U.S. CBD Pouches Market Size, Share, Trends, Industry Analysis Report

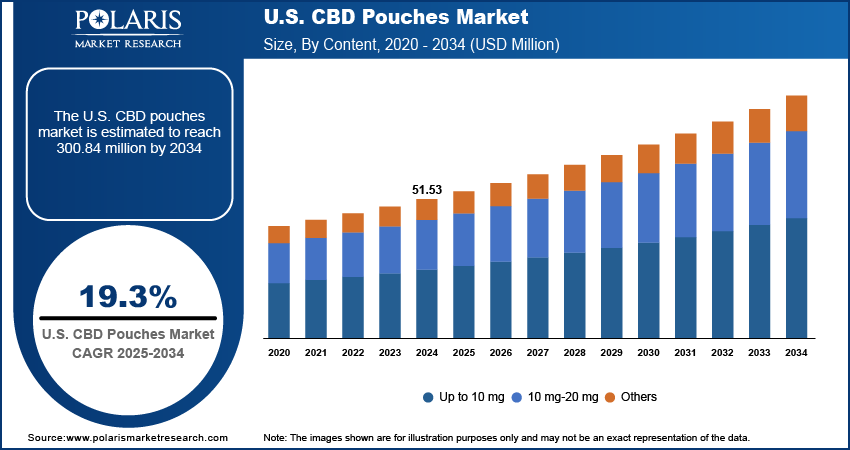

By Content (up to 10 mg, 10 mg–20 mg, Others), By Type (Flavored, Unflavored), By Distribution Channel – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6092

- Base Year: 2024

- Historical Data: 2020-2023

Overview

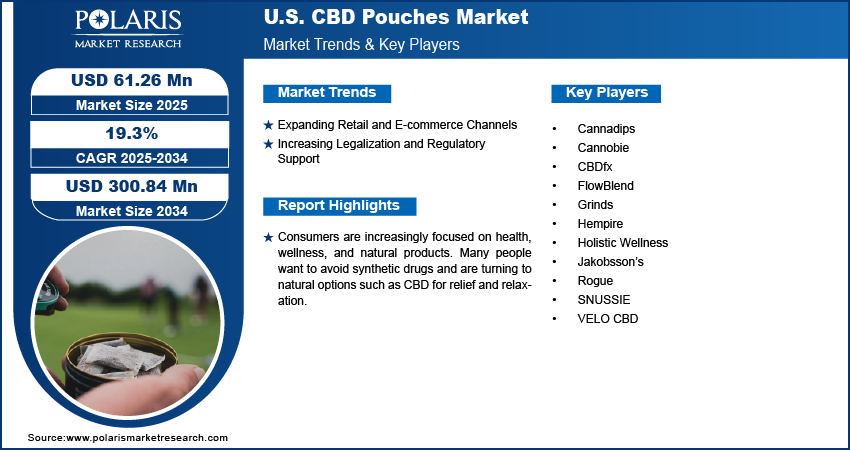

The U.S. CBD pouches market size was valued at USD 51.53 million in 2024, growing at a CAGR of 19.3% from 2025 to 2034. The market growth is driven by expanding retail and e-commerce channels and increasing legalization and regulatory support across the country.

Key Insights

- In 2024, the 10 mg–20 mg segment dominated with the largest share as this dosage range strikes a balance between effectiveness and safety, appealing to both new users and regular consumers.

- The up to 10 mg segment is expected to experience significant growth during the forecast period as CBD pouches with up to 10 mg of content are gaining popularity among first-time users and health-conscious consumers in the U.S.

- The unflavored segment is expected to experience significant growth during the forecast period as these products offer a more natural experience.

