Unified Communications Market Share, Size, Trends, Industry Analysis Report

By Platform (Telephony, Unified Messaging, Conferencing, Others); By Deployment Model; By Organization Size; By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Oct-2025

- Pages: 114

- Format: PDF

- Report ID: PM1073

- Base Year: 2024

- Historical Data: 2020-2023

What is the Current Market Size?

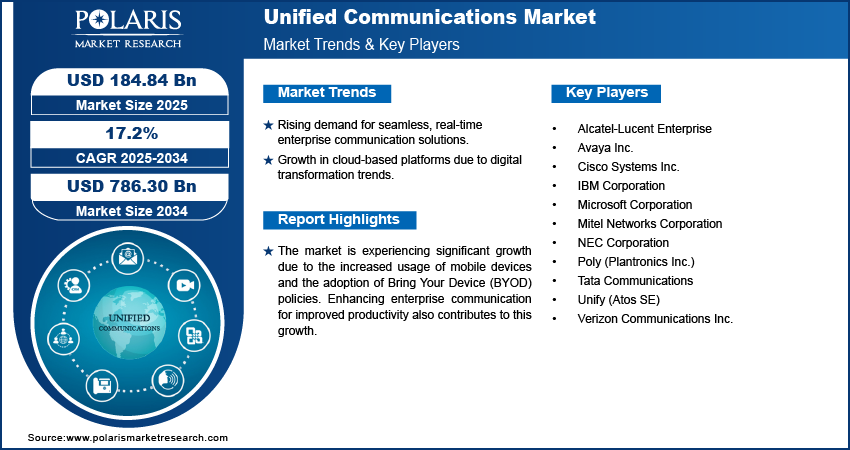

The global unified communications market was valued at USD 158.51 billion in 2024 and is expected to grow at a CAGR of 17.2% during the forecast period. The market is experiencing significant growth due to the increased usage of mobile devices and the adoption of Bring Your Device (BYOD) policies. Enhancing enterprise communication for improved productivity also contributes to this growth.

Key Insights

- By platform, unified messaging held the largest share in 2024 due to the increasing need for real-time communication and collaboration tools in modern enterprises drives the adoption of unified messaging solutions.

- By deployment, cloud-based held the largest share in 2024 due to the flexibility, scalability, and cost-effectiveness of cloud-based solutions make them increasingly popular among organizations of all sizes.

- By organization size, large enterprise held the largest share in 2024 due to Large enterprises often require robust and scalable communication solutions to support their extensive operations and global workforce.

- By end-use, IT& telecom held the largest share in 2024 due to IT & Telecom sector's constant need for advanced communication solutions to support their services and infrastructure drives the demand for UC solutions.

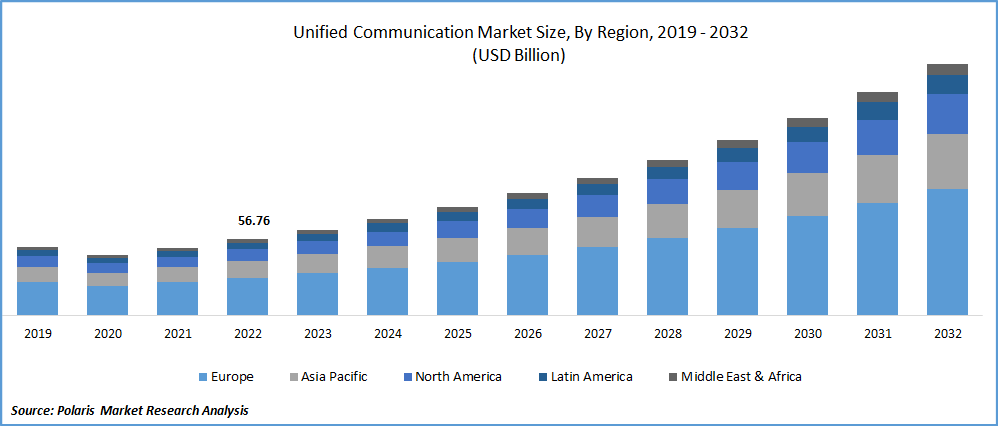

- By region, North America held the largest share in 2024 due to the early adoption of advanced technologies and the presence of major UC solution providers contribute to its dominance in the UC market.

Industry Dynamics

- The increasing need for seamless and real-time communication across organizations is driving the adoption of integrated solutions.

- Growing digital transformation initiatives and remote working trends are pushing organizations to invest in cloud-based and scalable communication platforms.

- Rising demand for advanced analytics, AI-powered features, and automation in communication tools is enhancing decision-making capabilities.

Market Statistics

- 2024 Market Size: USD 158.11 billion

- 2034 Projected Market Size: USD 768.30 billion

- CAGR (2025-2034): 17.2%

- North America: Largest market in 2024

AI Impact on Market

- Automation powered by AI is streamlining routine tasks and workflows, reducing manual effort, and minimizing errors.

