Gluten-Free Baking Mixes Market Size, Share, Trends, Industry Analysis Report

: By Product (Bread, Cookies, Pizza, Cakes, and Others), By Distribution Channel, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM4702

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

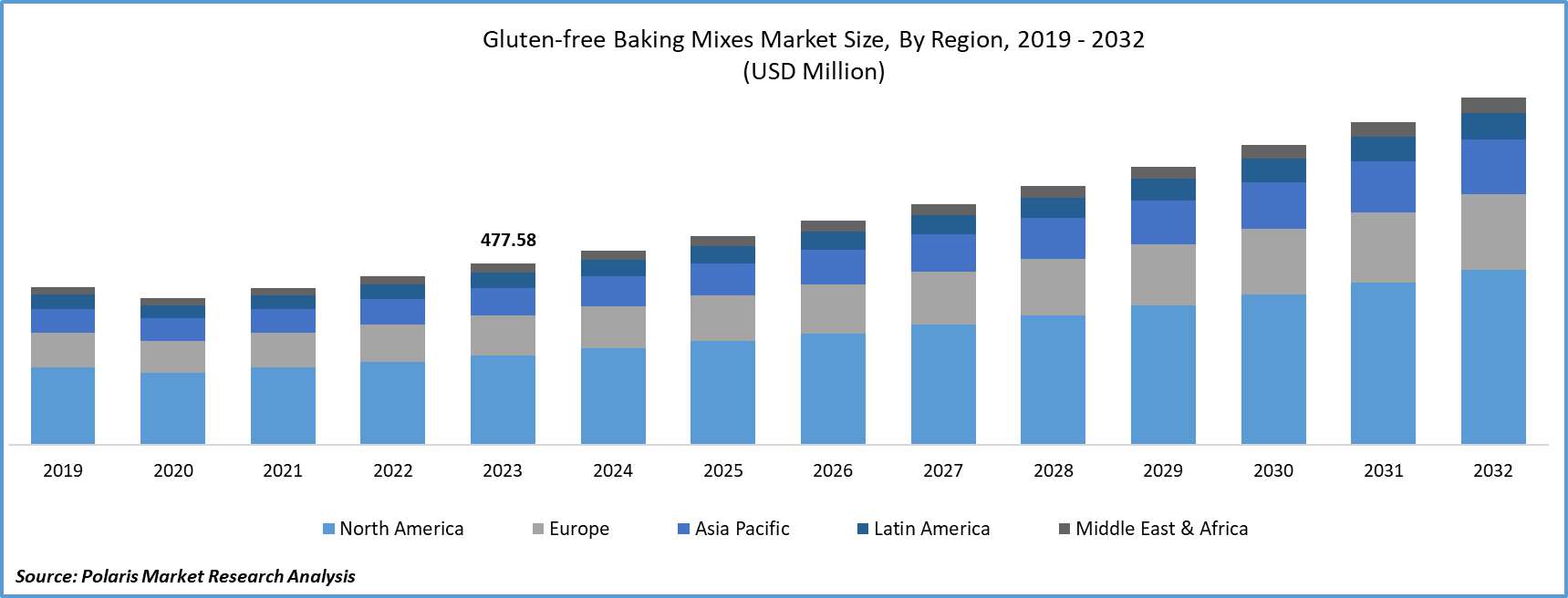

The global gluten-free baking mixes market size was valued at USD 504.19 million in 2024, growing at a CAGR of 7.59% during 2025–2034. Expanding distribution channels and growing product innovation and diversification are a few of the key factors driving market growth.

Key Insights

- The conventional stores segment led the market in 2024. The segment’s dominance is attributed to its widespread reach and ability to cater to everyday consumer demands.

- The bread segment is anticipated to witness substantial growth. The staple nature of bread in daily diets across various cultures is fueling the robust growth of the segment.

- North America led the global market in 2024. The presence of a well-established gluten-free food culture and high consumer awareness about gluten-related health conditions fuels the regional market dominance.

- Asia Pacific is projected to witness the fastest growth, owing to rising disposable incomes and growing awareness of gluten-related disorders.

