Tile Adhesives & Stone Adhesives Market Size, Share, Trends, & Industry Analysis Report

By Chemistry (Cementitious, Epoxy), By Construction Type, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 112

- Format: PDF

- Report ID: PM2557

- Base Year: 2024

- Historical Data: 2020-2023

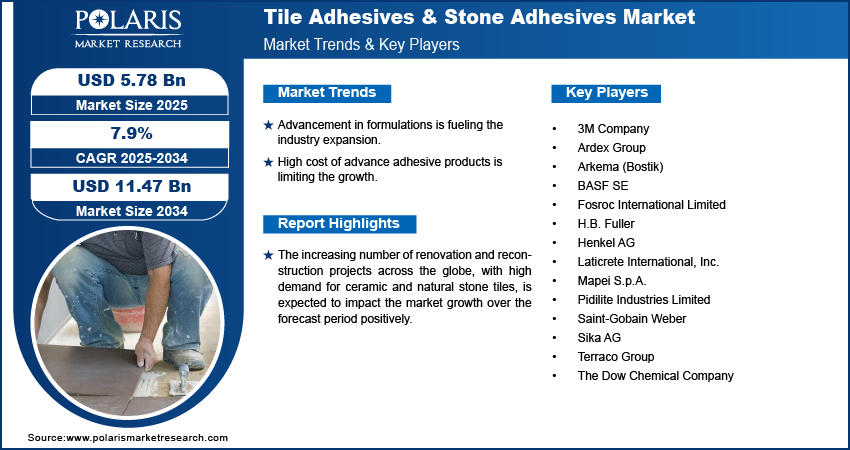

The global tile adhesives & stone adhesives market was valued at USD 5.37 billion in 2024 and is expected to grow at a CAGR of 7.9% during the forecast period. The demand for tile & stone adhesives is primarily driven by the growing residential construction projects across several developing economies in Asia Pacific, such as China and India. In addition, the high demand for tiles & stones adhesives in flooring applications in the region is expected to drive demand.

Key Insights

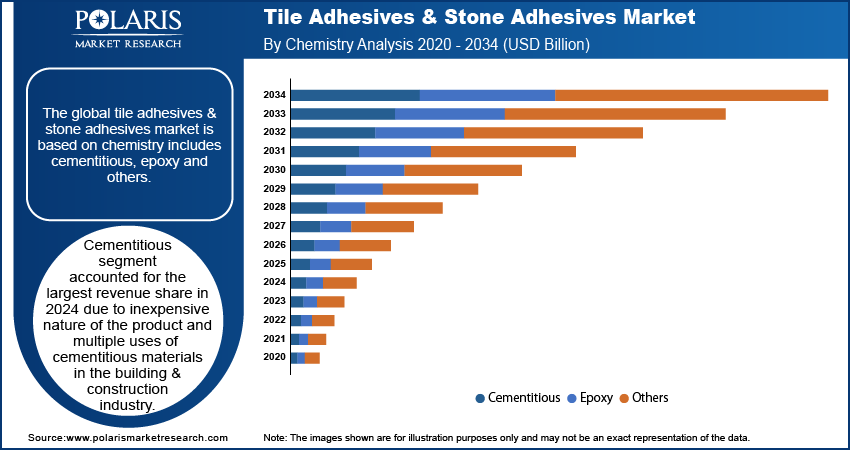

- Cementitious segment accounted for the largest revenue share in 2024 due to inexpensive nature of the product and multiple uses of cementitious materials in the building & construction industry.

- New construction segment is expected to hold the significant revenue share due to rising number of new residential, commercial, and infrastructural projects.

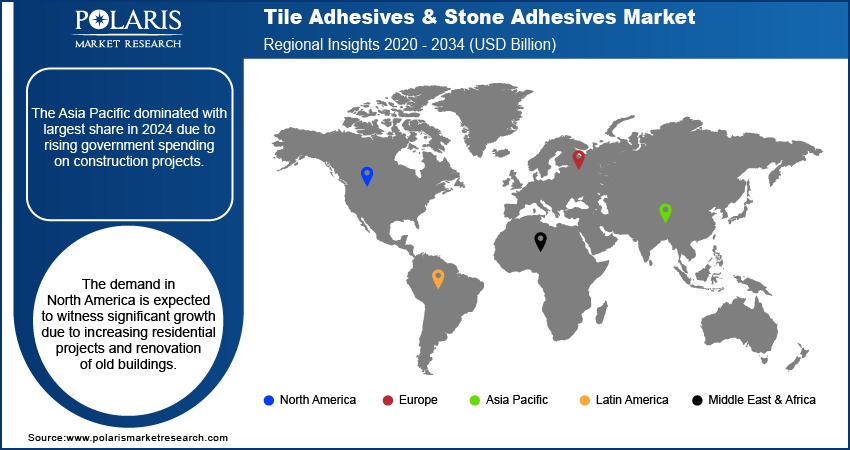

- The Asia Pacific dominated with largest share in 2024 due to rising government spending on construction projects.

- The demand in North America is expected to witness significant growth due to increasing residential projects and renovation of old buildings.

Industry Dynamics

- Increase in construction activity is fueling the demand for construction material such as tiles and stones adhesives.

- Rising renovation activity in residential, commercial and industrial sector is fueling the growth.

- Advancement in formulations is fueling the industry expansion.

- High cost of advance adhesive products is limiting the growth.

