Urinary Incontinence Devices Market Size, Share, Trends, Industry Analysis Report

: By Category (External Urinary Incontinence Device and Internal Incontinence Device), Product, Incontinence Type, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 116

- Format: PDF

- Report ID: PM4405

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

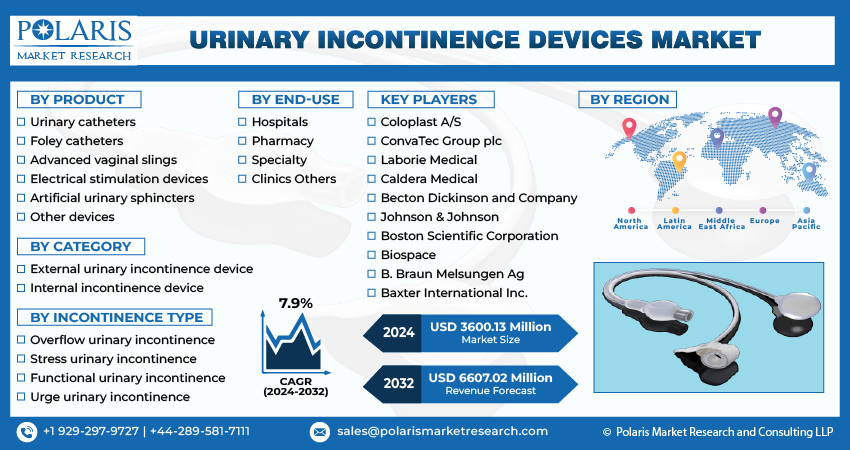

The urinary incontinence devices market size was valued at USD 4,198.17 million in 2024, growing at a CAGR of 11.0% during 2025–2034. The market growth is driven by increasing urinary incontinence incidence due to aging populations, growing prevalence of chronic conditions, and rising expenditures on healthcare.

Key Insights

- The external urinary incontinence devices segment accounts for a larger market share, primarily due to the increased adoption of minimally invasive procedures.

- The advanced vaginal slings segment is projected to witness the fastest growth. Urethral slings, especially mid-urethral slings, have shown notable efficiency in addressing stress urinary incontinence/

- The hospitals segment leads the market, owing to their comprehensive range of therapeutic, diagnostic, and surgical interventions for managing urinary incontinence.

- North America dominates the market. This is due to the high incidence of urinary incontinence in the region’s aging population and the presence of an advanced healthcare infrastructure.

- Asia Pacific is registering significant growth. Growing awareness about incontinence management and rapidly aging population are driving the regional market growth.

Industry Dynamics

- The increasing prevalence of urinary incontinence, due to aging global population, is fueling the demand for effective management solutions, including urinary incontinence devices.

- The introduction of advanced urinary incontinence devices that offer less invasive and more effective treatment options is fueling market growth.

- The rising integration of smart technologies is creating several market opportunities.

- Social stigma hindering patient adoption may present market challenges.

Market Statistics

2024 Market Size: USD 4,198.17 million

2034 Projected Market Size: USD 11,904.23 million

CAGR (2025-2034): 11.0%

North America: Largest Market in 2024

AI Impact on Urinary Incontinence Devices Market

- AI-enabled sensors track bladder activity and patient behavior. That way, they provide real-time monitoring for more accurate diagnosis.

- Predictive algorithms anticipate incontinence episodes, allowing devices to respond proactively and improve patient comfort.

- AI-powered mobile apps personalize treatment plans by analyzing lifestyle data and therapy effectiveness over time.

- Smart data integration helps clinicians refine interventions. This integration reduces trial-and-error and enhances quality of life for patients.

To Understand More About this Research: Request a Free Sample Report

Urinary incontinence devices are designed to manage involuntary urine leakage, a condition that affects millions globally. These devices include catheters, slings, artificial urinary sphincters, and absorbent products. The urinary incontinence devices market demand is driven by factors such as the rising prevalence of urinary incontinence due to aging populations, increased awareness about treatment options, and advancements in minimally invasive solutions. Additionally, growing healthcare expenditures and improved reimbursement policies in various regions contribute to the market expansion.

A qualitative analysis of the urinary incontinence devices market indicates significant growth potential due to increasing demand for effective treatment options. Key drivers include the rising incidence of chronic conditions such as diabetes and neurological disorders, which contribute to urinary incontinence. Technological advancements, such as smart incontinence devices and biofeedback-based solutions, are also fueling market adoption. Furthermore, growing patient preference for noninvasive and discreet management options is shaping product development. However, restraints such as high device costs and limited awareness in developing regions hinder the urinary incontinence devices market growth.

