U.S. Electric Construction Equipment Market Size, Share, Trends, Industry Analysis Report

By Equipment (Excavators, Loaders), By Battery Capacity, By Battery Technology, By Power Source, By End-Use Industry – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5985

- Base Year: 2024

- Historical Data: 2020-2023

Overview

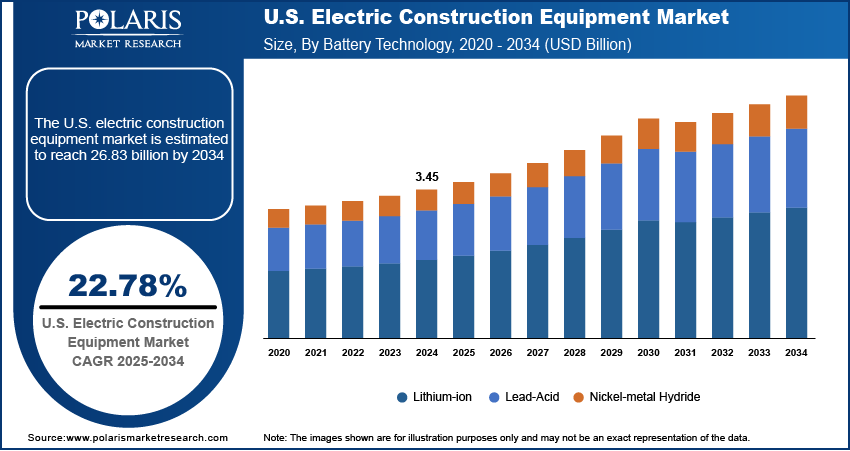

The U.S. electric construction equipment market size was valued at USD 3.45 billion in 2024, growing at a CAGR of 22.78% from 2025 to 2034. Key factors driving demand for electric construction equipment in the U.S. include increasing investments in the development of smart cities, strict carbon emission norms, and the expanding mining sector.

Key Insight

- The excavators segment held the largest U.S. electric construction equipment market share in 2024.

- The 50 kWh to 200 kWh segment dominated the revenue share in 2024.

- The lithium-ion segment accounted for a major revenue share in 2024.

- The battery electric vehicles (BEV) segment held a larger revenue share in 2024.

- The plug-in hybrid electric vehicles (PHEV) segment is projected to hold a substantial market share by 2034.

Electric construction equipment refers to heavy machinery powered by electric motors instead of traditional internal combustion engines. A few common types of electric construction equipment include electric excavators, loaders, dump trucks, and telehandlers. These machines offer significant benefits: they produce no local emissions, reduce carbon footprint, and operate much more quietly than their diesel counterparts, making them ideal for use in noise-sensitive environments such as residential areas and tunnels. These machines also require less maintenance and have higher energy efficiency, resulting in lower operating and energy costs.

In the U.S., electric construction equipment is still emerging but gaining momentum as manufacturers and contractors respond to environmental regulations, urbanization, and rising demand for sustainable practices. Major brands such as Volvo, Caterpillar, and Bobcat have introduced electric models in the U.S., including excavators and wheel loaders, that match the performance of their diesel counterparts. The adoption of electric construction equipment in the U.S. is driven by its various benefits such as reduced operating costs, lower maintenance needs, and compliance with emissions standards. The market growth is also fueled by government incentives and advancements in battery technology.

To Understand More About this Research: Request a Free Sample Report

The U.S. electric construction equipment market demand is driven by the increasing investments in the development of smart cities. Smart cities require eco-friendly infrastructure, pushing contractors to adopt electric excavators, cranes, and loaders to meet strict environmental regulations. These projects usually feature clean energy integration, making electric construction equipment a natural fit for solar-powered or grid-connected construction sites. Additionally, smart cities rely on data-driven operations, and ECE's advanced telematics align with IoT-enabled monitoring, enhancing productivity, leading to high adoption. Therefore, increasing investment in the development of smart cities is driving the growth of the market.

Industry Dynamics

- Strict carbon emission norms are driving the U.S. electric construction equipment market growth by banning the use of diesel-powered equipment.

- The expanding mining sector is driving the adoption of electric construction equipment, as it generates less noise and heat, thereby improving productivity in confined mining environments.

- Growing urbanization in the country is creating a lucrative market opportunity.

- The high cost of electric construction equipment hinders the U.S. electric construction equipment market growth.

Strict Carbon Emission Norms: Governments in the US are imposing heavy penalties or restrictions on high-emission vehicles, making electric alternatives more financially viable. Many cities in the country are now implementing low-emission zones, banning diesel-powered equipment, and requiring contractors to adopt zero-emission solutions, such as electric excavators and loaders, leading market growth. Companies are also gaining carbon credits or tax benefits by using electric construction equipment, contributing to their high adoption. Therefore, as global emission standards tighten, manufacturers are investing more in electric technology, thereby expanding market revenue.

