U.S. Anti-pollution Nasal Spray Market Size, Share, Trends, Analysis Report

By Product Type (Pollution Defense Products, Symptomatic Relief Nasal Sprays), By Distribution Channel – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 125

- Format: PDF

- Report ID: PM6058

- Base Year: 2024

- Historical Data: 2020-2023

Overview

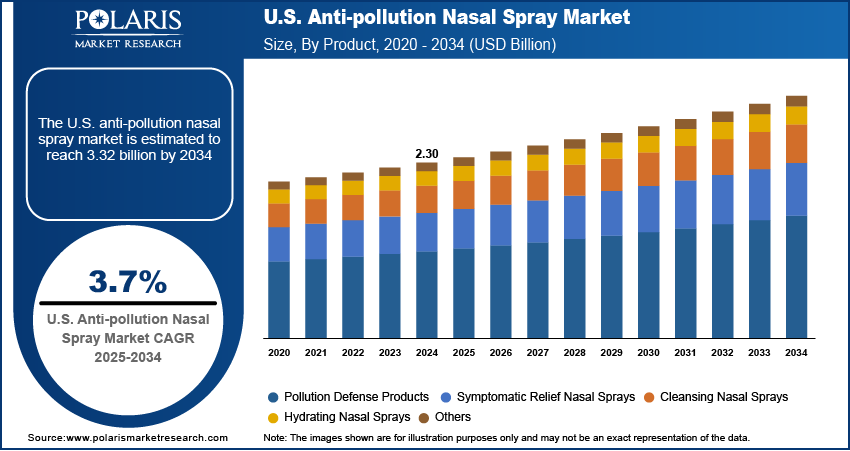

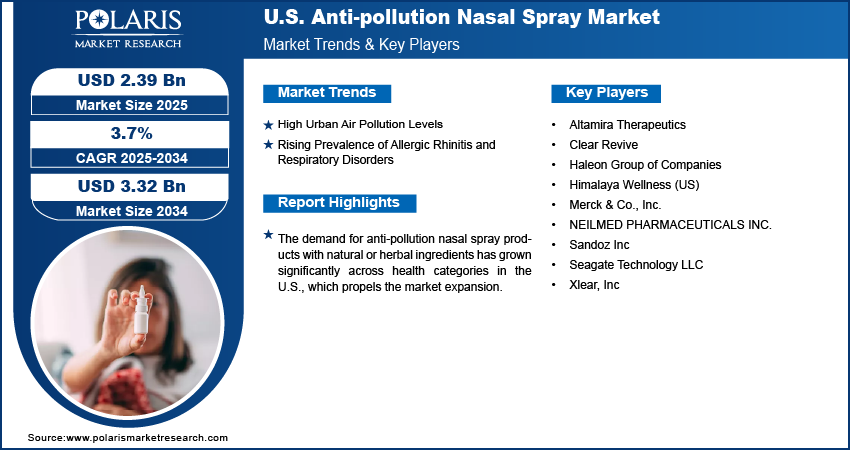

The U.S. anti-pollution nasal spray market size was valued at USD 2.30 billion in 2024, growing at a CAGR of 3.7% from 2025 to 2034. The growth is driven by high urban air pollution levels and the rising prevalence of allergic rhinitis and respiratory disorders.

Key Insights

- In 2024, the pollution defense products segment dominated with the largest share as these products are primarily used to create a protective barrier in the nasal cavity to prevent pollutants such as dust, allergens, and smog particles.

- The symptomatic relief nasal sprays segment is expected to experience significant growth during the forecast period due to the rising number of individuals reporting pollution-related nasal symptoms such as congestion, sneezing, and irritation.

- In 2024, the retail pharmacies segment dominated with the largest share as major pharmacy chains such as CVS, Walgreens, and Rite Aid provide consumers with convenient access to a wide variety of over-the-counter nasal care products.

- The online channels segment is expected to experience significant growth during the forecast period due to increasing preference for convenient, at-home shopping.

Industry Dynamics

- High urban air pollution levels drive the demand for anti-pollution nasal spray products.

- Rising prevalence of allergic rhinitis and respiratory disorders fuels the industry growth.

