Automated Medical Washer Disinfector Market Size, Share, Trend, Industry Analysis Report

By Product (Floor Standing, Benchtop, Others), By Capacity, By Chamber Type, By Device Classification, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 125

- Format: PDF

- Report ID: PM6059

- Base Year: 2024

- Historical Data: 2020-2023

Overview

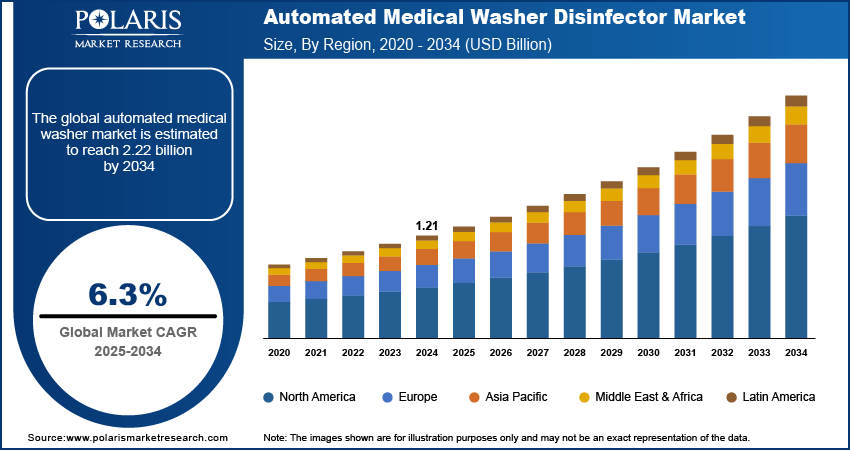

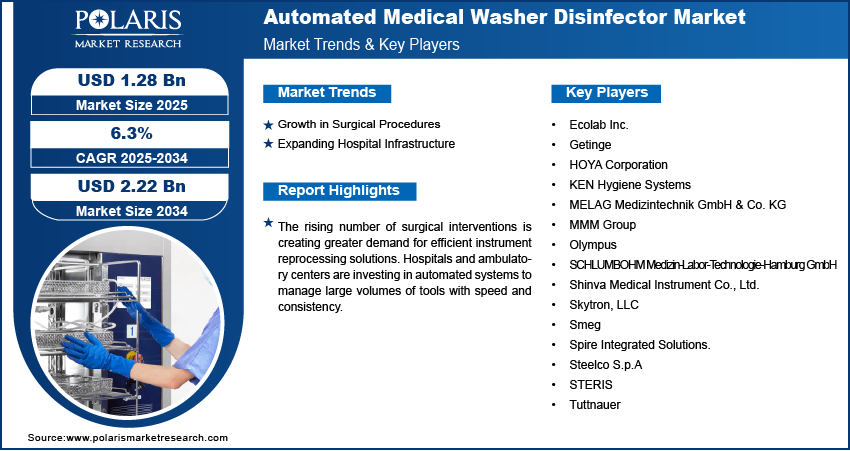

The global automated medical washer disinfector market size was valued at USD 1.21 billion in 2024, growing at a CAGR of 6.3% from 2025 to 2034. The rising number of surgical interventions is creating greater demand for efficient instrument reprocessing solutions. Hospitals and ambulatory centers are investing in automated systems to manage large volumes of tools with speed and consistency.

Key Insights

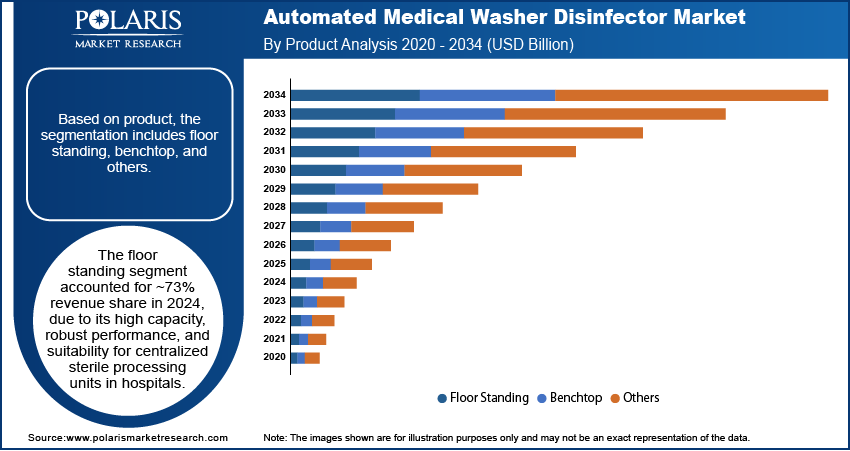

- The floor standing segment accounted for ~73% of the revenue share in 2024.

