U.S. Deburring Machine Market Size, Share, Trends, Industry Analysis Report

By Type (Vibratory Deburring, Barrel Tumbling, Brush Deburring), By Operation Mode, By Deburring Media, By End Use – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 124

- Format: PDF

- Report ID: PM6389

- Base Year: 2024

- Historical Data: 2020-2023

Overview

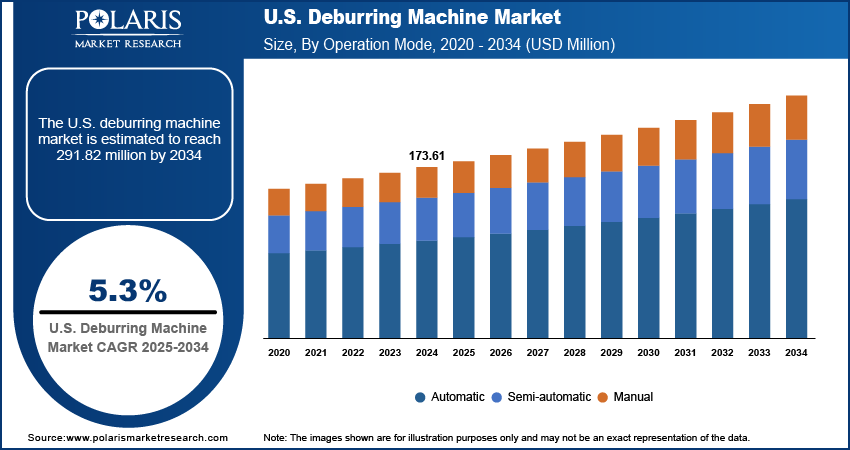

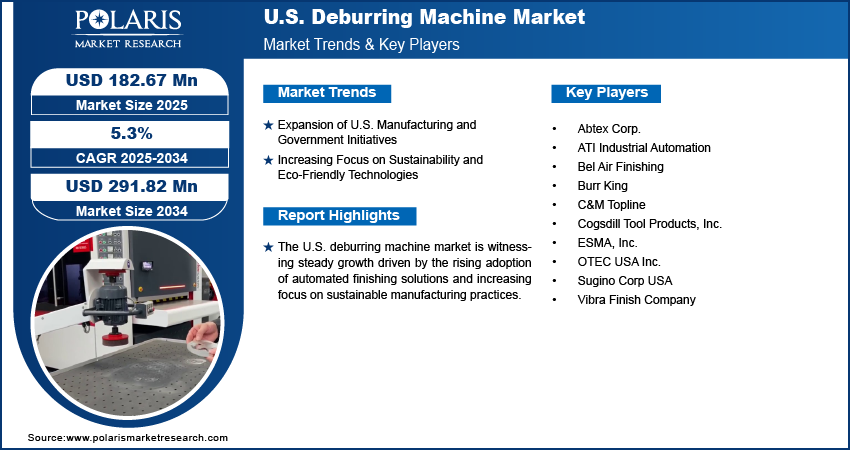

The U.S. deburring machine market size was valued at USD 173.61 million in 2024, growing at a CAGR of 5.3% from 2025 to 2034. Key factors driving demand include growing adoption in manufacturing sectors, rise of robotic and AI-driven deburring solutions, expansion of U.S. manufacturing and supportive government initiatives, and increasing focus on sustainability and eco-friendly technologies

Key Insights

- The vibratory deburring segment led the revenue share in 2024, favored for its efficient, high-volume processing and reliable finishing of bulk component batches.

- The semi-automatic segment would register the highest CAGR of 5.0% during the forecast period, appealing to firms seeking an optimal balance between productivity and upfront investments.

- The ceramic segment dominated in 2024 due to its exceptional durability and effectiveness on the hard alloys critical to U.S. aerospace and defense manufacturing.

