U.S. Hot Rolled Coil Steel Market Size, Share, Trends, Industry Analysis Report

By Thickness (Less Than or Equal to 3mm, Greater Than 3mm), by End Use – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM5841

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

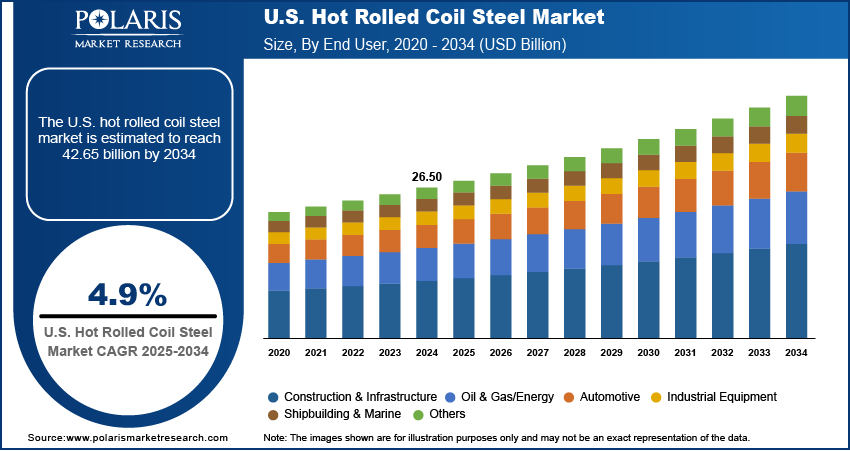

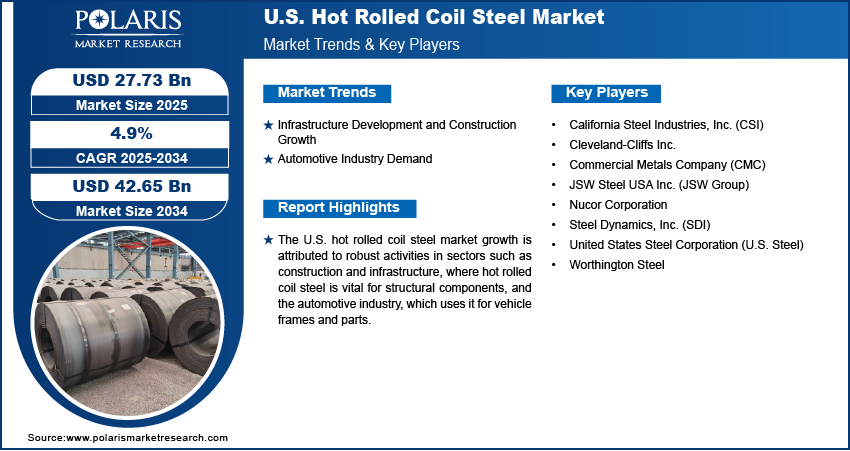

The U.S. hot rolled coil steel market size was valued at USD 26.50 billion in 2024 and is anticipated to register a CAGR of 4.9% from 2025 to 2034. The market growth is mainly driven by strong demand from key industries such as construction and automotive. Significant government spending on infrastructure projects also boosts demand for steel products and steel fiber.

The U.S. hot rolled coil steel market involves the production and sale of steel that has been rolled at high temperatures into flat coils. This process makes the steel strong and easy to use, making it a basic material for many industries.

A key driver of the U.S. hot rolled coil steel market is the strong demand from the construction sector. This sector relies heavily on hot rolled coil steel for various structural components, such as beams, columns, and reinforcement bars, which are essential for building bridges, highways, and skyscrapers. The need for robust and durable materials in construction makes hot rolled coil steel a crucial component.

Another significant driver is increased government spending on infrastructure projects. The U.S. government has been investing billions in revitalizing roads, bridges, and public facilities through various infrastructure bills. These large-scale projects directly increase the demand for steel products, including hot rolled coils. For example, reports indicate that the U.S. construction sector continues to drive steel demand, with particular strength in manufacturing construction due to federal programs such as the CHIPS Act and the Inflation Reduction Act. These initiatives have led to a significant rise in monthly spending on manufacturing construction, which has more than doubled since August 2022, becoming the largest category of nonresidential construction in the U.S. This consistent investment supports a positive outlook for the U.S. steel market.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Infrastructure Development and Construction Growth

The rising investments in infrastructure development across the U.S. are a major driver for the hot rolled coil steel market. This includes projects aimed at modernizing roads, bridges, public transportation, and utilities, all of which require significant amounts of steel. The durability and strength of hot rolled coil steel make it an essential material for the structural frameworks of these large-scale construction endeavors.

The Infrastructure Investment and Jobs Act of 2021, a significant piece of legislation, allocates substantial funds toward improving American infrastructure. This act is expected to provide billions of dollars for projects that will use steel, with some estimates suggesting approximately 50 million tons of metal products will be needed, as highlighted in a September 2024 article "US steelmakers hope to restore demand in 2025" from GMK Center. This continuous and planned government spending helps create a steady demand trend for hot rolled coil steel, thus driving the market growth.

Automotive Industry Demand

The growing automotive industry is another significant driver of the U.S. hot rolled coil steel market growth. Steel, particularly hot rolled coil, is a primary material in vehicle manufacturing, used in components such as chassis, body structures, and other parts that require high strength and formability. The production volume of vehicles directly impacts the demand for steel from mills.

According to the International Council on Clean Transportation (ICCT) in their February 2025 working paper, "Assessment of automotive steel demand in the United States," U.S. light-duty vehicle body-in-white (BiW) automotive steel demand is estimated at about 3.9 million tonnes annually. The paper also notes that overall U.S. automotive steel demand was around 11 million tonnes in 2023. This consistent need for steel in car and truck production ensures a strong and continuous demand for hot rolled coil steel, contributing significantly to the market's expansion.