- The large capacity (>200 L) segment held ~55% of the revenue share in 2024.

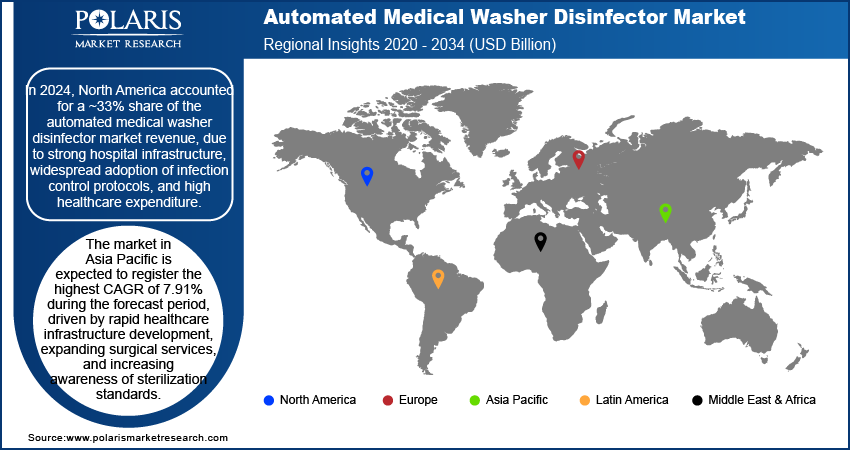

- In 2024, North America accounted for ~33% share of the automated medical washer disinfector market revenue.

- In 2024, the U.S. market reported a significant growth rate.

- The Asia Pacific market is expected to register the highest CAGR of 7.91% over the forecast period.

- The automated medical washer disinfector market in Europe is expanding steadily due to the region’s structured approach to surgical hygiene and infection control.

Industry Dynamics

- The rising number of surgical interventions is creating greater demand for efficient automated medical washer disinfectors.

- Healthcare infrastructure in many regions is undergoing rapid expansion, with new hospitals being built and older facilities being modernized to meet rising patient volumes and clinical demands. This growth is propelling the adoption of automated medical washer disinfectors.

- Investments in new hospitals and the upgrade of existing facilities are increasing demand for high-throughput, reliable disinfection solutions, such as automated medical washer disinfectors.

- High equipment costs and complex regulatory requirements limit the adoption of automated medical washer disinfectors, especially in small healthcare facilities and emerging markets.

Market Statistics

- 2024 Market Size: USD 1.21 billion

- 2034 Projected Market Size: USD 2.22 billion

- CAGR (2025–2034): 6.3%

- North America: Largest market in 2024

The automated medical washer disinfector market focuses on manufacturing and supplying automated equipment used for cleaning, disinfecting, and thermally treating surgical equipment, medical devices, and laboratory tools to meet strict hygiene and infection control standards in healthcare settings. Increasing awareness about hospital-acquired infections (HAIs) is driving the adoption of automated washer disinfectors to ensure standardized, high-level disinfection of reusable instruments and reduce cross-contamination risks in medical environments.

Healthcare facilities are required to meet strict sterilization and disinfection guidelines. Automated washer disinfectors offer validated cycles and documentation features that help institutions comply with national and international infection prevention standards. Moreover, investments in new hospitals and the upgrade of existing facilities are increasing demand for high-throughput, reliable disinfection solutions. Automated systems are being preferred to minimize manual labor and improve reprocessing accuracy.

Drivers and Opportunities

Growth in Surgical Procedures: The number of surgical procedures performed across healthcare settings is rising steadily due to the increasing prevalence of chronic conditions, aging populations, and advancements in minimally invasive surgery. According to the World Health Organization, around 20 million new cancer cases were reported globally in 2022. Projections suggested that this cases will rise above 35 million by 2050. Each surgical case generates a significant volume of reusable instruments that require thorough and timely cleaning. Manual reprocessing methods are no longer sufficient to handle this growing workload, especially in high-volume hospitals.

Automated medical washer disinfectors provide a reliable and efficient solution to ensure surgical instruments are cleaned and disinfected quickly, without compromising safety. These systems are designed to meet tight turnaround times while delivering consistent cleaning results, which helps reduce delays in operating room schedules. Hospitals and surgical centers are increasingly investing in these systems to enhance workflow efficiency, support infection prevention protocols, and optimize resource utilization. In an environment where patient safety and time management are critical, automated reprocessing has become a key component of modern surgical support infrastructure.

