U.S. Disclosure Management Market Size, Share, & Trends, Analysis Report

By Component (Software, Services), By Business Function, By Deployment, By Enterprise Size, and By End Use– Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5849

- Base Year: 2024

- Historical Data: 2020-2023

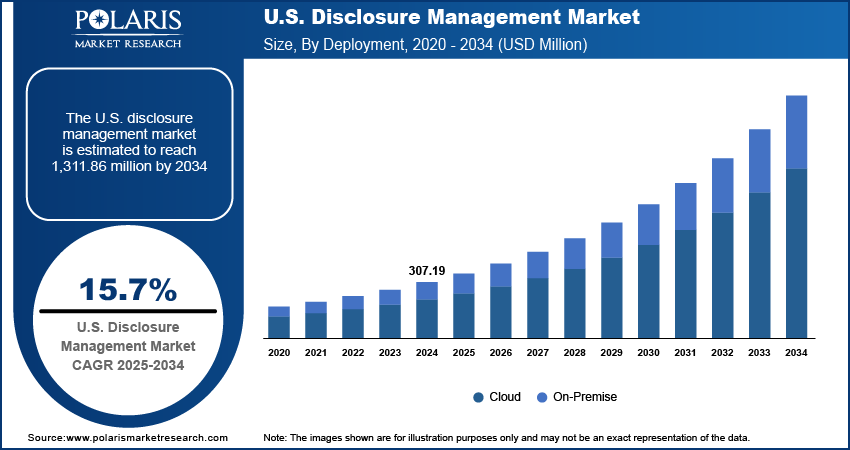

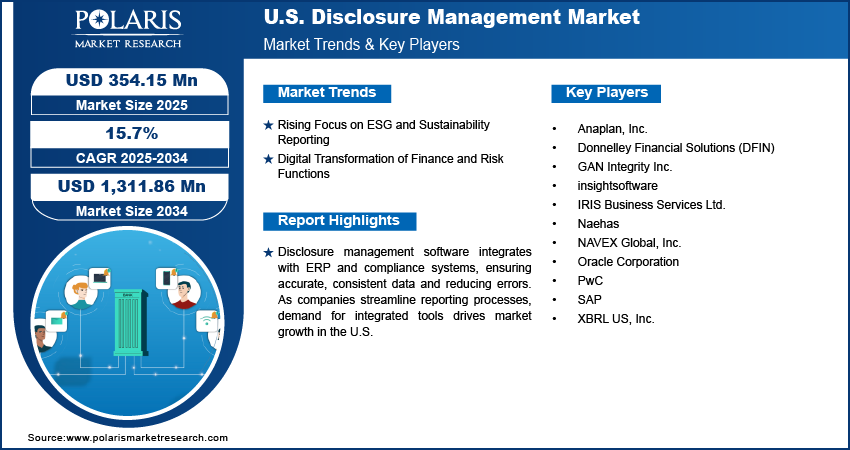

The U.S. disclosure management market size was valued at USD 307.19 million in 2024, growing at a CAGR of 15.7% during 2025–2034. The growth is driven by rising focus on ESG and sustainability reporting, and digital transformation of finance and risk functions

Market Overview

Disclosure management software is a tool that helps organizations collect, manage, and report financial, regulatory, and compliance information in a structured, accurate, and audit-ready format. It streamlines the reporting process by integrating data from multiple sources and ensuring consistency across disclosures such as financial statements, ESG reports, and regulatory filings.

Companies face increasing regulatory pressure in US from agencies like the SEC, IRS, and others to provide accurate and timely financial disclosures. Regulations such as the Sarbanes-Oxley Act, ESEF mandates, and ESG reporting guidelines require detailed, transparent, and audit-ready documentation. Manual reporting becomes inefficient and error-prone as these requirements become more complex. This is driving organizations to adopt disclosure management software that automates and simplifies compliance processes. These tools help companies stay compliant while reducing the risk of penalties and reputational damage due to inaccurate filings with built-in validation checks, audit trails, and standardized templates, thereby driving the growth.

