U.S. Gastric Cancer Diagnostics Market Size, Share, Trends, Industry Analysis Report

: By Product (Reagents & Consumables, Instruments), By Disease Type, By End Use – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 125

- Format: PDF

- Report ID: PM5916

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

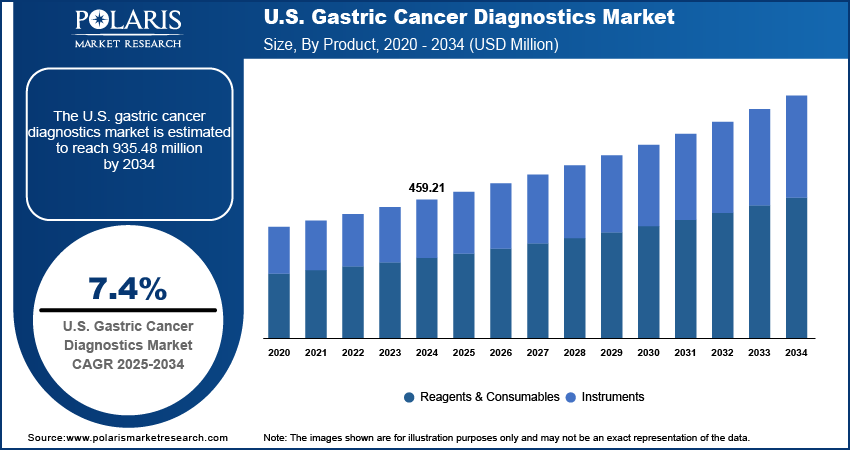

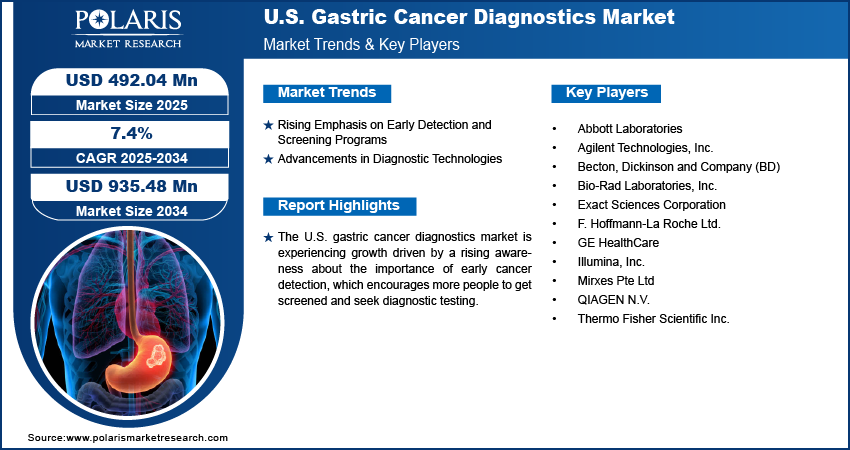

The U.S. gastric cancer diagnostics market size was valued at USD 459.21 million in 2024 and is anticipated to register a CAGR of 7.4% from 2025 to 2034. The market growth is largely driven by a growing awareness of early detection and screening programs, coupled with continued advancements in diagnostic technologies.

The U.S. gastric cancer diagnostics market involves various medical procedures, tests, and evaluations used to identify and confirm the presence of stomach cancer. Its goal is to detect the disease early, understand how far it has spread, and guide treatment decisions.

The prevalence of Helicobacter pylori (H. pylori) infection remains a significant driver for the U.S. gastric cancer diagnostics market expansion. This bacterium is a primary risk factor for gastric cancer, and its persistent presence in the stomach can lead to chronic inflammation and cellular changes that may eventually become cancerous. Diagnosing and eradicating H. pylori is a crucial step in preventing gastric cancer development, thereby fueling the demand for specific diagnostic tests. For example, the National Cancer Institute (NCI) provides a fact sheet titled "Helicobacter pylori (H. pylori) and Cancer" which states that chronic H. pylori infections significantly increase the risk of developing non-cardia gastric adenocarcinoma and gastric MALT lymphoma. The fact sheet further emphasizes that treating H. pylori infection can reduce the risk of gastric cancer in at-risk individuals. This strong link between H. pylori and gastric cancer directly drives the need for diagnostic methods to detect the infection and monitor its impact.

