Targeting Pods Market Size, Share, Trends, Industry Analysis Report

: By Type, Component, Fit, Platform (Combat Aircraft, Unmanned Aerial Vehicle, Attack Helicopters, and Bombers), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM5602

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

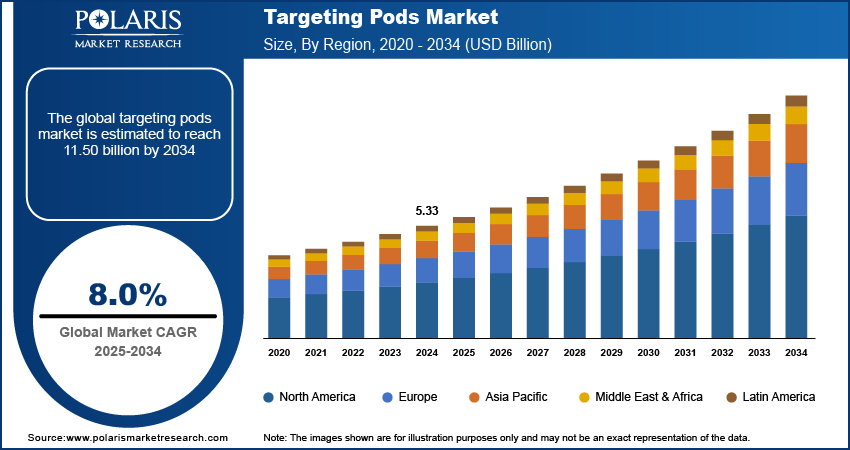

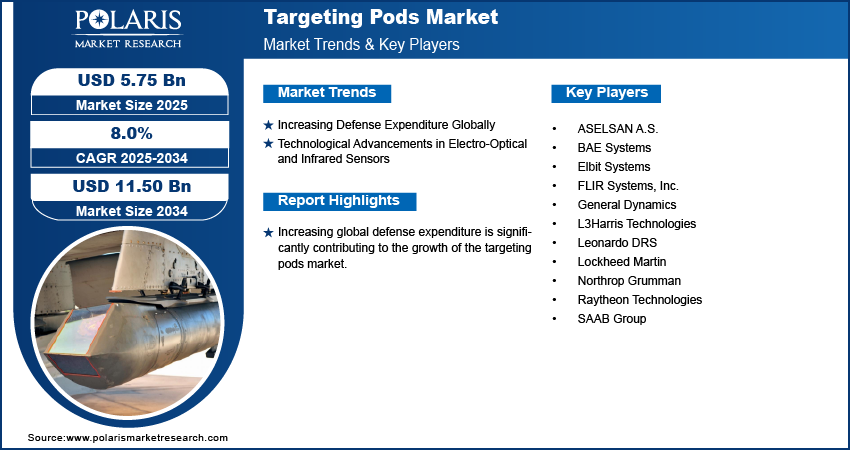

The global targeting pods market size was valued at USD 5.33 billion in 2024, exhibiting a CAGR of 8.0% during 2025–2034. Rising global defense expenditures and increasing conflicts drive demand for advanced targeting pods. At the same time, technological advancements in electro-optical, infrared, and AI-powered sensors enhance precision, autonomous target recognition, and operational capabilities across military platforms.

Key Insights

- FLIR & laser designator pods led the market due to their combined thermal imaging and laser targeting precision, ideal for multi-environment missions.

- Combat aircraft dominated the share in 2024 as air superiority missions increasingly rely on advanced targeting for real-time strike efficiency.

- North America led due to high defense spending, strong R&D, and robust collaborations between government and private sector for targeting innovation.

- Asia Pacific is projected to grow the highest owing to regional tensions, indigenous military modernization, and increasing adoption of EO/IR technologies.

Industry Dynamics

- Rising global defense spending is boosting demand for advanced surveillance and targeting pods to enhance mission success and reduce collateral damage.

- Increasing cross-border tensions and military modernization are driving the adoption of precision-targeting systems integrated with combat and reconnaissance aircraft.

