U.S. Connected Thermostat Market Size, Share, Trends, Industry Analysis Report

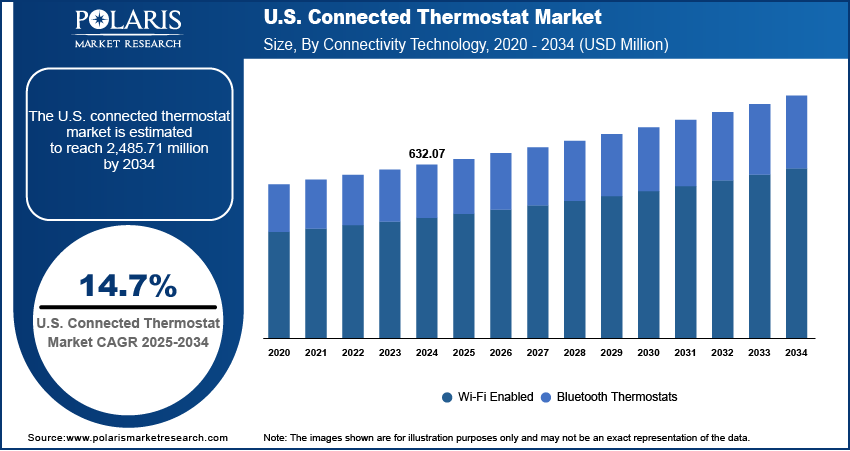

By Technology (Wi-Fi Enabled, Bluetooth Thermostats), By Distribution Channel, By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 125

- Format: PDF

- Report ID: PM6063

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

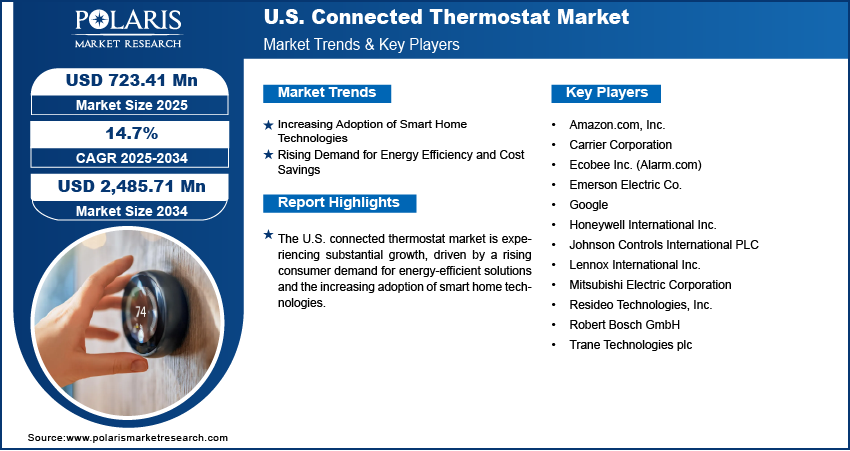

The U.S. connected thermostat market size was valued at USD 632.07 million in 2024 and is anticipated to register a CAGR of 14.7% from 2025 to 2034. The market is mainly driven by the increasing adoption of smart home technologies and a growing demand for energy-efficient solutions.

Key Insights

- By technology, the Bluetooth thermostats segment held the largest share in 2024 due to their widespread compatibility with existing home internet networks and their ability to offer comprehensive remote control and integration with various smart home ecosystems.

- By distribution channel, the retail stores segment accounted for the largest share in 2024, as physical stores provide customers with the opportunity for hands-on product interaction and immediate assistance from sales staff.

- By application, the retrofit & renovation segment held the largest share in 2024. This dominance is driven by the vast number of existing homes and buildings with older thermostat systems, where owners are increasingly seeking to upgrade to smart thermostats.

- By end use, the residential segment held the largest share in 2024. This is primarily due to the high volume of households seeking convenience, comfort, and significant energy savings, as well as the increasing integration of smart home technologies into daily life

Industry Dynamics

- Increasing adoption of smart home technologies drives the demand for connected thermostats as a central component of automated living.

