U.S. Neurovascular Intervention Devices Market Size, Share, Trends, & Industry Analysis Report

By Product, By Technique, By End User – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM6284

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

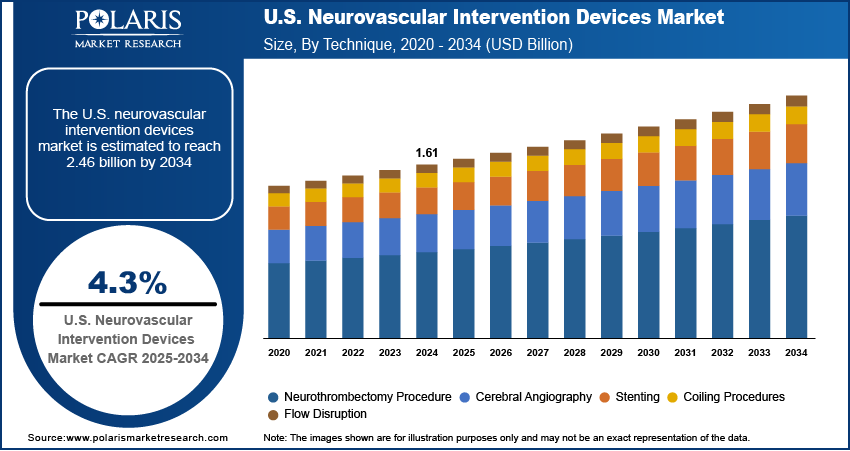

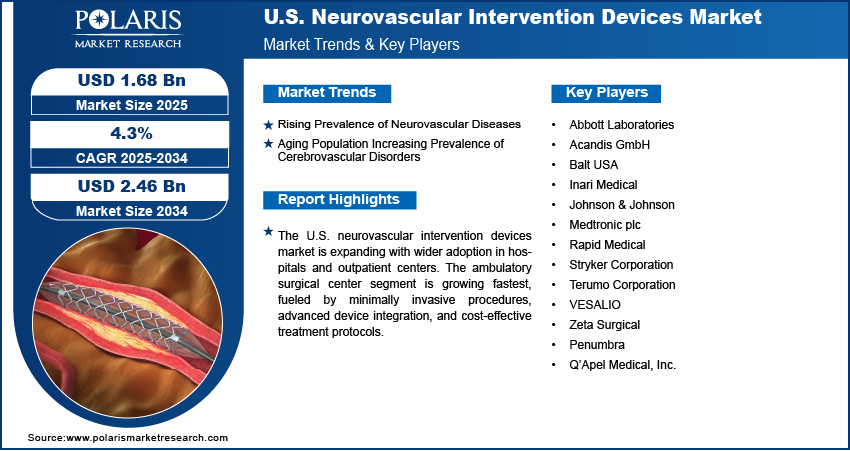

The U.S. neurovascular intervention devices market size was valued at USD 1.61 billion in 2024, growing at a CAGR of 4.3% during 2025–2034. Rising prevalence of neurovascular diseases coupled with the aging populations is driving demand for neurovascular intervention devices in the U.S.

Key Insights

- The embolic coils segment dominated the U.S. neurovascular intervention devices market share in 2024, driven by its proven efficacy in treating intracranial aneurysms and vascular malformations, high clinical adoption, and favorable reimbursement policies.

- The ambulatory surgical centers are projected to grow at the fastest CAGR, fueled by rising preference for minimally invasive surgery, shorter patient recovery times, and increasing adoption of advanced neurointervention technologies.

Industry Dynamics

- Rising prevalence of neurovascular diseases, including ischemic stroke and intracranial aneurysms, is driving demand for neurovascular intervention devices.

- Aging population is increasing the incidence of cerebrovascular disorders, further boosting market growth in the U.S.

- Development of next-generation devices and integration of robotic-assisted platforms create growth opportunities in complex interventions.

- High device costs and procedural complexity are restraining widespread adoption and limiting market expansion.

Market Statistics

- 2024 Market Size: USD 1.61 Billion

- 2034 Projected Market Size: USD 2.46 Billion

- CAGR (2025–2034): 4.3%

The U.S. neurovascular intervention devices industry is driven by increasing prevalence of ischemic stroke, intracranial aneurysms, and other cerebrovascular disorders. These devices, including stents, coils, thrombectomy systems, embolic protection devices, and flow diverters, enable precise navigation and targeted therapy within complex neurovascular networks. Manufacturers are investing in advanced imaging technologies, minimally invasive delivery systems, and device miniaturization to improve procedural accuracy and reduce patient recovery time. Regulatory approvals, including FDA clearance, ensure product safety and performance, pushing adoption across hospitals and specialty clinics.

Rising demand for minimally invasive procedures and technologically advanced treatment options is expanding applications in acute stroke management, aneurysm repair, and vascular malformation treatments. Device innovations, such as enhanced biocompatible coatings, improved thrombectomy catheters, and flow-diversion systems, are improving procedural outcomes and safety. Hospitals are integrating robotic-assisted platforms and digital planning tools to support complex interventions, streamline device selection, and ensure timely patient care while controlling procedural costs.

