U.S. Clinical Decision Support Systems Market Size, Share, Trend, Industry Analysis Report

By Component (Hardware, Software, Services), By Product, By Application, By Delivery Mode– Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6077

- Base Year: 2024

- Historical Data: 2020-2023

Overview

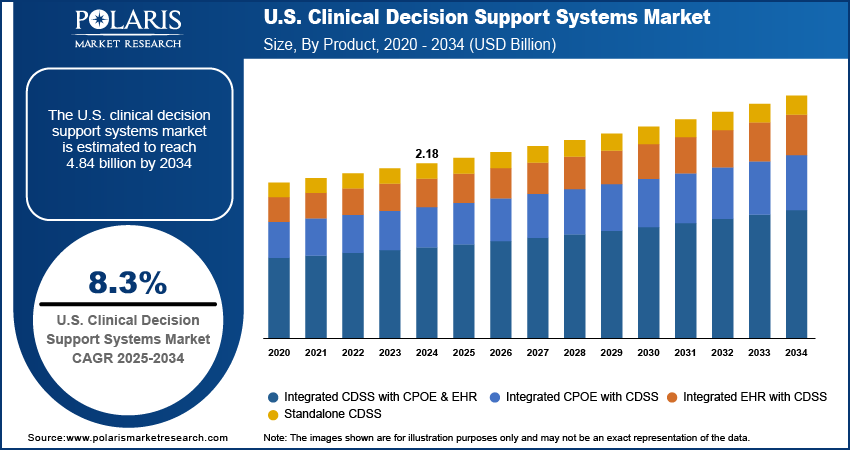

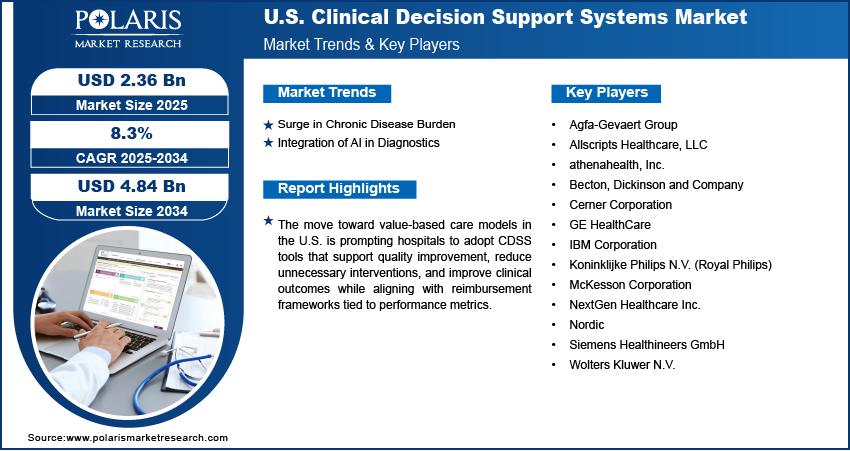

The U.S. clinical decision support systems market size was valued at USD 2.18 billion in 2024, growing at a CAGR of 8.3% from 2025 to 2034. The move toward value-based care models in the U.S. is prompting hospitals to adopt CDSS that support quality improvement, reduce unnecessary interventions, and improve clinical outcomes while aligning with reimbursement frameworks tied to performance metrics.

Key Insights

- The standalone CDSS segment accounted for ~31% of the revenue share in 2024 due to strong demand for modular solutions that can be deployed independently without requiring integration into existing hospital infrastructure.

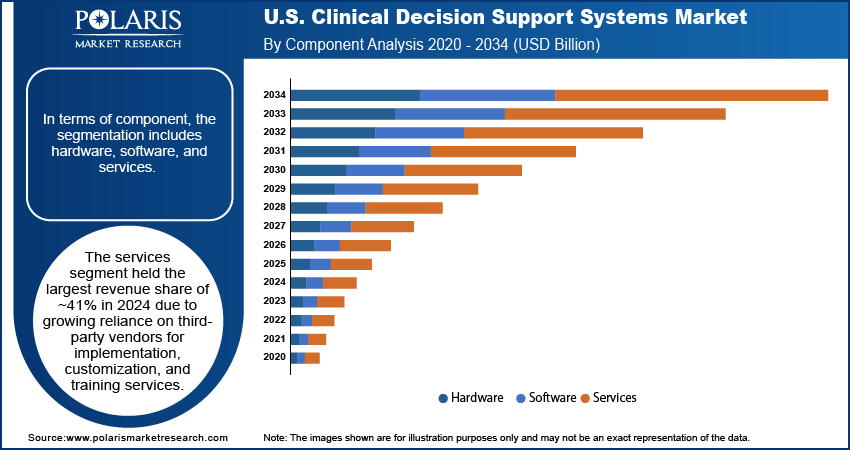

- The services segment held the largest revenue share of ~41% in 2024 due to growing reliance on third-party vendors for implementation, customization, and training services.