- AI-powered conversational tools, including chatbots and virtual assistants, are enhancing user experience by enabling real-time, personalized interactions.

- Integration of AI in communication and collaboration platforms is enabling intelligent features like sentiment analysis, smart routing, and automated transcription.

To Understand More About this Research: Request a Free Sample Report

What Does the Current Market Landscape Look for Unified Communications Sector?

Unified communication is a system that combines real-time and asynchronous tools to boost productivity and collaboration in business communication. This system connects different devices and applications for enterprise communication, which enhances interaction and workflow. Unified communication encompasses various communication modes, including voice communication (like voicemail, email, and fax), multimedia elements (such as pictures, animations, and videos), and real-time communication (like conferencing, call screening, instant messaging, and paging). By utilizing unified communication tools, companies can improve service delivery, increase profits, and generate higher revenue while keeping costs low. Technological advancements, a need for collaboration, mobility, and improved workforce productivity are also factors driving the unified communications market. However, concerns about data security and interoperability may hinder growth. Nonetheless, emerging economies and small to medium enterprises present growth opportunities.

Furthermore, the need for effective management of complex business communication, cost reduction, and increased productivity drives the adoption of Unified Communications (UC) solutions. These solutions are increasingly being delivered through cloud-based or hosted Unified Communications as a Service (UCaaS) models. Companies are redefining their business models to gain flexibility, productivity, and agility.

In addition, today's fast-paced business environment, real-time data, video communications, and telephony systems have become critical. As a result, organizations are adopting UC solutions to enhance both internal communication and collaboration with remote staff and external communication with clients and suppliers.

The Unified Communications Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

The Unified Communications (UC) market, with a sudden shift to remote work leading to increased demand for UC solutions that can facilitate communication and collaboration between remote teams. This has resulted in a surge in demand for cloud-based UC solutions that can be easily deployed and scaled to meet the needs of remote workers. The pandemic has also highlighted the importance of business continuity planning, fueling the adoption of UC solutions. Companies need reliable and flexible communication infrastructures to support remote work and enable seamless business operations during disruptions.

Industry Dynamics

Growth Drivers

What are the Factors Driving the Expansion Opportunities?

Several factors drive the market, including the increasing adoption of remote work, leading to a growing demand for UC solutions enabling remote communication and collaboration. This trend is expected to continue as more companies realize the benefits of remote work, such as increased productivity and reduced costs.

Another important driver of the market is technological advancements. Technological advances, such as the development of 5G networks and the Internet of Things (IoT), enable new features and capabilities for UC solutions. This allows companies to improve communication and collaboration processes, helping to drive the adoption of UC solutions.

The growing importance of customer experience is also driving the market. UC solutions can help companies improve customer experience by enabling faster response times and better customer communication. Additionally, the rising need for security drives demand for UC solutions that offer robust security measures to protect against data breaches and cyberattacks.

Report Segmentation

The market is primarily segmented based on platform, deployment model, organization size, end-use, and region.

|

By Platform |

By Deployment Model |

By Organization size |

By End-Use |

By Region |

|

|

|

|

|

Segmental Insights

Platform Analysis

Which Segment by Platform Dominated the Market in 2024

The unified messaging segment dominated the market in 2024. This is due to an increasing need among enterprises to have quick and efficient communication, especially in critical situations where real-time notifications are crucial. Unified Messaging is an ideal solution that combines voice, fax, and text messages in one platform that can be easily accessed via a PC or phone. This is particularly advantageous for mobile users who require seamless communication with clients and colleagues.

Deployment Model Analysis

Why Cloud-Based Segment is Expected to Hold Highest CAGR?

The cloud-based segment is expected to hold highest CAGR during the forecast period due to the increasing adoption of cloud-based solutions by organizations of all sizes. The cloud-based segment of the unified communications market refers to the delivery of UC services through cloud-based deployment models, where UC solutions are hosted and managed by third-party service providers on the cloud.

Cloud-based UC solutions offer numerous benefits, such as scalability, flexibility, cost-effectiveness, and ease of deployment and management, making them an attractive option for organizations looking to streamline their communication and collaboration processes. Additionally, cloud-based UC solutions enable remote work and support the growing trend of mobile workforces.

Organization Size Analysis

Which Segment by Organization Size Held the Highest Market Share?

Large enterprises segment held the highest market share in 2024. These enterprises prioritize corporate network performance and tightly integrate emerging technologies like SD-WAN. Service providers cater to the needs of multi-regional and multinational enterprises by improving UC solutions with additional features such as business process integration, centralized provisioning, and service management. Furthermore, large enterprises have a global presence and are consistently expanding, creating a demand for secure and efficient unified communication solutions.