- Consumers and businesses are increasingly seeking ways to reduce energy consumption and lower utility bills, making connected thermostats an attractive solution.

- Growing consumer awareness about environmental sustainability, due to rising focus on climate change and environmental impact, encourages the adoption of energy-efficient solutions such as connected thermostats.

- Government initiatives and regulations promoting energy conservation encourage the use of smart and energy-efficient devices.

- The evolving landscape of smart grid infrastructure and the proliferation of utility-led demand response (DR) programs are increasingly driving.

Market Statistics

- 2024 Market Size: USD 632.07 million

- 2034 Projected Market Size: USD 2,485.71 million

- CAGR (2025–2034): 14.7%

A connected thermostat is a smart home device that allows users to control their heating, ventilation, and air conditioning (HVAC) system remotely through a smartphone, tablet, or voice assistant. These thermostats connect to the internet, offering features such as scheduling, energy usage monitoring, and learning capabilities to optimize indoor climate control and reduce energy consumption.

Government initiatives and utility-sponsored programs are increasingly significant drivers for the adoption of connected thermostats in the U.S. Federal and state governments are implementing policies and providing incentives aimed at promoting energy conservation and reducing carbon emissions across residential and commercial sectors. These initiatives often include tax credits, rebates, and direct subsidies for homeowners and businesses that install energy-efficient products, including smart thermostats.

Continuous advancements in sensor technology integrated within connected thermostats are significantly enhancing their functionality and, consequently, driving their adoption. Modern smart thermostats often incorporate a range of sensors, including occupancy sensors, humidity sensors, and even air quality sensors, that allow for more precise and adaptive climate control. Occupancy sensors, for example, can detect when a room is vacant and automatically adjust temperatures to save energy, preventing unnecessary heating or cooling of unoccupied spaces.

Drivers and Opportunities

Increasing Adoption of Smart Home Technologies: The rapid integration of smart home technologies is a primary catalyst for the U.S. connected thermostat market development. As consumers increasingly embrace automated living environments, the demand for devices that offer seamless control and enhanced convenience grows. Connected thermostats serve as a cornerstone in this transformation, allowing users to manage their home's temperature remotely via smartphones, tablets, or voice assistants, and often integrating with other smart devices for a unified home automation experience. This trend reflects a broader shift toward intelligent and interconnected living solutions, where ease of use and centralized control are highly valued.

This driver is supported by the increasing number of Internet of Things (IoT) connections in North America. For example, a 2020 report by GSMA Intelligence, titled "IoT Connections Expected to Reach Approximately 5.1 Billion in North America by 2025," highlights the significant growth in IoT adoption, which underpins the expansion of smart home ecosystems. This widespread integration of IoT-based devices in homes, offering features such as energy saving, further propels the adoption of connected thermostats across the U.S.

Rising Demand for Energy Efficiency and Cost Savings: The escalating demand for energy efficiency and the potential for significant cost savings are major factors propelling the U.S. connected thermostat market growth. As energy prices fluctuate and environmental concerns grow, both homeowners and commercial entities are actively seeking solutions to optimize energy consumption. Connected thermostats offer precise control over heating and cooling systems, reducing energy waste through features such as intelligent scheduling, remote adjustments, and occupancy sensing. This ability to lower utility bills and contribute to a more sustainable lifestyle makes these devices highly appealing.

The financial benefits of connected thermostats are a strong motivator for adoption. For instance, the U.S. Department of Energy, in various publications, has indicated that smart thermostats can lead to substantial energy savings. Their analysis often points to potential savings of up to 10% to 15% on heating and cooling costs, which translates into tangible financial benefits for users. This clear economic advantage, coupled with the desire for reduced environmental impact, continues to drive the demand for connected thermostats .