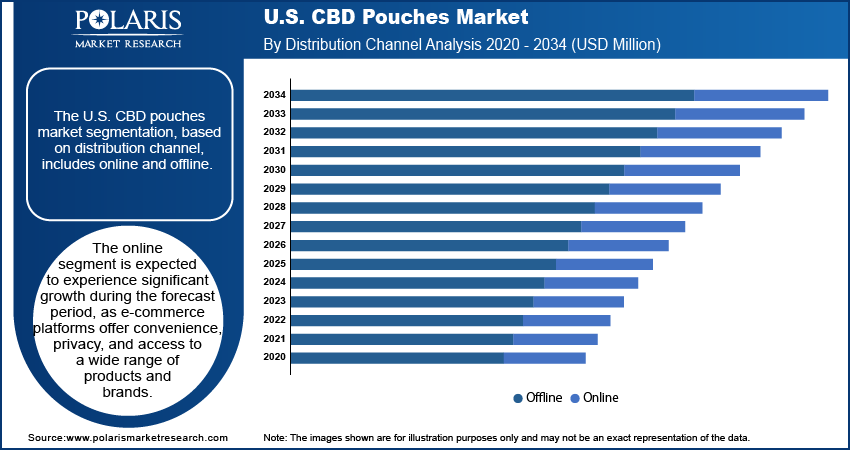

- The online segment is expected to experience significant growth during the forecast period, as online retail platforms provide consumers the convenience to browse, compare, and buy products from home.

Industry Dynamics

- Expanding retail and e-commerce channels drives the demand for CBD pouches.

- Increasing legalization and regulatory support is fueling the industry growth by boosting product accessibility.

- The rising focus on health, wellness, and natural products is fueling the U.S. CBD pouches market growth.

- Regulatory barrier and distribution barriers in some states restrain the growth.

Market Statistics

- 2024 Market Size: USD 51.53 million

- 2034 Projected Market Size: USD 300.84 million

- CAGR (2025–2034): 19.3%

To Understand More About this Research: Request a Free Sample Report

CBD pouches are small, smokeless, and tobacco-free sachets infused with cannabidiol (CBD), designed to be placed between the gum and lip for discreet oral absorption. They offer a convenient and mess-free way to consume CBD without vaping, smoking, or ingesting oils. Popular among wellness-focused consumers, CBD pouches are used for relaxation, focus, and stress relief.

Health and wellness movements are very strong in the U.S., with many consumers seeking natural remedies to manage stress, pain, and anxiety. CBD is increasingly viewed as a helpful supplement for these concerns. CBD pouches align with this trend, offering a convenient, discreet, and smoke-free way to consume CBD. Many Americans, especially in urban areas, are adopting healthier lifestyles and are open to trying CBD for both physical and mental well-being. The interest in CBD pouches continues to rise as people seek non-pharmaceutical and non-addictive options, thereby driving the U.S. CBD pouches market expansion.

In the U.S., CBD brands are constantly improving their products to attract new customers. Companies are developing CBD pouches with better flavors, faster absorption, precise dosing, and long-lasting effects. These innovations help make the experience more enjoyable and consistent for users. Some brands are further adding vitamins, caffeine, or herbal extracts for extra benefits. Innovation becomes crucial to standing out as the industry becomes more competitive. This focus on product quality and variety helps bring more consumers into the market and builds customer loyalty, which supports the U.S. CBD pouches market growth.

Drivers and Opportunities

Expanding Retail and E-commerce Channels: CBD pouches are becoming easier to buy in the U.S. due to broader availability in stores and online platforms. Major convenience stores, gas stations, wellness shops, and even grocery chains are now stocking CBD products, including pouches. At the same time, online platforms allow brands to reach customers directly with targeted advertising and subscription models. This improved accessibility removes barriers to entry for new consumers and supports repeat purchases. Sales of CBD pouches are growing nationwide as distribution networks strengthen and more retailers adopt CBD offerings, thereby driving the U.S. CBD pouches market demand.

Increasing Legalization and Regulatory Support: Legalization of hemp-derived CBD at the federal level, as outlined in the 2018 Farm Bill, has given a major boost to the CBD industry in the U.S. While some states still regulate CBD products differently, there is growing clarity and support from federal and state governments around hemp-based CBD. This legal environment makes it easier for companies to manufacture, distribute, and sell CBD pouches. The regulatory stability encourages investment and product development as more states relax their rules and the FDA gradually provides guidance, fueling the U.S. CBD pouches market expansion.

Segmental Insights

Content Analysis

The segmentation, based on content, includes up to 10 mg, 10 mg–20 mg, and others. In 2024, the 10 mg–20 mg segment dominated with the largest share as this dosage range strikes a balance between effectiveness and safety, appealing to both new users and regular consumers. Many Americans prefer a mid-range dose that provides noticeable relaxation or relief without feeling overwhelming. Brands further focus on this range due to its popularity in retail and online channels. This segment remains dominant because it offers versatility for daily use, whether for managing stress, sleep, or mild physical discomfort.

