Trail Mix Market Size, Share, Trends, & Industry Analysis Report

By Product (Nuts & Seed, Dried Fruit, Granola & Cereal Bar, and Others), By Type, By Distribution Channel, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6082

- Base Year: 2024

- Historical Data: 2020-2023

Overview

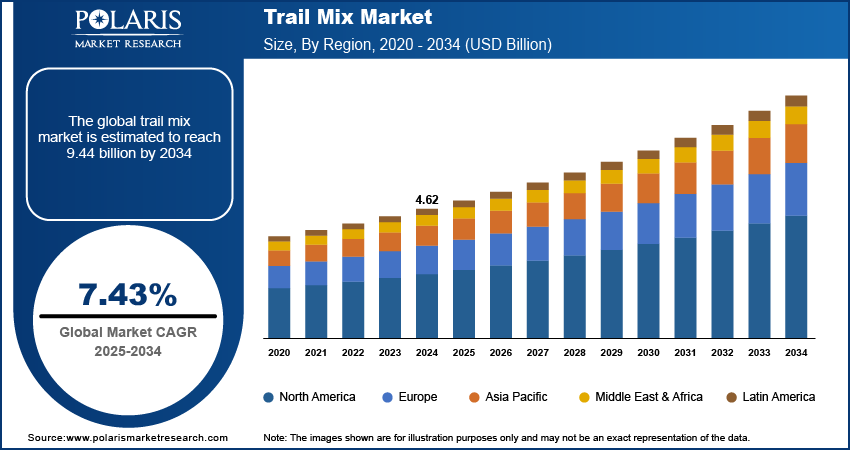

The global trail mix market size was valued at USD 4.62 billion in 2024, growing at a CAGR of 7.43% from 2025–2034. Rising preference for portable and functional snacking coupled with growing e-commerce and healthy food retail industry are driving the growth of the market.

Key Insights

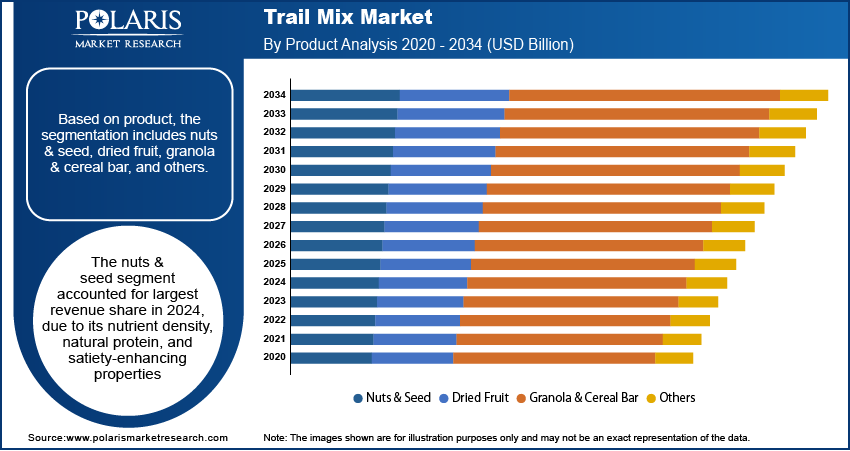

- The nuts & seed segment accounted for USD 2.02 billion revenue share in 2024.

- The organic segment is projected to grow at the fastest rate over the forecast period, due to the rising consumer interest in pesticide-free, non-GMO ingredients.

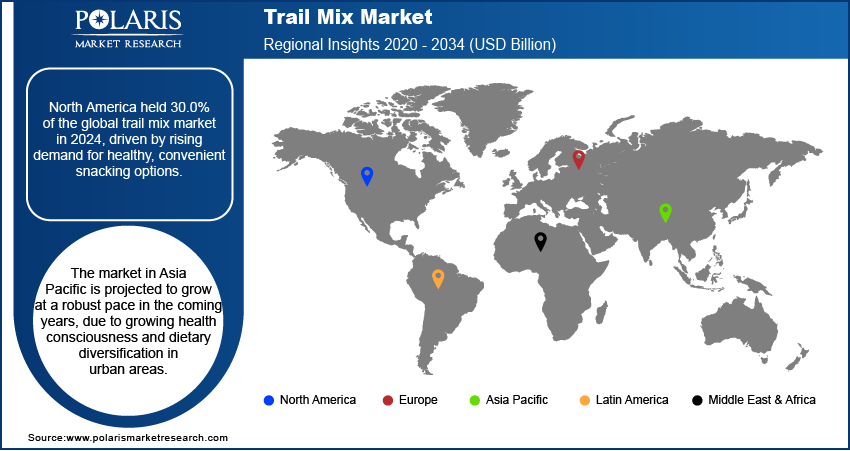

- The North America trail mix market accounted for 30.0% of the global market share in 2024.

