Surgical Sutures Market Size, Share, Trends, Industry Analysis Report

By Type (Absorbable, Non-absorbable), By Filament (Monofilament, Multifilament), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM5932

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

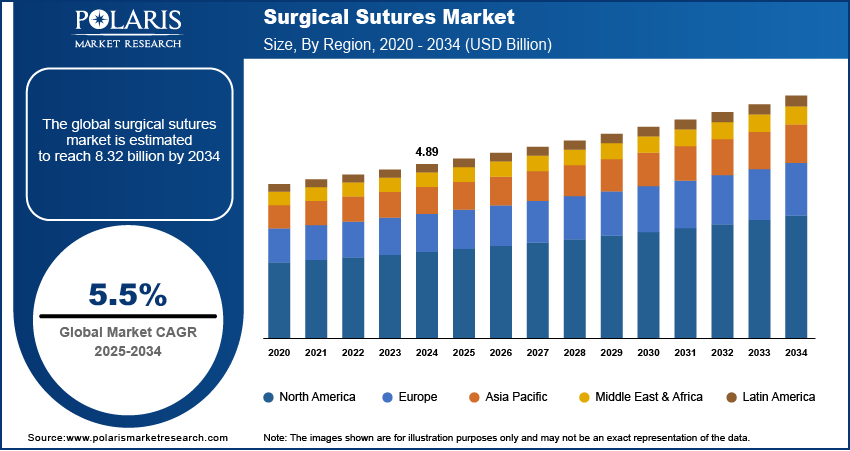

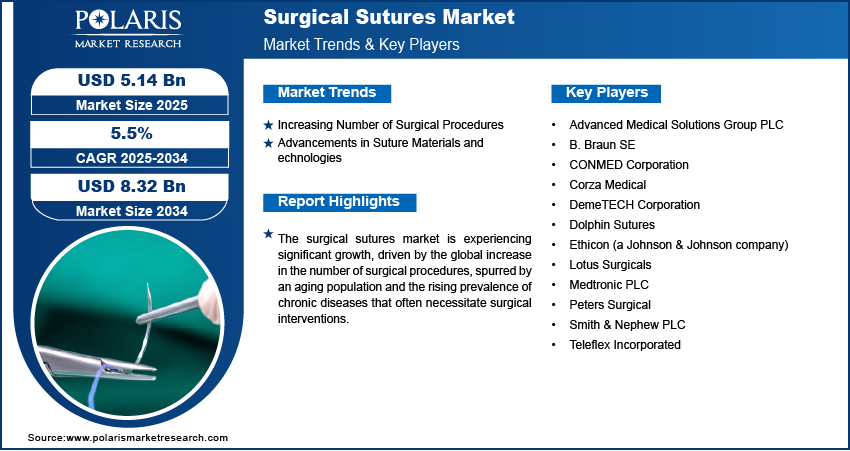

The global surgical sutures market size was valued at USD 4.89 billion in 2024 and is anticipated to register a CAGR of 5.5% from 2025 to 2034. The market is mainly driven by the increasing number of surgical procedures performed globally, largely due to a growing aging population and the rising prevalence of chronic diseases.

The surgical sutures market includes all types of materials and devices used by medical professionals to close wounds or join tissues after surgical procedures or injuries. These products are crucial for proper wound healing and are available in various forms, including absorbable and non-absorbable types.

The increasing prevalence of chronic wounds globally is a significant driver for the surgical sutures market growth. Chronic wounds, such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, often require surgical intervention for debridement, closure, or skin grafting. These complex wounds necessitate precise and often specialized sutures to ensure proper closure and to support the healing process, especially since such wounds can be difficult to manage and prone to infection.

The increasing number of ambulatory surgical centers (ASCs) and the shift toward outpatient surgical procedures are significantly driving the market. ASCs offer a more cost-effective and convenient alternative to traditional hospital settings for many surgical procedures. As more surgeries move to these outpatient facilities, the demand for sutures specifically suited for faster recovery times and less complex procedures performed in such settings rises.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Increasing Number of Surgical Procedures

The global rise in surgical procedures is a significant factor boosting the demand for surgical sutures. This growth is linked to several trends, including the increasing prevalence of chronic diseases and a growing aging population, both of which often require surgical intervention. As medical science advances, more conditions are becoming treatable through surgery, leading to a higher volume of operations performed.

