U.S. Granite Market Size, Share, Trends, & Industry Analysis Report

By Product, By Application, By End User, and By Country – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM5887

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

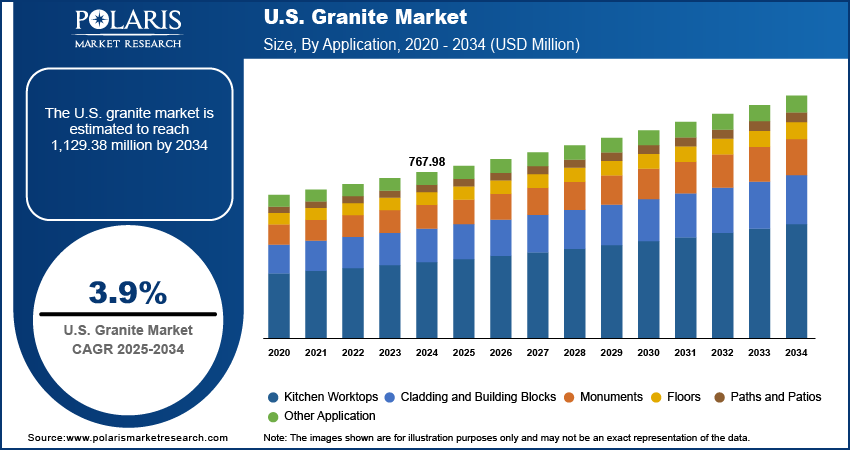

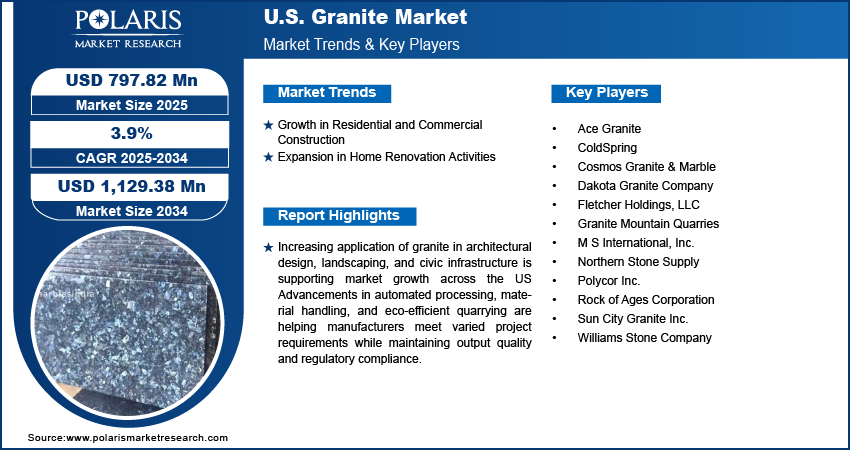

The U.S. granite market size was valued at USD 767.98 million in 2024, growing at a CAGR of 3.9% during 2025–2034. Rising construction activity across residential, commercial, and renovation sectors is steadily increasing demand for granite industry.

Granite in the U.S. is widely valued for its strength, natural appearance, and long-term performance across residential, commercial, and public infrastructure projects. Composed of quartz, feldspar, and mica, it offers resistance to wear and minimal maintenance needs, making it suitable for indoor and outdoor use. Companies are investing in automated cutting units, computer numerical control machine, and advanced surface finishing equipment to improve precision and reduce waste. Compact machinery layouts and integrated handling solutions are supporting better workflow management, while real-time monitoring tools are being used to minimize manual errors. The shift toward responsible production is boosting the adoption of energy-efficient technologies and water recycling systems, contributing to lower environmental impact and improved regulatory compliance.