- The US trail mix market held largest regional share of the North America market in 2024, driven by the presence of major health food brands and a well-developed private label ecosystem that offers a broad range of options.

- The market in Asia Pacific is projected to grow at a CAGR of 8.0% from 2025-2034. This growth is due to growing health consciousness and dietary diversification in urban areas.

- The market in China is expanding due the rising disposable incomes and a growing middle class, contributing to higher spending on premium food products.

Industry Dynamics

- Rising preference for portable and functional snacking is driving demand for trail mix, among urban consumers seeking convenient, nutrient-dense options that meet with active lifestyles and on-the-go consumption habits.

- Growth of e-commerce platforms and health-focused retail channels is expanding access to trail mix products, enabling brands to reach a broader audience with customizable, premium, and clean-label offerings.

- Incorporation of functional ingredients such as superfoods, protein crisps, probiotics, and adaptogens is emerging as a key opportunity, helping brands cater to consumers seeking added health benefits beyond basic nutrition.

- High product cost compared to conventional snacks continues to restrain market growth, in price-sensitive regions, where the inclusion of premium ingredients such as nuts and dried berries elevates retail prices and limits mass-market appeal.

Market Statistics

- 2024 Market Size: USD 4.62 billion

- 2034 Projected Market Size: USD 4.95 billion

- CAGR (2025-2034): 7.43%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Trail mix offers a balanced source of protein, fiber, and healthy fats, through blending dried fruits, nuts, seeds, grains, and sometimes chocolate or yogurt-coated ingredients ideal for on-the-go consumption. Its versatility and long shelf life contribute to widespread use across retail shelves, fitness centers, travel kits, and outdoor activities. The shift toward healthier snacking, plant-based diets, and clean-label ingredients is accelerating adoption, among health-conscious and active consumers. Additionally, innovations in flavor combinations, organic ingredients, and allergen-free formulations are expanding the market across diverse demographic segments.

Rising demand for healthy and convenient snacking options, among health-focused individuals and urban professionals, is fueling the growth of the trail mix market. Busy work routines and growing awareness about functional ingredients are shifting consumer habits toward snacks that deliver flavor and nutritional benefits. Retailers are expanding offerings with regionally tailored ingredient combinations and single-serve formats to meet with consumer preference for quick yet wholesome snacking.

Additionally, the global growth of plant-based and clean-label food trends is influencing consumer preference toward snacks made with recognizable, natural ingredients, thus boosting the market growth. Trail mix blends that feature nuts, seeds, dried fruits, and whole grains are gaining popularity among buyers seeking transparent ingredient lists and minimal processing. According to data from the Good Food Institute, plant-based foods accounted for 1.1% of total US retail food and beverage sales in 2024. Approximately 59% of US households purchased plant-based products during the year, maintaining a similar level of adoption as in 2023. This growth coupled with clean-label principles and plant-forward eating habits is accelerating the demand for trail mix products.

Drivers & Opportunities/Trends

Rising Preference for Portable and Functional Snacking: Busy lifestyles and on-the-go consumption trends in metropolitan regions are contributing to the growing preference for trail mix across diverse consumer groups. Urban professionals, students, and commuters are seeking compact, ready-to-eat snacks that are consumed without preparation. According to Mondelēz International’s 2024 State of Snacking Report, 75% of consumer’s snack to boost energy, 74% to improve mood, and 70% to support fitness goals. Additionally, 63% prefer snacks with minimal environmental impact, reflecting a growing demand for products that meet with personal and sustainability values. Trail mix offers a balance of energy, nutrition, and taste, making it suitable for work breaks, travel, and outdoor activities. This shift in consumption behavior is fueling the importance of functional snacking solutions that meet with fast-paced routines of individuals.

Growing E-commerce and Healthy Food Retail Industry: Expansion of e-commerce and health food retail channels is further accelerating the growth of the market. Online platforms and specialty food stores are offering a wide range of blends featuring region-specific ingredients, dietary certifications, and customized nutrition profiles. According to the International Trade Administration, global B2C e-commerce revenue is projected to reach USD 5.5 trillion by 2027, growing at a steady CAGR of 14.4% over the forecast period. Subscription-based models and direct-to-consumer brands are growing significantly through digital marketing campaigns that emphasize clean ingredients, protein content, and sustainability.

