US Cardiovascular Device Market Size, Share, Trends, Industry Analysis Report

By Device Type (Diagnostic and Monitoring Devices, Therapeutic and Surgical Device), By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 125

- Format: PDF

- Report ID: PM5834

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

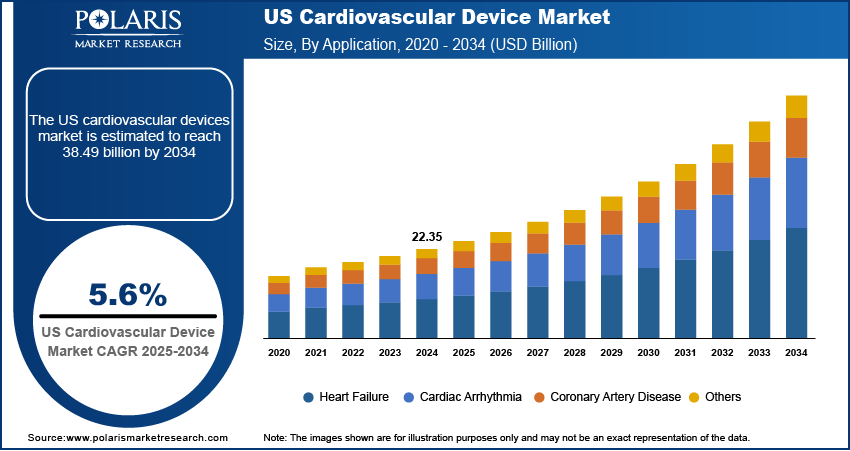

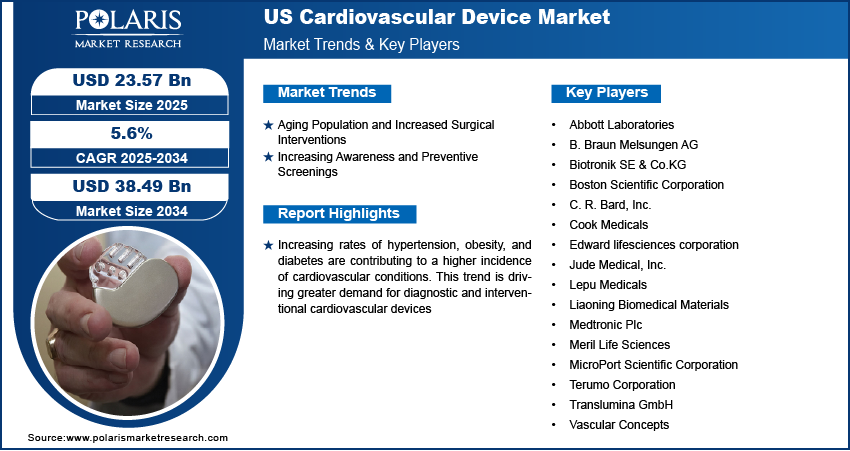

The US cardiovascular device market size was valued at USD 22.35 billion in 2024 and is projected to register a CAGR of 5.6% from 2025 to 2034.

Increasing rates of hypertension, obesity, and diabetes are contributing to a higher incidence of cardiovascular conditions. This trend is driving greater demand for diagnostic and interventional cardiovascular devices across hospitals, clinics, and ambulatory centers to improve treatment outcomes and reduce mortality.

A cardiovascular device is a medical instrument or implant used to diagnose, treat, or manage heart and blood vessel-related conditions. These devices include pacemakers, stents, heart valves, and defibrillators, all designed to improve heart function and prevent or manage cardiovascular diseases. Various cardiovascular devices such as pacemakers, vascular stents, and heart valves are essential for treating and managing conditions such as heart failure, arrhythmias, and coronary artery disease. Innovations such as AI-based diagnostic tools, next-gen stents, leadless pacemakers, and wearable cardiac monitors are transforming disease management. These advancements are improving early detection, patient monitoring, and treatment precision, making newer devices more appealing to both providers and patients. In June 2024, AliveCor launched the Kardia 12L ECG System, featuring AI-powered technology, which detects 35 cardiac conditions using a reduced lead, revolutionizing cardiac care. These developments make devices more effective, safer, and user-friendly, boosting demand for advanced cardiovascular technologies and thereby driving the U.S. cardiovascular device market growth.