- The aerospace & defense segment will expand rapidly at a 5.9% CAGR during the forecast period, driven by rising demand for perfectly finished, mission-critical precision components.

Industry Dynamics

- The U.S. manufacturing and supportive policies are fueling demand for deburring machines to produce high-precision components across end-use industries.

- A growing focus on sustainability and stricter environmental regulations is also driving manufacturers to adopt eco-friendly deburring technologies.

- Intense competition from lower-cost international manufacturers pressures profit margins and forces continuous innovation to justify premium pricing for domestic equipment.

- The reshoring of U.S. manufacturing creates substantial latent demand for automated deburring solutions to support high-volume, precision component production.

Market Statistics

- 2024 Market Size: USD 173.61 million

- 2034 Projected Market Size: USD 291.82 million

- CAGR (2025–2034): 5.3%

AI Impact on U.S. Deburring Machine Market

- AI-powered vision systems automatically identify burr locations and sizes, enabling unmatched, consistent finishing quality and reducing part rejection rates.

- AI algorithms analyze machine data to predict component failures before they happen, minimizing unplanned downtime and optimizing maintenance schedules for manufacturers.

- AI dynamically adjusts machining parameters in real-time for each unique part, especially reducing cycle times and lowering energy consumption.

- AI automation addresses the skilled labor shortage by handling complex programming tasks, shifting the human role towards supervision and system management.

Deburring machines remove burrs, sharp edges, and surface imperfections from components made of metal, plastic, or composite materials to ensure precision and safety in their end-use applications. This market is driven by the growing adoption of these machines across diverse manufacturing sectors such as automotive, aerospace, electronics, and medical devices. According to an FAA report, U.S. general aviation aircraft deliveries grew 3.1% in 2024. Piston aircraft rose 5.4%, while business jets increased 4.1%, significantly boosting deburring technology growth opportunities. Deburring machines have a critical role in enhancing product quality and performance as these industries demand components with tight tolerances and flawless finishes. Additionally, the U.S. manufacturing landscape highlights operational efficiency and compliance with quality standards, which further accelerates the reliance on automated and consistent deburring solutions. This increasing penetration across industrial verticals highlights the expanding role of deburring machines in ensuring reliability, consistency, and scalability in modern production processes.

The U.S. deburring machine market is driven by the rise of robotic and AI-driven deburring solutions, which are transforming traditional finishing processes. The integration of robotics ensures higher precision, repeatability, and reduced manual intervention, while AI-powered systems enable adaptive machining that can respond dynamically to complex geometries and varying material conditions. Such advancements reduce production time and also lower operational costs, aligning with the U.S. manufacturing sector’s focus on automation and smart factory initiatives. Moreover, these technologies provide manufacturers with the flexibility to handle complex designs and improve throughput without compromising quality. Therefore, as industries increasingly adopt Industry 4.0 practices, robotic and AI-enabled deburring solutions are becoming central to achieving next-generation manufacturing efficiency in the U.S.

Drivers & Opportunities

Expansion of U.S. Manufacturing and Government Initiatives: The expansion of U.S. manufacturing and supportive government initiatives drives the growth of the deburring machine market. For instance, in January 2025, the U.S. Department of Energy allocated nearly USD 13 million to improve domestic manufacturers' access to smart manufacturing technologies and high-performance computing resources. Industries such as automotive, aerospace, defense, and medical devices are demanding higher volumes of precision-engineered components with the steady resurgence of domestic manufacturing. This growth is further strengthened by government-backed initiatives that encourage advanced manufacturing practices, automation, and the reshoring of production facilities. As a result, the need for efficient finishing solutions such as deburring machines has increased, ensuring compliance with strict quality standards while enhancing productivity. The combined push from industrial expansion and policy support is creating a favorable environment for the adoption of advanced deburring technologies in the U.S.