Expanding Hospital Infrastructure: Healthcare infrastructure in many regions is undergoing rapid expansion, with new hospitals being built and older facilities being modernized to meet rising patient volumes and clinical demands. In September 2024, the Department of Health and Human Services announced a USD 75 million investments in rural healthcare. This growth necessitates advanced, high-capacity solutions that keep up with increased procedural and sterilization needs. Automated washer disinfectors are gaining preference in both large medical centers and mid-sized facilities due to their ability to manage high-throughput cleaning cycles while minimizing human intervention. These systems help standardize the reprocessing workflow, reduce the risk of manual error, and improve operational efficiency across departments. Hospital administrators view automated disinfection technology as an essential investment to support the scalability and compliance of new infrastructure projects. By incorporating automation into central sterile processing departments, hospitals comply with stringent hygiene requirements, streamline staffing needs, and future-proof their operations against rising procedural volumes and evolving infection control standards.

Segmental Insights

Product Analysis

Based on product, the segmentation includes floor standing, benchtop, and others. The floor standing segment accounted for ~73% of the revenue share in 2024 due to its high capacity, robust performance, and suitability for centralized sterile processing units in hospitals. These systems handle a wide range of instrument types and support multiple reprocessing cycles per day, making them ideal for high-volume environments. The ability to integrate seamlessly with drying units and automated loading systems adds to their operational appeal. Many large healthcare facilities prefer these machines for their durability, programmable cycles, and ease of validation. Investments in upgrading infection control infrastructure have further supported demand, especially in institutions handling complex surgical procedures.

The benchtop segment is projected to grow significantly from 2025 to 2034 due to rising adoption in outpatient clinics, dental practices, and smaller healthcare setups. These compact units offer a space-efficient solution without compromising performance, making them suitable for facilities where full-sized equipment is impractical. Growing awareness around infection prevention, coupled with stricter sterilization regulations across outpatient settings, is driving interest in these systems. Their relatively lower cost and ease of use make them attractive for small-scale operators seeking to improve hygiene standards. Advancements in compact automation and user-friendly interfaces are expected to support consistent market expansion for benchtop units over the forecast period.

Capacity Analysis

In terms of capacity, the segmentation includes small capacity (<100 L), medium capacity (100–200 L), and large capacity (>200 L). The large capacity (>200 L) segment held ~55% of the revenue share in 2024 due to their ability to clean and disinfect high volumes of surgical tools in fewer cycles. These units are essential for tertiary hospitals, trauma centers, and specialty institutions that manage large procedural caseloads. Facilities that operate multiple operating rooms simultaneously rely on high-throughput machines to maintain instrument availability without delays. These systems also reduce total processing time and labor requirements while delivering consistent cleaning outcomes. High-level customization, automation compatibility, and programmable features add further value, making them a preferred choice for institutions focused on optimizing sterilization workflow and meeting regulatory standards.

The medium capacity (100–200 L) segment is expected to register the highest CAGR of 7.0% during 2025–2034, due to rising demand in mid-sized hospitals and ambulatory centers. These units provide a balance between volume handling and space efficiency, making them suitable for institutions looking to scale operations without major infrastructure changes. Their flexibility in processing various types of instruments, from general surgery tools to delicate endoscopic equipment, makes them an ideal choice for facilities transitioning toward higher sterilization throughput. Cost-effective performance, faster installation times, and energy-efficient designs are also influencing procurement decisions. The growing need for reliable mid-range solutions across expanding healthcare networks supports this segment’s strong outlook.

Chamber Type Analysis

In terms of chamber type, the segmentation includes single chamber and multi chamber. The single chamber accounted for the largest revenue share in 2024 due to their operational simplicity, reliability, and suitability for a wide range of clinical applications. These machines are widely used in both large and small facilities for their ease of installation and maintenance. Their ability to handle multiple load types within a compact footprint makes them particularly appealing for institutions dealing with varied daily instrument reprocessing requirements. Reduced water and energy consumption, streamlined cleaning cycles, and strong manufacturer support further contribute to their popularity. Standardized reprocessing protocols using single chamber systems ensure consistent infection control and compliance.