The aging population in the U.S. is another major factor driving the U.S. gastric cancer diagnostics market growth. Gastric cancer disproportionately affects older individuals, with the average age of diagnosis being relatively high. As the number of elderly people in the U.S. continues to grow, there will be an increased number of individuals at higher risk for developing gastric cancer, leading to a greater need for diagnostic services. The American Cancer Society's "Key Statistics About Stomach Cancer" of January 2025 highlights this trend, noting that stomach cancer mostly affects older people, with about 6 out of every 10 people diagnosed each year being 65 or above. This demographic shift directly translates into an expanded pool of individuals requiring screening, early detection, and ongoing diagnostic monitoring for gastric cancer, thereby boosting the industry's growth.

Industry Dynamics

Rising Emphasis on Early Detection and Screening Programs

Early diagnosis of gastric cancer helps improve patient survival rates. When detected at an early stage, treatment options are more effective, and the chances of a successful recovery are significantly higher. This increased awareness among both the public and healthcare professionals is leading to a greater push for systematic screening and diagnostic efforts.

Data from the National Cancer Institute's Surveillance, Epidemiology, and End Results (SEER) program, as highlighted in the American Cancer Society's "Stomach (Gastric) Cancer Survival Rates", shows a stark difference in 5-year relative survival rates. The survival rate for localized stomach cancer is 75%, while for distant stage cancer, it drops to 7%. This significant difference underscores the critical importance of early diagnosis. This strong correlation between early detection and improved outcomes is a major force driving the growth of the U.S. gastric cancer diagnostics market.

Advancements in Diagnostic Technologies

The field of gastric cancer diagnostics is constantly evolving with new and improved technologies. These advancements offer more accurate, less invasive, and more efficient ways to detect and characterize gastric cancer. From enhanced imaging techniques to sophisticated molecular tests, these innovations are making it easier for doctors to diagnose the disease.

A review article published in PubMed Central titled "Advancements in non-invasive diagnosis of gastric cancer" discusses how methods such as advanced imaging, liquid biopsy, and breath tests are set to transform gastric cancer diagnosis, making it more accessible and efficient. The article also states that early diagnosis is crucial for improving patient outcomes, with 5-year survival rates approaching 90% when gastric cancer is curable through surgical resection. These ongoing technological developments improve the capabilities of diagnostic tools, thereby driving their adoption and use in the U.S. gastric cancer diagnostics market.

Segmental Insights

Product Analysis

The reagents and consumables segment held a larger share in 2024, due to the constant and high demand for these products in routine diagnostic tests, including histopathology, immunohistochemistry, and molecular testing. Every cancer biopsy, blood test, or imaging procedure requires a range of specialized reagents, kits, and other single-use items, leading to their continuous consumption. The ongoing need for specific dyes and chemical solutions for tissue staining in pathological examinations or the demand for test kits used in identifying Helicobacter pylori infection, a known risk factor for gastric cancer, contributes significantly to this segment's leading position.

The instruments segment is anticipated to register the highest growth rate during the forecast period. This growth is largely fueled by rapid technological advancements and the increasing integration of innovative solutions. New generations of endoscopic instruments with enhanced imaging capabilities, such as high-definition endoscopes with virtual chromoendoscopy, are improving the visualization of subtle lesions and aiding in earlier detection. Moreover, the emergence of advanced molecular diagnostic platforms, including next-generation sequencing (NGS) and liquid biopsy technologies, requires sophisticated instruments for analysis.

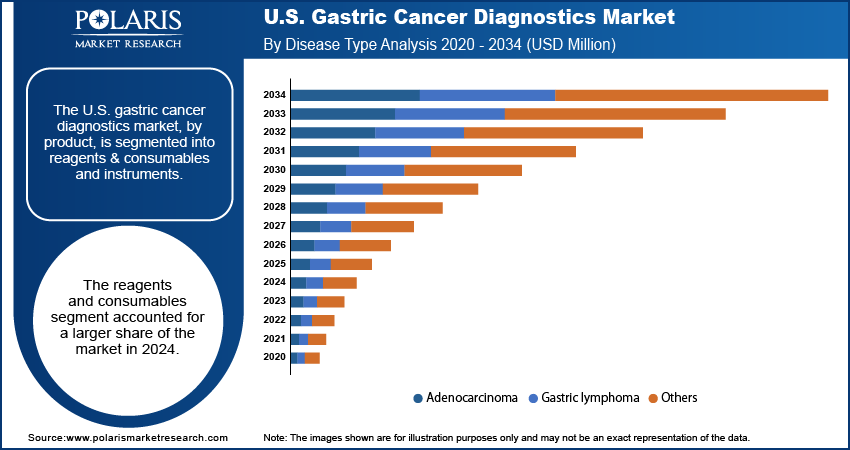

Disease Type Analysis

The adenocarcinoma segment held the largest share in 2024. This is because adenocarcinoma accounts for the vast majority of stomach cancer cases, making it the most frequently diagnosed type. Diagnostic efforts and research are heavily concentrated on this specific form of cancer due to its prevalence and the significant impact on public health. A review in PubMed Central titled "Incidence trends of gastric cancer in the United States over 2000–2020: A population-based analysis" indicates that adenocarcinoma was the most common subtype in both older and younger adult populations during the study period, highlighting its widespread occurrence.

