U.S. Breast Prosthetic Market Size, Share, Trends, Industry Analysis Report

By Product (Silicone Prosthesis, Foam Prosthesis), By Material, By Usage, By Distribution Channel– Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 125

- Format: PDF

- Report ID: PM5983

- Base Year: 2024

- Historical Data: 2020-2023

Overview

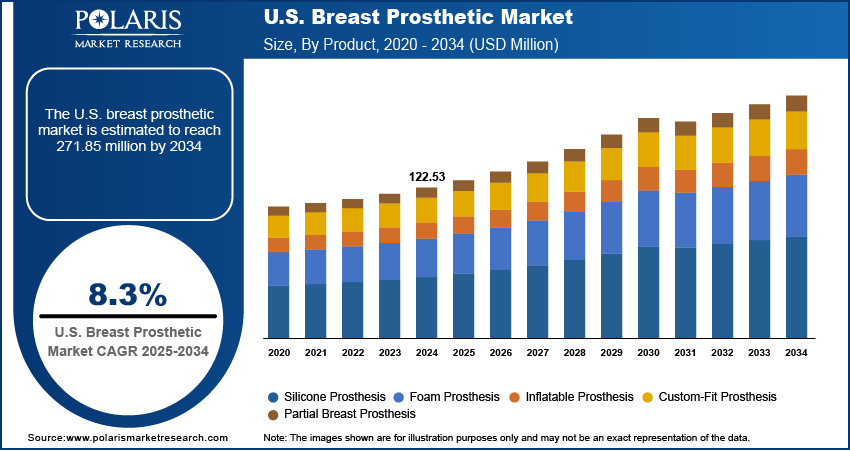

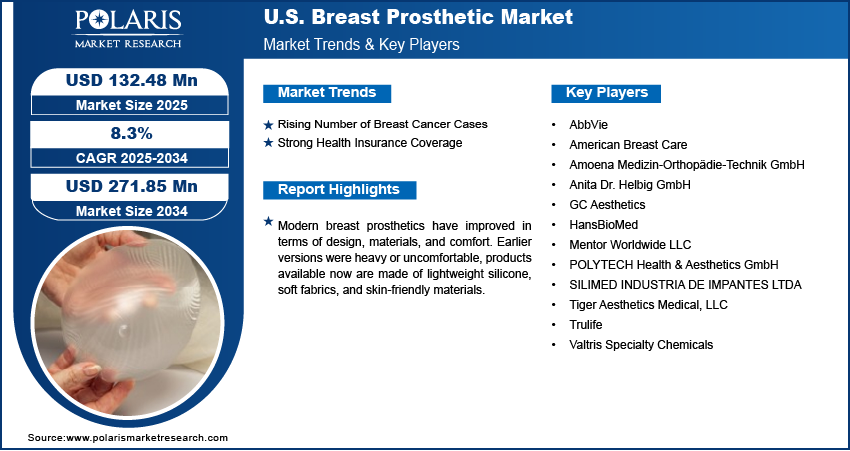

The U.S. breast prosthetic market size was valued at USD 122.53 million in 2024, growing at a CAGR of 8.3% from 2025 to 2034. The growth is driven by the rising number of breast cancer cases and growing reconstructive and cosmetic surgeries.

Key Insights

- In 2024, the silicone prosthesis segment dominated with the largest share due to their realistic feel, comfort, and long-term durability.

- The latex segment is expected to experience significant growth during the forecast period, due to their lower cost and improving comfort features.

- In 2024, the cosmetic improvement segment dominated with the largest share, driven by rising body awareness and lifestyle choices.

- The online retail segment is expected to experience significant growth during the forecast period due to the increasing preference for convenience and availability for wider product selection.

To Understand More About this Research: Request a Free Sample Report

A breast prosthetic is an artificial breast form designed to replace the shape of all or part of a breast that has been removed due to a mastectomy or other medical conditions. This prosthetic can be worn externally inside a bra or surgically implanted as a breast implant. It helps restore body symmetry, enhances self-confidence, and supports emotional recovery for individuals after breast surgery.

There are many trained mastectomy fitters and specialty stores in the U.S. that help women find the right prosthetic for their body. These professionals provide custom fittings and product education, making the experience more personalized and comfortable. Having access to such services makes it easier for women to choose prosthetics that match their lifestyle and needs. This level of care increases customer satisfaction and drives repeat purchases. The presence of professional support systems is making the U.S. breast prosthetic industry one of the most trusted and well-developed globally.

