U.S. Electrophysiology Mapping and Ablation Devices Market Size, Share, Trends, Industry Analysis Report

By Product (Mapping & Lab Systems, Diagnostic Catheters, Ablation Catheters), By Procedure – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM6217

- Base Year: 2024

- Historical Data: 2020-2023

Overview

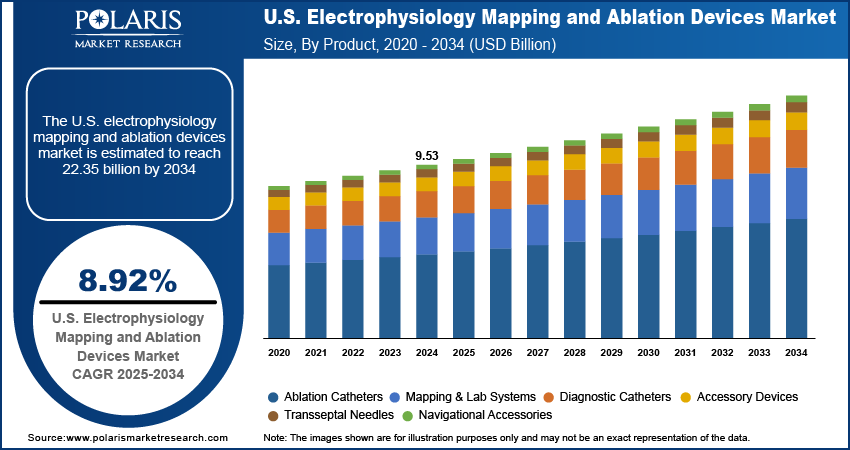

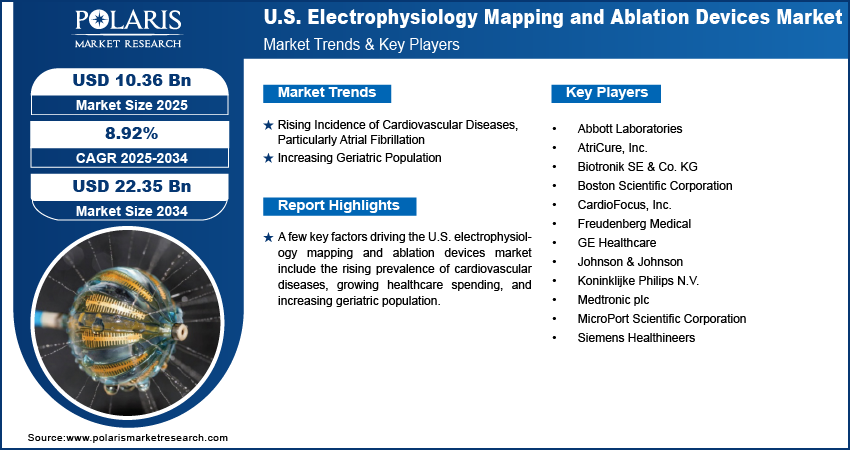

The U.S. electrophysiology mapping and ablation devices market size was valued at USD 9.53 billion in 2024, growing at a CAGR of 8.92% from 2025 to 2034. Key factors driving demand for the electrophysiology mapping and ablation devices in the U.S. include the rising incidence of cardiovascular diseases, growing healthcare spending, and increasing geriatric population.

Key Insights

- The ablation catheters segment dominated the U.S. electrophysiology mapping and ablation devices market share in 2024 due to their ability to treat atrial fibrillation.

- The mapping & lab systems segment is projected to grow at a robust pace in the coming years, owing to its capability to reduce fluoroscopy use.

- The EP ablation procedures segment held the largest revenue share in 2024 due to the growing prevalence of atrial fibrillation.

- The stand-alone EP diagnostic procedures segment is expected to grow at a rapid pace during the assessment period, owing to the rising focus on identifying precise arrhythmic foci to treat atrial fibrillation.