The small and medium enterprises (SMEs) segment is expected to experience significant growth in the market. SMEs utilize UC services to reduce capital and operational expenses incurred in deploying a UC solution independently. In addition, several vendors are now shifting their focus towards SMBs, which were previously not considered a primary market due to a lack of awareness about the potential benefits of UC and the high costs of on-premise equipment.

End Use Analysis

What are the Factors for IT&Telecom Sector's Growth?

The IT and telecom segment hold the largest market share in 2024. The segment is expected to continue its dominance during the forecast period due to the high demand for UC solutions among IT and telecom companies. UC solutions help these companies streamline their communication and collaboration processes, improve customer service, and enhance efficiency.

Moreover, the IT and telecom sector constantly evolves, with new technologies and trends emerging regularly. UC solutions can help these companies stay ahead of the competition by providing them with the latest communication tools and capabilities. For instance, the industry's growing adoption of 5G networks and IoT devices drives demand for UC solutions that can integrate these technologies.

Regional Insights

Why North America Led the Unified Communications Industry?

North America led the market in 2024. This is due to the early adoption and the strong digital infrastructure that extends beyond any region. The large number of big companies generates demand for unified communication tools that improve overall productivity and efficiency, further supporting these large enterprises. Additionally, numerous media collaborations lead to significant procurement and competition among UC vendors, pushing more differentiated products to market. This is accompanied by an active marketplace and growing public sector initiatives aimed at productivity.

What are the Factors for Europe and Asia Pacific Expansion

The Europe market is expanding. This is due to the increased adoption of BYOD services and the need for operational efficiency. This has prompted the expansion of UC systems across enterprise applications and an increase in regional vendors. Stringent data privacy regulations, such as GDPR, have encouraged trust in secure UC platforms that are appropriate for enterprise usage. The drive for cross-border collaboration in the European Union also necessitates unified systems. Additionally, the strong focus on digital transformation in both the manufacturing and finance sectors is a key driver of growth in the region. Competition in the market is increasing as regional vendors are developing solutions that are aligned to specific European compliance and language requirements.

The Asia Pacific is expected to witness substantial growth due to the increasing adoption of cloud-based solutions, the trend of remote work, and technological advancements such as 5G networks and IoT. The healthcare sector is also expected to drive growth by adopting automation strategies.

Competitive Insight

Some of the major players operating in the global unified communications market include Verizon Communications Inc., Mitel Network Corporation, Cisco Systems Inc., Alcatel-Lucent Enterprise, NEC Corporation, Poly (Platonics Inc.), IBM Corporation, Unify (Atos SE), Microsoft Corporation, Avaya Inc., and Tata Communications.

Recent Developments

- August 2023: Mitel Network Corporation introduced an updated version of MiCollab, its collaboration platform offering integrated messaging, voice, and meeting functionalities.

- February 2023: Zoho Corporation launched Trident, a UC&C platform that combines Zoho Cliq and Zoho Meeting for improved business communication.

- April 2022: Genesys and 8x8, Inc. collaborated to integrate unified communication through Genesys Cloud CX and 8x8 Work to provide employee and customer satisfaction by combining contact centers and UC.

Unified Communications Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 158.11 billion |

| Market size value in 2025 | USD 184.84 billion |

|

Revenue forecast in 2034 |

USD 786.30 billion |

|

CAGR |

17.2% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Platform, By Deployment Model, By Organization Size, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Verizon Communications Inc., Mitel Network Corporation, Cisco Systems Inc., Alcatel-Lucent Enterprise, NEC Corporation, Poly (Platonics Inc.), IBM Corporation, Unify (Atos SE), Microsoft Corporation, Avaya Inc., and Tata Communications. |

Want to check out the Unified Communications Market report before buying it? Then, our sample report has got you covered. It includes key market data points, ranging from trend analyses to industry estimates and forecasts. See for yourself by downloading the sample report.

Browse Our Top Selling Reports

Oxycodone Drugs Market Size, Share 2024 Research Report

U.S. Residential Remodeling Market Size, Share 2024 Research Report

Animal Sedatives Market Size, Share 2024 Research Report

Biguanides Market Size, Share 2024 Research Report

Cloud Mobile Backend as a Service (BaaS) Market Size, Share 2024 Research Report

FAQ's

The global unified communications market size is expected to reach USD 786.30 billion by 2034.

Key players in the unified communications market are Verizon Communications Inc., Mitel Network Corporation, Cisco Systems Inc., Alcatel-Lucent Enterprise, NEC Corporation, Poly (Platonics Inc.), IBM Corporation.

North America dominated the global unified communications market in 2024.

The global unified communications market expected to grow at a CAGR of 17.2% during the forecast period.

The unified communications market report covering key segments are platform, deployment model, organization size, end-use, and region.