U.S. Lateral Flow Assay Market Size, Share, Trends, Industry Analysis Report

By Product (Kits & Reagents, Lateral Flow Readers, Benchtop Readers), By Application, By Technique, By End Use – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5957

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

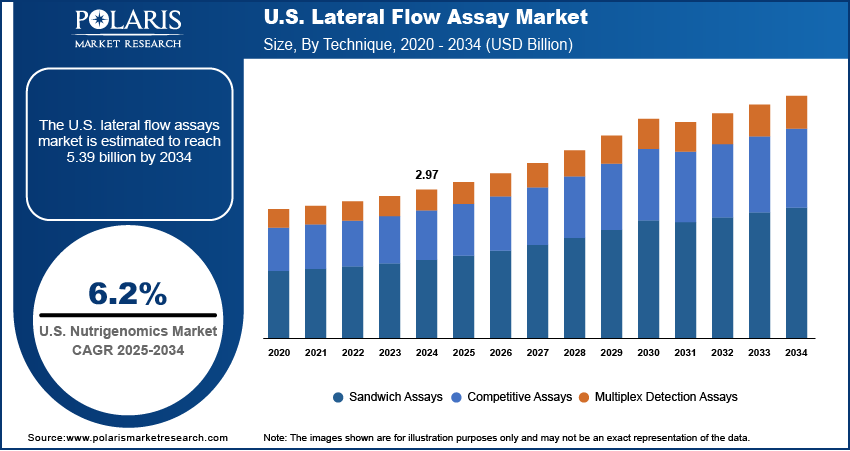

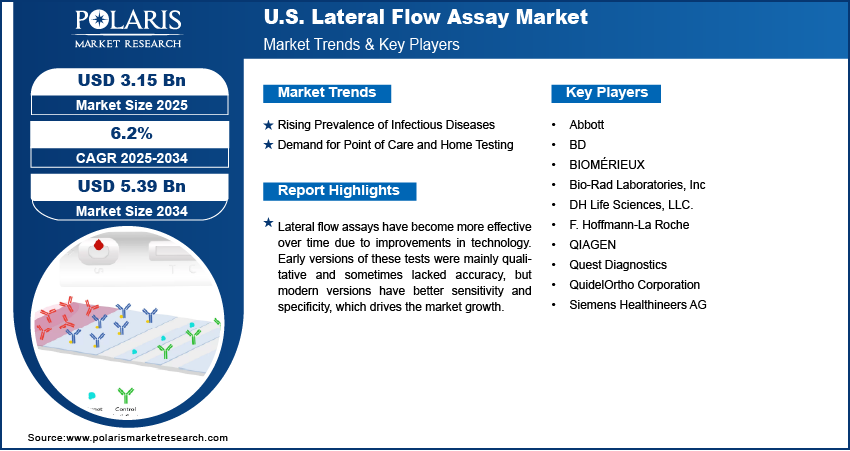

The U.S. lateral flow assay market was valued at USD 2.97 billion in 2024 and is expected to register a CAGR of 6.2% from 2025 to 2034. The growth is driven by the rising incidence of infectious diseases and increasing demand for point of care diagnostics and home testing.

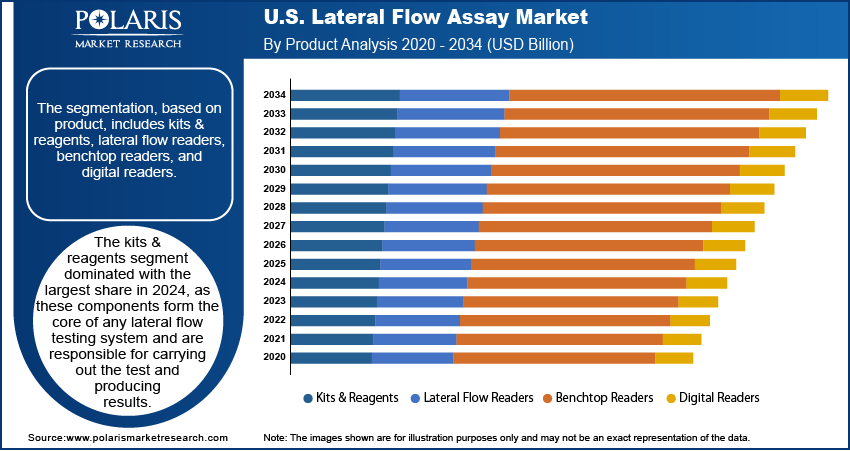

- The kits & reagents segment dominated with the largest share in 2024, as these components form the core of any lateral flow testing system and are directly responsible for carrying out the test and producing results.

- The drug development & quality testing segment is expected to experience significant growth as there is a rising need for fast, reliable testing tools that are used throughout the research and production pipeline.

- The multiplex detection assays segment is expected to experience significant growth during the forecast period, due to their ability to detect multiple targets simultaneously in a single test.

- The hospitals & clinics segment dominated with the largest share in 2024, as these healthcare settings require fast and accurate diagnostic tools to guide immediate treatment decisions.