- Integration of targeting pods with unmanned aerial vehicles is expanding their role in remote, low-risk surveillance and precision strike operations.

- High development and integration costs of advanced targeting pods limit adoption among smaller defense budgets and resource-constrained military forces.

Market Statistics

2024 Market Size: USD 5.33 billion

2034 Projected Market Size: USD 11.50 billion

CAGR (2025–2034): 8.0%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Targeting pods are advanced targeting systems used primarily in defense and military applications. These pods are electro-optical or infrared devices mounted on aircraft to enhance precision targeting, surveillance, and reconnaissance capabilities. They enable accurate identification and engagement of targets, especially in low-visibility conditions, making them critical for modern warfare and defense operations. The need for accuracy in military operations is driving the adoption of targeting pods as they integrate seamlessly with precision-guided weapons.

Rising conflicts and cross-border security challenges are increasing the demand for advanced targeting systems, ensuring dominance in aerial combat and reconnaissance missions. Additionally, the integration of targeting pods with UAVs for surveillance and combat roles is expected to create new targeting pods market opportunities during the forecast period.

Market Dynamics

Increasing Defense Expenditure Globally

Increasing global defense expenditure is significantly contributing to the growth of targeting pods market. According to USA Facts, in 2023, the US military expenditures were reported to be approximately USD 820.3 billion, representing around 13.3% of the total federal budget for that fiscal year. In March 2023, the Department of Defense (DoD) submitted a budget request of USD 842.0 billion for fiscal year 2024, indicating a proposed increase of 2.6%. This highlights the growing emphasis on enhancing precision strike capabilities and surveillance technologies as part of broader military modernization efforts. Governments across developed and developing nations are channeling substantial resources into modernizing their armed forces, prioritizing investments in next-generation surveillance and targeting systems. The emphasis on enhancing precision strike capabilities and expanding airborne reconnaissance operations is driving the adoption of EO/IR technologies across land, air, and naval platforms. These strategic allocations are boosting procurement activities and are also stimulating R&D in advanced sensor integration. EO/IR system manufacturers are responding to evolving military needs through performance optimization and multi-spectral capabilities, leading to increased deployment across mission-critical scenarios. This defense-driven demand trajectory is expected to strengthen targeting pods market expansion over the forecast period.

Technological Advancements in Electro-Optical and Infrared Sensors

Technological advancements in electro-optical and infrared sensors are reshaping operational capabilities and reinforcing smart warfare infrastructure. For instance, Lockheed Martin announced the successful integration of AI-driven target recognition into its latest sniper advanced targeting pod (ATP). This innovation enables autonomous detection and tracking of targets with enhanced accuracy, even in challenging environments such as dense fog or nighttime operations. Breakthroughs in high-resolution imaging, real-time data processing, and AI-based target recognition are elevating situational awareness, decision-making accuracy, and threat response speed. The integration of machine learning algorithms with EO/IR platforms is enabling autonomous detection, tracking, and classification of targets in complex environments. These innovations are contributing to the targeting pods market growth by enabling seamless performance in low-light or obscured visibility conditions.