Segmental Insights

Technology Analysis

Based on technology, the U.S. connected thermostat market segmentation includes Wi-Fi-enabled and Bluetooth thermostats. The Bluetooth thermostat segment held the largest share in 2024. This dominance is largely attributed to the ease of installation, lower cost points, and their suitability for specific applications where full internet connectivity is not always necessary or preferred. Bluetooth thermostats offer direct, localized control without relying on a constant internet connection, appealing to users who prioritize simplicity, privacy, or have less robust Wi-Fi coverage in certain areas of their homes or smaller living spaces. Advancements in Bluetooth technology, such as Bluetooth Low Energy (BLE), have also improved their energy efficiency and expanded their capabilities, making them increasingly viable for basic automation needs and retrofit projects.

The Wi-Fi thermostats segment is anticipated to register the highest growth rate during the forecast period. The widespread availability of Wi-Fi networks in homes and businesses make Wi-Fi enabled thermostats easy to integrate into existing internet infrastructures. Wi-Fi connectivity allows for robust remote control capabilities, enabling users to adjust settings from virtually anywhere via mobile applications. This seamless remote access, combined with the ability to integrate with various smart home ecosystems and voice assistants, has made Wi-Fi thermostats a preferred choice for consumers seeking comprehensive smart home management.

Distribution Channel Analysis

Based on distribution channel, the U.S. connected thermostat market segmentation includes online, retail stores, wholesale stores, and others. The retail stores segment held the largest share in 2024. Consumers often prefer purchasing connected thermostats from physical retail outlets because these stores offer the opportunity for hands-on demonstrations, allowing them to visualize and understand the product's features before making a purchase. The presence of sales staff to provide immediate assistance, answer questions, and offer bundled promotions with other smart home devices or installation services. Established retail chains and electronics stores serve as trusted points of sale, ensuring product availability and brand visibility, which is particularly important in a market where consumers may still be learning about smart home technology.

The online segment is anticipated to record the highest growth rate during the forecast period. This surge in growth is driven by the increasing preference for online shopping, which provides unparalleled convenience, a vast selection of products, and competitive pricing. E-commerce platforms allow consumers to easily compare different models, read customer reviews, and access detailed product specifications from the comfort of their homes. Furthermore, many manufacturers are increasingly focusing on direct-to-consumer sales through their own websites, often offering exclusive deals and streamlined purchasing experiences. The growing digital literacy of consumers and the expanding reach of internet services also play a crucial role in the rapid expansion of online sales, making it a pivotal channel for future market development.

Application Analysis

Based on application, the U.S. connected thermostat market segmentation includes new construction and retrofit & renovation. The retrofit & renovation segment held the largest share in 2024, due to the vast number of existing homes and commercial buildings that were built with traditional thermostat systems. As these properties age, and as owners become more aware of energy efficiency and smart home technologies, there is a strong drive to upgrade outdated HVAC controls. The relatively straightforward installation process for many connected thermostats, which can often replace an existing unit without major rewiring, makes them an accessible upgrade for property owners seeking to improve comfort, reduce energy bills, and enhance their home's technological capabilities without undertaking extensive modular construction. This extensive installed base of older systems provides a continuous and substantial demand for smart thermostat retrofits.

The new construction segment is anticipated to register the highest growth rate during the forecast period. This accelerated growth is fueled by several factors, including evolving building codes that increasingly mandate higher energy efficiency standards in new builds. Furthermore, as modern and energy efficient building practices increasingly emphasize energy efficiency, sustainability, and integrated smart technologies from the ground up, connected thermostats are becoming a standard inclusion in newly built homes and commercial properties. Also, homebuilders and commercial developers are integrating smart home technologies, including connected thermostats, as standard features to appeal to modern buyers who expect technologically advanced and energy-efficient properties. The ease of pre-installation during the construction phase allows for seamless integration with other building management systems, offering a cohesive smart environment from the outset.