- The demand for nasal spray products with natural or herbal ingredients has grown significantly across health categories.

- Limited clinical evidence supporting the long-term efficacy and safety of anti-pollution nasal sprays hinders consumer trust and widespread adoption.

Market Statistics

- 2024 Market Size: USD 2.30 billion

- 2034 Projected Market Size: USD 3.32 billion

- CAGR (2025-2034): 3.7%

Anti-pollution nasal spray is a nasal formulation designed to protect the nasal passages from airborne pollutants, allergens, and particulate matter. It works by forming a protective barrier or cleansing the nasal cavity to reduce irritation and block pollutant entry. These sprays are often used in urban environments with high levels of air pollution to support respiratory health.

The U.S. healthcare sector has been shifting from treatment-based models to preventive care. Consumers are investing more in personal health products that help avoid illness rather than only treating symptoms. This trend is strongly supported by rising awareness of environmental health and wellness. Anti-pollution nasal sprays fit well within this shift, offering an easy and affordable method to prevent pollution-related nasal issues. Retail shelves and online retail platforms are increasingly offering these sprays as part of the broader preventive healthcare category as spending on wellness products grows, thereby driving the growth.

The U.S. has a mature and extensive retail infrastructure that supports over-the-counter (OTC) health product distribution. Drug store chains such as CVS, Walgreens, and Rite Aid, along with large retailers such as Walmart and Target, make anti-pollution nasal sprays easily accessible to consumers. These products are further featured on popular e-commerce platforms, including Amazon and brand websites. The broad availability helps raise product visibility and simplifies the purchasing process for both first-time users and regular buyers. Retail promotions, in-store pharmacist recommendations, and online reviews further encourage trial and repeat usage in the U.S., thereby driving the growth.

Drivers and Opportunities

High Urban Air Pollution Levels: In several major U.S. cities, air quality continues to decline due to vehicle emissions, industrial activities, and construction-related dust. Urban populations often experience nasal irritation, allergies, and respiratory issues due to airborne pollutants. This fuels a demand for preventive solutions such as anti-pollution nasal spray products. These products offer a noninvasive method for reducing pollutant exposure, particularly for people living in cities such as Los Angeles, New York, and Houston. Urban consumers increasingly turn to nasal sprays as part of their daily personal care routine as awareness of pollution-related health risks grows, thereby driving the U.S. anti-pollution nasal spray market growth.

Rising Prevalence of Allergic Rhinitis and Respiratory Disorder: The U.S. reports a high prevalence of allergic rhinitis, asthma, and other respiratory conditions. According to the Centers for Disease Control and Prevention, in 2021, 24.9 million people in the U.S. suffered from asthma. Many of these conditions are triggered or worsened by airborne pollutants and allergens. Consumers are actively seeking over-the-counter products that offer daily protection without requiring a prescription. Anti-pollution nasal sprays help create a physical barrier in the nasal passage, reducing the impact of irritants. These sprays are becoming part of routine allergy management in American households as health-conscious individuals seek effective ways to manage their symptoms effectively, especially in outdoor settings, thereby fueling the U.S. anti-pollution nasal spray market expansion.

Segmental Insights

Product Analysis

The U.S. anti-pollution nasal spray market segmentation, based on product, includes pollution defense products, symptomatic relief nasal sprays, cleansing nasal sprays, hydrating nasal sprays, and others. In 2024, the pollution defense products segment dominated with the largest share as these products are primarily used to create a protective barrier in the nasal cavity to prevent pollutants such as dust, allergens, and smog particles from entering the respiratory tract. Growing concerns about urban air quality and increasing awareness of preventive health practices have driven adoption. Consumers in cities with high pollution levels, such as Los Angeles and Chicago, are incorporating these sprays into their daily routines. The appeal of noninvasive and drug-free protection has contributed to their widespread use across different age groups, thereby driving the segment growth.