Applications for granite continue to expand across kitchen countertops, flooring, wall panels, and exterior installations, with design professionals selecting the material for its consistency and visual appeal. Custom finishes help to make surfaces stronger and less slippery that is drawing more interest for granite products across the country. In response to regulatory directives concerning air quality, dust control, and noise levels, quarrying and fabrication practices are being modernized. The industry is also integrating digital modeling, robotic processing, and smart inventory tools to manage complex orders and maintain cost control.

Urban development initiatives across the U.S. are increasing the demand for durable, low-maintenance materials that meet the performance requirements of large-scale infrastructure and public design projects. Granite is being integrated into civic architecture, landscape elements, and transportation hubs due to its strength, visual appeal, and resistance to wear. City planners and design consultants are incorporating granite into sidewalks, public squares, and institutional buildings to ensure longevity with minimal maintenance. Its ability to retain structural and aesthetic properties under heavy usage makes it a practical choice for high-traffic areas.

Increasing focus on sustainable urban planning is also pushing the demand for natural materials processed with lower environmental impact. For instance, the US sustainability plan aims to cut federal carbon emissions by using only clean electricity by 2030, buying only zero-emission vehicles by 2035, and reaching net-zero emissions by 2050. US manufacturers are deploying compact machinery and high-precision cutting tools to reduce material waste and energy consumption during fabrication. The use of granite in monuments, fountains, and street furniture reflects a broader trend toward natural finishes in urban aesthetics. Regulatory frameworks focused on eco-friendly construction practices are further promoting the use of regionally sourced granite, extracted through responsible quarrying methods. These shifts are positioning granite as a preferred solution in long-term public infrastructure strategies where material durability, visual cohesion, and lifecycle cost efficiency are key priorities.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Growth in Residential and Commercial Construction

Rising construction activity across the U.S. is strengthening the demand for granite across both structural and decorative applications. As per the Federal Reserve Economic Data (FRED), US public construction spending rose steadily from around USD 360.88 million in March 2021 to over USD 511.12 million in March 2025, an increase of 41.6% within the span of four years. Moreover, in residential projects, granite is being used extensively in kitchens, bathrooms, entryways, and exterior landscaping due to its durability, aesthetic appeal, and resistance to moisture and scratches. Builders are selecting granite to meet the expectations of homeowners who prioritize long-lasting materials that do not require frequent repairs or replacements. Granite’s natural variation and ability to complement a wide range of architectural styles are contributing to its popularity in both contemporary and traditional home designs.

In the commercial sector, granite is gaining importance in office buildings, retail complexes, educational institutions, and hospitality developments. Developers are integrating granite into reception areas, corridors, façade cladding, and common-use surfaces where material performance and presentation matter equally. Its ability to withstand heavy usage and maintain a refined appearance aligns with the operational needs of commercial facilities. As construction spending continues to increase across urban and suburban markets, granite is expected to remain a preferred material for delivering both functional strength and visual continuity across a variety of property types.

Expansion in Home Renovation Activities

The growing volume of home renovation and remodeling projects across the US is driving demand for granite products that offer value, durability, and visual enhancement. According to LIRA, in early 2024, US homeowners spent about USD 463 million on home renovations. Most focused on kitchens, bathrooms, and living rooms, with an average budget of USD 15,000 and high returns from hardwood floor refinishing. Homeowners are upgrading kitchens, bathrooms, and outdoor living spaces with custom-finished granite slabs, which provide long-term usability while enhancing property appeal. The ability of granite to offer design versatility through a wide range of colors, grains, and finishes is making it a popular choice in personalized home improvement efforts. Demand for pre-fabricated countertops, vanity tops, and backsplashes continues to grow as homeowners seek high-quality yet manageable solutions for interior upgrades.

Additionally, the growing influence of real estate value optimization is prompting investments in renovation materials that balance aesthetics and long-term cost efficiency. Granite surfaces are being installed in high-usage areas due to their ability to maintain condition over time without frequent refinishing. Fabricators are offering tailored solutions to meet design preferences and installation requirements, while distributors are expanding product availability across retail and contractor-focused channels. As demand for upscale remodeling materials grows, granite remains well-positioned as a preferred solution for enhancing home interiors while delivering tangible return on investment.