Expanding Mining Sector: Environmental regulations in mining regions are pushing firms to adopt electric excavators, haul trucks, and loaders to reduce emissions and avoid penalties. Electric equipment also lowers long-term operational costs, as it requires less maintenance. This makes electric construction equipment ideal for the mining sector, as it demands long-operating machinery. Additionally, electric machinery generates less noise and heat, improving worker safety and productivity in confined mining environments. Therefore, as mineral demand increases across the world, mining companies are prioritizing sustainability, further accelerating the shift toward electric construction solutions.

Segmental Insights

Equipment Analysis

Based on equipment, the segmentation includes excavators, loaders, bulldozers, cranes, dump trucks, rollers, and others. The excavators segment dominated the U.S. electric construction equipment market share in 2024 due to their widespread use in both urban and rural infrastructure development projects. Contractors prefer electric excavators due to their ability to operate in noise-sensitive zones such as residential neighborhoods and hospital vicinities. Moreover, their lower maintenance requirements and reduced fuel costs have made them a cost-effective choice for long-term operations. Federal and state-level initiatives promoting zero-emission construction practices have further accelerated the adoption of electric variants, especially in states such as California and New York, where emission regulations are more stringent. The increasing trend of smart and autonomous construction solutions has also pushed manufacturers to integrate advanced features into electric excavators, enhancing their efficiency and adoption.

The loaders segment is projected to grow at a robust pace in the coming years, owing to the growing focus on indoor construction activities, including warehouse developments and industrial facility upgrades, which has increased demand for compact, maneuverable, and emission-free machines. Loaders effectively meet these needs, especially in confined spaces where ventilation is limited. Additionally, rapid advancements in battery technology are improving the operational duration and power output of these machines, making them more practical for extended use across job sites. Government funding for sustainable infrastructure and green building initiatives continues to support the transition toward electrified loaders, which would position them as a growing segment in the coming years.

Battery Capacity Analysis

In terms of battery capacity, the segmentation includes less than 50 kWh, 50 kWh to 200 kWh, and more than 200 kWh. The 50 kWh to 200 kWh segment dominated the revenue share in 2024 due to its suitability for a wide range of mid-sized construction machines such as electric excavators, loaders, and compact dump trucks. This capacity range provides a balanced combination of power and endurance, enabling machines to operate efficiently throughout an entire work shift without requiring frequent recharging. Contractors increasingly selected this battery capacity due to its compatibility with fast-charging infrastructure and manageable weight, which avoids compromising machine maneuverability. Furthermore, the rising adoption of electrified equipment in urban infrastructure and utility projects supported the demand for electric construction equipment with a battery capacity of 50 kWh to 200 kWh.

Battery Technology Analysis

In terms of battery technology, the segmentation includes lead-acid, lithium-ion, and nickel-metal hydride. The lithium-ion segment accounted for a major U.S. electric construction equipment market revenue share in 2024 due to its superior energy density, longer lifespan, and faster charging capabilities compared to other battery types. Manufacturers and contractors opt for lithium-ion-powered machines as they deliver consistent performance across a variety of operating conditions, including extreme temperatures. These batteries also offer a lighter weight, which helps improve equipment maneuverability and reduces structural strain on vehicles. Furthermore, the increasing availability of lithium-ion variants specifically designed for construction use has accelerated their adoption. Government incentives aimed at promoting cleaner energy use in construction activities have further propelled the demand for electric construction equipment powered by lithium-ion batteries.

Power Source Analysis

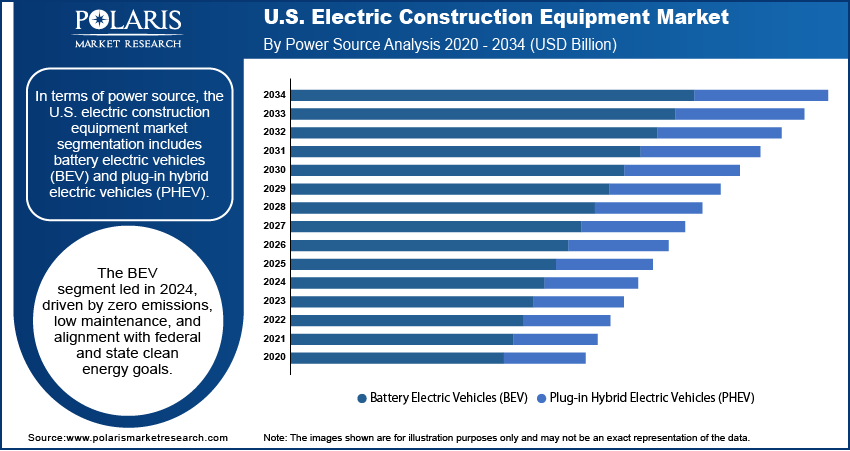

In terms of power source, the segmentation includes battery electric vehicles (BEV) and plug-in hybrid electric vehicles (PHEV). The battery electric vehicles (BEV) segment held a larger revenue share in 2024 due to their zero-emission operation, lower maintenance requirements, and compatibility with clean energy goals set by federal and state authorities. Contractors increasingly adopted BEV models for urban and indoor construction projects, where noise reduction and air quality standards are strictly regulated. Moreover, the expansion of fast-charging infrastructure and the increasing availability of mid- to large-sized electric machinery from major manufacturers have further accelerated the deployment of BEV equipment on job sites nationwide.