The up to 10 mg segment is expected to experience significant growth during the forecast period as CBD pouches with up to 10 mg of content are gaining popularity among first-time users and health-conscious consumers in the U.S. This low-dose option appeals to those seeking gentle, introductory effects or a lighter experience throughout the day. This segment is expected to grow quickly as awareness spreads about microdosing CBD and using it as a wellness supplement. Moreover, it is especially popular among working professionals and older adults who prefer subtle, non-intoxicating support for stress or focus. The growing interest in daily wellness routines and functional products further fuels the segment growth.

Type Analysis

The segmentation, based on type, includes flavored and unflavored. The unflavored segment is expected to experience significant growth during the forecast period as these products offer a more natural experience without artificial ingredients, which appeals to those who want clean labels and fewer additives. Some users prefer unflavored pouches for blending into their daily routines without lingering taste or odor. There is growing demand for high-quality, no-nonsense products in wellness and medical-use segments as the industry matures. Moreover, the rising consumer awareness about ingredients and product purity further fuels the segment growth.

Distribution Channel Analysis

The segmentation, based on distribution channel, includes online and offline. The online segment is expected to experience significant growth during the forecast period, as e-commerce platforms give consumers the convenience to browse, compare, and buy products from home. This is especially important for CBD, as online stores often offer a wider selection, detailed product descriptions, and verified reviews. Subscription models and direct-to-consumer strategies are helping brands build loyalty and ensure regular purchases. Online platforms are proving crucial for brand visibility and consumer education as regulations become clearer and marketing becomes more targeted, driving the segment growth.

Key Players and Competitive Analysis

The U.S. CBD pouches market is increasingly competitive, with several key players vying for market share through innovation, branding, and distribution. Cannadips remains a pioneer, known for its early entry and strong branding in flavored pouches. VELO CBD and Rogue, traditionally associated with nicotine pouches and products, are leveraging brand recognition and retail distribution to expand into CBD. CBDfx and Holistic Wellness focus on wellness-oriented consumers with clean-label and broad-spectrum options. Grinds and SNUSSIE cater to users transitioning from tobacco, offering similar formats with added CBD benefits. Emerging brands such as Cannobie, Hempire, and FlowBlend are gaining traction through online channels and niche positioning. Jakobsson’s, with its roots in Scandinavian snus, is also exploring U.S. CBD opportunities. Overall, competition is driven by innovation in dosage, flavors, and online engagement, while regulatory clarity and growing consumer interest continue to shape the evolving landscape of CBD pouches in the U.S.

Key Players

- Cannadips

- Cannobie

- CBDfx

- FlowBlend

- Grinds

- Hempire

- Holistic Wellness

- Jakobsson’s

- Rogue

- SNUSSIE

- VELO CBD

U.S. CBD Pouches Industry Development

In February 2023, Cannadips Europe partnered with Haypp Group to launch its Terpene Pouch Collection. The product became available on snusbolaget.se from February 13, 2023, targeting users seeking healthier, cannabis-free pouch options.

U.S. CBD Pouches Market Segmentation

By Content Outlook (Revenue, USD Million, 2020–2034)

- Up to 10 mg

- 10 mg–20 mg

- Others

By Type Outlook (Revenue, USD Million, 2020–2034)

- Flavored

- Unflavored

By Distribution Channel Outlook (Revenue, USD Million, 2020–2034)

- Offline

- Online

U.S. CBD Pouches Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 51.53 Million |

|

Market Size in 2025 |

USD 61.26 Million |

|

Revenue Forecast by 2034 |

USD 300.84 Million |

|

CAGR |

19.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 51.53 million in 2024 and is projected to grow to USD 300.84 million by 2034.

The market is projected to register a CAGR of 19.3% during the forecast period.

A few of the key players in the market are Cannadips, VELO CBD, Holistic Wellness, CBDfx, Grinds, SNUSSIE, Cannobie, Rogue, Hempire, Jakobsson’s, and FlowBlend.

The 10 mg–20 mg segment dominated the market share in 2024.

The online segment is expected to witness the significant growth during the forecast period.