Many companies use multiple software tools for finance, ERP, risk management, and compliance. Managing disclosures manually across these disconnected systems lead to inefficiencies and errors. Disclosure management software solves this by integrating with ERP platforms like SAP, Oracle, and others, allowing seamless data flow from source to report. This integration ensures that the reported data is up-to-date, consistent, and accurate. Integrated disclosure tools that connect with existing systems are gaining popularity as enterprises seek to streamline their reporting processes and unify their tech stacks, thereby driving the growth in US.

Industry Dynamics

Rising Focus on ESG and Sustainability Reporting

Environmental, Social, and Governance (ESG) factors are becoming essential parts of corporate reporting in the US Investors, regulators, and stakeholders now expect companies to disclose their sustainability performance in a clear and standardized manner. According to the Harvard Law School Forum on Corporate Governance, in 2023, 76.2% of top 3000 US companies reported climate change as major risk in 10-K form. Disclosure management software supports ESG reporting by collecting data from various departments and presenting it in line with frameworks like GRI, SASB, and the upcoming SEC climate disclosure rules. Organizations are investing in tools that allow them to track, manage, and transparently disclose their ESG commitments with increasing emphasis on corporate responsibility. This shift significantly drives the demand for advanced reporting solutions, thereby driving the growth.

Digital Transformation of Finance and Risk Functions

There's a growing push to replace outdated manual systems with integrated digital solutions as organizations modernize their finance and compliance operations. Disclosure management software plays a major role in this transformation by automating data consolidation, report generation, and submission processes. These tools improve collaboration across departments, improve data accuracy, and reduce time spent on routine tasks. The move toward cloud-based financial reporting platforms further allows teams to work remotely and securely. Digital disclosure management tools become a critical investment as businesses strive for agility and operational efficiency, supporting both compliance and strategic decision-making, thereby digital transformation is driving the growth in US.

Segmental Insights

By Component Analysis

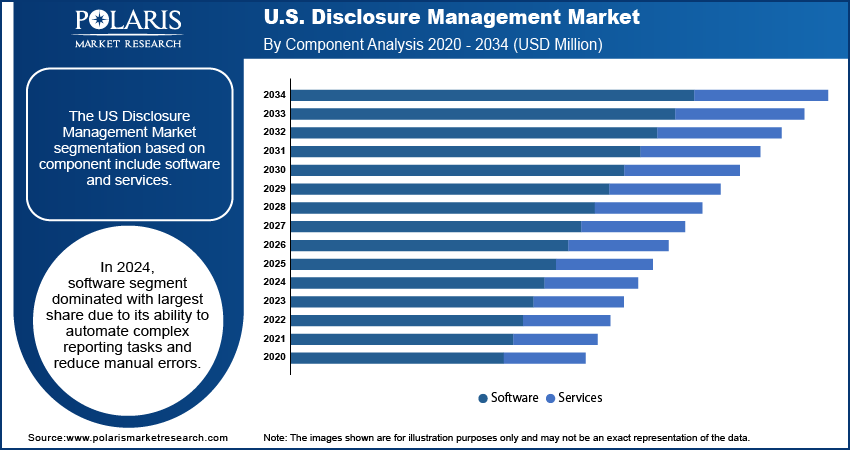

The segmentation based on component include software, services. In 2024, software segment dominated with largest share due to its ability to automate complex reporting tasks and reduce manual errors. Organizations increasingly adopted dedicated disclosure software to meet evolving regulatory and compliance needs, especially around financial and ESG reporting. These solutions provide robust features such as workflow automation, real-time collaboration, version control, and data validation. Businesses prefer purpose-built software over traditional spreadsheet-based methods as compliance standards tighten and demand for accuracy grows, thereby driving the segment growth.

By Deployment Analysis

The segmentation based on deployment includes cloud, on-premise. The on premise segment is expected to experience significant growth as many large enterprises and regulated industries prefer on-premise installations due to higher control over data, stronger internal security protocols, and regulatory constraints. These organizations value the ability to manage their disclosure systems within their own IT infrastructure, especially when handling sensitive financial or legal data. On-premise deployments offer a reliable and customizable alternative to cloud-based models with rising cybersecurity concerns and stricter compliance mandates, thereby driving the segment growth.