The symptomatic relief nasal sprays segment is expected to experience significant growth during the forecast period due to the rising number of individuals reporting pollution-related nasal symptoms such as congestion, sneezing, and irritation. These sprays contain soothing or decongestant ingredients that offer immediate relief. Demand is increasing among individuals with respiratory sensitivities who are seeking fast-acting, over-the-counter solutions. More consumers are turning to products that provide protection and symptom management as pollution levels fluctuate and seasonal allergies intensify. The availability of these sprays in natural and medicated formats is further expanding their reach in both urban and suburban areas, thereby propelling the segment growth.

Distribution Channel Analysis

The U.S. anti-pollution nasal spray market segmentation, based on distribution channel, includes online channels, retail pharmacies, supermarkets/general retail stores, and others. In 2024, the retail pharmacies segment dominated with the largest share as major pharmacy chains such as CVS, Walgreens, and Rite Aid provide consumers with convenient access to a wide variety of over-the-counter nasal care products. These stores benefit from strong brand trust, pharmacist recommendations, and consumer familiarity. In-store visibility and impulse purchases further contribute to sales. Many consumers prefer buying nasal sprays from brick-and-mortar stores where they seek professional advice. Widespread physical presence and consistent stocking across states further fuels the segment growth.

The online channels segment is expected to experience significant growth during the forecast period, due to increasing preference for convenient, at-home shopping. Consumers are using platforms such as Amazon, Walmart.com, and health brand websites to compare products, read reviews, and access niche or natural formulations not available in local stores. E-commerce enables access to better product variety and home delivery, which appeals especially to younger, tech-savvy demographics. Subscription models and targeted advertising are further driving repeat purchases, thereby boosting the segment growth.

.webp)

Key Players and Competitive Analysis

The U.S. anti-pollution nasal spray market features a moderately competitive landscape with several established and emerging players. Companies such as Altamira Therapeutics, Merck & Co., Inc., and Sandoz Inc offer medically focused products with strong clinical support. Haleon Group of Companies and NEILMED PHARMACEUTICALS INC. have wide distribution networks and maintain a significant retail presence through pharmacies and online platforms. Xlear, Inc., Himalaya Wellness (US), and Clear Revive focus on natural and herbal formulations, catering to the growing demand for chemical-free solutions. These companies often differentiate themselves through unique product ingredients, such as xylitol or saline blends. Seagate Technology LLC, though lesser-known in nasal care, participates with niche offerings targeting eco-conscious consumers. The market is witnessing increased emphasis on product efficacy, ease of use, and branding. Competitive strategies include product diversification, partnerships with healthcare providers, and targeted digital marketing to strengthen consumer awareness and brand loyalty in urban and high-pollution regions.

Key Players

- Altamira Therapeutics

- Clear Revive

- Haleon Group of Companies

- Himalaya Wellness (US)

- Merck & Co., Inc.

- NEILMED PHARMACEUTICALS INC.

- Sandoz Inc

- Seagate Technology LLC

- Xlear, Inc

U.S. Anti-Pollution Nasal Spray Industry Development

In July 2025, Lupin launched Ipratropium Bromide Nasal Solution in the U.S. market as a generic version of Atrovent, offering 0.03% and 0.06% strengths.

U.S. Anti-pollution Nasal Spray Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Pollution Defense Products

- Symptomatic Relief Nasal Sprays

- Cleansing Nasal Sprays

- Hydrating Nasal Sprays

- Others

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Online Channels

- Retail Pharmacies

- Supermarkets/General Retail Stores

- Others

U.S. Anti-pollution Nasal Spray Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.30 Billion |

|

Market Size in 2025 |

USD 2.39 Billion |

|

Revenue Forecast by 2034 |

USD 3.32 Billion |

|

CAGR |

3.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.30 billion in 2024 and is projected to grow to USD 3.32 billion by 2034.

The market is projected to register a CAGR of 3.7% during the forecast period.

A few of the key players in the market are Altamira Therapeutics; Clear Revive; Haleon Group of Companies; Himalaya Wellness (US); Merck & Co., Inc.; NEILMED PHARMACEUTICALS INC.; Sandoz Inc; Seagate Technology LLC; and Xlear, Inc.

The pollution defense products segment dominated the market share in 2024.

The online segment is expected to witness the significant growth during the forecast period.