U.S. Dietary Supplements Market Size, Share, Trends, Industry Analysis Report

By Type (Vitamins, Minerals), By Form, By Application, By Distribution Channel, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6175

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

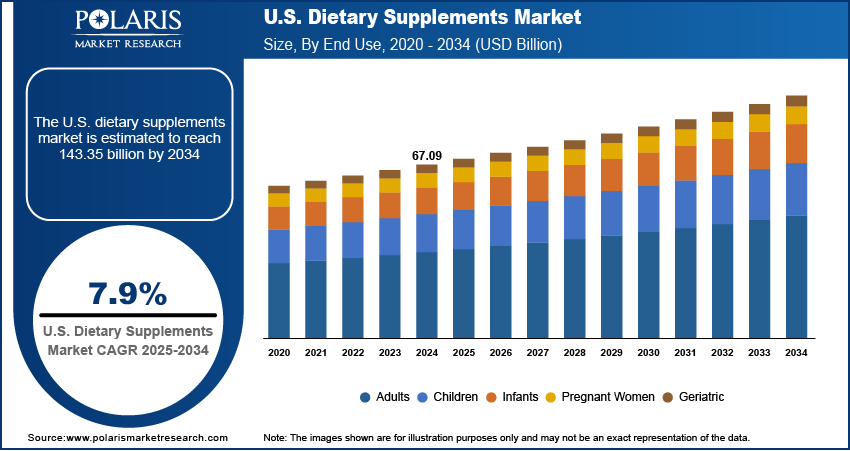

The U.S. dietary supplements market size was valued at USD 67.09 billion in 2024, growing at a CAGR of 7.9% from 2025 to 2034. The market growth is driven by the increasing e-commerce adoption and online supplement sales, and aging population and age-related health concerns.

Key Insights

- In 2024, the vitamins segment dominated with the largest share driven by rising consumer demand for essential micronutrients that support overall health maintenance.

- The powder segment is expected to experience the fastest growth during the forecast period due to its versatility and ease of incorporation into various dietary regimens.

- In 2024, the immunity segment dominated with the largest share as a significant consumer shift toward proactive health management and illness prevention.

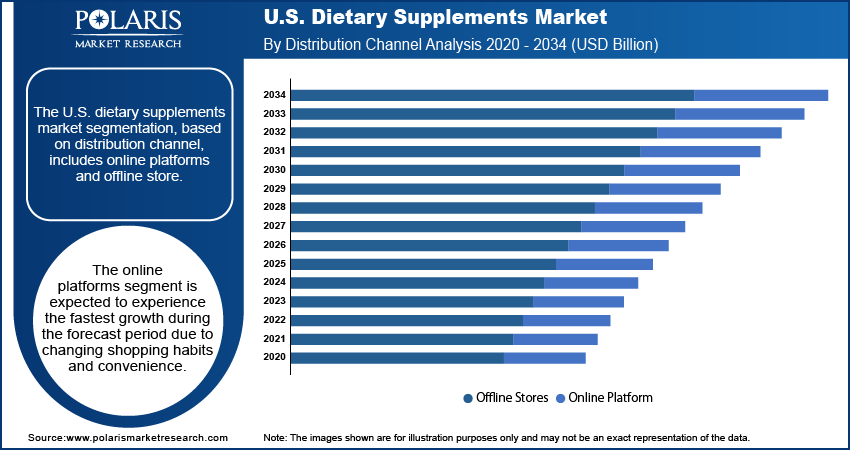

- The online platforms segment is expected to experience the fastest growth during the forecast period, driven by evolving consumer purchasing behaviors and the growing emphasis on convenience in shopping experiences.

Industry Dynamics

- Rising e-commerce penetration and online supplement sales drive the industry growth by improving accessibility.

- Aging population and age-related health concerns fuel the industry growth.

- Consumers who go to the gym, play sports, or follow workout routines often use dietary supplements to improve performance and recovery, thereby driving the demand

- High regulatory scrutiny and inconsistent product quality standards restrain widespread adoption of dietary supplements.