By Business Function Analysis

The segmentation based on business function includes finance, legal, marketing and communication, procurement, and human resources. The finance segment held the largest share in 2024 as financial reporting remains the core area requiring high accuracy and regulatory alignment. Finance teams use disclosure software to create annual reports, SEC filings, and quarterly earnings statements, ensuring data consistency across formats and departments. Automation and audit readiness are key priorities as financial disclosures are heavily scrutinized by regulators and investors. The software further supports real-time updates and version tracking, which simplifies collaboration and reduces last-minute reporting errors, thereby driving the segment growth.

By Enterprise Size Analysis

The segmentation based on enterprise size includes small & medium enterprises, large enterprises. The small & medium enterprises is expected to record significant growth the as they face increasing compliance requirements, especially around ESG and financial transparency. Traditionally reliant on manual or basic tools, SMEs are now recognizing the value of scalable and affordable disclosure solutions. Cloud-based and subscription models are becoming more accessible, even smaller organizations are now able to implement advanced tools without heavy upfront investment. These tools help SMEs automate workflows, reduce compliance risks, and present professional-grade reports to stakeholders, thereby driving the segment growth.

Key Players & Competitive Analysis Report

The US industry is marked by intense competition among technology providers, compliance specialists, and financial planning software firms. Major players like SAP, Oracle, and PwC offer robust enterprise-level solutions integrated with financial and ESG reporting capabilities, catering to large organizations. NAVEX Global and GAN Integrity focus on risk and compliance automation, delivering tools for conflict of interest and ethical disclosures. Donnelley Financial Solutions (DFIN) and IRIS Business Services provide specialized XBRL and regulatory reporting services. Anaplan and insightsoftware offer performance management and disclosure tools that align financial planning with compliance needs. Naehas supports dynamic content governance, while XBRL US, Inc. plays a key role in standard development and industry advocacy. The market is driven by increasing regulatory demands, especially around ESG and financial transparency, prompting organizations to seek integrated, scalable, and audit-ready disclosure solutions. Innovation, cloud computing capabilities, and regulatory alignment remain key competitive differentiators in this evolving landscape.

Key Players

- Anaplan, Inc.

- Donnelley Financial Solutions (DFIN)

- GAN Integrity Inc.

- insightsoftware

- IRIS Business Services Ltd.

- Naehas

- NAVEX Global, Inc.

- Oracle Corporation

- PwC

- SAP

- XBRL US, Inc.

Industry Developments

In November 2024, SAP released the Disclosure Management Stack 2200, enhancing sustainability reporting, XBRL capabilities, and data accuracy. New features included support for SCT integration, ESEF/ESRS Starter Kit, enumerations, typed dimensions, improved validations, partial previews, and CSV reporting for EBA.

In November 2021, NAVEX Global launched its COI Disclosures tool, offering a centralized solution to automate conflict of interest management. The tool replaced manual processes, improved audit readiness, and integrated with broader compliance systems to enhance risk visibility and regulatory defensibility.

US Disclosure Management Market Segmentation

By Component Outlook (Revenue, USD Million, 2020–2034)

- Software

- Services

By Business Function Outlook (Revenue, USD Million, 2020–2034)

- Finance

- Legal

- Marketing and Communication

- Procurement

- Human Resources

By Deployment Outlook (Revenue, USD Million, 2020–2034)

- Cloud

- On-Premise

By Enterprise Size Outlook (Revenue, USD Million, 2020–2034)

- Small & Medium Enterprises

- Large Enterprises

By End Use Outlook (Revenue, USD Million, 2020–2034)

- BFSI

- IT and Telecommunications

- Government and Defense

- Manufacturing

- Retail and E-commerce

- Media & Entertainment

- Healthcare

- Others

US Disclosure Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 307.19 Million |

|

Market Size Value in 2025 |

USD 354.15 Million |

|

Revenue Forecast by 2034 |

USD 1,311.86 Million |

|

CAGR |

15.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 307.19 million in 2024 and is projected to grow to USD 1,311.86 million by 2034.

The global market is projected to register a CAGR of 15.7% during the forecast period.

A few of the key players in the market are Anaplan, Inc.; Donnelley Financial Solutions (DFIN); GAN Integrity Inc.; insightsoftware; IRIS Business Services Ltd.; Naehas; NAVEX Global, Inc.; Oracle Corporation; PwC; SAP; XBRL US, Inc.

The software segment dominated the market share in 2024.

The on-premise segment is expected to witness the significant growth during the forecast period.