growing demands of global communication and connectivity.

Industry Dynamics

Growth Drivers

The increasing demand for high-speed internet services

Submarine communication cables play a vital role in facilitating inter-regional and international communications. They have become a critical component of the global internet infrastructure, with approximately 97% of worldwide internet traffic relying on these undersea cables. As the internet's demand continues to surge, there is a corresponding dramatic increase in the demand for submarine cables. These cables enable high-speed communication and carry massive volumes of data across vast distances, facilitating seamless connectivity and ensuring the smooth functioning of our increasingly interconnected world.

These cables are designed to support a capacity of up to 500 mbps and consist of 24 fiber pairs. These undersea cables are of paramount importance to most countries, as they are recognized as crucial assets for their economies. For instance, the Australian Communications and Media Authority (ACMA) has established safety zones around the submarine cables that connect Australia with the rest of the world. These safety zones serve to prohibit activities that could potentially cause damage to the cables.

Report Segmentation

The market is primarily segmented based on application, voltage, end use, offerings, component, and region.

|

By Application |

By Voltage |

By End Use |

By Offerings |

By Component |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Application analysis

Power cable segment accounted for the largest share in 2022

Power cable accounted for major global share. The industry's growth is primarily fueled by the rising demand for the inter-country connections, as well as the expansion of capacity in the off-shore wind sector. The proliferation of offshore wind farms & growing electrification of the offshore oil & gas networks has sparked increased R&D efforts, leading to a higher demand for the such power cables. As these industries continue to evolve, the need for reliable and efficient underwater power transmission has become increasingly vital, contributing significantly to the segment’s growth.

Communication cable segment is likely to register highest growth rate. The expansion and development of infrastructure and construction sectors, driven by the increasing urbanization and economic progress, are key factors influencing the demand for submarine cables. Various industries, including commercial, telecom, energy, and power, are experiencing rising demands, leading to the need for expanding and upgrading infrastructure. As a result, the industry is expected to experience significant growth due to the increasing demand from multiple sectors and the continuous efforts to enhance global connectivity and communication networks.

By Voltage analysis

High voltage segment expected to hold substantial market share in 2022

High voltage segment is projected to hold significant market share. This is primarily due to surging demand for high-voltage direct current (HVDC) power cables, which play a crucial role in efficient long-distance power transmission. With the increasing focus on renewable energy sources, particularly offshore wind, the demand for high-voltage cables is expected to continue growing, bolstering the overall growth.

Medium voltage cables segment witnessed steady growth. This growth can be primarily attributed to the expanding use of these cables in power transmission for offshore oil and gas infrastructure applications. As the offshore oil and gas sector continues to grow, the demand for reliable and high-performance cables is expected to surge, further fueling the growth of this segment.

Regional Insights

Asia Pacific region dominated the global market in 2022

APAC region dominated the global market. The region stands out for its significant adoption and deployment of wind farms, with China leading the way.

- According to data from IEEFA, China has been at the forefront of offshore wind power development, boasting an operational offshore wind power capacity of 4.6 GW1 in 2018. China installed an impressive 1.8 GW of offshore wind capacity, representing 40% of the total 4.5 GW added worldwide during that period.

Further emphasizing its commitment to offshore wind energy, China granted approval for 24 offshore wind power projects off the coast of Jiangsu Province, in January 2019. These projects have a combined capacity of 6.7 GW and involve an investment injection of USD 18 billion. It is anticipated that these projects will become operational by 2020, solidifying China's position as a major player in the offshore wind sector within the region and globally.

Furthermore, in April 2020, Facebook made a significant investment of USD 5.7 Bn in Reliance Jio. This move by the Facebook also contributes to the increased demand for submarine cables in the region. As a result of such substantial investments and growing interest in offshore wind and telecommunication projects, the region is swiftly emerging as a key destination for direct investments in submarine cable infrastructure. The rising focus on expanding connectivity and communication networks in the region further amplifies the importance of submarine cables in meeting these demands and promoting regional development.

Key Market Players & Competitive Insights

The submarine cables market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market:

- ALE International

- Amazon.com

- Microsoft

- NEC Corporation

- Nexans

- Prysmian

- SubCom

- NKT

- ZTT

Recent Developments

- In April 2023, Exans, acquired Reka Cables, a prominent cable manufacturer based in Finland. The strategic collaboration between the two companies is intended to offer secure and top-notch cable solutions to customers not only in the Nordic region but also in other markets worldwide.

Submarine Cables Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 28.26 billion |

|

Revenue forecast in 2032 |

USD 44.01 billion |

|

CAGR |

5.70% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Application, By Voltage, End Use, Offerings, Component, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in submarine cables market are ALE International, ALE USA, SubCom, NEC Corp., Prysmian, Nexans.