Segmental Insights

Product Analysis

Based on product, the segmentation includes nuts & seed, dried fruit, granola & cereal bar, and others. The nuts & seed segment accounted for largest revenue share in 2024, due to its nutrient density, natural protein, and satiety-enhancing properties. Ingredients such as almonds, cashews, walnuts, sunflower seeds, and pumpkin seeds are commonly used in sweet and savory formulations. This segment become a staple for individuals seeking plant-based protein and healthy fats, fueling its dominance in gym snacks, school packs, and workplace meal replacements.

The granola and cereal bar segment is expected to register the fastest CAGR during the forecast period, driven by growing demand for convenient, on-the-go formats that combine the nutritional benefits of trail mix with the portability and structure of bar-based snacks. These products are frequently consumed as balanced snacks that offer sustained energy, fiber, and flavor variety. The growing popularity of hybrid snack formats in travel retail, convenience chains, and subscription boxes is boosting the demand for trail mix-based granola and cereal bars.

Type Analysis

Based on type, the segmentation includes organic and conventional. The conventional segment dominated the market in 2024, driven by broad availability, affordability, and consumer familiarity, fueling the demand across conventional trail mix products. This segment continues to perform well in mass retail channels, where value-conscious buyers prioritize accessible pricing and established brand portfolios. Widespread sourcing and standardized production processes allow for consistent quality and shelf life across conventional offerings.

The organic segment is expected to record the fastest growth over the forecast period. Rising consumer interest in pesticide-free, non-GMO ingredients is boosting preference for certified organic snack foods. Health-conscious buyers, in North America and Europe, are opting for organic trail mix options that emphasize clean labels, minimal additives, and traceable sourcing. Growth in organic grocery aisles and the expansion of premium private label offerings are further supporting this segment’s expansion.

Distribution Channel Analysis

Based on distribution channel, the segmentation includes supermarkets & hypermarkets, convenience stores, specialty stores, and online. The supermarkets & hypermarkets accounted for largest revenue share in 2024, owing to its extensive shelf space, product variety, and competitive pricing. These retail formats offer trail mix products from global brands and private labels, catering to a wide consumer base. In-store promotions, bundling, and point-of-sale visibility continue to influence purchasing behavior among families and budget-conscious consumers.

The online segment is projected to grow at the fastest pace during the forecast period. E-commerce platforms are expanding assortment of trail mix offerings, including customizable packs, allergen-free formulations, and subscription models. Digital-first brands are leveraging social media and influencer marketing to engage health-conscious and convenience-driven buyers. According to Harvard Business Review, the influencer marketing industry was valued at USD 16.4 billion in 2022, with over 75% of brands allocating dedicated budgets to influencer campaigns. Additionally, increasing internet penetration and improvements in cold-chain and dry goods logistics are making it easier for consumers to explore and access trail mix products online.

Regional Analysis

North America trail mix market accounted for 30.0% of global market share in 2024. This dominance is due to strong demand for convenient and health-oriented snacks among working professionals, fitness-conscious individuals, and students. Consumers are adopting trail mix as a preferred option for sustained energy and balanced nutrition during busy routines and travel. Moreover, the presence of established distribution framework comprising supermarkets, health-focused retailers, and convenience chains, ensuring consistent product availability is further propelling the market growth.

The US Trail Mix Market Insight

The US held largest regional share in North America trail mix landscape in 2024, driven by the presence of major health food brands and a well-developed private label ecosystem that offers a broad range of options, including high-protein, gluten-free baking mixes, and low-sugar variants. For instance, in April 2025, Dunkin’ partnered with Kar’s Nuts to launch two new high-protein trail mix variants Caramel Cold Brew and Frosted Donut flavors, tailored for energy-focused consumers. These products are widely distributed across physical retail outlets and e-commerce platforms. Domestic manufacturers are leveraging clean-label claims and transparent ingredient sourcing to build consumer trust, driving brand engagement through digital campaigns across various demographic groups.

Asia Pacific Trail Mix Market

The market in Asia Pacific is projected to grow at a CAGR of 8.0% from 2025-2034. This growth is due to growing health consciousness and dietary diversification in urban areas across India, China, Japan, and Australia. Consumers in the region are exploring new snacking formats that incorporate natural ingredients without compromising on taste or convenience. Retail modernization, combined with the expansion of digital marketplaces, is allowing access to international and niche trail mix brands. Moreover, product localization and premium positioning are emerging as effective strategies for brands entering this market.