For instance, the National Center for Biotechnology Information (NCBI) published an article in the Archives of Surgery in 2005, titled "The Aging Population and Its Impact on the Surgery Workforce," which projected significant increases in surgical workload. The study highlighted that individuals aged 65 years and above were expected to increase by 53.2% between 2001 and 2020, and this demographic had higher rates of surgical use across various specialties. Another instance from a 2021 article in the World Journal of Surgery noted the high number of surgeries performed in India, indicating increasing surgical demand in developing regions due to factors such as chronic diseases and trauma injuries. This continuous increase in surgical volume directly translates to a higher demand for sutures, thereby driving the market growth.

Advancements in Suture Materials and Technologies

Innovation in surgical suture materials and the development of new technologies are key forces shaping and expanding the market. These advancements aim to improve patient outcomes by enhancing wound healing, reducing infection risk, and offering better handling properties for surgeons. From biodegradable options to those with antimicrobial properties, these developments make sutures more effective and versatile.

A review article titled "Seamless Innovations: Exploring the Latest Advancements in Sutures," published in the International Journal of Advanced Medicine in 2024, discusses how modified antimicrobial sutures have emerged as a promising development to combat infections at the wound site. The article also highlights drug-eluting sutures that can release medications gradually, offering therapeutic benefits during healing. Such ongoing research and development lead to improved suture performance and patient safety, thus contributing to the growth.

Segmental Insights

Type Analysis

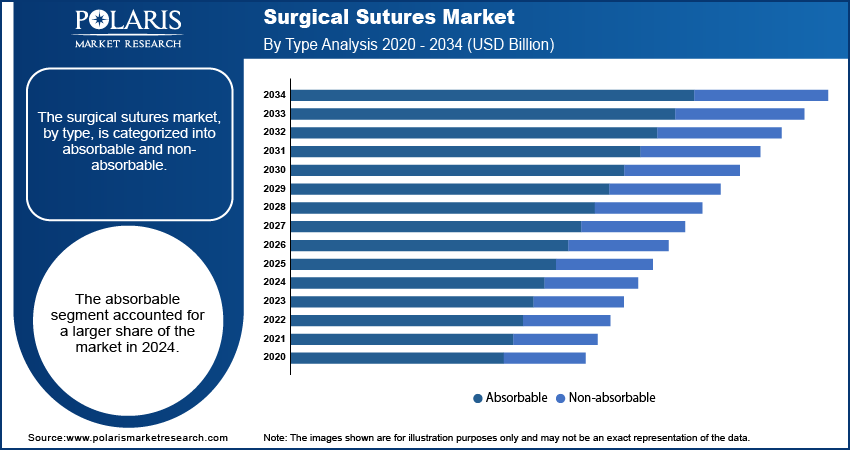

The absorbable segment held a larger share in 2024. The absorbable sutures are designed to naturally break down and be absorbed by the body over time, eliminating the need for a second procedure to remove them. This inherent advantage of biodegradability makes them highly preferred in many surgical applications, particularly for internal wound closure where long-term support is not required. For example, a 2020 review in the International Journal of Nanomedicine titled "Biodegradable Polymers for Surgical Suture Applications" discusses how the use of absorbable synthetic materials minimizes tissue reaction and promotes better healing, thereby contributing to their widespread adoption in various surgeries, including general, gynecological, and ophthalmic procedures.

The non-absorbable sutures segment is anticipated to grow at a higher growth rate during the forecast period. These sutures are made from materials that the body cannot break down, providing permanent tissue support. They are essential in procedures where long-term wound integrity is crucial, such as in cardiovascular surgeries or for repairing slow-healing tissues. An article from the National Library of Medicine (NLM) in 2022, "Non-absorbable Suture Materials in Modern Surgery: A Comprehensive Review," highlights their indispensable role in high-stress areas and complex reconstructions where durable closure is paramount.

Filament Analysis

The multifilament segment held a larger share in 2024. These sutures are made from multiple fine strands braided or twisted together, which gives them excellent tensile strength and flexibility. This construction allows for secure knot tying and provides robust support for wound closure, making them suitable for a wide range of surgical applications, especially where strong and reliable tissue approximation is needed. For example, a 2024 article published in the Journal of Biomedical Materials Research on advancements in suture technology highlighted that multifilament braids control a significant share due to their superior pliability and knot security, making them preferred in high-tension surgical areas such as cardiovascular and orthopedic surgeries.