To Understand More About this Research: Request a Free Sample Report

Supportive reimbursement frameworks from Medicare and Medicaid for cardiovascular procedures and devices are enhancing affordability and access. Regulatory pathways encouraging faster approval of innovative cardiac technologies also promote faster adoption across healthcare systems. Additionally, sedentary lifestyles, poor diets, and stress are contributing to a surge in heart conditions among younger demographics. This shift is prompting early interventions using wearable heart monitors, smart diagnostic systems, and implantable devices to manage long-term risk.

Market Dynamics

Rising Aging Population Susceptible to Cardiovascular Conditions

The rising proportion of older adults in the U.S. is leading to a growing number of patients affected by cardiovascular conditions such as arrhythmias, aortic stenosis, and coronary artery disease. According to the Population Reference Bureau, the U.S. demographic of individuals aged 65 and above is anticipated to grow significantly from 58 million in 2022 to 82 million by 2050, reflecting a 47% increase. Older individuals often require surgical procedures, including pacemaker implantation, angioplasty, and valve replacement, to manage these conditions effectively. This demographic shift is creating sustained demand for high-performance cardiovascular devices that are durable and also compatible with minimally invasive techniques. Manufacturers are focusing on developing compact and precise devices that reduce surgical risks and improve recovery times for elderly patients. Hospitals and cardiac centers are also increasing investments in advanced technologies to cater to the specific needs of geriatric populations, further fueling U.S. cardiovascular device market expansion.

Increasing Awareness and Preventive Screenings

Efforts to raise awareness about cardiovascular health through public health campaigns and wellness programs are encouraging more people to undergo regular heart screenings. Early testing for blood pressure, cholesterol, and ECG abnormalities is becoming common, prompting earlier detection of potential issues before they become severe. Patients are also becoming more proactive in managing their heart health, leading to a rise in the use of noninvasive diagnostic tools and wearable medical devices. Healthcare providers are expanding preventive care services and using data-driven insights to tailor treatment strategies. The importance of prevention is reducing hospital admissions for advanced conditions while driving demand for precise, easy-to-use diagnostic cardiovascular devices.

Segment Analysis

Device Type Outlook

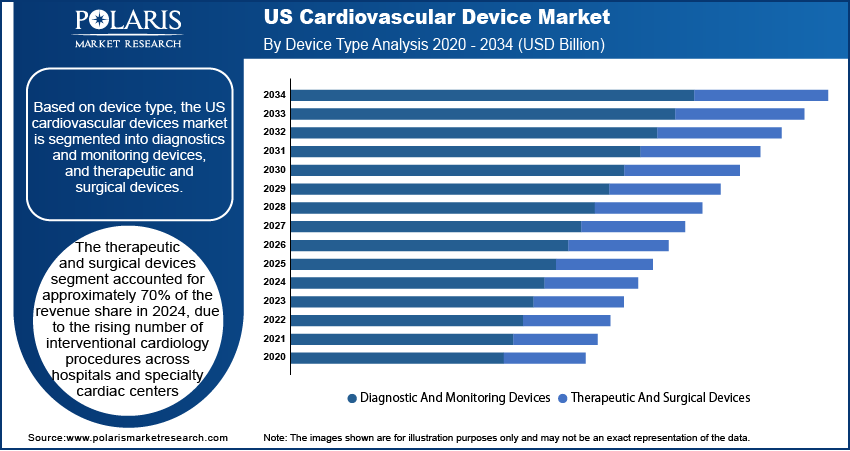

Based on device type, the U.S. cardiovascular device market is segmented into diagnostics and monitoring devices, and therapeutic and surgical devices. The therapeutic and surgical devices segment accounted for approximately 70% of the revenue share in 2024 due to the rising number of interventional cardiology procedures across hospitals and specialty cardiac centers. The growing prevalence of complex heart conditions such as coronary artery disease, valve disorders, and arrhythmias is leading to increased use of stents, pacemakers, implantable defibrillators, and valve repair devices. According to the National Library of Medicine, Coronary artery disease (CAD) is responsible for an estimated 610,000 fatalities each year, representing roughly 25% of all deaths in the U.S. Physicians are relying more on minimally invasive procedures that use next-generation surgical tools, reducing patient recovery time and improving procedural outcomes. Strong demand from high-risk cardiac patients and growing adoption of advanced surgical techniques across major healthcare networks are further contributing to the expansion of this segment. In addition, continuous product upgrades in terms of device compatibility, wireless connectivity, and battery life are making these tools more attractive to both clinicians and patients.