Increasing Focus on Sustainability and Eco-Friendly Technologies: The increasing focus on sustainability and eco-friendly technologies also boosts the expansion opportunities for deburring technologies. Manufacturers are under growing pressure to reduce their environmental footprint, comply with strict regulations, and adopt green production methods. According to a February 2024 Congressional Budget report, emissions from the U.S. manufacturing sector are forecast to increase 17% from 2024 to 2050. This trend has led to the development and adoption of energy-efficient deburring machines that minimize waste generation, optimize energy use, and reduce reliance on harmful chemicals. Companies improve their operational efficiency and also align with corporate sustainability goals and evolving consumer expectations by integrating sustainable practices. This shift toward environmentally responsible manufacturing propels the demand for advanced deburring solutions that balance precision with eco-conscious operations.

Segmental Insights

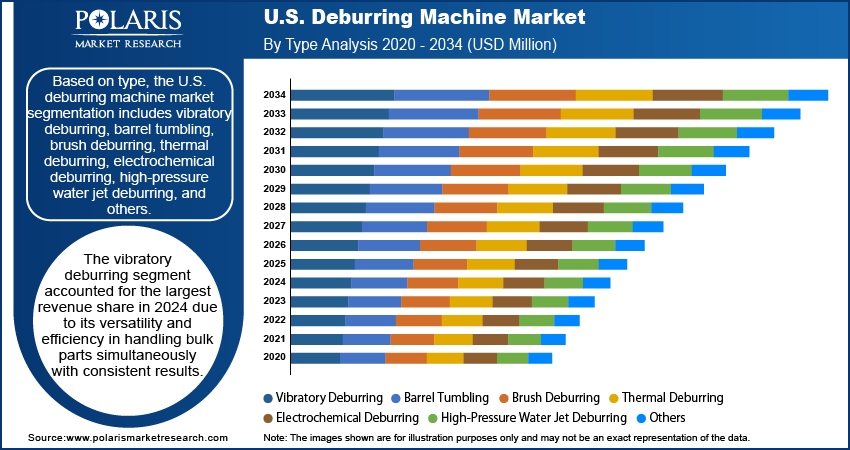

Type Analysis

Based on type, the segmentation includes vibratory deburring, barrel tumbling, brush deburring, thermal deburring, electrochemical deburring, high-pressure water jet deburring, and others. The vibratory deburring segment accounted for the largest revenue share in 2024 due to its versatility and efficiency in handling bulk parts simultaneously with consistent results. This method is widely preferred in the U.S. manufacturing industries such as automotive and aerospace, where high-volume production requires reliable finishing. Vibratory deburring ensures uniform removal of sharp edges and surface imperfections and is compatible with different types of deburring media. Its ability to reduce labor intensity and enhance process repeatability further strengthens its adoption across precision-driven U.S. industries.

Operation Mode Analysis

In terms of operation mode, the segmentation includes automatic, semi-automatic, and manual. The semi-automatic segment is expected to witness the fastest growth at a CAGR of 5.0% during the forecast period, supported by its balance of efficiency and cost-effectiveness. Semi-automatic systems provide a mix of automation for consistency while retaining manual flexibility for complex parts that require operator oversight. This mode of operation aligns well with U.S. manufacturers aiming to enhance throughput while managing investment costs. Additionally, semi-automatic deburring solutions are highly adaptable across small and medium-sized enterprises, enabling them to maintain high-quality standards without fully shifting to high-cost, fully automated systems.

Deburring Media Analysis

The segmentation, based on deburring media, includes ceramic, steel, plastic, and organic compounds. The ceramic segment dominated the market share in 2024 due to its superior durability, cutting power, and suitability for finishing hard metals used in U.S. industries such as aerospace, defense, and heavy machinery. Ceramic media offers consistent performance over extended cycles, making it ideal for high-precision applications where tolerance levels are critical. Moreover, its ability to handle both aggressive material removal and fine finishing makes it a preferred choice among manufacturers. The reliability and efficiency of ceramic media contribute to reducing cycle times while ensuring parts meet strict quality benchmarks.