The monofilament segment is anticipated to register the highest growth rate during the forecast period. Monofilament sutures consist of a single, smooth strand, which offers benefits such as reduced tissue drag and a lower risk of infection compared to multifilament sutures, as there are no interstices for bacteria to harbor. This makes them highly preferred in delicate procedures and those with a higher risk of infection. Monofilament sutures decrease infection rates in certain closures compared to multifilament ones, noting improved glide and reduced tissue drag. Their smooth surface also results in minimal tissue reaction, which is beneficial for patient healing and reduces complications, driving their increasing use in specialties such as plastic surgery and ophthalmology.

Application Analysis

The cardiac surgery segment held the largest share in 2024, due to the high global prevalence of cardiovascular diseases. The rising incidence of the disease necessitates a large volume of complex cardiac procedures such as bypass surgeries, valve repairs, and congenital heart defect corrections. These intricate operations require precise and reliable wound closure, making high-quality surgical sutures indispensable. For instance, the World Health Organization (WHO) continuously highlights cardiovascular diseases as a leading cause of mortality worldwide, driving the ongoing demand for surgical interventions and, consequently, for sutures in this field. The criticality and complexity of these surgeries underscore the need for advanced suturing solutions.

The orthopedic surgery segment is anticipated to register the highest growth rate during the forecast period. This growth is fueled by a rising number of orthopedic procedures, which include joint replacements, fracture repairs, and ligament reconstructions. An aging global population, combined with an increasing prevalence of sports injuries and degenerative bone conditions, contributes to the demand for these surgeries. A 2023 review in the Journal of Orthopaedic Surgery and Research on orthopedic wound closure techniques emphasized the continuous innovation in sutures tailored for specific orthopedic needs, such as those providing enhanced strength and faster healing in bone and soft tissue repair.

Regional Analysis

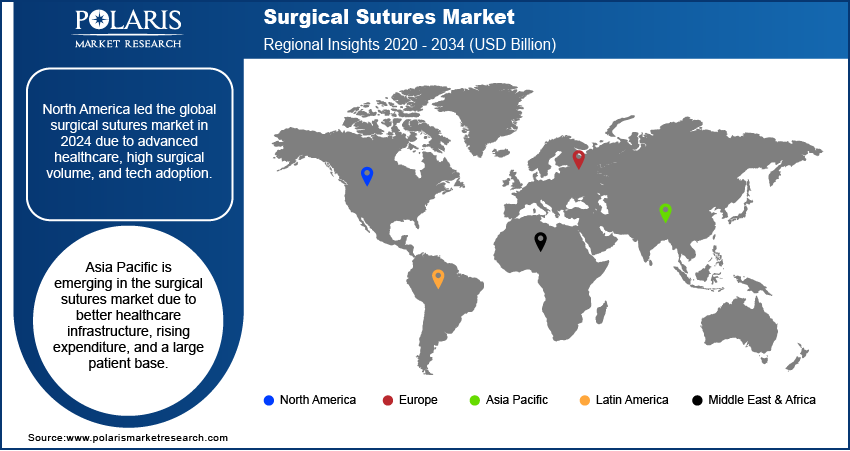

The North America surgical sutures market held the largest share in 2024, largely due to its advanced healthcare infrastructure and high healthcare spending. The region benefits from widespread adoption of sophisticated surgical techniques, including minimally invasive procedures, which often require specialized sutures. An aging population, coupled with a high prevalence of chronic diseases such as cardiovascular conditions and diabetes, consistently drives the demand for surgical interventions, thereby sustaining the need for sutures. Furthermore, a strong emphasis on patient safety and reducing surgical site infections in this region also encourages the use of advanced and antimicrobial-coated sutures.

U.S. Surgical Sutures Market Insight

The U.S. is a leading contributor to the surgical sutures market in North America. The country's robust healthcare system, coupled with a high volume of surgical procedures performed annually, significantly boosts product demand. The U.S. market is also characterized by continuous technological advancements and favorable reimbursement policies that support the adoption of innovative suture products. For example, the increasing trend of cosmetic surgical procedures in the country, as noted by various industry observations, also contributes to the demand for high-precision sutures. The presence of major market players and a strong focus on research and development further solidify the U.S.'s position in this market.