Industry Dynamics

- The rising prevalence of gluten-related health conditions, including gluten intolerance and celiac disease, is fueling the demand for gluten-free baking mixes.

- Growing health consciousness and rising preference for 'free-from' labeled products are driving the adoption of gluten-free baking mixes.

- Increased focus on introducing diverse offerings that align with evolving health trends is creating several opportunities.

- Regulatory compliance and labeling requirements may present market challenges.

Market Statistics

2024 Market Size: USD 504.19 million

2034 Projected Market Size: USD 1,046.17 million

CAGR (2025-2034): 7.59%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

Gluten-free baking mixes, formulated without wheat, barley, or rye, offer convenient solutions for consumers with gluten intolerance, celiac disease, or those pursuing a gluten-free lifestyle. The gluten-free baking mixes market growth is primarily driven by the expansion of distribution channels. According to a February 2025 Census Bureau report, in the US, e-commerce sales reached USD 308.9 million in Q4 2024, growing 2.7% from Q3 and 9.4% year-over-year. This represented 16.4% of total retail sales of USD1,883.3 million, further reflecting distribution channel growth. Brands are increasingly making their products available across supermarkets, specialty health stores, online platforms, and direct-to-consumer avenues, thereby enhancing product accessibility. This wider availability improves consumer reach and caters to rising demand from diverse geographic regions, strengthening the overall market presence of gluten-free products.

The demand for gluten-free baking mixes is increasing due to product innovation and diversification. Companies are continually investing in the development of new product varieties, such as high-protein bakery products and allergen-free formulations, to appeal to broader consumer preferences. In April 2022, Ardent Mills launched certified gluten-free and keto-friendly flour blends for the Canadian market. The new products, such as all-purpose and pizza flour variants, aim to meet the growing consumer demand for alternative baking ingredients while maintaining taste and functionality. Innovations such as multi-functional mixes, catering to both baking and cooking applications, are further enriching the product portfolio. Brands attract and retain a more extensive and loyal customer base by introducing diverse offerings that align with evolving health trends and dietary needs, reinforcing growth opportunities.

Market Dynamics

Rising Prevalence of Gluten-Related Health Conditions

There is a rising prevalence of gluten-related health conditions, such as celiac disease, gluten intolerance, and non-celiac gluten sensitivity, which is propelling the demand for gluten-free baking mixes. Consumers are actively seeking safe, convenient alternatives that fit their dietary restrictions as more individuals receive diagnoses and public awareness increases. A June 2021 Cleveland Clinic report indicates that approximately 6% of Americans have gluten intolerance, a condition more prevalent than celiac disease, which affects roughly 1% of the population. Gluten-free baking mixes offer a reliable solution, enabling affected individuals to enjoy baked goods without compromising their health. This growing health necessity is creating sustained demand, encouraging manufacturers to expand their gluten-free product lines and focus on quality and nutritional value.

Growing Health Consciousness and Demand for 'Free-From' Labeled Products

Growing health consciousness and the increasing preference for 'free-from' labeled products are boosting the preference for gluten-free baking mixes. Consumers are avoiding gluten for medical reasons but are also adopting gluten-free diets as part of a broader wellness lifestyle. Products labeled as “free from gluten” are often perceived as healthier, cleaner, and better aligned with natural eating habits. For instance, in March 2023, Dainty Rice launched a gluten-free baking line featuring four ready-to-mix options, including chocolate cake, pancake doughnuts, brownies, and vanilla cupcakes, requiring minimal preparation. The collection also includes a 1:1 all-purpose gluten-free flour substitute for conventional recipes. This shift in consumer mindset is expanding the appeal of gluten-free baking mixes beyond the medically diagnosed segment to a larger, health-focused audience.

Segment Insights

Market Assessment by Distribution Channel

The global market segmentation, based on distribution channel, includes conventional stores, specialty stores, drugstores and pharmacies, and others. The conventional stores segment dominated the gluten-free baking mixes market share in 2024 due to their extensive reach, wide product assortment, and ability to cater to everyday consumer needs. Conventional stores such as supermarkets and hypermarkets offer greater shelf visibility, convenient accessibility, and frequent promotional activities, making gluten-free options more accessible to a broader audience. The trust associated with established retail chains and the convenience of one-stop shopping experiences have further strengthened the position of conventional stores in the market.