The U.S. is home to many major players offering breast prosthetic, including American Breast Care, Trulife, and Mentor Worldwide. These companies offer a wide range of products for different needs and price points. Their strong brand presence, wide distribution channels, and consistent marketing efforts keep breast prosthetics visible and accessible. Regular product launches and educational campaigns help raise awareness and increase consumer trust. The competition among these established brands further boosts innovation and improves overall quality, which drives the U.S. breast prosthetic market demand.

Industry Dynamics

- Rising number of breast cancer cases is driving the demand for breast prosthetics.

- Growth in reconstructive and cosmetic surgeries is fueling the U.S. breast prosthetic market growth.

- Strong health insurance coverage is fueling the number of cosmetic surgeries, thereby driving the demand for breast prosthetics.

- High cost of advanced breast prosthetics, such as adjustable silicone forms, limits accessibility for patients without adequate insurance coverage.

Rising Number of Breast Cancer Cases: The U.S. has one of the highest rates of breast cancer in the world. According to the Breast Cancer Organization, breast cancer accounts for more than 30% of total cancer cases every year in the country. Many women undergo mastectomy as part of their treatment, which creates a strong need for breast prosthetics to help with recovery and body image. More women survive and seek solutions like prosthetics to support their daily lives as early detection improves. This rising number of breast cancer survivors plays a major role in driving the demand for breast prosthetic in the U.S, as these individuals look for high-quality, comfortable, and natural-looking options during and after treatment.

Strong Health Insurance Coverage: The insurance support in the U.S is highly developed. Many private health insurance plans, along with Medicare, cover breast prosthetics for post-mastectomy patients. This reduces the financial burden and encourages more women to choose prosthetics as part of their recovery. It further allows them to access better quality products, including premium silicone options. Manufacturers can introduce more advanced features with insurance helping cover the cost, knowing patients are more likely to afford them. This support makes the U.S. more accessible and stable for both buyers and sellers, thereby driving the U.S. breast prosthetic market growth.

Segmental Insights

Product Analysis

The U.S. breast prosthetic market segmentation, based on product, includes silicone prosthesis, foam prosthesis, inflatable prosthesis, custom-fit prosthesis, and partial breast prosthesis. In 2024, the silicone prosthesis segment dominated with the largest share due to its realistic feel, comfort, and long-term durability. American consumers prefer high-quality solutions, and silicone forms provide a natural appearance that supports both daily wear and self-confidence. These products are widely available through hospitals, specialty stores, and certified fitters. Many U.S. health insurance plans further cover silicone prosthetics, making them accessible for a large number of women recovering from mastectomy. Silicone remains the preferred choice across various age groups and lifestyles with strong clinical recommendations and user satisfaction, thereby driving the segment growth.

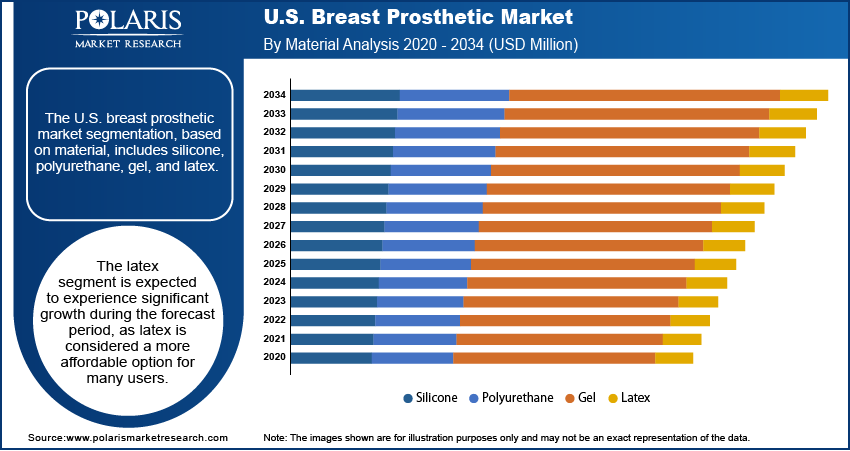

Material Analysis

The U.S. breast prosthetic market, based on material, is segmented into silicone, polyurethane, gel, and latex. The latex segment is expected to experience significant growth during the forecast period, due to their lower price and improving comfort features. Latex options are expected to grow as more women seek affordable yet functional alternatives. Newer latex designs are becoming softer, lighter, and more skin-friendly, addressing earlier concerns about irritation or allergies. The increasing awareness and demand for economic solutions, particularly among younger and uninsured patients is driving the segment growth.