- The drug allergy alerts segment accounted for the largest revenue share of ~26% in 2024 due to the critical need to prevent adverse drug events and ensure patient safety.

Industry Dynamics

- The rising adoption of AI and big data in healthcare to improve diagnosis and treatment planning is driving the U.S. clinical decision support systems market growth.

- Growing demand for personalized medicine and integrated digital health records in clinical settings boost the adoption of CDSS.

- Expansion of AI-driven CDSS in telemedicine and remote patient monitoring offers new growth avenues for the industry.

- Increasing data privacy concerns and high implementation costs limit CDSS adoption in smaller healthcare facilities.

Market Statistics

- 2024 Market Size: USD 2.18 billion

- 2034 Projected Market Size: USD 4.84 billion

- CAGR (2025–2034): 8.3%

To Understand More About this Research: Request a Free Sample Report

The U.S. clinical decision support systems (CDSS) market refers to software solutions integrated within healthcare IT systems that analyze clinical data and provide evidence-based recommendations to assist healthcare professionals in making accurate diagnostic, treatment, and care decisions. Government initiatives such as the Meaningful Use program and the 21st Century Cures Act are accelerating the implementation of CDSS by mandating health IT adoption, encouraging interoperability, and promoting clinical data exchange across care settings.

Overburdened healthcare staff and increased patient volumes are driving hospitals to invest in CDSS platforms that reduce cognitive load, automate alerts, and deliver real-time insights, improving both efficiency and patient safety. Moreover, the rapid scaling of telehealth services is pushing demand for cloud-based CDSS integration that supports remote diagnostics, virtual triage, and care decision-making across geographically dispersed health systems.

Drivers and Opportunities

Surge in Chronic Disease Burden: The cases of various chronic diseases such as diabetes, heart conditions, and cancer are rising steadily across the U.S., placing pressure on healthcare systems to manage patients more efficiently and effectively. For instance, according to the Centers for Disease Control and Prevention (CDC), in 2023, 76.4% of U.S. adults (194 million) were affected by one or more chronic conditions, with rates of 59.5% for young, 78.4% for midlife, and 93.0% for older adults. Additionally, 51.4% (130 million) were suffering from multiple chronic conditions (MCC), including 27.1% of young, 52.7% of midlife, and 78.8% of older adults. Physicians need real-time access to comprehensive patient data, evidence-based treatment pathways, and timely clinical alerts. Clinical decision support systems are addressing this need by offering tools that track disease progression, flag complications, and suggest medication adjustments tailored to patient profiles. These platforms also help reduce treatment variability and ensure alignment with national care guidelines. Growing demand for tools that assist in long-term disease management is driving broader CDSS adoption in hospitals and outpatient settings. Thus, the rising chronic disease burden boosts the U.S. CDSS market growth.

Integration of AI in Diagnostics: AI integration in clinical decision support systems is transforming diagnostic workflows by increasing precision and reducing turnaround time. Advanced algorithms process vast volumes of patient data, including lab results, imaging, and genetic information, to detect patterns that may not be visible to the human eye. These insights support earlier diagnosis, improved risk stratification, and personalized treatment recommendations. Health systems are leveraging AI-powered CDSS to streamline care delivery across departments, reduce diagnostic errors, and enhance patient outcomes. In May 2025, a biomedical engineer integrated AI methodologies to enhance the accuracy and efficacy of diagnostic medicine. Growing trust in AI capabilities and continuous algorithm training prompt healthcare providers to adopt these systems as critical tools in modern clinical environments. Hence, the upsurging integration of AI in diagnostics is expected to drive the U.S. clinical decision support systems market expansion in the coming years.

Segmental Insights

Product Analysis

Based on product, the U.S. clinical decision support systems market segmentation includes standalone CDSS, integrated CPOE with CDSS, integrated EHR with CDSS, and integrated CDSS with CPOE & HER. The standalone CDSS segment accounted for ~31% of the revenue share in 2024 due to strong demand for modular solutions that can be deployed independently without requiring integration into existing hospital infrastructure. Many small- and mid-sized facilities prefer standalone systems because of their lower upfront cost, ease of deployment, and focused clinical functionalities. These systems are typically used for specific tasks like drug interaction alerts, dosage recommendations, and clinical reminders. Their popularity is also linked to healthcare providers who want decision support tools but lack the resources or IT capabilities to upgrade to fully integrated platforms. Vendors have improved the compatibility of standalone CDSS with third-party software, further driving their adoption.