Segment Insights

Market Assessment by Type Outlook

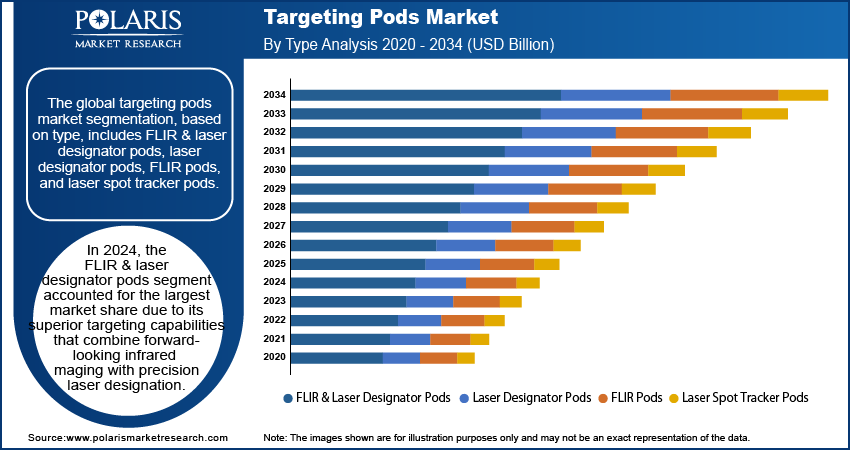

The global targeting pods market segmentation, based on type, includes FLIR & laser designator pods, laser designator pods, FLIR pods, and laser spot tracker pods. In 2024, the FLIR & laser designator pods segment dominated the targeting pods market share due to its superior targeting capabilities that combine forward-looking infrared imaging with precision laser designation. This dual functionality enables enhanced accuracy in identifying, tracking, and engaging targets under various operational scenarios, including low-visibility and night-time conditions. Military forces prioritize these pods for their adaptability in dynamic combat environments, making them integral to modern air-to-ground missions. The growing preference for multifunctional and interoperable targeting systems across multiple platform types is accelerating procurement efforts, strengthening the FLIR & laser designator pods segment’s influence on market dynamics and market expansion trajectories.

The laser designator pods segment is projected to witness the highest CAGR over the forecast period due to increasing emphasis on precision-guided munitions and minimizing collateral damage in conflict zones. These pods provide real-time target illumination for laser-guided weapons, enabling pinpoint accuracy in high-threat or urban warfare environments. Advancements in miniaturization and modularity are further supporting their integration into a broader range of aerial platforms, including UAVs and next-gen fighter jets. Rising global investments in advanced combat technologies and modernization programs are reinforcing procurement trends, fueling the laser designator pods segment’s contribution to market development.

Market Evaluation by Platform Outlook

The global targeting pods market segmentation, based on platform, includes combat aircraft, unmanned aerial vehicle, attack helicopters, and bombers. In 2024, the combat aircraft segment accounted for the largest share of the market due to the platform’s central role in delivering air superiority and precision strike capabilities. Combat aircraft routinely engage in high-stakes missions requiring advanced targeting, reconnaissance, and surveillance systems. The integration of targeting pods into fighter jets enhances situational awareness, supports real-time data sharing, and enables coordinated multi-domain operations. The growing deployment of multi-role aircraft across military forces globally is contributing to the demand for targeting pods. Strategic defense initiatives focused on force modernization and airpower optimization continue to position combat aircraft as the dominant platform segment, driving market expansion.

The unmanned aerial vehicle (UAV) segment is expected to register the highest CAGR during the forecast period, driven by the increasing reliance on unmanned platforms for ISR (intelligence, surveillance, and reconnaissance) and precision strike missions. Targeting pod integration into UAVs significantly enhances remote engagement capabilities while reducing risks to human pilots. Emerging technologies in lightweight, high-resolution military sensors and AI-based object recognition are enabling improved performance and mission flexibility for UAVs. Military policies are evolving to prioritize unmanned capabilities in contested environments, further boosting investment and development efforts. These factors are accelerating commercial UAV adoption in defense strategies, fueling the market growth for this platform segment.