Segmental Insights

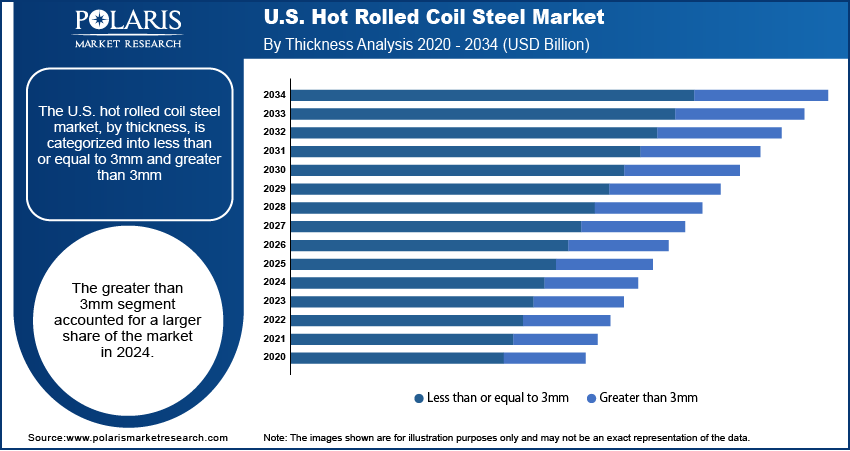

Thickness Analysis

The greater than 3mm segment held a larger share in 2024, due to its widespread use in heavy-duty applications where strength and durability are key. For instance, these thicker coils are crucial for large-scale construction projects, including bridges, high-rise buildings, and industrial facilities, providing the necessary structural integrity. They are also extensively utilized in the manufacturing of heavy machinery and in the automotive sector for chassis and structural components that demand high tensile and yield strength.

The less than or equal to 3mm segment is anticipated to register the highest growth rate during the forecast period. The growth is driven by increasing demand for lighter, more formable, and cost-efficient materials across various industries. For example, in the automotive industry, thinner hot rolled coil steel is gaining traction for producing lighter body panels and internal parts to improve fuel efficiency and support the growth of electric vehicles. Similarly, it is increasingly used in the manufacturing of home appliances, electrical enclosures, and in some construction equipment applications for items such as roofing and wall panels, where its ease of fabrication and adaptability are highly valued.

End Use Analysis

The construction and infrastructure segment held the largest share in 2024. The sector's ongoing need for durable and strong materials makes it a dominant force in demand. Hot rolled coil steel is essential for creating structural elements such as beams, columns, and rebar used in building residential and commercial structures, as well as for large-scale public works such as bridges, highways, and railway systems. The consistent investments in new modular construction and repair projects across the country ensure a steady and high volume of demand from this end-use segment.

The oil & gas/energy segment is anticipated to exhibit the highest growth rate during the forecast period. This growth is linked to the continued expansion and modernization of energy infrastructure, including pipelines for transporting oil and gas, as well as components for renewable energy installations. Hot rolled coil steel is vital for these applications due to its strength and ability to withstand harsh operating conditions. As the nation focuses on energy security and transitioning to more sustainable energy sources, the demand for hot rolled coil steel in this sector is set to increase significantly.

Key Players and Competitive Insights

The competitive landscape of the U.S. hot rolled coil steel market is marked by the presence of a few major producers and numerous smaller players, leading to a moderately concentrated environment. Competition often centers on production capacity, product quality, cost efficiency, and the ability to serve diverse end-use industries. Strategic initiatives, such as technological advancements, sustainable production methods, and effective supply chain management, are crucial for companies to maintain and expand their market positions.

A few prominent companies in the U.S. hot rolled coil steel market include Nucor Corporation, Cleveland-Cliffs Inc., United States Steel Corporation (U.S. Steel), Steel Dynamics, Inc. (SDI), Commercial Metals Company (CMC), JSW Steel USA Inc., and California Steel Industries, Inc. (CSI).

Key Players

- California Steel Industries, Inc. (CSI)

- Cleveland-Cliffs Inc.

- Commercial Metals Company (CMC)

- JSW Steel USA Inc. (JSW Group)

- Nucor Corporation

- Steel Dynamics, Inc. (SDI)

- United States Steel Corporation (U.S. Steel)

- Worthington Steel

Industry Development

November 2024: Cleveland-Cliffs Inc. announced the completion of its acquisition of Stelco Holdings Inc., a significant move that expands its footprint and enhances its position in the North American steel market.

U.S. Hot Rolled Coil Steel Market Segmentation

By Thickness Outlook (Revenue – USD Billion, 2020–2034)

- Less Than or Equal to 3mm

- Greater Than 3mm

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Construction & Infrastructure

- Oil & Gas/Energy

- Automotive

- Industrial Equipment

- Shipbuilding & Marine

- Others

U.S. Hot Rolled Coil Steel Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 26.50 billion |

|

Market Size in 2025 |

USD 27.73 billion |

|

Revenue Forecast by 2034 |

USD 42.65 billion |

|

CAGR |

4.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 26.50 billion in 2024 and is projected to grow to USD 42.65 billion by 2034.

The market is projected to register a CAGR of 4.9% during the forecast period.

A few key players in the market include Nucor Corporation, Cleveland-Cliffs Inc., United States Steel Corporation (U.S. Steel), Steel Dynamics, Inc. (SDI), Commercial Metals Company (CMC), JSW Steel USA Inc., and California Steel Industries, Inc. (CSI).

The greater than 3mm segment accounted for a larger share of the market in 2024.

The oil & gas/energy segment is expected to witness the fastest growth during the forecast period.