Industry Dynamics

- The rising prevalence of cardiovascular diseases, particularly atrial fibrillation, is boosting the demand for electrophysiology mapping and ablation devices, as atrial fibrillation requires catheter ablation procedures to restore normal heart rhythms.

- The increasing geriatric population is driving the U.S. electrophysiology mapping and ablation devices market growth, as the prevalence of atrial fibrillation is rapidly rising among the geriatric population.

- Advancements in AI-enabled navigation is projected to create a lucrative opportunity in the coming years.

- The risk of complications associated with catheter ablation procedures during or after the procedure hamper the market demand.

Market Statistics

- 2024 Market Size: USD 9.53 Billion

- 2034 Projected Market Size: USD 22.35 Billion

- CAGR (2025–2034): 8.92%

AI Impact on U.S. Electrophysiology Mapping and Ablation Devices Market

- AI tools enable seamless coordination between imaging platforms, robotic catheters, and mapping systems, which helps create a more connected EP suite.

- Various market players in the U.S. are focusing on developing AI-enabled driven mapping and pulsed-field ablation (PFA) devices to stay ahead in the competitive market.

- Rising FDA support for AI-enabled tools in cardiac care prompts companies to invest in innovation.

- In the U.S., market players and hospitals are adopting technologies that improve outcomes and reduce long-term healthcare costs, which propels AI integration in Electrophysiology mapping and ablation devices.

Electrophysiology mapping and ablation devices are medical tools used to diagnose and treat cardiac arrhythmias. Mapping systems create detailed 3D maps of the heart's electrical activity to locate abnormal tissue, while ablation devices destroy affected areas. These minimally invasive procedures restore normal heart rhythms, reducing reliance on medication. These procedures are commonly used for atrial fibrillation (AFib) as they improve patient outcomes with shorter recovery times compared to surgery.

The U.S. dominates the global electrophysiology mapping and ablation devices market due to advanced healthcare infrastructure, high arrhythmia prevalence, and strong adoption of innovative technologies. The U.S. is witnessing widespread use of robotic-assisted and AI-enhanced systems, improving precision in complex procedures. Reimbursement policies and growing AFib cases are further fueling demand in the country. The FDA’s stringent approvals ensure safety and efficacy, strengthening the U.S. as a leader in electrophysiology care, with increasing outpatient adoption enhancing accessibility and cost-efficiency.

The U.S. electrophysiology mapping and ablation devices market demand is driven by the growing healthcare spending. This is driving healthcare providers to prioritize treating complex cardiac conditions such as atrial fibrillation, which is fueling demand for electrophysiology mapping and ablation devices. Rising spending is also allowing broader insurance coverage, making these procedures more accessible to patients who need them, leading to market growth. Additionally, increasing healthcare expenditures is supporting research and development, leading to innovative and more effective devices that further stimulate market growth.

Drivers & Opportunities

Rising Incidence of Cardiovascular Diseases, Particularly Atrial Fibrillation: Atrial fibrillation (AFib) is a common and rapidly growing debilitating arrhythmia in the U.S., which is necessitating catheter ablation procedures to restore normal heart rhythms, driving hospitals and clinics to adopt advanced electrophysiology mapping and ablation devices. The American Heart Association estimated that the prevalence of atrial fibrillation in the U.S. will increase from 1.7% in 2020 to 2.4% in 2050. Additionally, the rising incidence of AFib is fueling awareness among the American population about the effectiveness of ablation therapy, which is encouraging patients to seek these procedures, sustaining long-term demand for electrophysiology mapping and ablation devices.

Increasing Geriatric Population: The prevalence of atrial fibrillation and other complex arrhythmias is rapidly rising among the geriatric population, which requires advanced diagnostic and treatment solutions such as electrophysiology procedures. Additionally, older patients often seek minimally invasive treatments, making catheter-based ablation procedures a preferred option over traditional surgery. Therefore, the expanding elderly demographic is ensuring a sustained need for electrophysiology mapping and ablation devices, encouraging manufacturers to innovate and healthcare facilities to invest in them. According to the Population Reference Bureau, the number of Americans aged 65 and above is projected to increase from 58 million in 2022 to 82 million by 2050. Hence, the rising geriatric population, which is prone to cardiovascular diseases, is driving the demand for electrophysiology mapping and ablation devices.