The diagnostics and monitoring devices segment is expected to register the highest CAGR during the forecast period due to increasing emphasis on early detection and real-time monitoring of cardiac conditions. The growing popularity of wearable ECG monitors, remote telemetry, and AI-integrated diagnostic tools is transforming how physicians track heart health and respond to abnormalities. Patients having chronic conditions are turning to portable monitoring systems for continuous assessment, especially outside of clinical environments. Innovations in compact diagnostic imaging and noninvasive tools are expanding usage in outpatient and home care settings. Increasing awareness of preventive cardiac care is driving uptake among younger and health-conscious individuals, accelerating market penetration. In addition, the demand for integrated diagnostic platforms that deliver accurate, fast, and user-friendly cardiac assessments is gaining momentum across both primary care and specialized settings.

Application Outlook

Based on application, the U.S. cardiovascular device market is segmented into heart failure, cardiac arrhythmia, coronary artery disease, and others. The coronary artery disease segment accounted for the largest revenue share in 2024 due to its widespread prevalence across the adult population and high incidence among aging individuals. For instance, according to the U.S. Centers for Disease Control and Prevention, coronary heart disease (CHD) is the leading type of heart disease, causing 371,506 deaths in 2022. It affects approximately 5% of adults aged 20 and older, or 1 in 20 individuals. Lifestyle factors such as poor diet, physical inactivity, and smoking are contributing to arterial plaque buildup, making coronary blockages one of the most treated cardiovascular conditions. This rising burden is driving consistent demand for stents, angioplasty catheters, and drug-eluting balloons across the U.S. health system. Increasing preference for minimally invasive revascularization techniques is also influencing procedure volume. Hospitals and heart centers are continuously adopting advanced interventional cardiology systems to address these cases efficiently. Availability of high-end surgical equipment and growing coverage under insurance plans are allowing wider access to treatment. Strong investments in research and development for novel stent materials and bioresorbable scaffolds further strengthen the segment’s market position.

The cardiac arrhythmia segment is expected to witness the fastest growth rate during the forecast period, due to the increasing incidence of atrial fibrillation, bradycardia, and ventricular tachycardia among both older and younger populations. The rise in wearable monitoring technologies and early diagnostic tools is allowing for faster and more accurate detection of rhythm irregularities. Demand for implantable cardioverter defibrillators (ICDs), cardiac resynchronization therapy (CRT) devices, and catheter ablation systems is steadily increasing in response to clinical guidelines recommending early intervention. Healthcare providers are also expanding electrophysiology labs and offering specialized care pathways to manage arrhythmic conditions more effectively. Technological improvements in leadless pacemakers and wireless cardiac monitors are enhancing patient comfort and procedural success. The growing focus on rhythm management through personalized therapy and smart monitoring tools is expected to drive adoption across clinical and home-based care environments.

End User Outlook

Based on end user, the segmentation includes hospitals, ambulatory surgical centers, and specialty clinics. The hospitals segment accounted for approximately 60% of the revenue share in 2024 due to their comprehensive infrastructure for handling complex cardiovascular interventions and emergency cardiac care. Large multispecialty hospitals have well-equipped catheterization labs, cardiac surgical theaters, and intensive care units that support high volumes of both elective and urgent procedures. Access to skilled cardiologists, multidisciplinary teams, and post-operative care facilities makes hospitals the preferred choice for critical interventions such as bypass surgeries, valve replacements, and stent placements. Advanced procurement capabilities allow hospitals to adopt the latest generation of cardiovascular devices quickly. In addition, favorable reimbursement models and integration with insurance providers support higher patient throughput and revenue. Hospitals also lead in clinical trials and adoption of newly approved technologies, giving them an edge in delivering innovative cardiac care.

The ambulatory surgical centers (ASCs) segment is expected to witness the fastest growth rate during the forecast period, due to a growing shift toward cost-efficient, same-day cardiovascular procedures. Patients increasingly prefer outpatient settings that offer shorter wait times, lower procedural costs, and quicker recovery. Advances in catheter-based and minimally invasive cardiac technologies are enabling safe and effective treatments in ASCs without the need for overnight hospital stays. These centers are rapidly upgrading facilities to meet accreditation standards for cardiovascular procedures, attracting both patients and physicians. Expansion of value-based care models and insurer preference for outpatient treatment paths are boosting ASC procedure volumes. Investments in compact diagnostic tools and portable interventional systems are supporting the trend, making ASCs a high-growth channel for cardiovascular device usage in the US.

