Teleneurology Market Size, Share, Trends, & Industry Analysis Report

By Service (Tele-Consulting, Tele-Monitoring, Tele-Education), By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6032

- Base Year: 2024

- Historical Data: 2020-2023

Overview

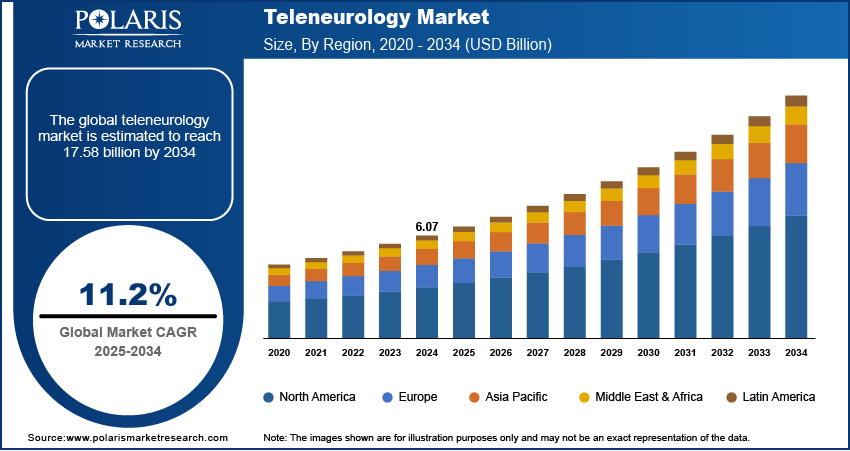

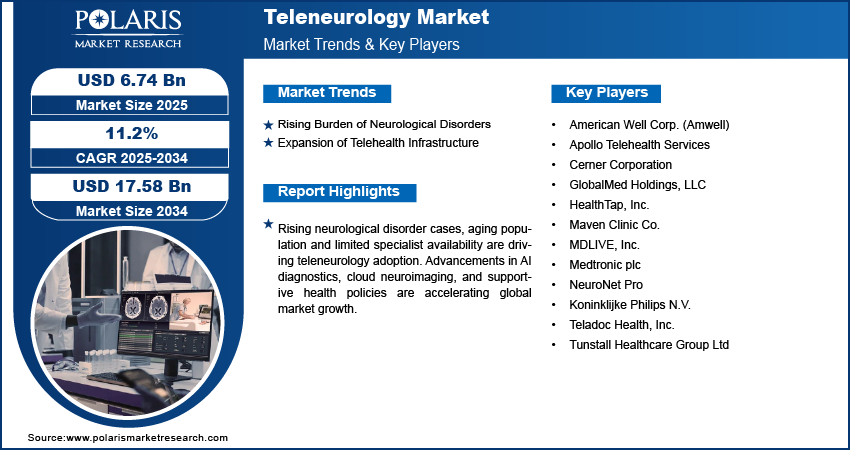

The global teleneurology market size was valued at USD 6.07 billion in 2024, growing at a CAGR of 11.2% from 2025–2034. The rising burden of neurological conditions and limited specialist availability are driving the adoption of remote neurology services globally.

Key Insights

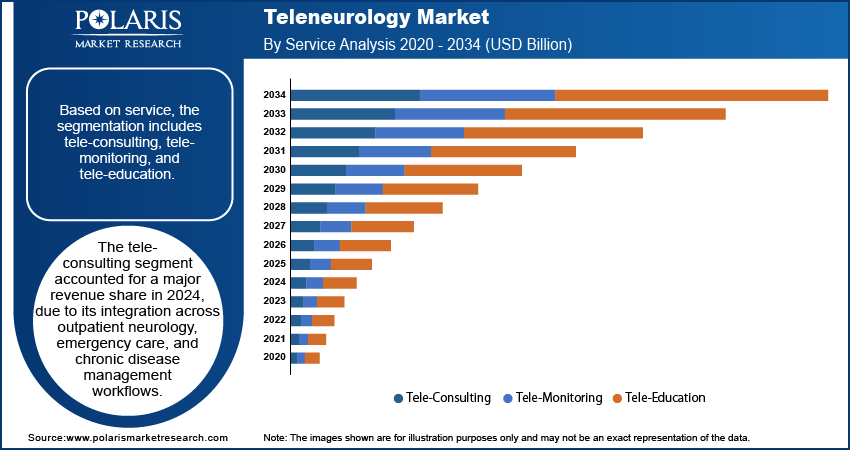

- The tele-consulting segment accounted for 45.65% market share in 2024.