The multi chamber segment is witnessing growing demand from high-capacity medical facilities that require parallel processing capabilities to increase efficiency. These systems allow the simultaneous execution of multiple cleaning stages, significantly reducing total cycle time. Hospitals with complex surgical programs and high instrument turnover prefer multi-chamber setups to maintain workflow without delays. Their modular design also supports scalability and tailored cycle configurations. Though more expensive, they offer superior performance and energy efficiency in busy sterile processing departments. As surgical caseloads rise and hospitals expand, the adoption of these advanced systems is expected to grow steadily, especially in urban healthcare networks.

End Use Analysis

In terms of end use, the segmentation includes hospitals, ambulatory surgical centers (ASCs), clinics, and others. The hospital segment accounted for the largest revenue share in 2024, due to its extensive use of reusable surgical instruments and rising need for rigorous, high-volume disinfection processes. Central sterile departments in hospitals rely heavily on automated washer disinfectors to meet daily sterilization demands across various specialties. The requirement for compliance with infection control standards and accreditation guidelines further drives hospitals to adopt advanced cleaning systems. Large procurement budgets and continuous infrastructure upgrades also support the segment’s dominance. Hospitals prioritize machines that offer traceability, validated cycle options, and compatibility with automated loading systems, making automated washers an integral part of their sterilization protocol.

The ambulatory surgical centers (ASCs) segment is projected to witness the significant growth during the forecast period, due to increasing procedural volumes performed outside of traditional hospitals. These facilities require compact yet efficient sterilization solutions that can support fast turnover and meet hygiene standards. Automated washer disinfectors are becoming essential for ambulatory services as they aim to maintain infection control while optimizing space and staff use. Regulatory pressures on outpatient care providers to meet hospital-grade disinfection standards are further accelerating adoption. As more surgical procedures shift to ambulatory settings due to cost and convenience factors, demand for reliable reprocessing technology in this segment is expected to rise sharply.

Regional Analysis

In 2024, the North America automated medical washer disinfector market accounted for ~33% of the revenue share, due to strong hospital infrastructure, widespread adoption of infection control protocols, and high healthcare expenditure. Advanced surgical departments and well-established central sterile services demand reliable and high-capacity reprocessing equipment. Healthcare facilities across the region continue to prioritize automation to reduce manual workload and improve sterilization accuracy. Government regulations and accreditation requirements related to surgical hygiene further fuel market demand. Investments in modernizing healthcare facilities, particularly in urban areas, support the widespread adoption of floor-standing and multi-chamber systems that streamline instrument turnaround and align with compliance standards.

U.S. Automated Medical Washer Disinfector Market Insights

In 2024, the U.S. market experienced significant growth due to high procedure volumes, aging surgical infrastructure, and increasing emphasis on operating room efficiency. Hospitals and ambulatory surgical centers are rapidly shifting to automated sterilization systems to minimize infection risks and reduce instrument processing time. A growing base of outpatient procedures and stringent regulatory oversight are pushing facilities to adopt validated, high-performance systems. Technological advancements such as cycle traceability, energy efficiency, and remote diagnostics are attracting more healthcare providers toward premium equipment. The need to replace aging manual systems and improve throughput is a strong contributor to this upward trend.

Asia Pacific Automated Medical Washer Disinfector Market Trends

The market in Asia Pacific is expected to register the highest CAGR of 7.91% during the forecast period due to rapid healthcare infrastructure development, expanding surgical services, and increasing awareness of sterilization standards. Public and private hospitals across countries such as India, Indonesia, and Thailand are investing in infection control technologies to improve care quality. According to the International Trade Administration, the Indian hospital market is currently valued at approximately USD 99 billion and is projected to reach USD 193 billion by 2032, indicating significant growth potential in the sector. Government support for hospital modernization, rising medical tourism, and the growing number of accredited surgical centers are encouraging the adoption of automated cleaning systems. Local manufacturers are also entering the market with cost-effective models tailored for smaller healthcare facilities. This blend of regulatory push, rising patient loads, and infrastructural upgrades is fueling market acceleration.

China Automated Medical Washer Disinfector Market Overview

China is witnessing strong growth due to large-scale expansion of hospital networks and strict enforcement of infection prevention protocols across provinces. Healthcare facilities are prioritizing automation in sterile processing departments to align with global standards and reduce reliance on manual reprocessing. Investment in tertiary hospitals and rising surgical volumes are key factors driving the demand for high-capacity washer disinfectors. Increasing partnerships between domestic and international manufacturers are introducing technologically advanced systems tailored to local needs. In both public and private sectors, growing pressure to improve sterilization efficiency and patient safety is pushing adoption rates across a wide range of healthcare institutions.