The plug-in hybrid electric vehicles (PHEV) segment is projected to hold a substantial market share by 2034. PHEVs are appealing to contractors working in remote or high-intensity construction zones where charging stations remain scarce or inaccessible. These machines provide the ability to switch between electric and fuel-based modes, ensuring uninterrupted productivity while still contributing to reduced emissions. Additionally, advances in hybrid system efficiency and battery integration are projected to enhance the appeal of PHEV models, positioning them as an ideal choice for contractors that require versatility without fully transitioning to electric-only fleets.

Key Players and Competitive Analysis

The U.S. electric construction equipment market is rapidly evolving, driven by sustainability initiatives, stricter emissions regulations, and advancements in battery technology. Established industry players such as Caterpillar Inc., Komatsu, and Volvo are at the forefront, leveraging their extensive dealer networks and R&D capabilities to introduce electric excavators, loaders, and compactors. Caterpillar’s Next Gen excavators and Volvo’s ECR25 electric compact excavator highlight their commitment to zero-emission machinery, targeting urban construction and indoor applications. Komatsu has also entered the space with its PC30E-5 electric mini-excavator, emphasizing lower operating costs and reduced noise pollution. New entrants, such as Bobcat and HD Hyundai, are expanding the competition in the market with advanced automation and telematics integration. The competitive landscape is further intensified by government incentives promoting electric adoption, pushing manufacturers to accelerate electrification.

A few major companies operating in the U.S. electric construction equipment market include Bobcat, Caterpillar Inc., HD Hyundai Construction Equipment, Hitachi Construction Machinery Americas Inc., JCB, Kobelco, Komatsu, Kubota, Liebherr Group, SANY, Volvo, Wacker Neuson, and Xuzhou Construction Machinery Group (XCMG).

Key Players

- Bobcat

- Caterpillar Inc.

- HD Hyundai Construction Equipment

- Hitachi Construction Machinery Americas Inc.

- JCB

- Kobelco

- Komatsu

- Kubota

- Liebherr Group

- SANY

- Volvo

- Wacker Neuson

- Xuzhou Construction Machinery Group (XCMG)

Industry Developments

April 2025: Volvo announced the launch of two mid-size electric machines, the L120 electric wheel loader and the 23-ton EC230 electric excavator, in Anaheim, California

September 2024: Hitachi Construction Machinery Co., Ltd. and Dimaag-AI, Inc., an American Corporation, announced a collaboration to develop and produce an electrified compact hydraulic excavator.

U.S. Electric Construction Equipment Market Segmentation

By Equipment Outlook (Revenue, USD Billion, 2020–2034)

- Excavators

- Loaders

- Bulldozers

- Cranes

- Dump trucks

- Roller

- Others

By Battery Capacity Outlook (Revenue, USD Billion, 2020–2034)

- Less Than 50 kWh

- 50 kWh to 200 kWh

- More Than 200 kWh

By Battery Technology Outlook (Revenue, USD Billion, 2020–2034)

- Lead-Acid

- Lithium-Ion

- Nickel-Metal Hydride

By Power Source Outlook (Revenue, USD Billion, 2020–2034)

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

By End-Use Industry Outlook (Revenue, USD Billion, 2020–2034)

- Construction

- Mining

- Material Handling

- Agriculture

- Others

U.S. Electric Construction Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.45 Billion |

|

Market Size in 2025 |

USD 4.23 Billion |

|

Revenue Forecast by 2034 |

USD 26.83 Billion |

|

CAGR |

22.78% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 3.45 billion in 2024 and is projected to grow to USD 26.83 billion by 2034.

The market is projected to register a CAGR of 22.78 % during the forecast period.

A few of the key players in the market are Bobcat, Caterpillar Inc., HD Hyundai Construction Equipment, Hitachi Construction Machinery Americas Inc., JCB, Kobelco, Komatsu, Kubota, Liebherr Group, SANY, Volvo, Wacker Neuson, and Xuzhou Construction Machinery Group (XCMG).

The excavators segment dominated the market share in 2024.

The plug-in hybrid electric vehicles (PHEV) segment is expected to witness the fastest growth during the forecast period.