- The homecare settings segment is projected to grow at the fastest rate over the forecast period, driven by rising demand for decentralized care, chronic condition management, and post-discharge neurological monitoring.

- The North America teleneurology market accounted for 33.20% of the global market share in 2024.

- The US teleneurology market held largest sgare of the North America landscape in 2024, with high deployment of telestroke programs, AI-enabled neurodiagnostics, and cloud-based neurology platforms integrated within multispecialty hospital systems.

- The market in Asia Pacific is projected to grow at a significant CAGR from 2025-2034, driven by expanding digital health programs, increasing neurological disorder prevalence, and growing adoption of mobile health platforms.

- The China market is expanding steadily, fueled by rapid telehealth infrastructure expansion, a high elderly population and national initiatives that fuel AI-based remote neurology tools.

Industry Dynamics

- The increasing incidence of stroke, epilepsy, Parkinson’s disease, and multiple sclerosis is driving demand for remote neurology consultations.

- Rising adoption of digital health platforms and AI-enabled neurodiagnostic tools is enhancing the scalability and efficiency of teleneurology programs.

- The adoption of real-time monitoring, cloud-based imaging and interoperable teleconsultation systems creates opportunity for teleneurology in care delivery and long-term patient management.

- Limited digital infrastructure and a shortage of trained neurology professionals for remote delivery are hindering teleneurology services.

Market Statistics

- 2024 Market Size: USD 6.07 billion

- 2034 Projected Market Size: USD 6.74 billion

- CAGR (2025-2034): 11.2%

- North America: Largest market in 2024

Teleneurology enables remote diagnosis and treatment of neurological conditions using telemedicine platforms. It supports stroke care, epilepsy management, Parkinson’s monitoring, and follow-up consultations for multiple sclerosis. Teleneurology expands access to neurological specialists in remote areas, helping reduce delays in diagnosis and treatment. Its integration with hospitals and primary care systems enables real-time neurological assessments and supports continuity of care. The model also minimizes the need for patient travel, helps reduce hospital readmission rates, and enhances emergency triage through secure video consultations, cloud-based neuroimaging, and remote EEG interpretation.

The teleneurology market is expanding due to rising neurological disorder prevalence and limited specialist availability. Government-backed digital health initiatives, improved telehealth reimbursements and AI-based in diagnostic are boosting telehealth services adoption. Hospitals are actively investing in remote patient monitoring systems, cloud-integrated neurology platforms and interoperable teleconsultation technologies to strengthen digital care delivery. Regulatory frameworks in countries such as the US, Germany, and India are further boosting the long-term integration of teleneurology into national healthcare systems. The growing need for decentralized neurology services, post-stroke rehabilitation and neurocritical care is expected to drive consistent market expansion across developed and emerging regions.

Rising demand for time-sensitive neurological care in acute and emergency settings is accelerating the deployment of teleneurology services within trauma centers and intensive care units. Health providers are adopting scalable tele-neurocritical care models to address staffing shortages during off-hours and high-demand periods. Advancements in real-time data sharing, neuromonitoring integration, and cloud-based decision support tools are improving diagnostic accuracy in complex neurological cases. For instance, in November 2023, National Park Medical Center introduced a teleneurology service to improve access to specialized neurological care in the local community. This service supports remote consultations between patients and neurologists, reducing the need for in-person visits. Additionally, collaborations between institutions and virtual neurology platforms are increasing access to care in both underserved regions and academic hospitals.