The integrated EHR with CDSS segment is expected to record the highest CAGR during the forecast period, due to increasing preference for unified platforms that centralize patient data and decision support in a single interface. Healthcare organizations are prioritizing integration to reduce clinician workload, enhance documentation efficiency, and eliminate data silos. The combination of CDSS with electronic health records enables real-time, evidence-based recommendations at the point of care. This integration also ensures that alerts, reminders, and guidelines are contextualized with patient history, lab results, and treatment plans. Larger health systems are investing in these integrated solutions to improve clinical workflows and population health management. Continued digitalization across hospitals and growing regulatory support for interoperable systems are also accelerating this shift toward integrated EHR-CDSS platforms.

Component Analysis

In terms of component, the U.S. clinical decision support systems market segmentation includes hardware, software, and services. The services segment held the largest revenue share of ~41% in 2024, due to growing reliance on third-party vendors for implementation, customization, and training services. Healthcare providers often require support for integrating CDSS into existing IT infrastructure, ensuring compliance, and optimizing system performance. Service providers offer value-added benefits such as clinical workflow alignment, ongoing technical support, and upgrades tailored to changing care standards. The complexity of deploying decision support tools across multi-specialty hospitals and aligning them with electronic health records drives demand for professional services. In addition, rising cybersecurity concerns and the need for regular maintenance encourage hospitals to engage in long-term service contracts. This trend is expected to continue as digital transformation deepens across the healthcare ecosystem.

The software segment is projected to record the highest CAGR from 2025 to 2034 due to increased innovation in decision algorithms, user interfaces, and machine learning capabilities. CDSS software is evolving rapidly, with tools that support predictive analytics, risk stratification, and natural language processing. Healthcare institutions are shifting toward customizable and scalable software that can adapt to diverse specialties and use cases. Software vendors are offering modular platforms, enabling providers to choose clinical features aligned with their workflow needs. Demand is rising for advanced visualization tools, mobile-friendly applications, and real-time alerting functionalities. Enhanced compatibility with EHRs and cloud environments also supports this segment’s rapid expansion. Investments in AI-driven CDSS software are accelerating growth, especially among large hospital networks seeking smarter diagnostics and treatment planning.

Application Analysis

In terms of application, the U.S. clinical decision support systems market segmentation includes drug-drug interactions, drug allergy alerts, clinical reminders, clinical guidelines, drug dosing support, and others. The drug allergy alerts segment accounted for the largest revenue share of ~26% in 2024 due to the critical need to prevent adverse drug events and ensure patient safety. CDSS tools that flag known allergies during prescribing or administration workflows help clinicians avoid harmful drug combinations or allergens. Hospitals are under increasing pressure to comply with medication safety standards, particularly when treating high-risk populations such as elderly patients or those on polypharmacy regimens. Integration of allergy alerts into e-prescribing and electronic health records helps reduce medical errors and legal risks. Drug allergy modules are among the most frequently adopted CDSS features due to their direct impact on outcomes and operational efficiency. Payers and regulators are also supporting technology adoption in this area to enhance care quality and reduce avoidable complications.

The clinical guidelines segment is expected to register the highest CAGR from 2025 to 2034 due to rising emphasis on standardized, evidence-based care delivery across specialties. Hospitals and health systems are embedding guideline-based decision support into their workflows to reduce clinical variability and improve adherence to best practices. These CDSS modules help physicians stay updated with rapidly evolving treatment protocols in areas such as oncology, cardiology, and infectious disease. The need for consistency in treatment plans—especially across large networks and value-based care settings—is driving investments in guideline-based tools. These solutions also enhance quality reporting, facilitate clinical audits, and support accreditation compliance. Increasing use of digital pathways and clinical documentation systems is further contributing to the expansion of this segment.

Delivery Mode Analysis

In terms of delivery mode, the U.S. clinical decision support systems market segmentation includes web-based systems, cloud-based systems, and on-premise systems. The on-premise systems segment accounted for the largest revenue share of ~42% in 2024 due to high adoption among hospitals prioritizing data control, customization, and security. Healthcare organizations dealing with sensitive patient information often prefer local hosting to ensure compliance with internal IT policies and privacy regulations. On-premise CDSS deployments allow greater flexibility for tailoring features and workflows to specific institutional requirements. Large academic and specialty hospitals invest in these systems to achieve deep integration with in-house platforms and to support research applications. Resistance to cloud migration in certain institutions due to concerns about latency, third-party access, or infrastructure reliability also sustains demand for on-premise models. Continued investments in local server capacity and IT support teams reinforce this segment’s dominance.

