U.S. Automotive Market Size, Share, & Industry Analysis Report

: By Vehicle Type (Passenger Car, Commercial Vehicle), By Propulsion Type (ICE Vehicle, Electric Vehicle) – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5921

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

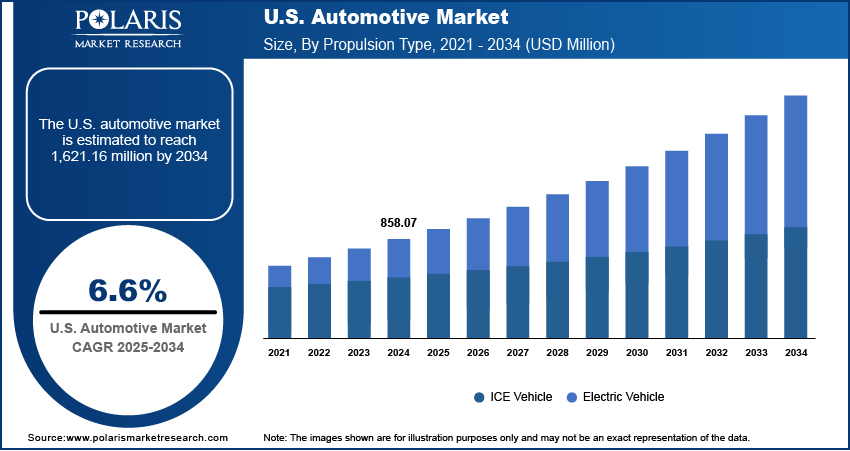

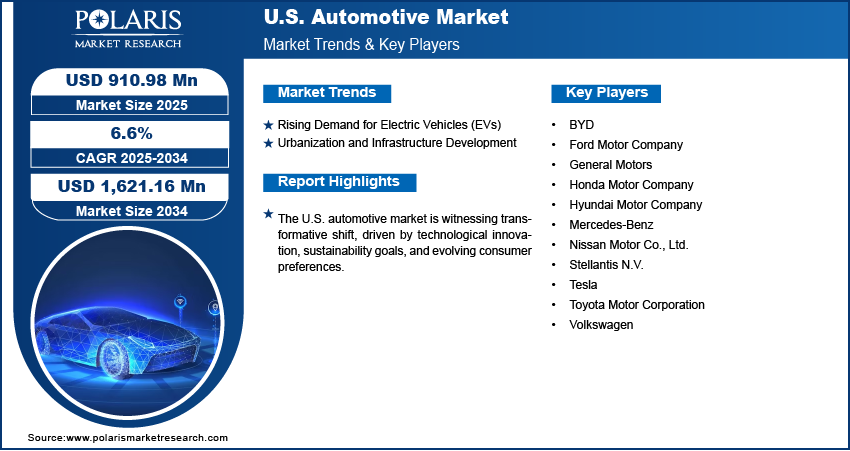

The U.S. automotive market size was valued at USD 858.07 million in 2024, growing at a CAGR of 6.6% from 2025 to 2034. The growth is being shaped by automaker investments in high-demand segments such as crossovers, SUVs, and pickups, alongside advancements in software-defined vehicles and smart manufacturing. Rising demand for electric vehicles (EVs) is further transforming the industry, supported by improving affordability and expanded credit availability. These trends reflect evolving consumer preferences and technological progress driving market growth.

The automotive sector refers to the industry involved in the design, development, manufacturing, and sale of motor vehicles. In the U.S., the market is experiencing momentum, driven by automaker investments in high-demand vehicle segments, including crossovers, SUVs, and pickup trucks. These vehicle types continue to align with consumer preferences for performance, space, and versatility, driving consistent demand. Manufacturers are strategically expanding model offerings in these categories, balancing utility with enhanced comfort and advanced in-vehicle features. This targeted investment approach supports sales volume and also strengthens brand loyalty and market competitiveness.