Drivers & Opportunities/Trends

Rising Burden of Neurological Disorders: The global increase in stroke cases, epilepsy, Alzheimer’s and Parkinson’s disease is creating demand for timely neurological interventions. According to the World Health Organization (WHO), approximately 15 million people worldwide experience a stroke each year, resulting in 5 million deaths and 5 million cases of permanent disability. Additionally, stroke affects nearly 8% of children diagnosed with sickle cell disease. Rising incidence of neurological disorders is driving demand for rapid specialist intervention, with teleneurology enabling timely access during acute episodes and reducing treatment delays. Increasing life expectancy and aging populations across developed and emerging countries are expanding the patient base needing long-term neurological monitoring. Remote consultation models are helping bridge capacity gaps in outpatient and emergency settings, ensuring early diagnosis and care delivery.

Expansion of Telehealth Infrastructure: The rapid development of telehealth ecosystems, including high-speed networks, cloud-based platforms and secure communication protocols is pushing the deployment of teleneurology services. Growing focus on digital connectivity across urban and semi-urban areas is enabling health systems to expand virtual neurology consultations beyond tertiary care centers. The integration of teleneurology tools with electronic health records and diagnostic imaging systems is improving care coordination and clinical decision-making. Additionally, the expanding telehealth infrastructure is fueling remote training, second-opinion services and collaborative neurological assessments across multi-site healthcare networks.

Segmental Insights

Service Analysis

Based on service, the segmentation includes tele-consulting, tele-monitoring, and tele-education. The tele-consulting segment accounted for 45.65% revenue share in 2024, due to rising demand for remote neurological assessments, second opinions and follow-up consultations. Integration of virtual consultation tools within hospital systems is enabling real-time interaction between neurologists and patients across urban and semi-urban areas. The rising burden of chronic neurological disorders combined with specialist shortages is driving the adoption of tele-consulting services. Additionally, growing focus on patient compliance, convenience and expansion of reimbursement models are contributing to segment dominance across public and private healthcare networks.

The tele-monitoring segment is projected to grow at the fastest pace during the forecast period, due to its increasing use in managing chronic neurological conditions such as epilepsy, Parkinson’s disease and Alzheimer’s. Advancements in wearable EEG devices, remote vital tracking systems, and integrated neuromonitoring platforms are enabling real-time patient surveillance. Health systems are adopting tele-monitoring to reduce hospital readmissions and ensure continuity of care in home and community settings. Rising investments in AI-based early warning systems and home-based neuro-monitoring tools are expected to further accelerate segment growth.

Application Analysis

Based on application, the segmentation includes stroke, epilepsy, multiple sclerosis, Parkinson’s disease, migraine, Alzheimer’s disease & dementia, and others. The stroke segment accounted for 29.00% revenue share in 2024, due to its critical need for rapid specialist evaluation and intervention during acute stroke episodes. Teleneurology enables time-sensitive diagnosis and remote administration of thrombolytic therapy through virtual stroke networks. Integration of telestroke programs in emergency departments and regional trauma centers is enhancing patient outcomes and reducing mortality. Growing awareness of stroke management protocols and increasing deployment of mobile stroke units with telehealth capabilities are contributing to drive segment dominance across high- and middle-income regions.

The Alzheimer’s disease and dementia segment is projected to grow at the fastest pace during the forecast period, driven by the rising global aging population and increasing focus on long-term cognitive care. According to the Alzheimer's Association, over 7 million people in the US currently live with Alzheimer’s and this figure is expected to reach nearly 13 million by 2050. Around 1 in 9 individuals aged 65 and above is affected by the condition. Teleneurology platforms support remote memory assessments, caregiver training and periodic monitoring of cognitive decline. Growing demand for home-based neurological care coupled with rising public awareness and early screening programs is enhancing segment expansion. Integration of virtual neurocognitive evaluations with behavioral tracking tools is further driving early intervention and disease progression management in this segment.