Market Statistics

- 2024 Market Size: USD 5.37 Billion

- 2034 Projected Market Size: USD 11.47 Billion

- CAGR (2025-2034): 7.9%

To Understand More About this Research: Request a Free Sample Report

The increasing number of renovation and reconstruction projects across the globe, with high demand for ceramic and natural stone tiles, is expected to impact the market growth over the forecast period positively. Furthermore, the use of tiles for decorative and design purposes is likely to complement the tile adhesives & stone adhesives market demand.

The demand for adhesives is also driven by the presence of low Volatile Organic Compounds (VOCs) and increasing penetration of thin tiles in residential and commercial applications. Furthermore, innovation in adhesive technology for improved performance is likely to drive demand.

Industry Dynamics

Growth Drivers

The post-peak pandemic period has been highly favorable for the building & construction sector as new projects which were delayed due to the lockdowns were initiated with an emphasis on completing them as soon as possible. As a result, the demand for construction products saw a sudden rise, likely to continue over the next couple of years. This led to the growth of the adhesives used for tiles and stones.

Renovation and new construction in industrial, commercial, and residential sectors of developing countries such as Brazil, Mexico, India, and China are expected to drive the demand for tile adhesives & stone adhesives in these countries. The majority of the residential or commercial flooring in the Asia Pacific countries is tiles-based and uses adhesives extensively, owing to which the demand for the product is high in the region.

Report Segmentation

The market is primarily segmented based on chemistry, construction type, end-use, and region.

|

By Chemistry |

By Construction Type |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Cementitious segment accounted for the largest revenue share in 2024

The use of cementitious materials as an adhesive for tiles and stones is highly popular across the major economies owing to the inexpensive nature of the product and multiple uses of cementitious materials in the building & construction industry. Furthermore, the growing demand for high-performance adhesives with a longer shelf life is also expected to drive the demand for cementitious materials.

The demand for epoxy adhesives is expected to witness significant growth owing to the ease of operability associated with the material. As adhesion with epoxy is fast and efficient, improved bonding strength offered by epoxy is expected to drive its demand over the next few years.

New construction segment is expected to account significant growth

The demand for tile and stone adhesives in new construction is expected to be high owing to the new residential, commercial, and infrastructural projects sanctioned in developing economies across the globe. In addition, the increasing global population is also driving the demand for new construction. However, the emergence of the COVID-19 pandemic led to the permanent shutdown of several projects, which had a negative impact on the demand for these solutions for new construction projects.

Asia Pacific dominated the market in 2024

Asia Pacific is one of the fastest developing markets across the globe. Increasing government spending on construction projects in countries such as India and China and growing foreign direct investments are expected to drive the demand in the building & construction industry. Furthermore, increasing industrial and commercial construction in the region is also expected to impact the market growth positively. Increasing consumer disposable income in developing countries such as India, with growing demand for improved residential construction and luxury homes, will likely complement market growth. Furthermore, a high preference for stone or tiles for flooring applications and floor designs is also one of the drivers positively influencing the market growth for adhesives in the country.

North America is expected to record significant growth

The North America tile adhesives & stone adhesives market is expected to record significant growth during the forecast period due to rise in spending on construction. According to the U.S. Census Bureau, in July 2025, spending on construction in U.S. was 2,140.5 billion. This large spending on construction is fueling the demand for the construction products, which thereby fuels the demand for the tiles and stones adhesives. Moreover, rising renovation activity in residential sector is further fueling the demand for the stones and tiles adhesive, thereby fueling the growth in North America region.

Competitive Insight

Some players operating in the market include 3M Company, Ardex Group, Arkema (Bostik), BASF SE, Fosroc International Limited, H.B. Fuller, Henkel AG, Laticrete International, Inc., Mapei S.P.A., Pidilite Industries Limited, Saint-Gobain Weber, Sika AG, Terraco Group, and The Dow Chemical Company.

Industry Developments

In March 2024, Pidilite inaugurated a fully automated manufacturing facility for its tile adhesive brand, Roff, in Sandila, India. The new plant aimed to enhance product availability and cater to Northern India’s specific market needs, improving delivery efficiency and customer responsiveness

Tiles Adhesive & Stone Adhesive Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5.37 billion |

| Market size value in 2025 | USD 5.78 billion |

|

Revenue forecast in 2034 |

USD 11.47 billion |

|

CAGR |

7.9% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Chemistry, By Construction Type, By End-Use, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

3M Company, Ardex Group, Arkema (Bostik), BASF SE, Fosroc International Limited, H.B. Fuller, Henkel AG, Laticrete International, Inc., Mapei S.P.A., Pidilite Industries Limited, Saint-Gobain Weber, Sika AG, Terraco Group, and The Dow Chemical Company. |

FAQ's

• The market size was valued at USD 5.37 billion in 2024 and is projected to grow to USD 11.47 billion by 2034.

• The market is projected to register a CAGR of 7.9% during the forecast period.

• A few of the key players in the market are 3M Company, Ardex Group, Arkema (Bostik), BASF SE, Fosroc International Limited, H.B. Fuller, Henkel AG, Laticrete International, Inc., Mapei S.P.A., Pidilite Industries Limited, Saint-Gobain Weber, Sika AG, Terraco Group, and The Dow Chemical Company

• The Cementitious segment dominated the market revenue share in 2024.

• The new construction segment is projected to witness the significant growth during the forecast period.