Europe Surgical Sutures Market Trends

Europe represents a substantial segment of the global market. The region's well-established healthcare systems, coupled with an aging demographic and a high incidence of chronic illnesses, contribute to a consistent demand for surgical procedures. There's also a growing adoption of advanced surgical techniques, including robotic-assisted surgeries, which require specialized and high-quality sutures. This focus on surgical precision and enhanced patient outcomes across Europe propels the demand for innovative suturing solutions across the region.

The Germany surgical sutures market plays a leading role in the Europe market. This is primarily attributed to its advanced healthcare infrastructure, high healthcare expenditure, and a large number of surgeries performed each year. The presence of several key medical device manufacturers in Germany, alongside ongoing research and development activities, contributes significantly to the availability and adoption of advanced suture technologies. The country's strong clinical research environment further supports the development and use of innovative surgical materials.

Asia Pacific Surgical Sutures Market Overview

Asia Pacific is rapidly emerging as a key growth region in the global surgical sutures market. This growth is driven by improving healthcare infrastructure, increasing healthcare expenditure, and a large patient pool across countries such as China and India. The rising prevalence of chronic diseases, coupled with a growing awareness of modern surgical treatments, is leading to a surge in surgical volumes. Additionally, the increasing focus on medical tourism in some parts of the region also contributes to the demand for surgical sutures.

The China surgical sutures market is a significant contributor to the Asia Pacific market and is expected to witness substantial growth in the coming years. The country's vast population, coupled with ongoing enhancements in its healthcare facilities, including a significant increase in the number of hospitals, directly drives the demand for surgical products such as sutures. There is also a rising adoption of minimally invasive surgeries and a growing interest in advanced medical technologies, which further boosts the need for modern and effective surgical sutures in the country.

Key Players and Competitive Insights

The surgical sutures market features a competitive landscape with several established players and emerging companies striving for innovation. Competition often centers on product differentiation, such as advanced materials, specialized coatings, and user-friendly designs, as well as pricing strategies and extensive distribution networks. Companies are continually investing in research and development to introduce new suture technologies that offer improved wound healing, reduced infection risks, and enhanced surgical efficiency, aiming to gain a competitive edge.

A few prominent companies in the industry include Ethicon (a Johnson & Johnson company), Medtronic PLC, B. Braun SE, Advanced Medical Solutions Group PLC, Teleflex Incorporated, Peters Surgical, Corza Medical, DemeTECH Corporation, Smith & Nephew PLC, CONMED Corporation, Dolphin Sutures, and Lotus Surgicals.

Key Players

- Advanced Medical Solutions Group PLC

- B. Braun SE

- CONMED Corporation

- Corza Medical

- DemeTECH Corporation

- Dolphin Sutures

- Ethicon (a Johnson & Johnson company)

- Lotus Surgicals

- Medtronic PLC

- Peters Surgical

- Smith & Nephew PLC

- Teleflex Incorporated

Industry Developments

September 2023: Genesis MedTech received approval from China’s NMPA to launch its antibacterial absorbable sutures, designed to enhance healing and reduce the risk of infections in the market.

August 2023: Healthium Medtech launched TRUMAS, a line of sutures specifically developed to address the complexities of suturing during minimally invasive surgeries.

Surgical Sutures Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Absorbable

- Non-absorbable

By Filament Outlook (Revenue – USD Billion, 2020–2034)

- Monofilament

- Multifilament

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Ophthalmic Surgery

- Cardiac Surgery

- Orthopedic Surgery

- Neurological Surgery

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Surgical Sutures Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.89 billion |

|

Market Size in 2025 |

USD 5.14 billion |

|

Revenue Forecast by 2034 |

USD 8.32 billion |

|

CAGR |

5.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.89 billion in 2024 and is projected to grow to USD 8.32 billion by 2034.

The global market is projected to register a CAGR of 5.5% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include Ethicon (a Johnson & Johnson company), Medtronic PLC, B. Braun SE, Advanced Medical Solutions Group PLC, Teleflex Incorporated, Peters Surgical, Corza Medical, DemeTECH Corporation, Smith & Nephew PLC, CONMED Corporation, Dolphin Sutures, and Lotus Surgicals.

The absorbable segment accounted for a larger share of the market in 2024.

The monofilament segment is expected to witness a faster growth during the forecast period.