Federal healthcare initiatives and infrastructure investments are supporting the growth of neurovascular intervention services. According to the U.S. Centers for Medicare & Medicaid Services, healthcare spending in the U.S. increased by 7.5% in 2023, reaching USD 4.9 trillion or USD 14,570 per person, representing 17.6% of the country’s GDP. Expanding outpatient neurointervention centers, coupled with rising awareness of early stroke treatment and preventive care, is driving hospital adoption of neurovascular devices. Focus on sustainable and cost-effective treatment protocols is promoting the use of durable, reusable, and efficient devices. Growing focus on precision medicine and compliance with clinical guidelines is positioning neurovascular intervention devices as a critical component in modern cerebrovascular care.

Drivers & Opportunities

Rising prevalence of neurovascular diseases: The increasing incidence of neurovascular diseases, including ischemic stroke, intracranial aneurysms, and vascular malformations, is a key driver for the U.S. neurovascular intervention devices market. The American Heart Association reports that over 795,000 people in the U.S. have a stroke each year, and about 87% of these are ischemic strokes caused by blocked blood flow to the brain. Growing risk factors such as hypertension, diabetes, obesity, and sedentary lifestyles are contributing to higher disease prevalence. This trend is pushing hospitals and specialty clinics to adopt advanced intervention devices, such as stents, coils, thrombectomy systems, and flow diverters, to improve patient outcomes. Rising awareness among clinicians and patients regarding early diagnosis and timely intervention is further accelerating device adoption, supporting sustained market growth across acute and preventive care settings.

Aging population increasing prevalence of cerebrovascular disorders: The aging population in the U.S. is significantly increasing the prevalence of cerebrovascular disorders, including stroke and aneurysms, driving demand for neurovascular intervention devices. According to the U.S. Census Bureau, the population of Americans aged 65 and older is projected to rise from 54 million in 2020 to 80 million by 2040, more than doubling over the next 40 years. Older adults are more susceptible to vascular degeneration, hypertension, and other comorbidities that elevate the risk of neurovascular complications. This demographic shift is pushing healthcare providers to expand neurointervention services, invest in minimally invasive devices, and adopt advanced imaging and robotic-assisted platforms for precise procedures. As the proportion of elderly patients rises, the need for reliable, safe, and effective intervention devices grows, positioning the market for sustained expansion in hospitals and specialized outpatient centers.

Segmental Insights

Product Analysis

Based on product, the segmentation includes embolic coils, carotid stents, intracranial stents, neurovascular thrombectomy, embolic protection devices, flow diverters devices, intrasaccular devices, liquid embolic, balloons, and stent retrievers. The embolic coils segment dominated the U.S. neurovascular intervention devices market in 2024, due to the high adoption is driven by their proven efficacy in treating intracranial aneurysms and vascular malformations. For instance, in July 2025, Radical Catheter Technologies’ 8-F Radical guide catheter introduced strong flexibility and support in initial Mount Sinai trials, allowing complex neurovascular procedures without an intermediate catheter. Moreover, the growing advancements in coil materials, such as platinum and bioactive coatings is improving occlusion rates and patient safety. Thus, there is a widespread clinical acceptance and strong reimbursement policies contribute to its sustained market leadership.

The flow diverter devices segment is projected to register the fastest CAGR during the forecast period. This is due to the rising use in complex intracranial aneurysm management, combined with technological advancements improving flexibility and flow diversion efficiency is driving the flow diverter devices adoption. Moreover, the increasing awareness among clinicians about minimally invasive aneurysm repair and favorable procedural outcomes support rapid market expansion for these devices.

Technique Analysis

Based on technique, the segmentation includes neurothrombectomy procedure, cerebral angiography, stenting, coiling procedures, and flow disruption. The neurothrombectomy procedure segment dominated the market in 2024, due to the rising prevalence of ischemic stroke and the need for rapid vessel recanalization. Also, the growing adoption of advanced mechanical thrombectomy devices and improved imaging systems enhanced procedural precision and patient outcomes. Additionally, the rapidly increasing hospital investments and standardized stroke treatment protocols are supporting continued revenue growth for this segment.

The flow disruption segment is projected to grow at the fastest rate during the forecast period. This is due to the growing clinical application in treating wide-neck aneurysms and complex vascular malformations is driving demand. In addition, the growing innovations in flow disruption devices, such as adjustable scaffolds and minimally invasive designs are improving treatment safety and efficacy. Additionally, rapidly rising awareness among neurointervention specialists is further accelerating adoption.