Market Evaluation by Product

The global gluten-free baking mixes market segmentation, based on product, includes bread, cookies, pizza, cakes, and others. The bread segment is expected to witness substantial growth during the forecast period, driven by the staple nature of bread in daily diets across various cultures. The need for gluten-free bread options is driven by rising consumer demand for healthier alternatives and the growing prevalence of gluten sensitivity. Innovations in texture, taste, and nutritional profile are making gluten-free bread increasingly comparable to traditional offerings, further encouraging adoption. Gluten-free bread continues to gain strong traction within the market as consumers seek familiar yet health-conscious choices.

Regional Analysis

By region, the report provides the gluten-free baking mixes market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market revenue share in 2024, primarily attributed to heightened consumer awareness about gluten-related health conditions and a well-established gluten-free food culture. The region benefits from strong demand for health-focused food products, significant presence of major gluten-free brands, and robust retail infrastructure. A March 2025 report by Auguste Escoffier School projected that the US health and wellness food market will grow from 250 million in 2023 to 468.9 million by 2030, nearly doubling in size. Moreover, favorable labeling regulations and a proactive approach toward product innovation have accelerated the adoption of gluten-free baking mixes, solidifying North America's leadership position in the global market.

The Asia Pacific gluten-free baking mixes market is projected to witness the fastest growth during the forecast period, fueled by increasing health consciousness, rising disposable incomes, and greater awareness of gluten-related disorders. Rapid urbanization and the growing influence of Western dietary trends have spurred demand for specialized food products, including gluten-free alternatives. Additionally, expanding modern retail networks and e-commerce platforms are improving product accessibility, enabling gluten-free baking mixes to reach a broader consumer base across emerging economies in the region.

Key Players and Competitive Analysis Report

The gluten-free baking mix segment continues showing robust expansion, with companies such as Bob's Red Mill, King Arthur Flour, Betty Crocker, and others competing against emerging brands such as Simple Mills, Partake Foods, and others. Established players leverage extensive distribution networks while newer entrants disrupt through innovative formulations and clean-label positioning. Consumer demand is primarily driven by rising health-conscious consumers, increasing prevalence of celiac diseases, and the upsurging number of consumers following dietary trends. Revenue opportunities exist in premium organic food & beverage segments and allergen-free subcategories, with smaller brands capturing significant value through direct-to-consumer channels and specialized retailers. The competitive landscape is increasingly shaped by strategic alliances between manufacturers and ingredient suppliers to secure reliable access to alternative flours. Pricing remains a critical differentiator, with premium brands commanding 30-50% higher prices justified through superior taste profiles and nutritional benefits. Economic shifts are creating growth opportunities in international markets, particularly in regions experiencing growing health awareness and rising disposable incomes. A few key major players are Betty Crocker; Bob’s Red Mill; Cherrybrook Kitchen; Conagra Brands, Inc.; Continental Mills, Inc.; Enjoy Life Foods; General Mills Inc.; King Arthur Baking Company, Inc.; Kinnikinnick Foods Inc.; Pamela’s Products; Partake Foods; Simple Mills; The Pure Pantry; Wholesome Chow; and Williams-Sonoma Inc.

Conagra Brands, Inc., headquartered in Chicago, is in the packaged foods industry with a diverse portfolio that includes iconic names such as Duncan Hines and Udi’s Gluten-Free. The company has made inroads into the gluten-free baking mixes segment, responding to rising consumer demand for allergen-friendly and health-conscious products. Conagra’s gluten-free range features its Eagle Mills all-purpose flour, a certified gluten-free blend of brown rice, quinoa, sorghum, millet, and teff, designed to deliver the taste, texture, and visual appeal of traditional baked goods for gluten-sensitive consumers. This multi-grain flour, showcased in products such as pancakes, sandwiches, and snack foods, is complemented by other offerings such as amaranth, quinoa, millet, and teff flours, all certified by the Gluten-Free Certification Organization. The company’s Duncan Hines brand has also expanded to include gluten-free cake and cookie mixes, catering to the growing segment seeking convenient, ready-to-bake solutions. Conagra’s strategic focus on innovation and quality allows it to address both health-driven and lifestyle-oriented consumers, positioning the company to capture revenue opportunities in a gluten-free category projected to grow at an annual rate of 15%. Conagra Brands continues to strengthen its presence in the evolving gluten-free baking mixes landscape with robust manufacturing capabilities and a commitment to consumer-centric product development.