Regional Analysis

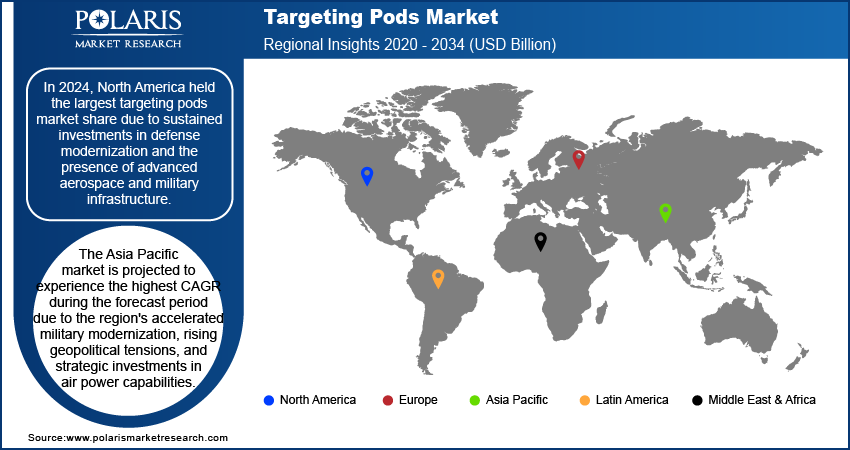

By region, the study provides targeting pods market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest share of the market revenue due to sustained investments in defense modernization and the presence of advanced aerospace and military infrastructure. High procurement volumes of next-generation combat aircraft and unmanned aerial vehicles across the US and Canada have significantly driven the integration of precision targeting systems. The regional focus on interoperability across NATO-aligned forces has accelerated the development and deployment of multi-mission pods capable of high-resolution imaging, laser designation, and AI-enabled target tracking. Major defense programs highlight enhanced strike precision and reduced collateral damage, supporting widespread targeting pod adoption. Additionally, strong collaboration between defense agencies and private defense contractors is facilitating rapid innovation and commercialization of advance technologies. For instance, the US Army collaborated with Northrop Grumman to enhance the combat-proven Forward Area Air Defense (FAAD) system, keeping it at the forefront of counter-unmanned aerial systems (C-UAS) technology. The new AI feature allows warfighters to make real-time, informed decisions while addressing the complexities of C-UAS threats through the FAAD Advanced Battle Manager (ABM) system. The regional market dynamics are further strengthened by consistent funding allocations, a high frequency of joint military exercises, and evolving battlefield requirements that demand superior sensor fusion and real-time target engagement capabilities.

The Asia Pacific targeting pods market is projected to register the highest CAGR during the forecast period due to the region's accelerated military modernization, rising geopolitical tensions, and strategic investments in air power capabilities. Nations such as China, India, South Korea, and Japan are heavily investing in upgrading their air forces through the acquisition of advanced combat platforms equipped with advance targeting solutions. Indigenous defense production initiatives and offset agreements are boosting the local integration of electro-optical and infrared sensor technologies, facilitating cost-effective targeting pod deployment. Rapid technological adoption, coupled with a surge in domestic defense manufacturing capabilities, is fostering a competitive environment for targeting pod manufacturers. Government-backed research and development efforts, combined with collaborations between public and private sectors, are catalyzing innovation and driving robust market growth across Asia Pacific.

Key Players & Competitive Analysis Report

The competitive landscape of the targeting pods market is shaped by a dynamic interplay of strategic alliances, joint ventures, and continuous technology advancements aimed at addressing evolving defense needs. Industry analysis reveals an intensifying focus on developing multi-functional, AI-integrated targeting systems with enhanced imaging resolution, sensor fusion capabilities, and cross-platform compatibility. Companies are actively pursuing market expansion strategies, including cross-border partnerships and localized production facilities, to secure contracts with emerging defense economies and meet offset obligations. Mergers and acquisitions are driving consolidation, enabling firms to streamline R&D, achieve economies of scale, and expand their technological portfolios. Post-merger integration efforts are centered on combining legacy capabilities with next-generation sensor and processing technologies, accelerating product development cycles. Strategic alliances between defense contractors and national militaries are fostering long-term development programs that align with military modernization agendas. The increasing emphasis on modular design and interoperability across various aerial platforms reflects the market’s shift toward future-ready systems. Continuous innovation in infrared and laser-based tracking, AI-powered target recognition, and real-time data sharing is setting new performance benchmarks. These competitive dynamics underscore a market characterized by aggressive innovation, diversified product pipelines, and a sustained push to meet the demand for precision, survivability, and situational awareness in modern aerial combat scenarios.