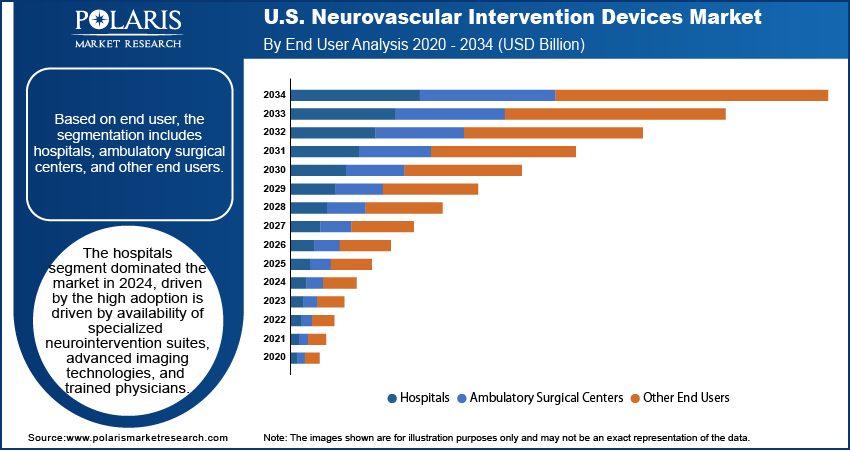

End User Analysis

Based on end user, the segmentation includes hospitals, ambulatory surgical centers, and other end users. The hospitals segment dominated the market in 2024, driven by the high adoption is driven by availability of specialized neurointervention suites, advanced imaging technologies, and trained physicians. Furthermore, the hospitals manage complex stroke and aneurysm cases, ensuring optimal device utilization. Additionally, the rapidly expanding inpatient and outpatient services, along with insurance coverage, continues to support consistent revenue growth.

The ambulatory surgical centers segment is projected to grow at the fastest CAGR during the forecast period, due to the rising preference for minimally invasive neurovascular procedures, shorter patient recovery times, and lower procedural costs are driving adoption. Moreover, the expanding investment in advanced imaging and neurointervention technologies is enabling centers to handle complex cases, creating a high-growth opportunity for device manufacturers targeting outpatient care.

Key Players & Competitive Analysis Report

The U.S. neurovascular intervention devices industry is moderately competitive, driven by growing demand from stroke management, aneurysm repair, and vascular malformation treatments. Leading manufacturers are focusing on advanced device technologies, biocompatible coatings, and strong distribution networks to meet hospital and specialty clinic requirements. Competitive positioning is influenced by investments in robotic-assisted platforms, next-generation flow diverters, and minimally invasive device development. Companies are improving operational efficiency through digital planning tools, integrated inventory systems, and streamlined procedural workflows. Strategic collaborations with hospitals and neurointervention specialists are supporting wider market access, while regulatory compliance and safety-focused innovations enhance clinical adoption.

Key companies in the U.S. neurovascular intervention devices industry include Medtronic plc, Stryker Corporation, Penumbra, Q’Apel Medical, Inc., Johnson & Johnson, Terumo Corporation, Abbott Laboratories, Balt USA, Rapid Medical, VESALIO, Acandis GmbH, Inari Medical, and Zeta Surgical.

Key Players

- Abbott Laboratories

- Acandis GmbH

- Balt USA

- Inari Medical

- Johnson & Johnson

- Medtronic plc

- Rapid Medical

- Stryker Corporation

- Terumo Corporation

- VESALIO

- Zeta Surgical

- Penumbra

- Q’Apel Medical, Inc.

Industry Developments

July 2025: Q’Apel Medical’s Zebra Neurovascular Access System received FDA clearance. It comes in 6-F and 7-F sizes, designed for flexible and supported delivery of interventional devices in complex neurovascular anatomy.

June 2025: Stryker launched the AXS Lift Intracranial Base Catheter, a single device that improves neurovascular procedures by providing stable access and supporting multiple therapies.

U.S. Neurovascular Intervention Devices Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Embolic Coils

- Carotid Stents

- Intracranial Stents

- Neurovascular Thrombectomy

- Embolic Protection Devices

- Flow Diverters Devices

- Intrasaccular Devices

- Liquid Embolic

- Balloons

- Stent Retrievers

By Technique Outlook (Revenue, USD Billion, 2020–2034)

- Neurothrombectomy Procedure

- Cerebral Angiography

- Stenting

- Coiling Procedures

- Flow Disruption

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Ambulatory Surgical Centers

- Other End Users

U.S. Neurovascular Intervention Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.61 Billion |

|

Market Size in 2025 |

USD 1.68 Billion |

|

Revenue Forecast by 2034 |

USD 2.46 Billion |

|

CAGR |

4.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 1.61 billion in 2024 and is projected to grow to USD 2.46 billion by 2034.

The U.S. market is projected to register a CAGR of 4.3% during the forecast period.

A few of the key players in the market are Medtronic plc, Stryker Corporation, Penumbra, Q’Apel Medical, Inc., Johnson & Johnson, Terumo Corporation, Abbott Laboratories, Balt USA, Rapid Medical, VESALIO, Acandis GmbH, Inari Medical, and Zeta Surgical.

The embolic coils segment dominated the market in 2024, driven by its proven efficacy in treating intracranial aneurysms and vascular malformations, along with strong clinical adoption and favorable reimbursement policies.

Ambulatory surgical centers are projected to grow at the fastest CAGR, due to rising preference for minimally invasive procedures, shorter patient recovery times, and adoption of advanced neurointervention technologies.