End Use Analysis

Based on end use, the segmentation includes commercial, residential, and industrial. The residential segment held the largest share in 2024. This dominance is primarily driven by the sheer volume of households across the country and the increasing consumer desire for convenience, comfort, and energy savings in their homes. Connected thermostats offer homeowners the ability to remotely manage their heating and cooling systems, integrate with other smart home devices such as lighting and security systems, and benefit from features such as geofencing and learning capabilities that adapt to their daily routines. The rising awareness of personal energy consumption and the potential for substantial utility bill reductions further motivate residential users to adopt these smart devices, making homes the leading application area for connected thermostats.

The residential segment is anticipated to register the highest growth rate during the forecast period. This accelerated growth in industrial applications is driven by the increasing need for precise climate control, operational efficiency, and significant energy cost reductions in large-scale facilities. Industries such as manufacturing plants, data centers, and warehouses require specific temperature and humidity conditions to protect equipment, ensure product quality, and maintain optimal working environments. Connected thermostats, especially when integrated into broader building management systems, allow industrial operators to centralize control, monitor energy usage across vast spaces, and implement automated adjustments, leading to substantial energy savings and improved operational stability.

.webp)

Key Players and Competitive Insights

In the U.S. connected thermostat market, the competitive landscape is characterized by a mix of established HVAC manufacturers and newer technology-focused firms. Companies are constantly innovating, offering advanced features such as AI-powered learning capabilities, geofencing, and seamless integration with broader smart home ecosystems. Competition often revolves around user-friendly interfaces, energy-saving potential, design aesthetics, and compatibility with various smart home platforms. Strategic partnerships with utility providers and smart home service companies are also common as players seek to expand their reach and customer base.

A few prominent players in the market include Resideo Technologies, Inc.; Ecobee Inc. (Alarm.com); Johnson Controls International PLC; Emerson Electric Co.; Honeywell International Inc.; Robert Bosch GmbH; Google LLC; Amazon.com, Inc.; Carrier Corporation; Trane Technologies plc; Lennox International Inc.; and Mitsubishi Electric Corporation.

Key Players

- Amazon.com, Inc.

- Carrier Corporation

- Ecobee Inc. (Alarm.com)

- Emerson Electric Co.

- Honeywell International Inc.

- Johnson Controls International PLC

- Lennox International Inc.

- Mitsubishi Electric Corporation

- Resideo Technologies, Inc.

- Robert Bosch GmbH

- Trane Technologies plc

U.S. Connected Thermostat Industry Development

February 2024: Carrier launched a new Smart Thermostat targeted at residential new construction builders and homeowners. Designed for enhanced connectivity at a cost-effective price, the 24V thermostat features a sleek, modern design, supports various accessories, integrates with smart home platforms, and offers warranty coverage of up to five years when connected.

U.S. Connected Thermostat Market Segmentation

By Technology Outlook (Revenue – USD Million, 2020–2034)

- Wi-Fi Enabled

- Bluetooth Thermostats

By Distribution Channel Outlook (Revenue – USD Million, 2020–2034)

- Online

- Retail Stores

- Wholesale Stores

- Others

By Application Outlook (Revenue – USD Million, 2020–2034)

- New Construction

- Retrofit & Renovation

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Commercial

- Residential

- Industrial

U.S. Connected Thermostat Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 632.07 million |

|

Market Size in 2025 |

USD 723.41 million |

|

Revenue Forecast by 2034 |

USD 2,485.71 million |

|

CAGR |

14.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 632.07 million in 2024 and is projected to grow to USD 2,485.71 million by 2034.

The market is projected to register a CAGR of 14.7% during the forecast period.

A few key players in the market include Resideo Technologies, Inc.; Ecobee Inc. (Alarm.com); Johnson Controls International PLC; Emerson Electric Co.; Honeywell International Inc.; Robert Bosch GmbH; Google LLC; Amazon.com, Inc.; Carrier Corporation; Trane Technologies plc; Lennox International Inc.; and Mitsubishi Electric Corporation.

The Bluetooth thermostat segment accounted for the largest share of the market in 2024.

The retail segment is expected to witness the fastest growth during the forecast period.