Europe Automated Medical Washer Disinfector Market Analysis

The market in Europe is expanding steadily due to the region’s structured approach to surgical hygiene and infection control. Healthcare systems emphasize compliance with EN ISO standards, which require advanced and validated disinfection processes. Countries such as Germany, France, and the UK continue to modernize their hospital sterilization departments using high-efficiency equipment that reduces energy and water usage. Funding from healthcare authorities and support for green technologies also encourage facilities to transition to automated solutions. Increasing procedural volumes, especially in orthopedic and dental clinics, combined with a focus on sustainable healthcare, are driving consistent growth across the region.

Key Players and Competitive Analysis

The competitive landscape of the automated medical washer disinfector market is shaped by a combination of technology innovation, strategic alliances, and aggressive market expansion strategies. Companies are focusing on industry analysis to identify high-growth opportunities across emerging healthcare infrastructures and outpatient settings. Mergers and acquisitions are being used to strengthen product portfolios and expand regional presence, particularly in Asia Pacific and Latin America. Post-merger integration efforts are centered around streamlining manufacturing capabilities and enhancing service networks. Strategic joint ventures are helping firms gain access to localized distribution channels and tailor solutions for specific clinical needs.

Technological advancements such as IoT-enabled monitoring, automated cycle validation, and energy-efficient systems are key differentiators in the market. Players are also investing in smart sterilization solutions that support compliance, traceability, and data-driven operations. Competitive intensity remains high, as manufacturers strive to deliver scalable, cost-effective solutions while meeting global regulatory standards for infection prevention and instrument reprocessing in clinical environments.

Key Players

- Ecolab Inc.

- Getinge

- HOYA Corporation

- KEN Hygiene Systems

- MELAG Medizintechnik GmbH & Co. KG

- MMM Group

- Olympus

- SCHLUMBOHM Medizin-Labor-Technologie-Hamburg GmbH

- Shinva Medical Instrument Co., Ltd.

- Skytron, LLC

- Smeg

- Spire Integrated Solutions.

- Steelco S.p.A

- STERIS

- Tuttnauer

Automated Medical Washer Disinfector Industry Developments

June 2024: Metall Zug and Miele completed their joint venture, merging Steelco and Belimed to form SteelcoBelimed, a unified brand focused on infection control and life science. The new entity combines both companies' expertise to offer advanced, integrated solutions for sterile processing in healthcare and pharmaceutical settings.

June 2023: Olympus Launched New ETD Endoscope Washer Disinfector. This device is designed to enhance the efficiency and effectiveness of the cleaning and disinfection processes for flexible endoscopes.

Automated Medical Washer Disinfector Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Floor Standing

- Benchtop

- Others

By Capacity Outlook (Revenue, USD Billion, 2020–2034)

- Small Capacity (<100 L)

- Medium Capacity (100–200 L)

- Large Capacity (>200 L)

By Chamber Type Outlook (Revenue, USD Billion, 2020–2034)

- Single Chamber

- Multi Chamber

By Device Classification Outlook (Revenue, USD Billion, 2020–2034)

- Critical

- Semi Critical

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Clinics

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automated Medical Washer Disinfector Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.21 billion |

|

Market Size in 2025 |

USD 1.28 billion |

|

Revenue Forecast by 2034 |

USD 2.22 billion |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.21 billion in 2024 and is projected to grow to USD 2.22 billion by 2034.

The global market is projected to register a CAGR of 6.3% during the forecast period.

In 2024, the North America automated medical washer disinfector market accounted for ~33% of the revenue share due to strong hospital infrastructure, widespread adoption of infection control protocols, and high healthcare expenditure.

A few of the key players in the market are Ecolab Inc.; Getinge; HOYA Corporation; KEN Hygiene Systems; MELAG Medizintechnik GmbH & Co. KG; MMM Group; Olympus; SCHLUMBOHM Medizin-Labor-Technologie-Hamburg GmbH; Shinva Medical Instrument Co., Ltd.; Skytron, LLC; Smeg; Spire Integrated Solutions.; Steelco S.p.A; and STERIS.

The floor standing segment accounted for ~73% of the revenue share in 2024, due to their high capacity, robust performance, and suitability for centralized sterile processing units in hospitals.

The large capacity (>200 L) segment held ~55% of the revenue share in 2024, due to its ability to clean and disinfect high volumes of surgical tools in fewer cycles.