Segmental Insights

Product Analysis

Based on product, the segmentation includes mapping & lab systems, diagnostic catheters, ablation catheters, accessory devices, transseptal needles, and navigational accessories. The ablation catheters segment dominated the U.S. electrophysiology mapping and ablation devices market share in 2024 due to their crucial role in treating a wide range of cardiac arrhythmias, especially atrial fibrillation. The increasing prevalence of arrhythmia-related conditions and the growing preference for minimally invasive procedures contributed to the segment's dominance. Hospitals and cardiac centers increasingly adopted radiofrequency and cryoablation catheters due to their precision, safety profile, and proven clinical outcomes. Technological advancements, including contact force sensing, irrigated tip designs, and integration with 3D mapping systems, enhanced procedural efficiency and improved patient outcomes. Furthermore, favorable reimbursement policies and the rising number of catheter ablation procedures supported sustained segment demand.

The mapping & lab systems segment is projected to grow at a robust pace in the coming years, owing to their ability to improve the accuracy of ablation procedures and reduce fluoroscopy use. The demand for these systems continues to grow as electrophysiologists prioritize precision and procedural safety, particularly for complex arrhythmias. Additionally, the integration of artificial intelligence and improved user interfaces in mapping systems is expected to enhance their utility, further contributing to their future growth.

Procedure Analysis

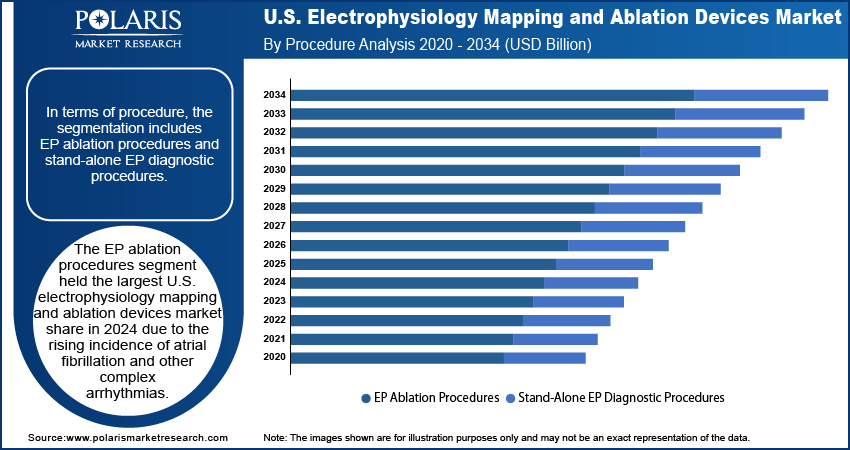

In terms of procedure, the segmentation includes EP ablation procedures and stand-alone EP diagnostic procedures. The EP ablation procedures segment held the largest U.S. electrophysiology mapping and ablation devices market revenue share in 2024 due to the rising incidence of atrial fibrillation and other complex arrhythmias. Cardiologists increasingly favored catheter ablation as a first-line treatment option due to its ability to provide long-term rhythm control and reduce reliance on antiarrhythmic drugs. The growing availability of advanced ablation technologies, such as contact force-sensing catheters and high-density mapping systems, has significantly improved procedural accuracy and outcomes. Furthermore, favorable clinical guidelines and increasing physician experience accelerated the adoption of EP ablation therapy across hospitals and cardiac centers. The expansion of electrophysiology labs and the growing number of board-certified electrophysiologists also contributed to the surge in EP ablation procedures across the country.