Market Statistics

- 2024 Market Size: USD 67.09 billion

- 2034 Projected Market Size: USD 143.35 billion

- CAGR (2025–2034): 7.9%

To Understand More About this Research: Request a Free Sample Report

Dietary supplements are taken orally and contain numerous nutrients such as vitamins, minerals, herbs, amino acids, and enzymes intended to supplement the diet. The supplements are available in various forms, including tablets, capsules, powders, and liquids. They are not meant to replace whole foods but to support overall health or address specific nutritional gaps.

Consumers in the U.S. are increasingly focused on maintaining good health and preventing illness. Many individuals are choosing to support their health through dietary supplements that provide essential vitamins, minerals, and other nutrients. Public health campaigns and online health information have contributed to this shift in behavior. Individuals now recognize the value of nutrition in promoting energy, immunity, and long-term wellness. This awareness has led to higher interest in products such as multivitamins, probiotics, and herbal supplements. The growing demand reflects a stronger commitment to personal health and nutritional balance across all age groups, thereby driving the growth.

Physical fitness and regular exercise are important to a growing number of Americans. People who go to the gym, play sports, or follow workout routines often use dietary supplements to improve performance and recovery. Products such as protein powders, branched-chain amino acids, and energy boosters are commonly used to support fitness goals. Promotions through sports influencers, fitness videos, and gym communities have increased awareness of these products. This demand is especially strong among younger adults who value physical activity. The connection between fitness and nutrition is contributing to consistent growth in this supplement category, thereby fueling the growth of the industry in the country.

Drivers & Opportunities

Expansion of E-Commerce and Online Supplement Sales: The e-commerce sector in the U.S. is growing rapidly. According to the U.S. Census Bureau, in the first quarter of 2025, e-commerce sales totaled USD 300.2 billion. Online retail platforms have made dietary supplements more accessible to consumers across the U.S. People now order products from home, compare brands, read customer reviews, and receive items through fast delivery services. Additionally, e-commerce websites often offer a wider selection and flexible purchase options, including subscriptions. Smaller supplement brands compete more easily by reaching buyers directly online. The strong presence of supplements on digital platforms is positively impacting the growth in the U.S.

Aging Population and Age-Related Health Concerns: The number of older adults in the U.S. continues to increase, creating a larger demand for dietary supplements as the population witnesses the rising age-related health challenges. According to the World Bank Group, in 2024, 18% of the total country’s population was 65 years and above. Common issues such as joint stiffness, memory decline, and weaker bones are prompting many seniors to include dietary supplements in their daily routines. Products such as calcium, vitamin D, and omega-3 fatty acids are frequently used to support these needs. Additionally, healthcare professionals often recommend supplements to help manage specific conditions or deficiencies, thereby driving the growth.

Segmental Insights

Type Analysis

The segmentation, based on type, includes vitamins, minerals, amino acids, botanicals, probiotics, enzymes, and others. In 2024, the vitamins segment dominated with the largest share due to high consumer demand for essential nutrients that support general health. Products such as vitamin C, D, B-complex, and multivitamins are widely used to maintain energy levels, immunity, and overall wellness. Many individuals use vitamins daily to fill nutritional gaps caused by poor diets or busy lifestyles. Increased awareness of preventive healthcare and frequent recommendations by healthcare professionals have further supported vitamin sales. The strong trust in these products and their well-known health benefits further fuels the segment growth.

Form Analysis

The U.S. dietary supplements market segmentation, based on form, includes tablets, capsules, gummies, powder, soft gels, liquids, and others. The powder segment is expected to experience fastest growth during the forecast period due to their flexibility and ease of use. These products can be mixed with water, smoothies, or food, making them suitable for people who prefer not to take pills. The format is especially popular in fitness and sports nutrition, where protein powders and performance blends are widely used. Additionally, new formulations with added flavors, nutrients, and plant-based ingredients are attracting a broader audience. Moreover, the rise of health-conscious consumers and increased interest in custom dosages are driving the popularity of powdered supplements in the U.S.

Application Analysis

The segmentation, based on application, includes energy & weight management, bone & joint health, immunity, general health, cardia health, and others. In 2024, the immunity segment dominated with the largest share as consumers focused on staying healthy and avoiding illness. Immune-supporting ingredients such as vitamin C, zinc, elderberry, and probiotics became household staples. The trend was influenced by recent health events, seasonal illnesses, and a strong push for preventive care. Many people, including older adults and parents of young children, choose immune health supplements as part of their daily routines. Strong consumer trust and wide availability further boosts the segment growth.