End User Analysis

By end user, the market includes hospitals & clinics, ambulatory surgical centers, homecare settings, and other end users. The hospitals & clinics segment held the largest revenue share in 2024, due to its infrastructure readiness, availability of neurology departments, and integration of telehealth into routine patient workflows. Growing institutional partnerships and centralized data systems are enabling seamless tele-consultation, imaging review and remote diagnostics. Rising adoption of teleneurology by hospitals to manage patient volumes, streamline triage and reduce neurologist travel along with reimbursement support and digital transformation.

The homecare settings segment is anticipated to grow at the fastest rate, due to rising demand for decentralized neurological care and post-discharge monitoring. Tele-neurological services support at-home management of chronic conditions, enabling remote therapy adjustments and ongoing assessments. Increasing availability of consumer-grade EEG devices, mobile apps, and video consultation platforms is making home-based neurology care more accessible. Additionally, the shift toward value-based care coupled with the growing need for elderly patient support is pushing health systems to expand services into home environments.

Regional Analysis

North America teleneurology market accounted for 33.20% of the global market share in 2024. This dominance is attributed to widespread digital health adoption, strong healthcare IT infrastructure, and rising prevalence of neurological disorders such as stroke, Alzheimer’s disease, and Parkinson’s disease. According to the US National Institutes of Health (NIH), around 795,000 stroke cases occur annually in the US, with approximately 610,000 being first-time strokes. Also, the rapidly rising funding for telehealth initiatives and the integration of remote neurology services across trauma centers and specialist clinics are boosting market growth. Moreover, established reimbursement policies and broad adoption of electronic health records are facilitating the integration of teleneurology services in this region. In addition, the presence of advanced clinical workflows, integration of AI in neuro-diagnostics and large-scale virtual neurology networks across academic medical centers continues to accelerate regional deployment of telehealth services.

The US Teleneurology Market Insight

The US held significant share in the North America teleneurology landscape in 2024, driven by a combination of federal telehealth funding, neurologist shortages in rural areas and expansion of virtual stroke networks. Moreover, the growing government initiatives such as the Telehealth Expansion Act and ongoing Centers for Medicare & Medicaid Services (CMS) reimbursement enhancements are fueling the integration of remote neurological care across public and private hospitals. In addition, the increasing use of cloud-based EEG platforms, AI-enabled diagnostic tools and mobile app-based monitoring solutions is driving teleneurology expansion in the US.

Asia Pacific Teleneurology Market Outlook

The market in Asia Pacific is projected to grow at a significant CAGR during the forecast period, driven by increasing disease burden, growing elderly population and rapid digitalization of healthcare services. Also, the rising focus on government-based health transformation programs in India, China, Japan, and South Korea is pushing virtual neurology access in semi-urban and rural areas. In addition, the growing smartphone penetration, improving broadband infrastructure and increasing deployment of tele-ICU and remote monitoring tools are boosting teleneurology integration.

China Teleneurology Market Overview

The market in China is expanding due to large-scale investments in digital healthcare infrastructure and growing neurological disorder prevalence. The country is scaling up virtual neurology services through AI-driven symptom assessment tools, hospital-linked teleconsultation platforms, and integrated diagnostic imaging systems. According to the China National Health Commission, the population aged 60 and above is expected to rise from 280 million in 2023 to 400 million by 2035. Thus, there is an increasing demand for remote neurodegenerative disorder management. Furthermore, the rising collaborations between provincial health authorities and telehealth vendors are pushing the deployment of teleneurology services across secondary and tertiary hospitals.

Europe Teleneurology Market Trend

The teleneurology landscape in Europe is projected to hold a substantial share in 2034, driven by the adoption of digital health ecosystems, regional reimbursement harmonization and pan-European research collaborations. Also, the rising adoption of teleneurology through remote stroke care and outpatient neurology integration, improving access and reducing care delays in countries such as Germany, the UK, France, and the Netherlands fuels the market. In addition, rising investments in AI-assisted cognitive assessment platforms and multilingual neurorehabilitation apps are driving the expansion of teleneurology in urban and rural areas. For example, in June 2024, CVS Group launched Vet Oracle Teleneurology services, highlighting the growing demand for remote veterinary neurology consultations. This service enables faster diagnosis and expert-led treatment planning by connecting general veterinary practices with neurology specialists.