Usage Analysis

Based on usage, the U.S. breast prosthetic market is segmented into post-mastectomy, post-lumpectomy, reconstructive surgery, and cosmetic improvement. In 2024, the cosmetic improvement segment dominated with the largest share, driven by rising body awareness and lifestyle choices. Many women use prosthetics to improve symmetry or improve appearance without undergoing surgery. This is common among those who have uneven breasts, experienced lumpectomy, or simply prefer a noninvasive solution. The trend is particularly strong in urban areas where aesthetic products are in higher demand. The focus on body confidence and fashion fit has helped expand the use of breast prosthetics beyond post-surgical needs into everyday cosmetic use, thereby driving the segment growth.

Distribution Channel Analysis

The U.S. breast prosthetic market segmentation, based on distribution channel, includes online retail, specialty stores, hospitals and clinics, and pharmacies. The online retail segment is expected to experience significant growth during the forecast period. Due to the increasing preference for convenience and availability for wider product selection, many women shop for prosthetics online. U.S.-based e-commerce platforms, including brand-owned websites and medical product retailers, enable users to browse sizes, read reviews, and place orders from the comfort of their home. The COVID-19 pandemic further accelerated this shift toward online retail platforms, thereby driving the segment growth.

Key Players and Competitive Analysis

The U.S. breast prosthetic market is highly competitive, with international and domestic players offering a wide range of products tailored to post-mastectomy and cosmetic needs. Key players such as American Breast Care, Trulife, and Mentor Worldwide LLC have a strong presence across the U.S., supported by extensive distribution networks and certified fitters. Companies such as Amoena and Anita Dr. Helbig GmbH also hold a notable share due to their premium silicone products and advanced technologies such as adjustable air chambers. The market sees growing interest in lightweight and custom-fit solutions, prompting innovation from players such as GC Aesthetics and HansBioMed. Additionally, increasing online retail has allowed brands to expand their direct-to-consumer reach.

Key Players

- AbbVie

- American Breast Care

- Amoena Medizin-Orthopädie-Technik GmbH

- Anita Dr. Helbig GmbH

- GC Aesthetics

- HansBioMed

- Mentor Worldwide LLC

- POLYTECH Health & Aesthetics GmbH

- SILIMED INDUSTRIA DE IMPANTES LTDA

- Tiger Aesthetics Medical, LLC

- Trulife

- Valtris Specialty Chemicals

Industry Developments

In April 2023, Amoena launched Adapt Air breast form, featuring adjustable air chamber technology, lightweight silicone, and Comfort+ for a customizable fit and all-day comfort after mastectomy.

U.S. Breast Prosthetic Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Silicone Prosthesis

- Foam Prosthesis

- Inflatable Prosthesis

- Custom-Fit Prosthesis

- Partial Breast Prosthesis

By Material Outlook (Revenue, USD Million, 2020–2034)

- Silicone

- Polyurethane

- Gel

- Latex

By Usage Outlook (Revenue, USD Million, 2020–2034)

- Post-Mastectomy

- Post-Lumpectomy

- Reconstructive Surgery

- Cosmetic Improvement

By Distribution Channel Outlook (Revenue, USD Million, 2020–2034)

- Online Retail

- Specialty Stores

- Hospitals and Clinics

- Pharmacies

U.S. Breast Prosthetic Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 122.53 Million |

|

Market Size in 2025 |

USD 132.48 Million |

|

Revenue Forecast by 2034 |

USD 271.85 Million |

|

CAGR |

8.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 122.53 million in 2024 and is projected to grow to USD 271.85 million by 2034.

The market is projected to register a CAGR of 8.3% during the forecast period.

A few of the key players in the market are AbbVie; American Breast Care; Amoena Medizin-Orthopädie-Technik GmbH; Anita Dr. Helbig GmbH; GC Aesthetics; HansBioMed; Mentor Worldwide LLC; POLYTECH Health & Aesthetics GmbH; SILIMED INDUSTRIA DE IMPANTES LTDA; Tiger Aesthetics Medical, LLC; Trulife; and Valtris Specialty Chemicals.

The silicone prosthesis segment dominated the market share in 2024.

The latex segment is expected to witness the significant growth during the forecast period.