The stand-alone EP diagnostic procedures segment is expected to grow at a rapid pace during the forecast period, owing to its ability to identify precise arrhythmic foci using high-resolution mapping systems. Rising awareness of early arrhythmia detection and the need to stratify patients based on risk factors is further supporting the growth of diagnostic EP procedures. Additionally, advancements in non-fluoroscopic and AI-integrated diagnostic platforms are enhancing procedural safety and efficiency of EP diagnostic procedures, encouraging wider adoption across large academic hospitals and community-based facilities.

Key Players and Competitive Analysis

The U.S. electrophysiology (EP) mapping and ablation devices market is highly competitive, dominated by established medical technology leaders such as Johnson & Johnson, Abbott Laboratories, and Medtronic plc, which hold significant revenue share due to their advanced 3D mapping systems and radiofrequency (RF) ablation technologies. Boston Scientific Corporation and Biotronik also play key roles, offering innovative cryoablation and high-density mapping solutions. Emerging players are gaining traction with specialized ablation technologies, including laser-based systems. Koninklijke Philips N.V. and Siemens Healthineers contribute through advanced imaging and navigation integration, enhancing procedural precision. The market is characterized by rapid technological advancements, including AI-driven mapping and pulsed-field ablation (PFA), intensifying competition. Strategic partnerships, mergers, and FDA clearances for next-gen devices further drive innovation, positioning the U.S. as a leader in EP ablation therapies while increasing accessibility for cardiac arrhythmia treatments.

A few major companies operating in the U.S. electrophysiology mapping and ablation devices market include Abbott Laboratories; AtriCure, Inc.; Biotronik SE & Co. KG; Boston Scientific Corporation; CardioFocus, Inc.; Freudenberg Medical; GE Healthcare; Johnson & Johnson; Koninklijke Philips N.V.; Medtronic plc; MicroPort Scientific Corporation; and Siemens Healthineers.

Key Companies

- Abbott Laboratories

- AtriCure, Inc.

- Biotronik SE & Co. KG

- Boston Scientific Corporation

- CardioFocus, Inc.

- Freudenberg Medical

- GE Healthcare

- Johnson & Johnson

- Koninklijke Philips N.V.

- Medtronic plc

- MicroPort Scientific Corporation

- Siemens Healthineers

U.S. Electrophysiology Mapping and Ablation Devices Industry Developments

In November 2024, the U.S. Food and Drug Administration (FDA) approved the VARIPULSE pulsed field ablation platform by Johnson & Johnson for the treatment of atrial fibrillation.

In October 2024, the FDA approved enabled FARAWAVE NAV ablation catheter by Boston Scientific Corporation for the treatment of paroxysmal atrial fibrillation.

U.S. Electrophysiology Mapping and Ablation Devices Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Mapping & Lab Systems

- Diagnostic Catheters

- Ablation Catheters

- Accessory Devices

- Transseptal Needles

- Navigational Accessories

By Procedure Outlook (Revenue, USD Billion, 2020–2034)

- EP Ablation Procedures

- Stand-Alone EP Diagnostic Procedures

U.S. Electrophysiology Mapping and Ablation Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 9.53 Billion |

|

Market Size in 2025 |

USD 10.36 Billion |

|

Revenue Forecast by 2034 |

USD 22.35 Billion |

|

CAGR |

8.92% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 9.53 billion in 2024 and is projected to grow to USD 22.35 billion by 2034.

The market is projected to register a CAGR of 8.92% during the forecast period.

A few of the key players in the market are Abbott Laboratories; AtriCure, Inc.; Biotronik SE & Co. KG; Boston Scientific Corporation; CardioFocus, Inc.; Freudenberg Medical; GE Healthcare; Johnson & Johnson; Koninklijke Philips N.V.; Medtronic plc; MicroPort Scientific Corporation; and Siemens Healthineers.

The ablation catheters segment dominated the market share in 2024.

The stand-alone EP diagnostic procedures segment is expected to witness the fastest growth during the forecast period.