U.S. Hemostasis Valve Market Size, Share, Trends, Industry Analysis Report

By Type (Hemostasis Valve Y- Connectors, Double Y- Connector Hemostasis Valves), By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5995

- Base Year: 2024

- Historical Data: 2020-2023

Overview

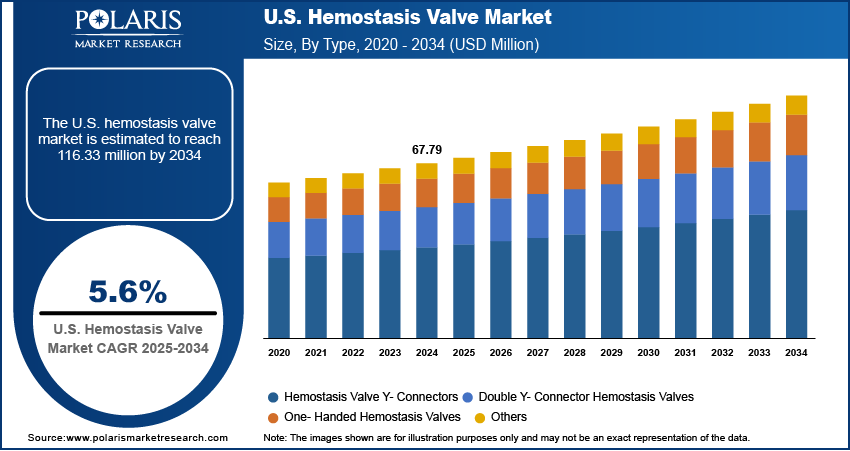

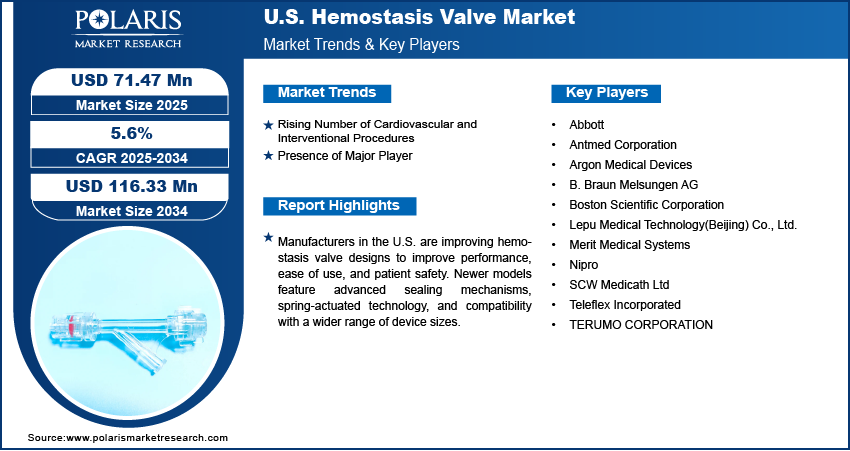

The U.S. hemostasis valve market size was valued at USD 67.79 million in 2024, growing at a CAGR of 5.6% from 2025 to 2034. The growth is driven by the rising number of cardiovascular and interventional procedures and the presence of major industry players.

Key Insights

- In 2024, the hemostasis valve Y- connectors segment dominated with the largest share due to their widespread use in interventional cardiology and radiology procedures.

- The one- handed hemostasis valves segment is expected to experience significant growth during the forecast period, driven by the demand for faster, more ergonomic procedural tools.

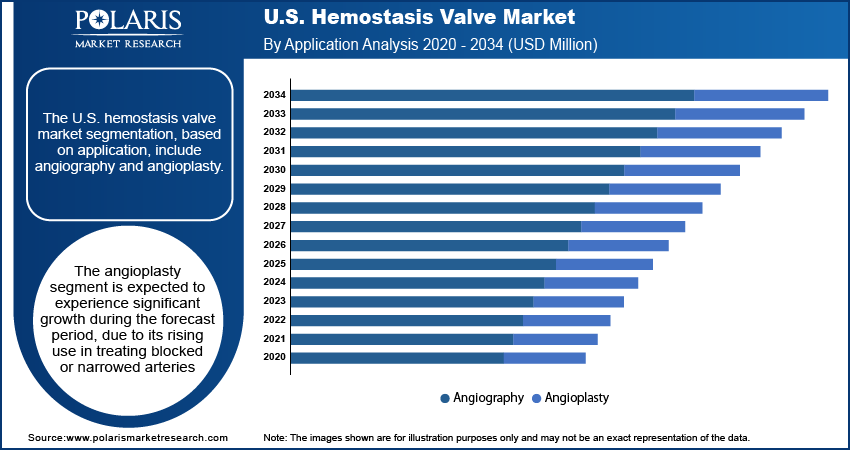

- The angioplasty segment is expected to experience significant growth during the forecast period, as angioplasty remains one of the most commonly performed interventional procedures in the U.S., especially for treating coronary artery disease.

