Natural Stone Market Size, Share, Trends, & Industry Analysis By Type, (Marble, Granite, Limestone, and Others), By Construction Type, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5884

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The natural stone market size was valued at USD 9.94 billion in 2024, growing at a CAGR of 5.44% from 2025–2034. Rise in urbanization in emerging economies along with government investments in infrastructure projects is accelerating the natural stone market growth.

Natural stone includes materials such as marble, granite, limestone, slate, and travertine, which are extracted from quarries and processed into tiles, slabs, blocks, or finished products. These stones are widely used in construction and decorative applications due to their durability, aesthetic appeal, and resistance to weathering. Natural stone is valued for its uniqueness, as no two pieces are identical, which contributes to its popularity in high-end architectural design. It is commonly used for flooring, cladding, countertops, monuments, and exterior paving. Unlike synthetic materials, natural stone offers a timeless appearance and long lifecycle, contributing to its growing use in sustainable construction practices.

To Understand More About this Research: Request a Free Sample Report

The market is gaining traction in residential applications, particularly in kitchen countertops, bathrooms, and outdoor landscaping. The demand for natural stone is also expanding in commercial projects such as hotels, resorts, retail complexes, and corporate spaces where aesthetic finishes and durability are prioritized. Restoration and refurbishment activities are further propelling the demand for natural stone, in regions with historical architecture. Additionally, global trends in eco-conscious architecture are fueling the use of natural stone due to its minimal environmental impact during processing and its recyclability.

The expansion of the global construction equipment sector is significantly driving the demand for natural stone products across various building applications. According to the latest report from National Action Plans on Business and Human Rights, the global construction market is projected to grow by USD 4.5 trillion, reaching USD 15.2 trillion over the next decade. China, India, the US, and Indonesia are expected to contribute 58.3% of this total growth. Large-scale residential developments, commercial real estate projects, and public infrastructure initiatives are increasingly utilizing natural stone materials such as marble, granite, limestone, and sandstone. These materials are preferred due to their durability, structural strength, and ability to withstand environmental wear over long periods. Natural stone is commonly used in flooring, cladding, staircases, and façade finishes in interior and exterior construction. As global construction spending continues to rise particularly in emerging markets across Asia Pacific, the Middle East, and Africa natural stone is gaining prominence as a core material in project specifications.

Growing emphasis on sustainable construction is boosting the adoption of natural stone in green-certified buildings, accelerating the market growth. Natural stone aligns well with environmental certification systems such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method), which prioritize materials with low embodied energy and high durability. Stone products such as granite and limestone are quarried with minimal chemical processing and are inherently recyclable, making them suitable for sustainable architectural design. Stricter environmental regulations and the push for green compliance benchmarks are pushing developers to choose natural stone more frequently for exterior and interior applications in certified sustainable buildings.

Industry Dynamics

Urbanization in Emerging Economies

Growing urbanization across the globe, particularly in rapidly developing nations such as India, China, Brazil, and Southeast Asian countries are generating substantial demand for natural stone in the construction sector. A United Nations report estimates an increase of 2.5 billion people in urban areas by 2050, driven by the continued global shift from rural to urban living. Urban expansion and the development of new townships are propelling the use of marble, granite, travertine, and limestone in residential and commercial buildings for structural integrity and decorative appeal. These materials are valued for the ability to provide a premium aesthetic while maintaining durability in high-traffic and exposed environments. Urban infrastructure projects, including shopping malls, office buildings, and luxury housing developments, are integrating natural stone for flooring, facades, and landscaping, contributing to rising consumption in the region.

The growing middle-class population and rising disposable income in these countries are further fueling demand for aesthetically appealing and high-quality construction materials. Urban dwellers in metropolitan areas are showing increased preference for stone-based finishes in kitchens, bathrooms, hallways, and outdoor patios. Moreover, architects and developers are emphasizing long-lasting materials that require minimal upkeep in dense urban environments, making natural stone a suitable option. The ability of natural stone to withstand high footfall, climate variability, and wear from environmental exposure supports its widespread application in newly urbanized areas.

Government Investments in Infrastructure Projects

Government-led infrastructure development is a major contributor to the increasing demand for natural stone across global markets. Public investments in highways, airports, metro stations, government buildings, museums, and cultural landmarks require durable and visually appealing materials for interior and exterior surfaces. For instance, in March 2025, Germany approved approximately USD 578.6 billion special infrastructure fund, unlocking new investment outside the national debt brake to modernize energy, transport, digital, and public infrastructure over 12 years. Natural stone particularly granite and sandstone are adopted extensively in these projects due to its compressive strength, resistance to weathering, and architectural versatility. Infrastructure projects across the across the globe are deploying stone in paving, staircases, pillars, and wall cladding, thereby creating a strong base of institutional and public sector demand.

