Tankless Water Heater Market Share, Size, Trends, Industry Analysis Report

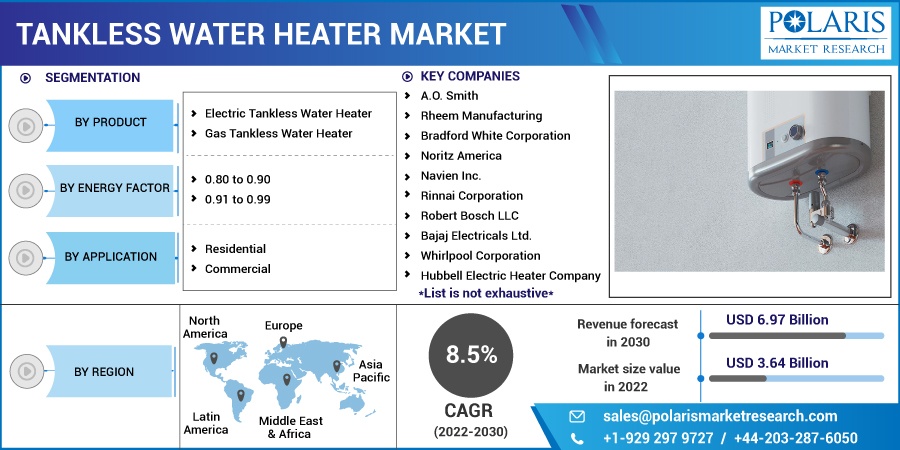

By Product (Electric Tankless Water Heater and Gas Tankless Water Heater); By Energy Factor; By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Dec-2022

- Pages: 118

- Format: PDF

- Report ID: PM2928

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

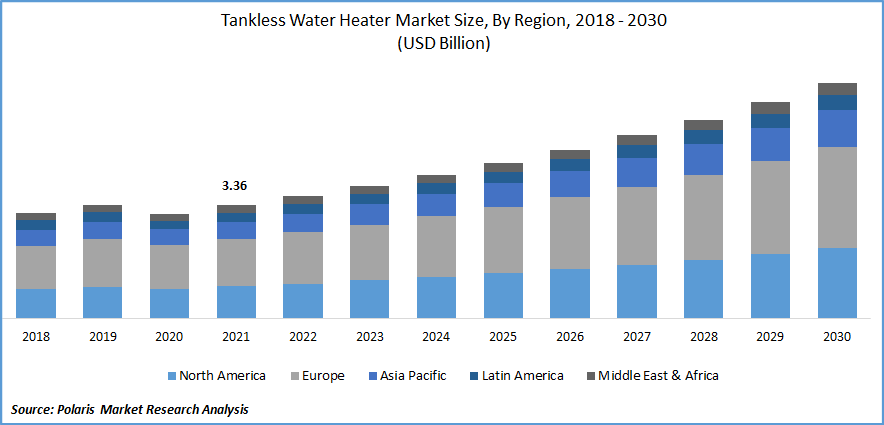

The global tankless water heater market was valued at USD 3.36 billion in 2021 and is expected to grow at a CAGR of 8.5% during the forecast period.

The rapid growth in the adoption of tankless water heater among both residential and commercial sectors because of its ability to save space and energy as well coupled with the increasing consumer concerns over the substantial use of the energy are major factors driving the growth and demand for these heaters across the globe. Moreover, introduction to tankless water heaters equipped with Wi-Fi connectivity for the remote monitoring of water temperature and flow and rising prevalence across schools, restaurants, and hotels are further expected to boost the growth.

Know more about this report: Request for sample pages

For instance, in August 2022, Rinnai Corporation, a global manufacturer of tankless water heaters announced the launch of its new RE Series Tankless Water Heaters integrated with Smart-Circ Intelligent Recirculation. The newly developed RE series is compatible with Wi-Fi module controller for on-demand operations and achieve better scheduled recirculation.

In the recent years, the demand for electric tankless water heaters across the globe have seen a rapid upsurge as it need very less maintenance procedures and are easy and simple to install. In addition, electric heaters have a longer lifespan and low replacement and other types of expenses as compared to others available in the market along with its cutting-edge design, which makes possible to put these heaters in confined spaces and eliminates the need for ventilation also, which is likely to contribute significantly to the tankless water heater market growth in the next coming years.

The outbreak of the COVID-19 pandemic has significantly impacted the growth market. Due to rapid emergence of deadly coronavirus, a high decline in sales and revenue has been observed by many large companies as a result of globally imposed lockdown and other strict regulations on various activities. This has highly impacted the need for tankless water heaters in both residential and commercial sectors. In addition, building and construction activities were also impacted and on hold during the pandemic, which has also hampered the growth of the market.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Rapid urbanization around the world and high penetration for energy-efficient tankless water heaters especially form various industrialized nations are key factors expected to drive the growth of the global market over the forecast period. For instance, the United Nations estimated that by the year 2050, nearly 68% of the world’s total population would reside in the urban regions, with a significant rise of 55% in 2018.