The cloud-based systems segment is expected to register the highest CAGR from 2025 to 2034 due to rising demand for scalable, cost-effective, and remotely accessible solutions. Cloud-hosted CDSS platforms support rapid deployment across multiple sites and offer seamless updates, reducing the burden on in-house IT teams. These systems are particularly attractive to outpatient centers, rural hospitals, and fast-growing healthcare startups aiming to expand access to advanced decision support. Improvements in cloud cybersecurity, interoperability, and uptime reliability are increasing provider confidence in this model. Additionally, cloud infrastructure supports AI-driven CDSS functionalities by enabling real-time analytics and large-scale data processing. Healthcare systems are turning to cloud adoption to modernize IT infrastructure while optimizing operational costs and future-proofing their decision support capabilities.

Key Players and Competitive Analysis

The competitive landscape of the U.S. clinical decision support systems market is shaped by continuous innovation, strategic collaborations, and growing demand for real-time data-driven solutions across healthcare ecosystems. Industry analysis reveals a strong focus on developing AI-powered platforms and integrating advanced analytics for predictive care delivery. Companies adopt market expansion strategies through joint ventures with healthcare providers and IT vendors to co-develop customized solutions. Mergers and acquisitions are being pursued to enhance software capabilities, access proprietary datasets, and improve geographic reach.

In the U.S. clinical decision support systems market, post-merger integration efforts are targeting interoperability improvements and seamless incorporation into existing electronic health records. Strategic alliances between clinical informatics firms and academic institutions are fostering technology advancements and real-world validation of CDSS tools. The market is also witnessing a rise in partnerships that combine clinical expertise with cloud computing infrastructure, enabling scalable and secure deployment models.

Vendors in the U.S. clinical decision support systems market are investing in machine learning and natural language processing to improve accuracy, context awareness, and adaptability of decision algorithms. Regulatory compliance, usability design, and clinician training continue to be core areas of competitive differentiation. Stakeholders are also emphasizing workflow integration and user experience as key priorities, driving greater adoption in acute care, chronic disease management, and population health applications.

Key Players

- Agfa-Gevaert Group

- Allscripts Healthcare, LLC

- athenahealth, Inc.

- Becton, Dickinson and Company

- Cerner Corporation

- GE HealthCare

- IBM Corporation

- Koninklijke Philips N.V. (Royal Philips)

- McKesson Corporation

- NextGen Healthcare Inc.

- Nordic

- Siemens Healthineers GmbH

- Wolters Kluwer N.V.

Industry Developments

April 2025: Becton, Dickinson and Company introduced the HemoSphere Advanced Monitoring Platform, an AI-powered system designed to improve real-time hemodynamic monitoring and support clinical decision-making in critical care settings.

December 2024: Philips announced CT 5300 to enhance CT workflows, integrating advanced hardware, software, and AI for improved screening, diagnostics, and interventional imaging. It also offers AI support through Philips Advanced Visualization Workspace applications.

Clinical Decision Support Systems Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Standalone CDSS

- Integrated CPOE with CDSS

- Integrated EHR with CDSS

- Integrated CDSS with CPOE & EHR

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Drug-Drug Interactions

- Drug Allergy Alerts

- Clinical Reminders

- Clinical Guidelines

- Drug Dosing Support

- Others

By Delivery Mode Outlook (Revenue, USD Billion, 2020–2034)

- Web-Based Systems

- Cloud-Based Systems

- On -Premise Systems

Clinical Decision Support Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.18 billion |

|

Market Size in 2025 |

USD 2.36 billion |

|

Revenue Forecast by 2034 |

USD 4.84 billion |

|

CAGR |

8.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 2.18 billion in 2024 and is projected to grow to USD 4.84 billion by 2034.

The U.S. market is projected to register a CAGR of 8.3% during the forecast period.

A few of the key players in the market are Agfa-Gevaert Group; Allscripts Healthcare, LLC; athenahealth, Inc.; Becton, Dickinson and Company; Cerner Corporation; GE HealthCare; IBM Corporation; Koninklijke Philips N.V. (Royal Philips); McKesson Corporation; NextGen Healthcare Inc.; Nordic; Siemens Healthineers GmbH; and Wolters Kluwer N.V.

The standalone CDSS segment accounted for ~31% of the revenue share in 2024 due to strong demand for modular solutions that can be deployed independently without requiring integration into existing hospital infrastructure.

The services segment held the largest revenue share of ~41% in 2024 due to growing reliance on third-party vendors for implementation, customization, and training services.