Market Dynamics

Increasing Prevalence of Urinary Incontinence

Urinary incontinence (UI) is a widespread condition affecting a significant portion of the population, particularly among the elderly. Studies have reported prevalence rates ranging from approximately 5% to 70%, with most indicating that 25% to 45% of women experience some form of UI. Notably, in women aged 70 years and above, more than 40% are affected by this condition. As the global population continues to age, the overall prevalence of UI is expected to rise, thereby increasing the demand for effective management solutions, including urinary incontinence devices.

Impact on Quality of Life and Mobility

Urinary incontinence significantly impairs the quality of life and mobility of affected individuals. A survey conducted by Longitudinal Aging Study in India (LASI) in India revealed that 18% of elderly participants identified UI as the second-largest factor limiting their mobility, following joint and body pain. Furthermore, 16.2% of respondents reported experiencing an urgent need to urinate during the day or night most of the time in the preceding 30 days, while 27.3% accidentally leaked urine on their clothes at least once in the past week. These findings underscore the profound impact of UI on daily activities and the consequent need for effective management solutions, thereby driving the demand for urinary incontinence devices.

Advancements in Treatment Options

The development of advanced urinary incontinence devices has significantly improved the management of UI, offering patients more effective and less invasive treatment options. Innovations such as urethral and vaginal slings have gained prominence due to their efficacy and preference for the use of biomaterials in surgical treatments. These advancements enhance patient outcomes and contribute to the growing adoption of urinary incontinence devices in clinical practice.

Segment Insights

Assessment by Category Outlook

The urinary incontinence devices market, by category, is segmented into external urinary incontinence device and internal incontinence device. The external urinary incontinence devices segment holds a larger share of the urinary incontinence devices market revenue. This dominance is primarily attributed to the increasing adoption of minimally invasive procedures, such as urethral slings, which offer effective treatment for stress urinary incontinence. The preference for these devices is further bolstered by their demonstrated efficacy and patient satisfaction rates.

The internal devices segment is experiencing significant growth due to continuous technological advancements aimed at enhancing patient comfort and treatment outcomes. Innovations in biomaterials and surgical techniques have improved the safety and effectiveness of devices such as artificial urinary sphincters and electrical stimulation devices. Additionally, the rising prevalence of stress urinary incontinence, particularly among the aging population, contributes to the expanding demand for internal urinary incontinence devices.

Evaluation by Product Outlook

The urinary incontinence devices market, by product, is segmented into urinary catheters, foley catheters, advanced vaginal slings, electrical stimulation devices, artificial urinary sphincters, and other devices. The urinary catheters segment dominates the urinary incontinence devices market share. This prominence is attributed to the essential role these devices play in managing incontinence among individuals suffering from chronic health conditions, such as spinal cord injuries, multiple sclerosis, and certain neurological disorders. The widespread utilization of urinary catheters in both hospital and home care settings underscores their significance in providing effective management solutions for urinary incontinence.

The advanced vaginal slings segment is experiencing the highest growth within the market. This surge is driven by the increasing demand for minimally invasive procedures that offer effective treatment for stress urinary incontinence. Urethral slings, particularly mid-urethral slings, have demonstrated notable efficacy in addressing this condition, leading to high levels of patient satisfaction and substantial cure rates. The preference for these advanced solutions reflects a broader trend toward less invasive treatment options that provide reliable and successful outcomes for individuals seeking interventions for stress urinary incontinence.

Assessment by Incontinence Type Outlook

The urinary incontinence devices market, by incontinence type, is segmented into urinary incontinence, stress urinary incontinence, functional urinary incontinence, and urge urinary incontinence. The stress urinary incontinence segment holds the largest market share due to the high prevalence of stress urinary incontinence, particularly among women. Factors such as pregnancy, childbirth, and menopause contribute to the weakening of pelvic floor muscles, leading to increased instances of stress urinary incontinence. The demand for effective management solutions, including urethral slings and other medical devices, has risen accordingly. According to the National Association for Continence, stress urinary incontinence is the most prevalent form of incontinence, affecting approximately 15 million adult women in the US.

The urge urinary incontinence segment is experiencing significant growth within the market. This trend is driven by the increasing adoption of advanced treatment devices, such as implantable electrical stimulation devices, which offer effective solutions for managing overactive bladder symptoms associated with urge incontinence. The higher cost of these advanced devices, compared to traditional methods such as indwelling Foley catheters, contributes to the segment's expanding market value. Additionally, the rising incidence of urge incontinence and the introduction of innovative products are propelling the growth of this segment.