China Trail Mix Market Overview

The market in China is expanding due the rising disposable incomes and a growing middle class, contributing to higher spending on premium food products. According to the National Bureau of Statistics, China’s per capita disposable income reached approximately USD 1,624.57 in Q1 2024, reflecting a 6.2% year-on-year increase in nominal terms. Consumers are embracing plant-based and protein-rich snacks, creating opportunities for trail mix brands to expand shelf presence in traditional and modern retail channels. Product visibility during peak consumption seasons, such as holidays and travel periods, is further supporting sales growth in the country.

Europe Trail Mix Market

The trail mix landscape in Europe is projected to hold a substantial share in 2034, driven by the popularity of clean-label, organic, and plant-based snack options across countries such as Germany, France, and the UK. Consumers are placing higher value on product transparency, environmentally responsible packaging, and nutritional integrity. Regulatory frameworks that support ingredient clarity and allergen labeling are boosting wider adoption across retail shelves. In addition, growing emphasis on sustainable sourcing and ethical production practices is shaping consumer preference in favor of trail mix brands aligned with responsible manufacturing standards.

Key Players & Competitive Analysis Report

The trail mix market is moderately competitive, with key players focusing on product innovation, nutritional enhancement, and strategic distribution to expand their global presence. Leading manufacturers are introducing novel combinations featuring functional ingredients such as superfoods, plant proteins, probiotics, and no added sugar to cater to rising health-conscious consumer preferences. Companies are investing in sustainable sourcing practices and clean-label formulations to strengthen brand loyalty and address growing demand for natural and organic snack options. In response to evolving lifestyle trends, prominent brands are offering portion-controlled packaging and on-the-go formats to meet convenience-driven snacking habits. The rising consumer interest in energy-boosting snacks, fitness-oriented diets, and allergen-free products is propelling trail mix companies to diversify product offerings with keto-friendly, gluten-free, and vegan variants.

Major companies operating in the global trail mix market include Clif Bar & Company, Creative Snacks Co., General Mills, Inc., Hormel Foods Corporation, Kellogg Company, Kind LLC, Mars, Incorporated, Mouth Foods, National Raisin Company, Oberto Snacks Inc., PepsiCo, Inc., Second Nature Brands, Texas Star Nut & Food Co., Inc., The J.M. Smucker Company, and Whitworths Ltd.

Key Players

- Clif Bar & Company

- Creative Snacks Co.

- General Mills, Inc.

- Hormel Foods Corporation

- Kellogg Company

- Kind LLC

- Mars, Incorporated

- Mouth Foods

- National Raisin Company

- Oberto Snacks Inc.

- PepsiCo, Inc.

- Second Nature Brands

- Texas Star Nut & Food Co., Inc.

- The J.M. Smucker Company

- Whitworths Ltd.

Industry Developments

- July 2025: Forest Feast launched a new range of plant-based trail mixes in three bold flavors Classic American, Mochaccino, and Buffalo Ranch packaged in 45g snack pouches, targeting health-conscious, on-the-go consumers. The blends were gluten-free, vegan, palm-oil-free, and branded as environmentally conscious planting a tree for every order highlighting sustainability as a key differentiator.

- June 2024: Nutraj launched its Snackrite Daily Nutrition Pack, featuring 21 individual 25 g trail mix pouches available in seven flavors and using 19 different nutrient-rich ingredients. The product included a reusable tiffin box and adopted a “21‑day cycle” habit-forming concept, blending nutrition with convenience and sustainability.

Trail Mix Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Nuts & Seed

- Dried Fruit

- Granola & Cereal Bar

- Others

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Organic

- Conventional

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Trail Mix Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.62 Billion |

|

Market Size in 2025 |

USD 4.95 Billion |

|

Revenue Forecast by 2034 |

USD 9.44 Billion |

|

CAGR |

7.43% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.62 billion in 2024 and is projected to grow to USD 9.44 billion by 2034.

The global market is projected to register a CAGR of 7.43% during the forecast period.

North America dominated the market in 2024, holding 30.0% share.

A few of the key players in the market are Clif Bar & Company, Creative Snacks Co., General Mills, Inc., Hormel Foods Corporation, Kellogg Company, Kind LLC, Mars, Incorporated, Mouth Foods, National Raisin Company, Oberto Snacks Inc., PepsiCo, Inc., Second Nature Brands, Texas Star Nut & Food Co., Inc., The J.M. Smucker Company, and Whitworths Ltd.

The nuts & seed segment dominated the market in 2024. This dominance is due to its nutrient density, natural protein, and satiety-enhancing properties.

The organic segment is expected to witness the fastest growth during the forecast period, due to the rising consumer interest in pesticide-free, non-GMO ingredients.