A lateral flow assay is a simple, paper-based diagnostic device used to detect the presence of a target substance such as proteins, hormones, or pathogens, in a liquid sample. It works by capillary action, drawing the sample across a test strip that contains antibodies or other binding agents, producing a visible signal (such as a colored line) if the target is present. LFAs are widely used for rapid, point-of-care testing, such as in pregnancy tests or COVID-19 antigen tests.

The structure of the U.S. healthcare system has played an important role in the demand for lateral flow assays. There is a strong emphasis on diagnostics in both public and private healthcare, and funding is available for technologies that improve early detection and reduce hospital admissions. Health insurance plans often cover point-of-care testing when it helps make quicker treatment decisions. Additionally, government agencies and healthcare programs have promoted the use of rapid testing in schools, nursing homes, and underserved communities. Emergency authorizations and streamlined regulatory pathways have allowed many lateral flow tests to reach the market faster than traditional lab-based tests. Hospitals, pharmacies, and urgent care clinics across the country are equipped to use these tools, and they are also becoming more available in nonmedical settings. This wide access, combined with a favorable policy environment, helps support continued investments in and adoption of lateral flow assay technology, thereby driving the growth.

Lateral flow assays have become more effective over time due to improvements in technology. Early versions of these tests were mainly qualitative and sometimes lacked accuracy, but modern versions have better sensitivity and specificity. Advances in materials, such as high-quality antibodies and better membranes, have helped increase performance. Some tests now include fluorescent or digital markers that provide more precise results. Additionally, certain tests allow multiple conditions to be detected on one strip, which saves time and resources. These changes have made lateral flow assays useful for basic health screening and monitoring more serious health issues. Healthcare providers are more willing to rely on these tests for frontline diagnosis, especially in time-sensitive situations such as cardiac events or infectious disease outbreaks, where early results are critical, thereby driving the U.S. lateral flow assay market growth.

Industry Dynamics

- Rising prevalence of infectious diseases is driving the market growth.

- Increasing demand for point‑of‑care and home testing is fueling the need for lateral flow assays.

- Technological advancement is improving the efficiency and reliability of the lateral flow assay.

- The limited sensitivity and accuracy of some tests compared to laboratory-based diagnostic methods are limiting the adoption

Rising Prevalence of Infectious Diseases: Infectious diseases continue to be a major concern across the U.S., with illnesses such as influenza, hepatitis, and sexually transmitted infections affecting millions each year. According to the Center for Disease Control, in 2023, 39,000 people were diagnosed with HIV. The rise in such diseases has created a strong need for rapid, accessible diagnostic tools. Lateral flow assays meet this need because they are quick, simple to use, and do not require laboratory infrastructure. These tests are especially useful in early detection and outbreak control, which helps limit the spread of disease and initiate timely treatment. Public health efforts and increased awareness have also led to more routine testing for conditions such as HIV and respiratory viruses. In communities where access to healthcare is limited, LFAs provide a reliable option for diagnosis outside of traditional lab settings. This demand for quicker, more accessible diagnosis contributes to the growing reliance on LFAs in both clinical settings and public health programs across the country, thereby driving the U.S. lateral flow assay market expansion.

Demand for Point‑of‑Care and Home Testing: The need for quick medical decisions has increased interest in point-of-care and home-based testing across the U.S. Patients, providers, and employers seek diagnostic tools that deliver results immediately. Lateral flow assays fit this demand perfectly as they require minimal equipment and used by individuals with little or no training. The pandemic made at-home testing more common, helping people get fast answers about their health and reducing the burden on clinics. Beyond infections, lateral flow tests are now used to monitor conditions such as fertility, heart health, and allergies. The ability to test at home or at the point of care improves convenience, saves time, and allows faster treatment decisions. This shift toward decentralized testing is fueling the U.S. lateral flow assay market demand.

Segmental Insights

Product Analysis

The U.S. lateral flow assay market segmentation, based on product, include kits & reagents, lateral flow readers, benchtop readers, and digital readers. The kits & reagents segment dominated with the largest share in 2024, as these components form the core of any lateral flow testing system and are directly responsible for carrying out the test and producing results. The growing use of point-of-care and at-home tests has driven high demand for readily available, easy-to-use test kits. Reagents such as antibodies, antigens, enzymes, and buffers are crucial for ensuring accurate detection, and improvements in their quality have increased test sensitivity and reliability. The flexibility of kits for various applications has made them a staple across healthcare, research, and industrial sectors, thereby driving the segment growth.

Application Analysis

The U.S. lateral flow assay market segmentation, based on application, includes clinical testing, veterinary diagnostics, food safety & environment testing, and drug development & quality testing. The drug development & quality testing segment is expected to experience significant growth during the forecast period as there is a rising need for fast, reliable testing tools that are used throughout the research and production pipeline, as pharmaceutical companies continue to invest in new therapies and personalized medicine. Lateral flow assays are increasingly being adopted during clinical trials for monitoring biomarkers, drug levels, and immune responses, helping streamline decision-making and reduce lab turnaround times. Additionally, they are also used in manufacturing and quality control to verify the consistency and safety of pharmaceutical products. Compared to traditional lab methods, LFAs offer speed, simplicity, and scalability, thereby driving the segment growth.