Strategic initiatives and budget allocations toward national infrastructure are further boosting the use of stone in public architecture. For instance, smart city programs, tourism development schemes, and heritage restoration initiatives specify natural stone as a primary construction and finishing material. Stone’s natural resistance to fire, abrasion, and heavy load makes it suitable for airports, railway terminals, and high-capacity transit centers. Additionally, cultural projects that require design authenticity and long-term durability such as statues, memorials, and religious structures frequently source regional varieties of stone, accelerating local quarrying industries. These infrastructure investments are strengthening the role of natural stone in public construction, thus boosting the market growth.

Segmental Insights

Type Analysis

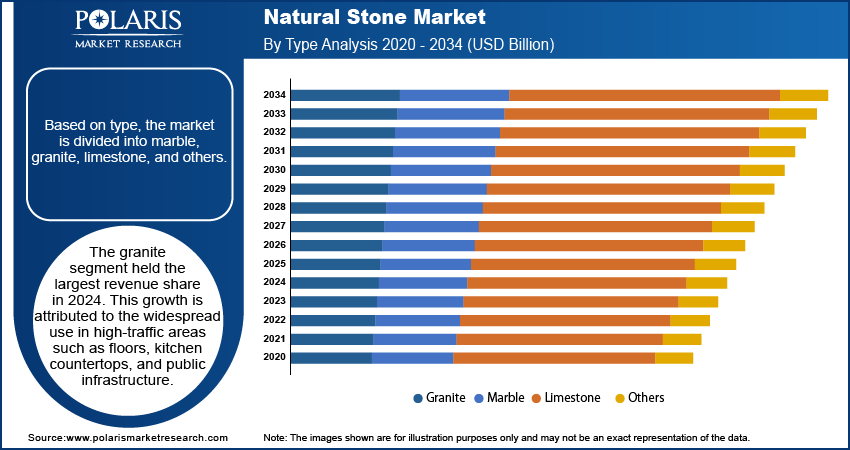

The global segmentation, based on type, includes, marble, granite, limestone, and others. The granite segment held the largest revenue share in 2024. This growth is attributed to the widespread use in high-traffic areas such as floors, kitchen countertops, and public infrastructure. Its resistance to abrasion, durability under heavy loads, and polished appearance made granite an idle material of choice in residential and commercial construction. Additionally, its availability in a variety of colors and patterns adds to its appeal in decorative applications. The rising demand in luxury real estate and institutional buildings continues to support the segment's strong market position. As per India Brand Equity Foundation report, India witnessed a significant rise in demand for luxury homes in 2024, particularly those priced at USD 0.5 million and above, with sales increasing by 53% across seven major cities. Real estate consultancy firm CBRE reported that 19,700 luxury housing units were sold over the year. Granite's thermal resistance and low maintenance needs also contribute to its broad usage across diverse climate conditions, especially in urban construction projects.

The marble segment is projected to register the fastest growth rate during the forecast period. This growth is the due to the rising consumer demand for high-end interior finishes and customized aesthetics in upscale homes, hotels, and cultural centers. The increasing number of restoration and renovation projects involving heritage buildings and public monuments is also contributing to marble's growing demand. Enhanced processing technologies and the growing availability of imported and regional marble varieties are making it more accessible to mid-tier construction markets. Marble's appeal in modern architecture, especially in flooring and facades, is expanding across regions emphasizing premium design and classical aesthetics.

Construction Type Analysis

The global segmentation, based on construction type, includes, new construction, and renovation. The new construction segment dominated the market, in 2024. This dominance is attributed to the increasing global spending on infrastructure and real estate development. Urban expansion, government-funded public works, and private investments in residential and commercial properties are supporting the use of natural stone in new construction. For instance, Blackstone, a prominent private market investor with existing investments totaling USD 50 billion in India's real estate sector, plans to inject an additional USD 22 billion into the market by 2030. Builders are specifying stone for exterior finishes, interior design, landscaping, and public facilities where long-term durability and premium appearance are required.

The renovation segment is expected to register the fastest growth through 2034. Aging building stock in North America, Europe, and parts of Asia is propelling a surge in restoration and remodeling projects that emphasize material quality and design authenticity. Natural stone is widely used in refurbishing heritage buildings, upgrading interior finishes, and restoring culturally significant monuments. The shift toward sustainable renovation practices is further contributing to stone’s adoption, as it aligns with eco-conscious design goals. Increased homeowner investment in aesthetic upgrades, coupled with a preference for long-lasting materials, is driving demand for natural stone in small- to medium-scale residential renovations.