Segmental Insights

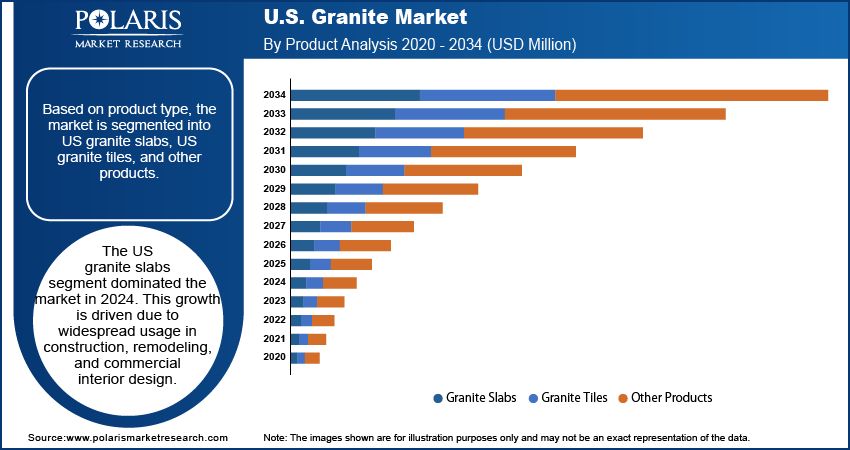

Product Analysis

The segmentation, based on product includes, granite slabs, granite tiles, and other products. The US granite slabs segment dominated the market in 2024. This growth is driven due to widespread usage in construction, remodeling, and commercial interior design. Their large format, visual appeal, and adaptability to various finishes make them ideal for countertops, flooring, and wall installations. Builders and contractors prefer slabs for their versatility and ability to meet detailed architectural specifications. Advancements in precision-cutting and surface treatment have improved product quality and reduced processing time. Pre-polished slab availability has simplified installation processes, increasing their appeal in high-end residential and commercial projects. Consistent demand across applications continues to support the dominant position of granite slabs in the market.

The US granite tiles segment is projected to grow at a robust pace in the coming years, due to their affordability, lightweight structure, and suitability for small-scale applications. Frequently used in flooring, wall accents, and backsplashes, tiles offer a practical alternative to slabs for cost-sensitive or compact projects. The increase in modular construction practices and demand for easy-to-install materials is supporting this segment's expansion. Fabricators are offering more finish options and standardized sizes to meet diverse aesthetic requirements. Retail availability and growing consumer preference for DIY-friendly natural stone solutions are also contributing to the rapid growth of granite tiles in urban and suburban markets.

Application Analysis

The segmentation, based on application includes, monuments, floors, paths and patios, cladding and building blocks, kitchen worktops, and other application. The kitchen worktops segment accounted for substantial market share in 2024, driven by high demand in residential and hospitality kitchens. Granite’s heat resistance, durability, and polished finish make it ideal for food preparation areas. Homeowners favor the material for its long service life and minimal maintenance requirements. Real estate developers are incorporating granite countertops to enhance property value and align with current design preferences. Custom edge profiles and color selections add design flexibility. The continued popularity of kitchen renovations and upscale interior features ensures granite worktops remain the leading application in the US granite industry.

The cladding and building blocks segment is projected to grow at a significant pace during the assessment phase, due to the increasing use of granite in façades, boundary walls, and external features. Granite’s ability to withstand harsh weather, resist impact, and maintain appearance over time makes it suitable for commercial and institutional exteriors. Architects and city planners are specifying granite for visual consistency and structural reliability. Improved cutting precision and availability of modular formats are enabling faster installation in modern construction. The rise in civic buildings, educational campuses, and cultural centers is accelerating the adoption of granite cladding, contributing to rapid growth within this application category.