Pamela’s Products, founded in 1988 and based in Golden, Colorado, is in the gluten-free baking mixes segment, recognized for its commitment to quality, taste, and ingredient integrity. The company develops and approves every recipe, ensuring that each product maintains optimal flavor and texture while meeting strict gluten-free standards. Pamela’s Products offers a diverse range of baking mixes, such as its flagship baking & pancake mix, artisan flour blend, oatmeal cookie mix, and sugar cookie mix – roll & cut. These mixes are crafted with premium ingredients such as brown rice flour, almond meal, and whole grains. They are free from wheat, gluten, dairy foods, soy, and corn, with many products also certified by the Gluten Free Certification Organization. The company is dedicated to sustainability, utilizing energy-efficient manufacturing, local sourcing, and environmentally responsible practices. Pamela’s Baking & Pancake Mix is in the natural market and is widely praised for making gluten-free baking accessible and delicious for those with celiac disease, gluten intolerance, or anyone seeking healthier alternatives.

List of Key Companies

- Betty Crocker

- Bob’s Red Mill

- Cherrybrook Kitchen

- Conagra Brands, Inc.

- Continental Mills, Inc.

- Enjoy Life Foods

- General Mills Inc.

- King Arthur Baking Company, Inc.

- Kinnikinnick Foods Inc.

- Pamela’s Products

- Partake Foods

- Simple Mills

- The Pure Pantry

- Wholesome Chow

- Williams-Sonoma Inc.

Gluten-Free Baking Mixes Industry Developments

May 2024: Chips Ahoy! launched its first certified gluten-free chocolate chip cookie after extensive development involving 40+ recipes and 3,000+ hours of testing. The product aims to replicate the brand's signature taste while meeting gluten-free dietary needs.

March 2023: Dainty Rice, a Canadian rice company, launched a new collection of gluten-free baking mixes. This line comprises four convenient baking mixes—Chocolate Cake, Doughnut Pancakes, Fudgy Brownies, and Vanilla Cupcakes.

April 2023: Krusteaz revealed three fresh baking mixes, featuring a Gluten-Free Vanilla Muffin with Sweet Glaze Mix, Vanilla Pound Cake Mix, and Gluten-Free Meyer Lemon Bar Mix.

June 2022: The King Arthur Baking Co. launched a fresh range of baking mixes suitable for keto diets, along with a gluten-free pizza dough flour. These keto-friendly mixes, crafted from non-GMO certified components, are available in a variety of options, including yellow cake, chocolate cake, all-purpose muffin, and pizza crust.

Gluten-Free Baking Mixes Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Bread

- Cookies

- Pizza

- Cakes

- Others

By Distribution Channel Outlook (Revenue, USD Million, 2020–2034)

- Conventional Stores

- Specialty Stores

- Drugstores and Pharmacies

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Gluten-Free Baking Mixes Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 504.19 million |

|

Market Size Value in 2025 |

USD 541.57 million |

|

Revenue Forecast in 2034 |

USD 1,046.17 million |

|

CAGR |

7.59% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 504.19 million in 2024 and is projected to grow to USD 1,046.17 million by 2034.

The global market is projected to register a CAGR of 7.59% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Betty Crocker; Bob’s Red Mill; Cherrybrook Kitchen; Conagra Brands, Inc.; Continental Mills, Inc.; Enjoy Life Foods; General Mills Inc.; King Arthur Baking Company, Inc.; Kinnikinnick Foods Inc.; Pamela’s Products; Partake Foods; Simple Mills; The Pure Pantry; Wholesome Chow; and Williams-Sonoma Inc.

The conventional stores segment dominated the market share in 2024.

The bread segment is expected to witness substantial growth during the forecast period.