Furthermore, continuing development of advanced and modern technology and growing adoption of tankless water heaters in the business areas including hotels and restaurants are another key factor projected to duel the market growth in the coming years. Increasing focus by key market manufacturers on creating innovative product and effective ways for promoting their products all over the world are propelling the adoption of these types of heaters.

Report Segmentation

The market is primarily segmented based on product, energy factor, application, and region.

|

By Product |

By Energy Factor |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Electric tankless water heaters segment accounted for the largest market share

Electric tankless water heaters segment accounted for the highest global market share and is projected to maintain its position throughout the forecast period owing less maintenance cost required and easy to set up and install. In addition, the highly innovative designs and competitively longer lifespan of these heaters makes them highly feasible to get installed in small places and does not need any ventilation, is driving the growth of the segment market around the world.

For instance, in May 2021, Laars Heating Systems, introduced new commercial electric tank-less water heaters. This new product comes with the PID modulating control which can hold the temperature as per demand charges & include a Incoloy 800 low-watt density element that helps to enhance durability, resistance to scaling, low activation of water flow, and easy heat transfer.

Furthermore, the gas tankless heaters segment anticipated to witness considerable growth during the forecast period. The growth of the segment market is mainly driven by its ability to tend higher flow rates than electric heaters and do not require the upgrades. And, consumer access to heats the water tank according to their need and demand, so that the energy isn’t wasted. Thus, the adoption of these types of heaters are likely to grow at a steady rate in the next coming years.

Residential segment held the significant revenue share in 2021

The residential segment held the significant percentage of global revenue share in 2021 due to the rising adoption of energy-efficient and eco-friendly water heaters. Moreover, the continuously growing number of residential units as a result of surge in middle-class population mainly in developing nations such as China, India, and Indonesia are likely to boost the sales of tankless water heaters over the projected period. Increasing consumer awareness towards the health issues associated with gas and other types of heaters and standardized consumer living are expected to fuel the expansion of the segment market at a high growth rate.

Furthermore, the commercial segment is anticipated to register fastest growth during the projected period. The growth of the market can be attributed to increasing visibility of various innovative products and increasing popularity about the remote monitoring of 24 hours a day, seven days a week with the help of various serviceable components. Additionally, growing government efforts on promoting environmentally friendly water heaters among several government hospitals and buildings are augmenting the demand for segment market.

The demand in North America is expected to witness significant growth

North America is anticipated to expand at fastest growth rate during the forecast period on account of rising consumer awareness towards the ecological products and high growth in product visibility coupled with the higher consumer spending power in the region. Moreover, continuous development of modern technology and rising penetration of tankless water heaters in various industrial applications along with the presence of wide range of prominent market companies in the North America are likely to create lucrative growth opportunities over the coming years.

Furthermore, Europe accounted for the largest market share in 2021 with a significant growth rate and is expected to maintain its dominance over the anticipated period. The growth of the regional market is being driven by high product innovation and increasing investment on the development of economical and energy-efficient products. Additionally, increasing adoption of these type of heaters in various developed economies such as Switzerland, Germany, France, and United Kingdom coupled with a surge in demand from commercial sector are further expected to propel the market demand and growth.

Competitive Insight

Key players include A.O. Smith, Rheem Manufacturing, Bradford White Corporation, Noritz America, Navien Inc., Rinnai Corporation, Robert Bosch, Bajaj Electricals, Whirlpool Corporation, Hubbell Electric Heater, Stiebel Eltron, EcoSmart Green Energy Products, Ariston Thermo, Haier Smart Home, and Lennox International.

Recent Developments

In January 2022, Bradford White Corporation, launched Kwick Shot, a totally dependable and easy-to-install tankless electric water heater. The product is available in both thermostatic and non-thermostatic models to cater the rising need of variety of everyday applications of wide range of water temperature.

In December 2021, A. O. Smith, world’s largest manufacturer of water heater, launched Zip Digital Tankless Water Heater in Mumbai, India. The product has mainly designed to enhance the bathing experience through continuous and instant hot water with a chamber of 5500 watt. With its superior and improved safety features and feather touch display panel, it offers a positive user experience.

Tankless Water Heater Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 3.64 billion |

|

Revenue forecast in 2030 |

USD 6.97 billion |

|

CAGR |

8.5% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Energy Factor, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

A.O. Smith, Rheem Manufacturing, Bradford White Corporation, Noritz America, Navien Inc., Rinnai Corporation, Robert Bosch LLC, Bajaj Electricals Ltd., Whirlpool Corporation, Hubbell Electric Heater Company, Stiebel Eltron Inc., EcoSmart Green Energy Products, Ariston Thermo Spa, Haier Smart Home Co. Ltd., and Lennox International Inc. |