Distribution Channel Analysis

The segmentation, based on distribution channel, includes online platforms and offline store. The online platforms segment is expected to experience the fastest growth during the forecast period due to changing shopping habits and convenience. Consumers increasingly prefer to buy supplements from websites and apps where they can compare products, read reviews, and access a wider range of options. Subscription services, targeted ads, and influencer marketing have made online platforms more appealing. The shift to digital shopping has further helped smaller brands reach customers nationwide. Improved delivery services and user-friendly websites have made it easier for consumers to find and regularly purchase their preferred supplements online, thereby driving the segment growth.

Key Players and Competitive Analysis

The U.S. dietary supplements market is highly competitive, with a mix of global pharmaceutical companies, specialized nutrition firms, and direct-selling brands. Major players such as Abbott Laboratories, Pfizer Inc., and GlaxoSmithKline plc leverage strong research capabilities and trusted healthcare brands to offer a wide range of supplements. Companies such as Amway Corp., Herbalife International, and XanGo, LLC focus on direct selling and personalized nutrition, gaining a loyal customer base. Glanbia Plc and The Archer-Daniels-Midland Company lead in sports nutrition and ingredient innovation. Firms such as Nature’s Sunshine, PharmaNutrics Himalaya, and Nutraceutics Corp. cater to niche segments with herbal and plant-based supplements. Competition is driven by product quality, pricing, brand reputation, and innovation in delivery formats. Market leaders continue to invest in research, online retail, and consumer education to maintain their edge in a rapidly evolving wellness-focused environment. Mergers and partnerships are also shaping the competitive landscape.

Key Players

- Abbott Laboratories

- Amway Corp.

- Bayer AG

- Glanbia Plc

- GlaxoSmithKline plc

- Herbalife International of America, Inc.

- Nature’s Sunshine Products, Inc.

- Nutraceutics Corp.

- Pfizer Inc.

- PharmaNutrics Himalaya Global Holdings Ltd.

- The Archer-Daniels-Midland Company

- XanGo, LLC

U.S. Dietary Supplements Industry Developments

In January 2024, Abbott launched its PROTALITY brand, starting with a high-protein nutrition shake. This product targets adults seeking weight management while preserving muscle mass and optimizing nutrition, aligning with contemporary trends in nutritional science.

In October 2023, Optimum Nutrition launched Clear Protein, an innovative transparent protein shake made from 100% plant-based protein isolate. Each serving provides 20 grams of high-quality protein and a refreshing fruity flavor, effectively supporting training and nutrition goals.

U.S. Dietary Supplements Market Segmentation

By Type Outlook (Revenue, USD Billion; 2020–2034)

- Vitamins

- Minerals

- Amino Acids

- Botanicals

- Probiotics

- Enzymes

- Others

By Form Outlook (Revenue, USD Billion; 2020–2034)

- Tablets

- Capsules

- Gummies

- Powder

- Soft Gels

- Liquids

- Others

By Application Outlook (Revenue, USD Billion; 2020–2034)

- Energy & Weight Management

- Bone & Joint Health

- Immunity

- General Health

- Cardia Health

- Others

By Distribution Channel Outlook (Revenue, USD Billion; 2020–2034)

- Online Platforms

- Offline Stores

By End Use Outlook (Revenue, USD Billion; 2020–2034)

- Adults

- Children

- Infants

- Pregnant Women

- Geriatric

U.S. Dietary Supplements Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 67.09 Billion |

|

Market Size in 2025 |

USD 72.27 Billion |

|

Revenue Forecast by 2034 |

USD 143.35 Billion |

|

CAGR |

7.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 67.09 billion in 2024 and is projected to grow to USD 143.35 billion by 2034.

The market is projected to register a CAGR of 7.9% during the forecast period.

A few of the key players in the market are Abbott Laboratories; Glanbia Plc; The Archer-Daniels-Midland Company; Nature’s Sunshine Products, Inc.; GlaxoSmithKline plc; Amway Corp.; Herbalife International of America, Inc.; XanGo, LLC; PharmaNutrics Himalaya Global Holdings Ltd.; Nutraceutics Corp.; Pfizer Inc.; and Bayer AG.

The vitamin segment dominated the market share in 2024.

The online platform segment is expected to witness the fastest growth during the forecast period.