The others segment, which includes rarer types of gastric cancers, is anticipated to register the highest growth rate in the U.S. gastric cancer diagnostics market during the forecast period. While less common, conditions such as neuroendocrine tumors, gastrointestinal stromal tumors (GISTs), and squamous cell carcinomas are gaining more attention due to improved diagnostic techniques and increased research into their specific characteristics. As diagnostic tools become more sophisticated, the ability to accurately identify these less common, yet distinct, cancer types is improving.

End Use Analysis

The hospitals segment held the largest share. Hospitals are often the first point of contact for patients experiencing symptoms, and they offer a comprehensive range of diagnostic services under one roof, from initial consultations and endoscopies to advanced imaging and biopsies. The integrated nature of care within hospitals, including the immediate availability of pathology labs and specialists for multidisciplinary team discussions, makes them central to the diagnostic pathway. For example, Memorial Sloan Kettering Cancer Center, as noted in their "Stomach Cancer Treatment" information, emphasizes their comprehensive approach, seeing a high volume of patients and performing numerous diagnostic procedures, which underscores the significant role hospitals play.

The diagnostic laboratories segment is anticipated to register the highest growth rate during the forecast period. This growth is driven by the increasing demand for specialized and high-volume testing, including molecular diagnostics, cancer biomarker testing, and advanced pathology services. While hospitals perform some tests in-house, complex or high-throughput analyses are often outsourced to dedicated diagnostic laboratories that possess specialized equipment and expertise. These labs are crucial for confirming diagnoses and cancer stages, and guiding personalized treatment plans through detailed molecular profiling. The growing adoption of liquid biopsies and next-generation sequencing (NGS) for detecting circulating tumor DNA and other biomarkers often requires the advanced capabilities found in specialized diagnostic laboratories.

Key Players and Competitive Insights

The U.S. gastric cancer diagnostics market is competitive, with a mix of established global healthcare companies and specialized diagnostic firms. These companies focus on continuous innovation in product development, strategic partnerships, and expanding their reach to gain a stronger foothold. The competition is driven by the need for more accurate, less invasive, and earlier detection methods for gastric cancer.

A few prominent companies in the industry include Abbott Laboratories; Becton, Dickinson and Company (BD); Bio-Rad Laboratories, Inc.; F. Hoffmann-La Roche Ltd.; Thermo Fisher Scientific Inc.; Agilent Technologies, Inc.; Illumina, Inc.; QIAGEN N.V.; Exact Sciences Corporation; Mirxes Pte Ltd; and GE HealthCare.

Key Players

- Abbott Laboratories

- Agilent Technologies, Inc.

- Becton, Dickinson and Company (BD)

- Bio-Rad Laboratories, Inc.

- Exact Sciences Corporation

- F. Hoffmann-La Roche Ltd.

- GE HealthCare

- Illumina, Inc.

- Mirxes Pte Ltd

- QIAGEN N.V.

- Thermo Fisher Scientific Inc.

Industry Developments

U.S. Gastric Cancer Diagnostics Market Segmentation

By Product Outlook (Revenue – USD Million, 2020–2034)

- Reagents & Consumables

- Instruments

By Disease Type Outlook (Revenue – USD Million, 2020–2034)

- Adenocarcinoma

- Gastric lymphoma

- Others

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Hospitals

- Diagnostic Laboratories

- Diagnostic Imaging

U.S. Gastric Cancer Diagnostics Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 459.21 million |

|

Market Size in 2025 |

USD 492.04 million |

|

Revenue Forecast by 2034 |

USD 935.48 million |

|

CAGR |

7.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 459.21 million in 2024 and is projected to grow to USD 935.48 million by 2034.

The global market is projected to register a CAGR of 7.4% during the forecast period.

A few key players in the market include Abbott Laboratories; Becton, Dickinson and Company (BD); Bio-Rad Laboratories, Inc.; F. Hoffmann-La Roche Ltd.; Thermo Fisher Scientific Inc.; Agilent Technologies, Inc.; Illumina, Inc.; QIAGEN N.V.; Exact Sciences Corporation; Mirxes Pte Ltd; and GE HealthCare.

The reagents and consumables segment accounted for the largest share of the market in 2024.

The others segment is expected to witness the fastest growth during the forecast period.