Technique Analysis

The U.S. lateral flow assay market segmentation, based on technique, includes sandwich assays, competitive assays, and multiplex detection assays. The multiplex detection assays segment is expected to experience significant growth due to their ability to detect multiple targets simultaneously in a single test. This technique is particularly valuable in settings where clinicians need to assess several conditions or pathogens at once, such as distinguishing between different respiratory viruses (e.g., COVID-19, flu, RSV) or testing for multiple drug residues or biomarkers in clinical and research environments. Multiplex assays save time, reduce the need for multiple samples, and offer more complete diagnostic information in one step. Technological advancements in assay design and reader devices have made it easier to interpret complex results accurately. These benefits make multiplex testing increasingly popular in hospitals, pharmaceutical research, and even at-home testing kits, thereby driving the segment growth.

End Use Analysis

The U.S. lateral flow assay market segmentation, based on end use, includes hospitals & clinics, diagnostic laboratories, home care, pharmaceutical & biotechnology companies, and others. The hospitals & clinics segment dominated with the largest share in 2024, as these healthcare settings require fast and accurate diagnostic tools to guide immediate treatment decisions, particularly in emergency departments, outpatient clinics, and during infectious disease outbreaks. Lateral flow tests are well-suited for these environments because they are portable, easy to use, and deliver results within minutes. This allows healthcare providers to quickly diagnose and manage conditions without waiting for centralized lab results. Hospitals use LFAs for detecting cardiac markers, infectious diseases, and pregnancy-related hormones, while clinics rely on them for routine screening and triage. The ability to provide rapid answers helps reduce patient wait times, manage workloads more efficiently, and support timely interventions, thereby driving the segment growth.

Key Players and Competitive Analysis

The U.S. lateral flow assay market is highly competitive, driven by the presence of several major players offering innovative diagnostic solutions. Companies such as Abbott, QuidelOrtho Corporation, and BD dominate with a strong portfolio of rapid point-of-care tests, particularly for infectious diseases such as COVID-19 and influenza. Siemens Healthineers, F. Hoffmann-La Roche, and BIOMÉRIEUX contribute significantly through advanced technologies and integrated diagnostics platforms. Bio-Rad Laboratories and QIAGEN focus on specialized assays and molecular diagnostics integration, enhancing test accuracy and usability. Quest Diagnostics strengthens market dynamics with its vast testing network and distribution capabilities. Meanwhile, DH Life Sciences, LLC represents emerging competition with a focus on innovation and niche market segments. Intense research and development (R&D) efforts, regulatory approvals, and strategic partnerships are shaping the competitive landscape, with companies striving to improve sensitivity, speed, and affordability of lateral flow tests to meet growing demand in clinical, home, and emergency settings across the U.S.

Key Players

- Abbott

- BD

- BIOMÉRIEUX

- Bio-Rad Laboratories, Inc

- DH Life Sciences, LLC.

- F. Hoffmann-La Roche

- QIAGEN

- Quest Diagnostics

- QuidelOrtho Corporation

- Siemens Healthineers AG

Industry Developments

December 2024: bioMérieux launched the BIOFIRE FILMARRAY Tropical Fever Panel in the U.S. after receiving FDA Special 510(k) clearance. The PCR-based test quickly identified tropical fever pathogens, enhancing diagnostic accuracy and patient care in both endemic and non-endemic regions.

U.S. Lateral Flow Assay Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Kits & Reagents

- Lateral Flow Readers

- Benchtop Readers

- Digital Readers

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Clinical Testing

- Veterinary Diagnostics

- Food Safety & Environment Testing

- Drug Development & Quality Testing

By Technique Outlook (Revenue, USD Billion, 2020–2034)

- Sandwich Assays

- Competitive Assays

- Multiplex Detection Assays

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals & Clinics

- Diagnostic Laboratories

- Home Care

- Pharmaceutical & Biotechnology Companies

- Others

U.S. Lateral Flow Assay Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.97 Billion |

|

Market Size in 2025 |

USD 3.15 Billion |

|

Revenue Forecast by 2034 |

USD 5.39 Billion |

|

CAGR |

6.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.97 billion in 2024 and is projected to grow to USD 5.39 billion by 2034.

The market is projected to register a CAGR of 6.2% during the forecast period.

A few of the key players in the market are Abbott; Bio-Rad Laboratories, Inc; Siemens Healthineers AG; BIOMÉRIEUX; BD; QIAGEN; QuidelOrtho Corporation; F. Hoffmann-La Roche; DH Life Sciences, LLC; and Quest Diagnostics.

The reagent and kits segment dominated the market share in 2024.

The multiplex detection assay segment is expected to witness the fastest growth during the forecast period.