Treasury Management System Market Share, Size, Trends, Industry Analysis Report

By Type (Local Systems, Cloud-Based Systems, Others); By Vertical; By Applications; By Regions; Segment Forecast, 2023 – 2032

- Published Date:May-2023

- Pages: 118

- Format: PDF

- Report ID: PM3224

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

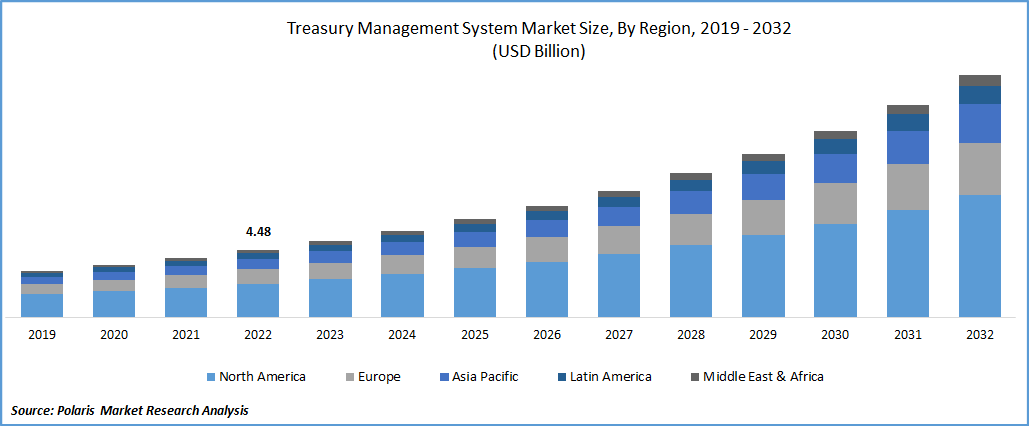

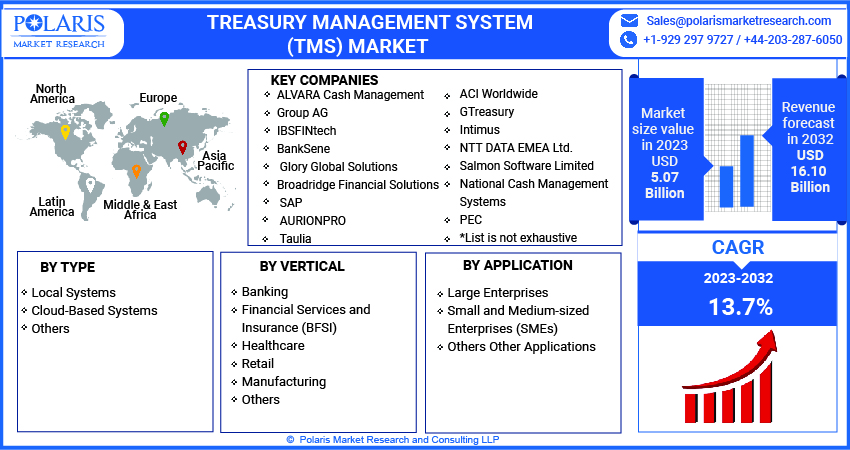

The global treasury management system market was valued at USD 4.48 billion in 2022 and is expected to grow at a CAGR of 13.7% during the forecast period. A Treasury Management System (TMS) market is a software platform designed to help organizations manage their financial operations more effectively. It provides a centralized hub for handling cash, investments, debt, and other financial instruments and facilitating risk management and compliance activities.

Know more about this report: Request for sample pages

A TMS typically includes various features and functions, such as cash forecasting, cash position management, payment processing, bank account reconciliation, foreign exchange management, investment management, debt management, and financial reporting. It can also integrate with other economic systems and data sources to comprehensively view an organization's financial position.

Organizations can use a TMS to improve their cash visibility, reduce operational risks, automate routine tasks, and make more informed financial decisions. This can enhance overall financial performance and support strategic growth objectives.

The TMS market has been growing steadily in recent years due to the increasing need for efficient cash management and the growing complexity of financial operations. The market is driven by the increasing demand for cloud-based TMS solutions, the rising adoption of automation and Artificial Intelligence (AI) technologies, and the growing need for regulatory compliance and risk management. Furthermore, the COVID-19 pandemic has accelerated the adoption of digital solutions and remote work practices, further boosting the demand for Treasury Management System market.

The TMS market is segmented by type, application, and vertical. Cloud-based deployment is expected to grow at the highest rate due to its cost-effectiveness and flexibility. Large enterprises are the major adopters of TMS solutions, but small and medium-sized enterprises are also increasingly adopting them.

In terms of verticals, the TMS market is driven by the banking, financial services, and insurance (BFSI) sector, followed by healthcare, retail, and manufacturing. Depending on this, the market is expected to continue growing in the coming years due to the increasing need for efficient financial operations and the growing adoption of digital technologies.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Companies are looking for solutions to manage their cash more efficiently and effectively. TMS solutions provide a centralized platform for managing money, investments, debt, and other financial instruments, allowing organizations to optimize their cash management processes. With the increasing globalization of businesses, financial operations have become more complex, making it difficult for organizations to manage them manually. TMS solutions automate routine tasks, streamline processes, and provide real-time visibility into financial operations, helping organizations manage their financial operations more efficiently, which drives the market in the forecast period.