To Understand More About this Research: Request a Free Sample Report

Advancements in automotive manufacturing are reshaping the industry’s operational framework. Automation, digitized production lines, and the emergence of software-defined vehicles are revolutionizing the engineering and assembly of vehicles. Automakers are increasingly adopting integrated software platforms that enable real-time updates and enhanced vehicle functionality post-sale, thereby creating new value streams. For instance, in April 2025, Nissan announced that it will introduce next-gen ProPILOT in FY2027, combining its Ground Truth Perception Lidar with Wayve's AI Driver software. The system enhances collision avoidance and adapts to complex driving scenarios using AI learning, advancing autonomous capabilities. These innovations optimize production efficiency, reduce complexity, and enable more agile responses to market changes. Therefore, as the industry moves toward more connected and intelligent vehicles, advanced manufacturing technologies serve as a major enabler of long-term growth and competitiveness in the U.S. market.

Industry Dynamics

Rising Demand for Electric Vehicles (EVs)

Consumers and governments are prioritizing energy efficient transportation solutions, leading to a rise in EV adoption across the U.S. According to a 2024 IEA report, electric car registrations in the country reached 1.4 million units in 2023, reflecting a growth of over 40% year-over-year, highlighting accelerating consumer adoption of EVs. Automakers are investing heavily in battery technology, electric vehicle charging infrastructure, and production scalability to meet this growing demand driven by the shift toward sustainable mobility and the need to reduce carbon emissions. Additionally, advancements in battery efficiency, such as solid-state batteries, nickel-rich cathodes, lithium-sulfur chemistries, and composite materials, aim to improve energy storage efficiency in compact, lightweight designs for advanced applications. Also, cost reduction is making EVs more accessible to a broader market. This transition is reshaping vehicle design, supply chains, and manufacturing processes, positioning EVs as a central component of the industry's future. As environmental regulations become stricter, the automotive sector is accelerating its shift toward electrification to align with long-term sustainability goals. Thus, rising EV demand propels the U.S. automotive market expansion.

Improving Vehicle Affordability and Expanding Credit Availability

Improving vehicle affordability and expanding credit availability are driving growth opportunities, as they directly influence consumer purchasing power and access to credit. Vehicles become attainable to a broader demographic as manufacturers introduce more competitively priced models across various segments. At the same time, the availability of flexible financing options, low-interest loans, and extended repayment plans makes it easier for consumers to manage large-ticket purchases. For instance, the U.S. federal EV tax credit provides up to USD 7,500 for qualifying new plug-in electric vehicles through 2032. Eligibility depends on income ranging from USD 150,000 to USD 300,000 (based on filing status), vehicle price caps, and specific requirements for sourcing battery components and critical minerals. This combination enables first-time vehicle ownership and also boosts repeat purchases and upgrades. These factors help sustain consistent demand across both new and pre-owned vehicle segments by lowering financial barriers. Furthermore, they support stable production volumes and strengthen the overall resilience of the automotive ecosystem.

Segmental Insights

Vehicle Type Analysis

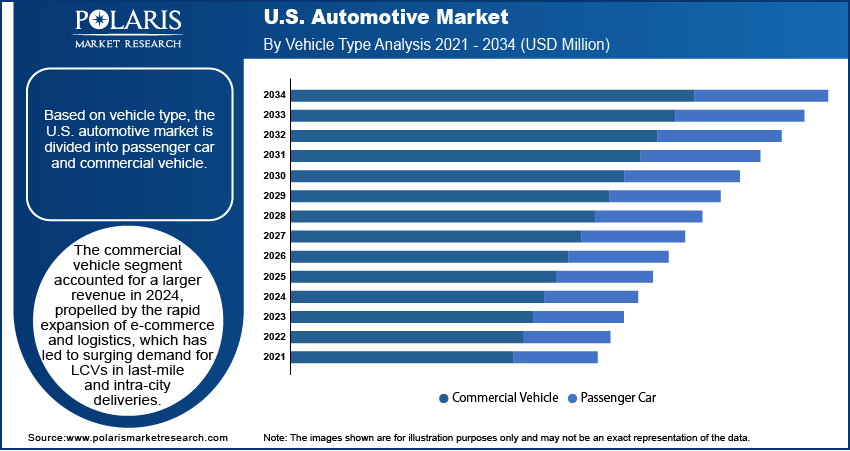

The segmentation, based on vehicle type, includes passenger car and commercial vehicle. The commercial vehicle segment accounted for the largest revenue share valued in 2024, propelled by the rapid expansion of e-commerce and logistics, which has led to surging demand for LCVs in last-mile and intra-city deliveries. E-retailers and logistics companies are continuously expanding their fleets to meet faster delivery timelines and service growing online consumer bases. Additionally, industrialization and infrastructure development, driven by rising government spending, are stimulating demand for medium- and heavy-duty vehicles. According to the Council on Foreign Relations, the IIJA in the U.S. included USD 550 billion in spending to upgrade physical infrastructure, such as roads, bridges, railways, airports, and water systems. These vehicles are crucial for transporting raw materials, machinery, and finished goods over long distances.