Key Players and Competitive Analysis

The competitive landscape of the U.S. cardiovascular device market is shaped by continuous innovation, strategic partnerships, and aggressive market expansion strategies aimed at addressing the rising burden of heart-related conditions. Industry analysis highlights a clear focus on enhancing product portfolios through mergers and acquisitions, enabling established players to integrate advanced technologies such as AI-powered diagnostics, next-generation stents, and wireless implantable devices into their offerings. Strategic alliances between device manufacturers and healthcare providers are fostering the co-development of value-based solutions that improve patient outcomes while reducing procedural costs.

Post-merger integration efforts have led to streamlined R&D pipelines and expanded distribution capabilities across hospitals and ambulatory centers. Technology advancements remain a key competitive lever, particularly in minimally invasive surgical tools, wearable cardiac monitors, and remote patient management platforms. Joint ventures are also accelerating innovation in digital cardiology and interventional systems. Companies are targeting niche markets such as transcatheter valve therapies, structural heart interventions, and arrhythmia management to differentiate their positioning.

Rising demand for data-integrated, user-friendly devices is driving investments in interoperability and software-driven monitoring systems. The competitive intensity is expected to increase in the future as regulatory agencies promote faster approvals and value-based reimbursement models continue to gain traction.

List of Key Companies in US Cardiovascular Device Market

- Abbott Laboratories

- B. Braun Melsungen AG

- Biotronik SE & Co.KG

- Boston Scientific Corporation

- C. R. Bard, Inc.

- Cook Medicals

- Edward lifesciences corporation

- Jude Medical, Inc.

- Lepu Medicals

- Liaoning Biomedical Materials

- Medtronic Plc

- Meril Life Sciences

- MicroPort Scientific Corporation

- Terumo Corporation

- Translumina GmbH

- Vascular Concepts

US Cardiovascular Devices Industry Developments

In March 2025, Abbott obtained CE Mark certification for its Volt Pulsed Field Ablation System, designed specifically for the treatment of patients suffering from arrhythmias. This system utilizes advanced pulsed field ablation technology to selectively target and ablate cardiac tissue, offering a novel approach to managing abnormal heart rhythms.

In November 2024, Johnson & Johnson MedTech secured FDA approval for the VARIPULSE Pulsed Field Ablation (PFA) platform, specifically designed for the ablation of atrial fibrillation (AF).

In January 2024, Boston Scientific secured FDA approval for the FARAPULSE Pulsed Field Ablation System, a significant advancement in the ablation technology landscape. This system utilizes pulsed field ablation (PFA), a novel approach that leverages non-thermal energy to selectively target cardiac tissue, minimizing damage to surrounding structures.

U.S. Cardiovascular Device Market Segmentation

By Device Type Outlook (Revenue USD Billion, 2020–2034)

- Diagnostic and Monitoring Devices

- Electrocardiogram

- Remote Cardiac Monitoring

- MRI

- Others

- Therapeutic and Surgical Devices

- Ventricular Assist Devices

- Cardiac Rhythm Management Devices

- Catheter

- Stents

- Others

By Application Outlook (Revenue USD Billion, 2020–2034)

- Heart Failure

- Cardiac Arrhythmia

- Coronary Artery Disease

- Others

By End Use Outlook (Revenue USD Billion, 2020–2034)

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

U.S. Cardiovascular Device Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 22.35 billion |

|

Market Size in 2025 |

USD 23.57 billion |

|

Revenue Forecast by 2034 |

USD 38.49 billion |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. cardiovascular device market size was valued at USD 22.35 billion in 2024 and is projected to grow to USD 38.49 billion by 2034.

The US market is projected to register a CAGR of 5.6% during the forecast period.

A few key players in the market are Abbott Laboratories; B. Braun Melsungen AG; Biotronik SE & Co.KG; Boston Scientific Corporation; C. R. Bard, Inc.; Cook Medicals; Lepu Medicals; Liaoning Biomedical Materials; Medtronic Plc; Meril Life Sciences; MicroPort Scientific Corporation; Terumo Corporation; Translumina GmbH; Vascular Concepts; Jude Medical, Inc.; and Edward Lifesciences Corporation.

The therapeutic and surgical devices segment accounted for approximately 70% of the revenue share in 2024 due to the rising number of interventional cardiology procedures across hospitals and specialty cardiac centers.

The coronary artery disease segment accounted for the largest revenue share in 2024, due to its widespread prevalence of high incidence of cardiovascular disease among aging individuals.