Application Analysis

The global segmentation, based on application, includes, flooring, memorial arts, wall cladding, and others The flooring segment accounted for significant share in 2024 due to the extensive use of natural stone in residential and commercial flooring solutions. Granite, limestone, and marble are widely applied in lobbies, hallways, living spaces, and patios, driven by their durability, aesthetic variety, and long lifecycle. Builders and architects favor natural stone for flooring in high-traffic zones such as airports, hotels, and corporate offices, where performance and appearance are equally critical. Advances in surface finishing and slip-resistance treatments are also broadening its use in wet and outdoor environments. These factors continue to strengthen the position of natural stone flooring in the global construction sector.

The wall cladding segment is expected to expand at the fastest CAGR from 2025 to 2034. Rising demand for durable and visually distinct exterior and interior finishes is propelling the use of stone in wall applications. Natural stone offers superior insulation properties, weather resistance, and textural diversity, making it suitable for decorative facades and protective surfaces. Modern architectural trends emphasizing earthy textures and natural aesthetics are increasing demand for stone wall cladding in residential, commercial, and institutional projects. Additionally, innovations in lightweight stone panels and dry cladding systems are expanding the scope of use in high-rise construction and refurbishment projects.

Regional Analysis

Asia Pacific natural stone market accounted for largest revenue share in 2024, driven by rapid urbanization and infrastructure development across the region. Large-scale construction activities in countries such as China, India, Indonesia, and Vietnam are fueling the demand for natural stone in residential housing, public infrastructure, and commercial buildings. Urban planning initiatives, increasing foreign direct investments, and rising middle-class populations are propelling the growth of premium construction materials. Natural stone is extensively used in airports, railway stations, commercial complexes, and urban landscaping, where design aesthetics and durability are critical.

Also, the strong domestic mining and processing capabilities in countries such as India and China is further driving the market growth. These countries hold abundant reserves of granite, marble, sandstone, and limestone, along with a well-established network of local manufacturers and exporters. These strengths are supporting efficient supply chains and enhancing the region's position as a key exporter of natural stone to international markets.

China Natural Stone Market Insight

China natural stone market, in particular, dominated the regional share in 2024, due to its large-scale infrastructure investment programs and strong construction industry. Initiatives such as the Belt and Road Initiative and urban redevelopment programs are incorporating natural stone in transportation hubs, public squares, and high-rise commercial structures. The Green Finance & Development Center reported that in 2024, Chinese engagement in the Belt and Road Initiative reached a record high, with construction contracts totaling USD 70.7 billion and investments amounting to approximately USD 51 billion. The government's emphasis on expanding metro networks, airports, and smart cities is increasing demand for materials such as granite and limestone that combine functionality with a polished finish. Domestic quarrying activities and export capabilities are supporting the supply chain, while rising income levels and lifestyle upgrades are boosting demand for stone in high-end residential interiors.

North America Natural Stone Market

The North America natural stone market is projected to reach substantial share by 2034. The region is witnessing steady expansion in the commercial real estate sector, with rising investments in corporate buildings, luxury hotels, and mixed-use developments. Natural stone is widely preferred in these projects for its durability, texture variation, and upscale visual appeal. Architects and developers are using stone in high-traffic areas such as lobbies, entrances, and facades to enhance design value while maintaining performance under wear.

Government initiatives to preserve historic structures are further contributing to the growth of the market. For instance, in May 2025, Congress approved full funding of USD 225 million for the Historic Preservation Fund (HPF) for fiscal year 2025. The amount will support State and Tribal Historic Preservation Offices, along with key grant programs. Projects involving museums, courthouses, universities, and places of worship require authentic materials with long service life and design compatibility. This surge in investment is supporting the adoption of locally sourced and historically accurate stone materials including granite and sandstone. Additionally, homeowners across the US are incorporating natural stone in renovation projects, further boosting growth in residential and public-sector applications.

Europe In Natural Stone Market Overview

Europe natural stone market growth is driven by rising adoption of sustainable architecture and materials. Architects and developers across the region are integrating natural stone in energy-efficient buildings, attracted by its thermal mass properties, recyclability, and low lifecycle emissions. For instance, the Renovation Wave initiative, launched by the European Commission, aimed to boost the energy performance of buildings across the EU. It set a target to double the renovation rate by 2030, focusing on improving energy and resource efficiency. Under this plan, up to 35 million buildings were expected to be renovated by 2030. Natural stone are specified for façades, flooring, and cladding in projects targeting green certifications such as BREEAM and LEED. The material’s low embodied energy and minimal processing requirements to meet regional goals for reducing the carbon footprint of buildings.