Propulsion Type Analysis

The segmentation, based on propulsion type, includes ICE vehicle and electric vehicle. The electric vehicle segment is expected to witness the fastest growth during the forecast period, driven by increasing environmental awareness and supportive regulatory policies promoting clean energy transportation. Advancement in battery technology, improved charging infrastructure, and cost reductions in EV components are making EVs more affordable and efficient. Automakers are accelerating their electrification strategies, expanding EV portfolios to meet rising consumer demand. Public investment in EV charging infrastructure is expanding rapidly, making EV ownership more feasible and attractive for consumers and fleet operators. Additionally, strict emissions regulations and incentives for EV adoption are boosting U.S. automotive market growth. Therefore, as global efforts to achieve carbon neutrality amplify, the transition to electric mobility is expected to gain effective momentum, driving the rapid expansion of the EV segment.

Key Players and Competitive Analysis

The U.S. automotive sector is witnessing competition as traditional OEMs confront disruptions from electric vehicle pioneers and technology companies. Ford, General Motors, and others are making strategic investments in electrification and autonomous technologies to counter the dominance of emerging manufacturers. Revenue opportunities are shifting toward software-defined vehicles and subscription services, with competitive intelligence revealing that technology partnerships have become critical differentiators. Small and medium-sized businesses specializing in EV components and semiconductor solutions are capturing a significant share of the vendor market as supply chain disruptions force OEMs to diversify their supplier networks. Economic and geopolitical shifts, particularly trade tensions with China, are accelerating domestic manufacturing investments and reshoring initiatives. Sustainable value chains have emerged as competitive advantages, with companies such as GM and Ford investing heavily in circular economy practices. Industry trends show consolidation through joint ventures and mergers, particularly in autonomous driving capabilities.

A few key players are BYD; General Motors; Honda Motor Company; Hyundai Motor Company; Mercedes-Benz; Nissan Motor Co., Ltd.; Stellantis N.V.; Suzuki Motor Corporation; Tesla; Toyota Motor Corporation; and Volkswagen.

Key Players

- BYD

- Ford Motor Company

- General Motors

- Honda Motor Company

- Hyundai Motor Company

- Mercedes-Benz

- Nissan Motor Co., Ltd.

- Stellantis N.V.

- Tesla

- Toyota Motor Corporation

- Volkswagen

Industry Developments

June 2025: General Motors delivered the first hand-built Cadillac CELESTIQ to its owner in a private ceremony at the General Motors Global Technical Center.

March 2025: Hyundai Motor Group planned a USD 21 billion investment in the U.S. through 2028, allocating USD 9 billion for production expansion to 1.2 million annual units, USD 6 billion for supply chain localization, and USD 6 billion for future technologies and charging infrastructure development.

U.S. Automotive Market Segmentation

By Vehicle Type Outlook (Revenue, USD Million, 2020–2034)

- Passenger Car

- Hatchback

- Sedan

- SUV

- MUV

- Commercial Vehicle

- LCVs

- Heavy Trucks

- Buses & Coaches

By Propulsion Type Outlook (Revenue, USD Million, 2020–2034)

- ICE Vehicle

- Electric Vehicle

U.S. Automotive Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 858.07 million |

|

Market Size in 2025 |

USD 910.98 million |

|

Revenue Forecast by 2034 |

USD 1,621.16 million |

|

CAGR |

6.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 858.07 million in 2024 and is projected to grow to USD 1,621.16 million by 2034.

The market is projected to register a CAGR of 6.6% during the forecast period.

A few of the key players in the market are BYD; General Motors; Honda Motor Company; Hyundai Motor Company; Mercedes-Benz; Nissan Motor Co., Ltd.; Stellantis N.V.; Suzuki Motor Corporation; Tesla; and Toyota Motor Corporation; and Volkswagen.

The commercial vehicle segment accounted for the largest revenue share in 2024.

The electric vehicle segment is expected to witness the fastest growth during the forecast period.