Evaluation by End Use Outlook

Based on end use, the urinary incontinence devices market is segmented into hospitals, pharmacy, specialty clinics, and others. The hospitals segment holds the largest market share. This dominance is attributed to the comprehensive range of diagnostic, therapeutic, and surgical interventions that hospitals provide for managing urinary incontinence. Hospitals serve as primary centers for patients seeking treatment for urinary incontinence, offering advanced medical technologies and specialized healthcare professionals. The significant patient volume and the availability of various treatment options contribute to the substantial market share held by this segment.

The hospitals segment is experiencing the highest growth within the market. This growth is driven by the increasing number of surgical procedures performed for urinary incontinence treatment and favorable reimbursement policies for medical devices in both developed and developing countries. As awareness and diagnosis rates of urinary incontinence rise, more patients are seeking hospital-based treatments, further propelling the expansion of this segment.

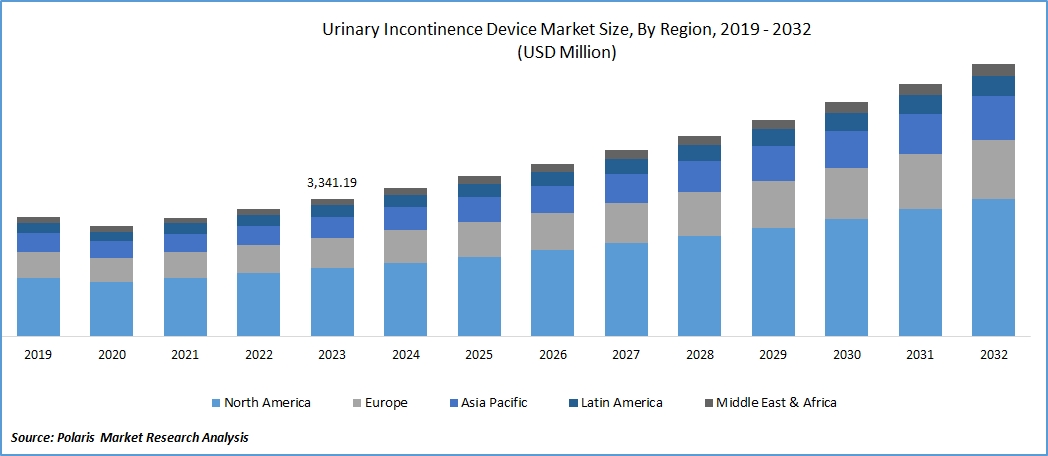

Regional Outlook

By region, the study provides urinary incontinence devices market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share in the urinary incontinence devices market, primarily due to the region's advanced healthcare infrastructure and the high prevalence of urinary incontinence among its aging population. The availability of favorable reimbursement policies further facilitates patient access to these devices, encouraging widespread adoption. Additionally, the presence of key market players and ongoing technological advancements contribute to the region's market dominance. These factors collectively drive the demand for urinary incontinence devices in North America.

In Europe, the urinary incontinence devices market benefits from a well-established healthcare infrastructure and a growing elderly population, which increases the demand for effective incontinence management solutions. The region's focus on healthcare quality and patient care has led to the adoption of advanced medical technologies, including innovative urinary incontinence devices. Additionally, increased awareness and reduced stigma associated with incontinence have encouraged more individuals to seek treatment, further driving the urinary incontinence devices market expansion.

The Asia Pacific urinary incontinence devices market is witnessing significant growth, driven by factors such as a rapidly aging population, rising prevalence of chronic diseases, and increasing awareness about incontinence management. Countries such as India are expected to register the highest growth rates in the coming years. Government initiatives aimed at improving healthcare infrastructure and addressing incontinence-related issues are also contributing to market expansion. For instance, the Asia Pacific Society of Infection Control introduced guidelines in July 2022 to prevent catheter-linked urinary incontinence infections, supporting high standards of infection prevention and management in the region.

Key Players and Competitive Insights

The urinary incontinence devices market is highly competitive, driven by technological advancements, increasing awareness, and a growing aging population. Companies are focusing on developing innovative and minimally invasive solutions to improve patient comfort and treatment efficacy. The market is witnessing significant investments in research and development to enhance product durability, bio-compatibility, and effectiveness. Regulatory approvals and compliance with healthcare standards play a crucial role in market positioning, as stringent requirements impact product launches and adoption rates. Pricing pressures and reimbursement challenges remain obstacles, prompting companies to explore value-based pricing models. The integration of smart technologies, such as wearable sensors and AI-driven diagnostics, is creating new opportunities, enhancing patient monitoring and treatment personalization.