Cloud-based TMS solutions offer several advantages, including lower costs, faster deployment, and greater scalability. As a result, more organizations are adopting cloud-based TMS solutions, driving the growth of the TMS market. Regulatory compliance requirements are becoming more stringent, making it difficult for organizations to manage their financial operations manually. TMS solutions provide compliance management tools, helping organizations effectively meet regulatory requirements.

With the increasing volatility of financial markets, organizations seek solutions to manage their financial risks more effectively. TMS solutions provide risk management tools, such as foreign exchange and interest rate management, helping organizations to manage their financial risks more effectively. Overall, these growth drivers are expected to continue driving the growth of the TMS market in the coming years as organizations look for solutions to manage their financial operations more efficiently and effectively.

Report Segmentation

The market is primarily segmented based on type, vertical, application, and region.

|

By Type |

By Vertical |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The cloud-based system segment is expected to grow at the highest rate CAGR in 2022

The cloud-based system is expected to grow at the highest rate CAGR and dominate the TMS market, which will continue in the coming years. It offers several advantages: cost-effectiveness, scalability, flexibility, faster deployment, and strong security features. As a result, more organizations are adopting cloud-based TMS solutions to manage their financial operations.

Cloud-based TMS solutions provide real-time visibility into financial operations, enabling organizations to make informed decisions quickly. It can be easily integrated with other systems, such as enterprise resource planning (ERP) systems, allowing organizations to streamline their financial processes. Cloud-based TMS solutions are automatically updated by the vendor, ensuring that users always have access to the latest features and functionality.

The BFSI segment is anticipated to hold the largest market share in 2022

The BFSI (Banking, Financial Services, and Insurance) segment is anticipated to hold the largest market share for the TMS market. The BFSI sector is a critical component of the global economy, and several factors drive the demand for TMS solutions in this industry. Firstly, BFSI organizations deal with a vast volume of financial transactions that require effective cash management, which TMS solutions can facilitate. Secondly, the regulatory landscape in the BFSI sector is complex and ever-changing, and TMS solutions can help organizations comply with various regulations, such as Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements.

Furthermore, the BFSI sector is highly competitive, and organizations must stay ahead of the curve regarding financial management and risk mitigation. TMS solutions provide real-time visibility into cash positions, forecast cash flows, and enable organizations to identify potential risks and take necessary actions. In summary, the BFSI segment is a significant.

North America is dominating the market in 2022

The Treasury Management System market in North America is one of the largest in the world. This region is home to many large corporations and financial institutions, which have complex financial operations and require robust TMS solutions to manage their cash, liquidity, and risk. Several factors drive the North American TMS market, including regulatory compliance requirements, greater visibility and control over financial operations, and the growing trend toward automation and digitization of economic processes.

Regulatory compliance is a critical driver of the North American TMS market. The regulatory landscape in North America is complex and ever-changing, and organizations must comply with various regulations such as Anti-Money Laundering (AML), Know Your Customer (KYC), and Dodd-Frank requirements. TMS solutions provide the necessary tools and technology to help organizations comply with these regulations. Another factor driving the North American TMS market is the need for greater visibility and control over financial operations.

The Asia Pacific (APAC) region is a rapidly growing market for TMS solutions. The region is home to many emerging economies, and many companies are investing heavily in technology to improve their financial operations and gain a competitive advantage. Several factors drive the APAC TMS market, including increasing regulatory compliance requirements, greater visibility and control over financial operations, and the growing trend toward automation and digitization of economic processes. Regulatory compliance is a critical driver of the APAC TMS market.

Competitive Insight

Some of the major players operating in the global market include ALVARA Cash Management Group AG, IBSFINtech, BankSene, Glory Global Solutions, Broadridge Financial Solutions, SAP, AURIONPRO, Taulia, ACI Worldwide, GTreasury, Intimus, NTT DATA EMEA Ltd., Salmon Software Limited, National Cash Management Systems, PEC, Finastra, Oracle, Gresham Technologies, Path Solutions, Sopra Banking, Giesecke and Devrient GmbH, Cash Management Solutions, and Nextage.

Recent Developments

- In April 2022, IBSFINtech and Oracle partnered to facilitate digital transformation for their customers through ERP and TMS solutions. By integrating IBSFINtech's TMS InTReaX with Oracle Fusion Cloud Enterprise Resource Planning (ERP), they are committed to accelerating the digital transformation journey for their clients globally.

- In June 2021, Uni Systems and Finastra partnered to provide treasury, risk, and payment solutions and services. Uni Systems leveraged Finastra's Fusion Treasury, Fusion Risk, and Fusion Global PAYplus software for local markets, offering on-site implementation and support services.

Treasury Management System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 5.07 billion |

|

Revenue forecast in 2032 |

USD 16.10 billion |

|

CAGR |

13.7% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Vertical, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

ALVARA Cash Management Group AG, IBSFINtech, BankSene, Glory Global Solutions, Broadridge Financial Solutions, SAP, AURIONPRO, Taulia, ACI Worldwide, GTreasury, Intimus, NTT DATA EMEA Ltd., Salmon Software Limited, National Cash Management Systems, PEC, Finastra, Oracle, Gresham Technologies, Path Solutions, Sopra Banking, Giesecke and Devrient GmbH, Cash Management Solutions, and Nextage |

FAQ's

The treasury management system market report covering key segments are type, vertical, application, and region.

Treasury Management System Market Size Worth $16.10 Billion By 2032.

The global treasury management system market expected to grow at a CAGR of 13.7% during the forecast period.

North America is leading the global market.

key driving factors in treasury management system market are growing demand for advanced treasury management systems for enhancing customer experience