Lockheed Martin Corporation is a security and aerospace company formed by combining the businesses of Martin Marietta Corporation and Lockheed Corporation. The company engaged in diverse industry sectors, including research, development, design, integration, and manufacture of advanced technology products, systems, and services. It provides a wide range of technical, scientific, engineering, management, information, and logistics services. Lockheed Martin serves the US and international markets with applications in civil, defense, and commercial industries. The multinational company has a strong presence across North America, Asia, Europe, and Australia. The company offers counter-drone solutions such as counter-drone swarms, Area Defense Anti-Munitions (ADAM) systems, and Lcarus. Lockheed Martin Corporation is engaged in the development and production of advanced targeting systems, including the Sniper Advanced Targeting Pod (ATP).

Northrop Grumman offers products to various industries, including aerospace and defense. The company is known for its innovative technologies and products that are designed to meet the needs of customers in the defense, intelligence, and space industries. One of the key areas of focus for Northrop Grumman is unmanned systems, including drones and autonomous vehicles. The company has played a key role in NASA's space exploration programs, including the development of the James Webb Space Telescope. It has also developed satellites and other space systems for a variety of customers, including the US military and commercial companies. Northrop Grumman Corporation is engaged in producing targeting pods such as the LITENING Large Aperture (LA) pod. The LITENING LA pod incorporates high-definition daylight and infrared sensors, multi-wavelength imaging capabilities, and advanced video processing for enhanced resolution and range. Designed for seamless integration with existing aircraft inventory, it supports platforms such as F-16 Fighting Falcons and F/A-18 Super Hornets.

List of Key Companies

- ASELSAN A.S.

- BAE Systems

- Elbit Systems

- FLIR Systems, Inc.

- General Dynamics

- L3Harris Technologies

- Leonardo DRS

- Lockheed Martin

- Northrop Grumman

- Raytheon Technologies

- SAAB Group

Targeting Pods Industry Development

In July 2024, Lockheed Martin launched an upgraded Sniper targeting pod with advanced networking capabilities. This upgrade is designed to create a secure communication link between non-stealthy fourth-generation aircraft, such as the F-16 Viper, and stealth aircraft, such as the F-35 Joint Strike Fighter, enhancing situational awareness and target engagement across platforms.

Targeting Pods Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- FLIR & Laser Designator Pods

- Laser Designator Pods

- FLIR Pods

- Laser Spot Tracker Pods

By Component Outlook (Revenue – USD Billion, 2020–2034)

- OEM Fit

- Upgrades

By Fit Outlook (Revenue – USD Billion, 2020–2034)

- FLIR Sensor

- Charge Coupled Device (CCD) Camera

- Environmental Control Unit (ECU)

- Moving Map System (MMS)

- Video Datalink

- Digital Data Recorder

- Processor

- High Definition (HD) TV

- Others

By Platform Outlook (Revenue – USD Billion, 2020–2034)

- Combat Aircraft

- Unmanned Aerial Vehicle (UAV)

- Attack Helicopters

- Bombers

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.33 billion |

|

Market Size Value in 2025 |

USD 5.75 billion |

|

Revenue Forecast in 2034 |

USD 11.50 billion |

|

CAGR |

8.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.33 billion in 2024 and is projected to grow to USD 11.50 billion by 2034.

The global market is projected to register a CAGR of 8.0% during the forecast period.

In 2024, North America held the largest share due to sustained investments in defense modernization and the presence of advanced aerospace and military infrastructure.

A few of the key players in the market are ASELSAN A.S.; BAE Systems; Elbit Systems; FLIR Systems, Inc.; General Dynamics; L3Harris Technologies; Leonardo DRS; Lockheed Martin; Northrop Grumman; Raytheon Technologies; and SAAB Group.

In 2024, the FLIR & laser designator pods segment accounted for the largest market share due to its superior targeting capabilities that combine forward-looking infrared imaging with precision laser designation.

In 2024, the combat aircraft segment accounted for the largest share of the market due to the platform’s central role in delivering air superiority and precision strike capabilities.