In addition, the regulatory environment in Europe is increasingly fueling the use of environmentally responsible materials. Policies aimed at reducing reliance on synthetic and high-emission building products are propelling the adoption of natural alternatives. Local sourcing practices are also gaining traction as they reduce transportation-related emissions and support regional economies. Governments and municipalities across Western and Northern Europe are prioritizing public works and cultural projects that utilize indigenous materials. These regulatory and architectural trends are expected to support continued growth in the European natural stone market.

Key Players & Competitive Analysis Report

The natural stone market is highly competitive, with established companies focusing on vertical integration, quarry ownership, and global distribution networks to strengthen their market presence. Leading manufacturers are expanding their product portfolios with diversified stone types such as marble, granite, limestone, travertine, and slate to cater to varying design and structural requirements across residential, commercial, and infrastructure segments. Industry players are focusing on mergers, partnerships, and advanced cutting technologies to boost quality, streamline production, and meet regional demand. Players are also leveraging growing demand for custom-finished and eco-friendly stone products by investing in sustainable quarrying practices and waste reduction initiatives. Enhanced digital tools such as 3D imaging, CNC-based fabrication, and AI-driven design software are integrated into production workflows, helping manufacturers deliver precision and flexibility in high-volume orders.

Prominent companies operating in the natural stone market include Antolini Luigi & C. Società per Azioni, Aro Granite Industries Ltd., Cosentino Sociedad Anónima Unipersonal, CUPA Group Sociedad Anónima, Dermitzakis Bros Societé Anonyme, Dimpomar Sociedade Anónima, Dongxing Group Company Limited, Granite Canada Incorporated, Levantina y Asociados de Minerales Sociedad Anónima, MARGRAF Società per Azioni, MSI Stone Group Incorporated, Polycor Incorporated, Southland Stone USA Incorporated, Temmer Marble & Granite Trading Gesellschaft mit beschränkter Haftung, and Xishi Stone Group Company Limited.

Key Players

- Antolini Luigi & C. Società per Azioni

- Aro Granite Industries Ltd.

- Cosentino Sociedad Anónima Unipersonal

- CUPA Group Sociedad Anónima

- Dermitzakis Bros Societé Anonyme

- Dimpomar Sociedade Anónima

- Dongxing Group Company Limited

- Granite Canada Incorporated

- Levantina y Asociados de Minerales Sociedad Anónima

- MARGRAF Società per Azioni

- MSI Stone Group Incorporated

- Polycor Incorporated

- Southland Stone USA Incorporated

- Temmer Marble & Granite Trading Gesellschaft mit beschränkter Haftung

- Xishi Stone Group Company Limited

Industry Developments

May 2025: Sensa by Cosentino expanded its protected natural stone catalogue by launching six new quartzites treated with Senguard NK anti-stain technology and available in large slabs with “Mirage” glossy textures. This addition enriched the company’s natural stone offering by combining premium aesthetics with durable, low-maintenance performance, meeting growing demand for luxury, functional surfaces.

February 2025: Anatolia launched new natural stone collections featuring premium curated lines in materials such as dolomite, marble, travertine, limestone, pebble mosaics, and sculptural 3D-format stones designed for classic and contemporary aesthetics. These collections were crafted to reflect evolving architectural trends and growing demand for statement surfaces in luxury design projects.

Natural Stone Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Marble

- Granite

- Limestone

- Others

By Construction Type Outlook (Revenue, USD Billion, 2020–2034)

- New construction

- Renovation

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Flooring

- Memorial Arts

- Wall Cladding

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Natural Stone Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 9.94 Billion |

|

Market Size in 2025 |

USD 10.47 Billion |

|

Revenue Forecast by 2034 |

USD 16.87 Billion |

|

CAGR |

5.44% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 9.94 billion in 2024 and is projected to grow to USD 16.87 billion by 2034.

The global market is projected to register a CAGR of 5.44% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Antolini Luigi & C. Società per Azioni, Aro Granite Industries Ltd., Cosentino Sociedad Anónima Unipersonal, CUPA Group Sociedad Anónima, Dermitzakis Bros Societé Anonyme, Dimpomar Sociedade Anónima, Dongxing Group Company Limited, Granite Canada Incorporated, Levantina y Asociados de Minerales Sociedad Anónima.

The granite segment held the largest revenue share in 2024.

The wall cladding segment is expected to expand at the fastest CAGR from 2025 to 2034.