Key Players & Competitive Analysis Report

The teleneurology market is moderately fragmented, with key players competing on diagnostic precision, platform integration, and service scalability. Leading firms are focusing on AI-enabled neuro-assessment tools and cloud-based imaging solutions to enhance care delivery. Strategic partnerships with hospitals and EEG device manufacturers are expanding clinical reach and service offerings. Companies are also investing in virtual stroke networks, remote monitoring, and tele-rehabilitation modules to strengthen their market position. Growing emphasis on multilingual access, data security, and real-time consultation capabilities is driving competitive differentiation.

Major companies operating in the teleneurology industry include Teladoc Health, Inc., American Well Corp. (Amwell), MDLIVE, Inc., NeuroNet Pro, Maven Clinic Co., Medtronic plc, Koninklijke Philips N.V., Cerner Corporation, Apollo Telehealth Services, HealthTap, Inc., Tunstall Healthcare Group Ltd, and GlobalMed Holdings, LLC.

Key Players

- American Well Corp. (Amwell)

- Apollo Telehealth Services

- Cerner Corporation

- GlobalMed Holdings, LLC

- HealthTap, Inc.

- Maven Clinic Co.

- MDLIVE, Inc.

- Medtronic plc

- NeuroNet Pro

- Koninklijke Philips N.V.

- Teladoc Health, Inc.

- Tunstall Healthcare Group Ltd

Industry Developments

- May 2025: Equum Medical acquired VeeOne Health’s clinical services portfolio to strengthen its national telehealth footprint. This acquisition significantly enhances Equum’s teleneurology capabilities, addressing the growing demand for remote neurological care across hospitals and health systems.

- March 2025: The Acute Teleneurology Service at the University of Alabama at Birmingham (UAB) announced to achieved a milestone of 10,000 telehealth consultations, underscoring its growing role in delivering remote neurological care. This service enables real-time access to specialized neurologists, improving acute care outcomes across partner hospitals.

- November 2023: National Park Medical Center launched a new teleneurology service to provide patients with remote access to specialized neurological care. This initiative enhances timely diagnosis and treatment for neurological conditions by connecting local patients with expert neurologists through virtual consultations.

Teleneurology Market Segmentation

By Service Outlook (Revenue, USD Billion, 2020–2034)

- Tele-Consulting

- Tele-Monitoring

- Tele-Education

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Stroke

- Epilepsy

- Multiple Sclerosis

- Parkinson’s Disease

- Migraine

- Alzheimer’s Disease & Dementia

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Homecare Settings

- Other End Users

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Teleneurology Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 6.07 Billion |

|

Market Size in 2025 |

USD 6.74 Billion |

|

Revenue Forecast by 2034 |

USD 17.58 Billion |

|

CAGR |

11.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 6.07 billion in 2024 and is projected to grow to USD 17.58 billion by 2034.

The global market is projected to register a CAGR of 11.2% during the forecast period.

North America dominated the market in 2024, holding 33.20% share.

A few of the key players in the market are Teladoc Health, Inc., American Well Corp. (Amwell), MDLIVE, Inc., NeuroNet Pro, Maven Clinic Co., Medtronic plc, Koninklijke Philips N.V., Cerner Corporation, Apollo Telehealth Services, HealthTap, Inc., Tunstall Healthcare Group Ltd, and GlobalMedia Group, LLC.

The tele-consulting segment dominated the market in 2024, holding 45.65% share. This dominance is attributed to its widespread use in remote assessments, follow-ups, and specialist referrals, enabling faster access to neurological care across diverse healthcare settings.

The homecare settings segment is expected to witness the fastest growth during the forecast period, owing to rising demand for decentralized neurological care, post-discharge monitoring, and remote management of chronic conditions in elderly populations.