End User Analysis

The segmentation, based on end user includes, residential, commercial, industrial, and infrastructural. The residential segment was valued at substantial revenue share in 2024, with granite widely used in kitchens, bathrooms, flooring, and outdoor landscaping. Homeowners are selecting granite for its natural look, surface strength, and resistance to daily wear. Renovation projects often include granite countertops and vanities to improve functionality and aesthetic appeal. Suppliers are offering pre-finished, cut-to-size products that reduce installation time and labor costs. The trend toward personalized and durable interiors continues to support demand. As housing development and remodeling activity remain strong across the US, the residential segment holds the dominant position in granite consumption.

The infrastructural segment is estimated to hold a substantial market share in 2034, due to its rapid adoption in public spaces, transit hubs, and civic landmarks. Granite is being integrated into pavements, monuments, and retaining structures due to its strength, longevity, and minimal upkeep. State and local governments are including granite in urban improvement plans to enhance durability and visual appeal in shared environments. Responsible sourcing and sustainable processing practices are aligning granite with public sector material standards. As federal infrastructure funding increases, the use of granite in transportation, landscaping, and municipal developments is rising, positioning the infrastructural segment as the fastest-expanding end-user category.

Key Players & Competitive Analysis Report

The U.S. granite industry is moderately competition, fueled by the consistent demand for durable natural stone across residential, commercial, and infrastructure-based construction. Leading companies are focusing on efficient quarrying, precision-driven fabrication, and reliable supply chains to meet diverse application requirements. Competitive advantage is being shaped by investments in digital processing systems, pre-fabrication capabilities, and region-specific distribution strategies. Companies are enhancing output through modern cutting technologies and integrated logistics to ensure timely delivery of customized slabs and tiles.

Key companies in the US granite industry include Polycor Inc., Rock of Ages Corporation, Coldspring, Dakota Granite Company, Northern Stone Supply, Williams Stone Company, Granite Mountain Quarries, M S International, Inc., Ace Granite, Fletcher Holdings, LLC, Sun City Granite Inc., and Cosmos Granite & Marble.

Key Players

- Ace Granite

- ColdSpring

- Cosmos Granite & Marble

- Dakota Granite Company

- Fletcher Holdings, LLC

- Granite Mountain Quarries

- M S International, Inc.

- Northern Stone Supply

- Polycor Inc

- Rock of Ages Corporation

- Sun City Granite Inc.

- Williams Stone Company

Industry Developments

January 2021: Polycor acquired North Carolina Granite to boosts its position in the US granite market by adding premium domestic stone to its portfolio and expanding supply capabilities.

U.S. Granite Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Granite Slabs

- Granite Tiles

- Other Products

By Application Outlook (Revenue, USD Million, 2020–2034)

- Monuments

- Floors

- Paths and Patios

- Cladding and Building Blocks

- Kitchen Worktops

- Other Application

By End User Type Outlook (Revenue, USD Million, 2020–2034)

- Residential

- Commercial

- Industrial

- Infrastructural

US Granite Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 767.98 Million |

|

Market Size in 2025 |

USD 797.82 Million |

|

Revenue Forecast by 2034 |

USD 1,129.38 Million |

|

CAGR |

3.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 767.98 million in 2024 and is projected to grow to USD 1,129.38 million by 2034.

The U.S. market is projected to register a CAGR of 3.9% during the forecast period.

A few of the key players in the market are Polycor Inc., Rock of Ages Corporation, Coldspring, Dakota Granite Company, Northern Stone Supply, Williams Stone Company, Granite Mountain Quarries, M S International, Inc., Ace Granite, Fletcher Holdings, LLC, Sun City Granite Inc., and Cosmos Granite & Marble.

The U.S. granite slabs segment dominated the market share in 2024, due to strong demand in countertops, flooring, and large-format applications.

The infrastructural segment is expected to witness the fastest growth during the forecast period, driven by rising use in public and urban development projects.