- In 2024, the hospital segment dominated with the largest share, due to their advanced infrastructure, access to high patient volumes, and integration of interventional care units

A hemostasis valve is a specialized medical device utilized in catheter-based interventional procedures to mitigate blood loss while enabling the passage of instruments through vascular access points. This device typically features a sophisticated sealing mechanism that maintains hemostatic integrity during the insertion or removal of guidewires, catheters, or other interventional devices. Hemostasis valves are crucial for maintaining a sterile environment and minimizing the risk of complications, including hemorrhage or air embolism. Their design ensures optimal performance under the varied pressures and conditions encountered during vascular access.

The U.S. has one of the most technologically advanced healthcare systems in the world, with hospitals regularly adopting the latest medical devices and procedural tools. This environment promotes the use of high-performance hemostasis valves, featuring one-handed operation, enhanced seal mechanisms, and compatibility with various catheter sizes. In the U.S., healthcare providers prioritize safety, efficiency, and procedural accuracy, which fuels demand for next-generation vascular access devices. There is a strong demand for high-quality hemostasis valves as hospitals continue to modernize their cath labs and interventional suites, thereby driving the U.S. hemostasis valve market growth.

The well-established reimbursement system for cardiovascular and interventional procedures fuels the demand for this valve. Medicare, Medicaid, and private insurers cover procedures that involve the use of vascular access tools, reducing the financial burden on both patients and healthcare providers. This encourages widespread use of hemostasis valves in routine clinical settings. The assurance of reimbursement helps hospitals invest in advanced, premium valve technologies without facing cost-related hesitation, ensuring consistent procurement and use across a range of clinical applications, thereby propelling the U.S. hemostasis valve market demand.

Industry Dynamics

- Rising number of cardiovascular and interventional procedures drives the demand for coating pretreatments.

- The presence of major industry players is fueling the industry.

- The well-established reimbursement system for cardiovascular and interventional procedures fuels the demand for this valve.

- High cost of advanced hemostasis valves and limited access in low-resource settings restrict widespread adoption.

Rising Number of Cardiovascular and Interventional Procedures: Cardiovascular diseases remain the major cause of death in the U.S., leading to a consistently high number of interventional procedures such as angioplasty, catheter ablation, and stent placements. According to the American Heart Association, cardiovascular disease accounted for 931,578 deaths in the U.S. in 2021. These procedures require hemostasis valves to safely manage blood flow while inserting or removing catheters and guidewires. The country’s widespread access to advanced medical facilities and experienced cardiologists supports this high procedural volume. The need for interventional procedures grows across hospitals and surgical centers in the U.S. as the population ages and chronic health issues such as obesity and hypertension persist, thereby fueling the U.S. hemostasis valve market expansion.

Presence of Major Industry Players: Many of the leading medical device manufacturers such as Abbott, Boston Scientific, and Teleflex are headquartered or have major operations in the U.S., giving the market early and easy access to the latest innovations. This close proximity accelerates product availability, physician training, and feedback-driven design improvements. Companies in the U.S. lead in clinical research and product trials, giving healthcare providers confidence in adopting new valve technologies. The domestic presence of these major players results in aggressive marketing, streamlined distribution, and faster regulatory approvals, all of which improve product penetration and usage, thereby accelerating the U.S. hemostasis valve market growth.

Segmental Insights

Type Analysis

The U.S. hemostasis valve market segmentation, based on product, includes hemostasis valve Y- connectors, double Y- connector hemostasis valves, one- handed hemostasis valves, and others. In 2024, the hemostasis valve Y- connectors segment dominated with the largest share due to their widespread use in interventional cardiology and radiology procedures. These connectors are highly valued for their ability to allow simultaneous access through dual ports while effectively controlling blood flow. Hospitals and cath labs in the U.S. frequently perform complex procedures that require multiple device exchanges, making Y-connectors essential for maintaining a sterile, blood-free environment. Their compatibility with a variety of guidewires and catheters, along with their proven reliability, drives the segment growth.