Boston Scientific Corporation is a global medical technology company that develops and manufactures a wide range of medical devices used in various interventional medical specialties. The company offers products for urology and pelvic health, including solutions for urinary incontinence management.

Coloplast Corp is a Danish multinational company specializing in the development of products and services that assist individuals with intimate healthcare needs. The company provides a range of continence care products designed to help manage urinary incontinence effectively.

List of Key Companies

- B. Braun SE

- Becton, Dickinson and Company (BD)

- Boston Scientific Corporation

- Caldera Medical Inc.

- Cardinal Health

- Coloplast Corp

- Convatec Inc.

- Cook Group

- Hollister Incorporated

- Johnson & Johnson Services, Inc.

- Laborie

- Medtronic

- PROMEDON GmbH

- Teleflex Incorporated

- Zephyr Surgical Implants

Urinary Incontinence Devices Industry Developments

- November 2024: Boston Scientific Corporation completed the acquisition of Axonics, Inc., a medical technology company recognized for its innovative solutions for urinary and bowel dysfunction, including urethral bulking for women. This acquisition enhances Boston Scientific’s position in sacral neuromodulation, a rapidly growing segment of its urology business.

- November 2023: Coloplast allocated approximately USD 100.5 million (700 million DKK) to establish a new manufacturing facility in Portugal to support its future growth. The facility specializes in producing intermittent catheters for individuals having urinary retention, such as those with spinal cord injuries or spina bifida. This expansion aims to meet rising global demand, particularly in the European market.

Urinary Incontinence Devices Market Segmentation

By Category Outlook (Revenue-USD Million, 2020–2034)

- External Urinary Incontinence Device

- Internal Incontinence Device

By Product Outlook (Revenue-USD Million, 2020–2034)

- Urinary Catheters

- Foley Catheters

- Advanced Vaginal Slings

- Electrical Stimulation Devices

- Artificial Urinary Sphincters

- Other Devices

By Incontinence Type Outlook (Revenue-USD Million, 2020–2034)

- Urinary Incontinence

- Stress Urinary Incontinence

- Functional Urinary Incontinence

- Urge Urinary Incontinence

By End Use Outlook (Revenue-USD Million, 2020–2034)

- Hospitals

- Pharmacy

- Specialty Clinics

- Others

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Urinary Incontinence Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4,198.17 million |

|

Market Size Value in 2025 |

USD 4,653.67 million |

|

Revenue Forecast by 2034 |

USD 11,904.23 million |

|

CAGR |

11.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The urinary incontinence devices market has been segmented into detailed segments of category, product, incontinence type, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

Companies in the urinary incontinence devices market focus on growth and marketing strategies such as product innovation, strategic acquisitions, and geographic expansion to strengthen their market presence. Investments in research and development drive the introduction of advanced devices, including minimally invasive solutions and smart incontinence management systems. Collaborations with healthcare institutions and government initiatives help expand awareness and accessibility of incontinence care. Additionally, companies leverage digital marketing and direct-to-consumer campaigns to reduce stigma and encourage early diagnosis and treatment adoption. Expanding distribution networks and favorable reimbursement policies further support market growth.

FAQ's

The urinary incontinence devices market size was valued at USD 4,198.17 million in 2024 and is projected to grow to USD 11,904.23 million by 2034.

The market is projected to register a CAGR of 11.0% during the forecast period.

North America held the largest share of the market in 2024

A few key players in the market include B. Braun SE; Becton, Dickinson and Company (BD); Boston Scientific Corporation; Caldera Medical Inc.; Cardinal Health; Coloplast Corp; Convatec Inc.; Cook Group; Hollister Incorporated; Johnson & Johnson Services, Inc.; Laborie; Medtronic; PROMEDON GmbH; Teleflex Incorporated; and Zephyr Surgical Implants.

The internal incontinence devices segment accounted for a larger share of the market in 2024.

Urinary incontinence devices are medical products designed to manage or treat involuntary leakage of urine due to weakened bladder control or other underlying conditions. These devices help individuals suffering from different types of urinary incontinence, including stress, urge, functional, and overflow incontinence. Common urinary incontinence devices include urinary catheters, Foley catheters, urethral slings, electrical stimulation devices, artificial urinary sphincters, and absorbent products. They are used in hospitals, specialty clinics, and home care settings to improve patients' quality of life by providing effective bladder control solutions.