End Use Analysis

Based on end use, the U.S. deburring machine market segmentation includes automotive, aerospace & defense, electronics, medical devices, metalworking, and others. The aerospace & defense segment is expected to register a CAGR of 5.9% due to the rising demand for high-precision components with flawless finishes. In the U.S., where aerospace and defense manufacturing hold strategic importance, deburring machines play a critical role in ensuring compliance with rigorous quality and safety standards. The ability to produce parts with zero defects, particularly in turbine blades, engine parts, and structural components, drives the reliance on advanced deburring solutions. Therefore, as defense programs and aerospace production expand, the segment continues to boost growth in the U.S. deburring machine market.

Key Players & Competitive Analysis

The competitive intelligence and strategy landscape of the U.S. deburring machine market is defined by technological advancement in automation and robotics, a key industry trend driven by the need for precision. Vendor strategies focus on serving small and medium-sized businesses seeking flexible solutions, while larger players target high-growth markets and emerging technologies such as AI-powered vision systems. Supply chain disruptions and economic and geopolitical shifts remain significant challenges, forcing manufacturers to build more sustainable value chains. For new entrants, conducting thorough market entry assessments is essential to identify hidden demand and opportunities within specific business segments. Success relies on competitive positioning through superior product offerings and leveraging expert’s insight on evolving industry ecosystems to capitalize on expansion opportunities.

A few major companies operating in the U.S. deburring machine market include Abtex Corp.; ATI Industrial Automation; Bel Air Finishing; Burr King; C&M Topline; Cogsdill Tool Products, Inc.; ESMA, Inc.; OTEC USA Inc.; Sugino Corp USA; and Vibra Finish Company.

Key Players

- Abtex Corp.

- ATI Industrial Automation

- Bel Air Finishing

- Burr King

- C&M Topline

- Cogsdill Tool Products, Inc.

- ESMA, Inc.

- OTEC USA Inc.

- Sugino Corp USA

- Vibra Finish Company

U.S. Deburring Machine Industry Developments

- July 2025: MC Machinery Systems launched a Finishing Division through a partnership with Italy's EMC Srl. This expands its portfolio to provide end-to-end fabrication capabilities, including surface finishing alongside laser cutting and bending.

- April 2025: Brother Industries launched new deburring machines in its SPEEDIO series, including a compact 4-axis BT15 spindle model for die-cast parts. It offers simplified teaching point setup and automated tool path generation to minimize preparation time.

U.S. Deburring Machine Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Vibratory Deburring

- Barrel Tumbling

- Brush Deburring

- Thermal Deburring

- Electrochemical Deburring

- High-Pressure Water Jet Deburring

- Others

By Operation Mode Outlook (Revenue, USD Million, 2020–2034)

- Automatic

- Semi-automatic

- Manual

By Deburring Media Outlook (Revenue, USD Million, 2020–2034)

- Ceramic

- Steel

- Plastic

- Organic Compounds

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Automotive

- Aerospace & Defense

- Electronics

- Medical Devices

- Metalworking

- Others

U.S. Deburring Machine Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 173.61 Million |

|

Market Size in 2025 |

USD 182.67 Million |

|

Revenue Forecast by 2034 |

USD 291.82 Million |

|

CAGR |

5.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

|

FAQ's

The market size was valued at USD 173.61 million in 2024 and is projected to grow to USD 291.82 million by 2034.

The market is projected to register a CAGR of 5.3% during the forecast period.

A few of the key players in the market are Abtex Corp.; ATI Industrial Automation; Bel Air Finishing; Burr King; C&M Topline; Cogsdill Tool Products, Inc.; ESMA, Inc.; OTEC USA Inc.; Sugino Corp USA; and Vibra Finish Company.

The vibratory deburring segment accounted for the largest revenue share in 2024.

The semi-automatic segment is expected to witness the highest CAGR of 5.0% during the forecast period.