The one- handed hemostasis valves segment is expected to experience significant growth during the forecast period, driven by the demand for faster, more ergonomic procedural tools. These valves enable interventionalists to operate with one hand, allowing better device control and increased procedural efficiency particularly valuable in high-pressure, fast-paced environments such as emergency rooms or hybrid operating suites. Clinicians in the U.S. are adopting one-handed designs that minimize blood exposure with increasing focus on operator safety and infection control. The demand is expected to grow significantly as hospitals continue upgrading to advanced interventional equipment, thereby driving the segment growth.

Application Analysis

The U.S. hemostasis valve market segmentation, based on application, includes angiography and angioplasty. The angioplasty segment is expected to experience significant growth during the forecast period as angioplasty remains one of the most commonly performed interventional procedures in the U.S., especially for treating coronary artery disease. Hemostasis valves are essential in these procedures for managing blood flow during catheter insertion and removal. Angioplasty procedures are on the rise with a large aging population, high prevalence of cardiovascular conditions, and expanded screening programs. The push toward minimally invasive techniques and shorter hospital stays has further increased the frequency of angioplasty, directly boosting demand for reliable hemostasis valves, thereby driving the segment growth.

End Use Analysis

The U.S. hemostasis valve market segmentation, based on end use, includes hospitals, ambulatory surgical centers, and others. In 2024, the hospital segment dominated with the largest share due to their advanced infrastructure, access to high patient volumes, and integration of interventional care units. Most cardiovascular and endovascular procedures requiring vascular access and hemostasis management are conducted in hospital settings. The U.S. hospitals lead in adopting advance medical technologies, enabling quicker adoption of innovative valve designs. Their strong purchasing power, emphasis on patient safety, and in-house clinical training programs drives the segment growth.

Key Players and Competitive Analysis

The U.S. hemostasis valve market features a highly competitive landscape, dominated by global and regional players focused on innovation, performance, and clinical reliability. Key companies such as Abbott, Boston Scientific Corporation, Merit Medical Systems, and Teleflex Incorporated hold significant market share due to their strong distribution networks, advanced R&D capabilities, and established relationships with hospitals and surgical centers. These leaders continuously invest in product enhancements, such as improved seal technology and one-handed operation, to meet evolving procedural demands. Other players such as TERUMO CORPORATION, B. Braun Melsungen AG, and Argon Medical Devices are also strengthening their presence through product diversification and strategic collaborations. Meanwhile, companies such as Antmed Corporation, Nipro, and Beijing Demax Medical Technology Co. are increasingly entering the U.S. market with cost-effective and efficient alternatives. The competitive environment is shaped by technological advancements, FDA approvals, physician preferences, and hospital purchasing patterns, making innovation and regulatory compliance critical for long-term market positioning.

Key Players

- Abbott

- Antmed Corporation

- Argon Medical Devices

- B. Braun Melsungen AG

- Boston Scientific Corporation

- Lepu Medical Technology (Beijing) Co.,Ltd.

- Merit Medical Systems

- Nipro

- SCW Medicath Ltd

- Teleflex Incorporated

- TERUMO CORPORATION

U.S. Hemostasis Valve Market Industry Developments

In June 2023, SYNDEO Medical launched the Rover SA, a spring-actuated hemostasis valve supporting up to 9.5 French devices, enhancing interventional procedures with improved control, minimized blood loss, and compatibility. It became available standalone and within the SYNDEOPack.

U.S. Hemostasis Valve Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Hemostasis Valve Y- Connectors

- Double Y- Connector Hemostasis Valves

- One- Handed Hemostasis Valves

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Angiography

- Angioplasty

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Ambulatory Surgical Centers

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

U.S. Hemostasis Valve Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 67.79 Million |

|

Market Size in 2025 |

USD 71.47 Million |

|

Revenue Forecast by 2034 |

USD 116.33 Million |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 67.79 million in 2024 and is projected to grow to USD 116.33 million by 2034.

The market is projected to register a CAGR of 5.6% during the forecast period.

A few of the key players in the market are Abbott; Antmed Corporation; Argon Medical Devices; B. Braun Melsungen AG; Boston Scientific Corporation; Lepu Medical Technology (Beijing) Co., Ltd.; Merit Medical Systems; Nipro; SCW Medicath Ltd.; Teleflex Incorporated; and TERUMO CORPORATION.

The hospital segment dominated the market share in 2024.

The angioplasty segment is expected to witness the significant growth during the forecast period.