U.S. Next-Generation Sequencing Library Preparation Market Size, Share, Trends, Industry Analysis Report

By Sequencing Type (Targeted Genome Sequencing, Whole Genome Sequencing), By Product, By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5946

- Base Year: 2024

- Historical Data: 2020-2023

Overview

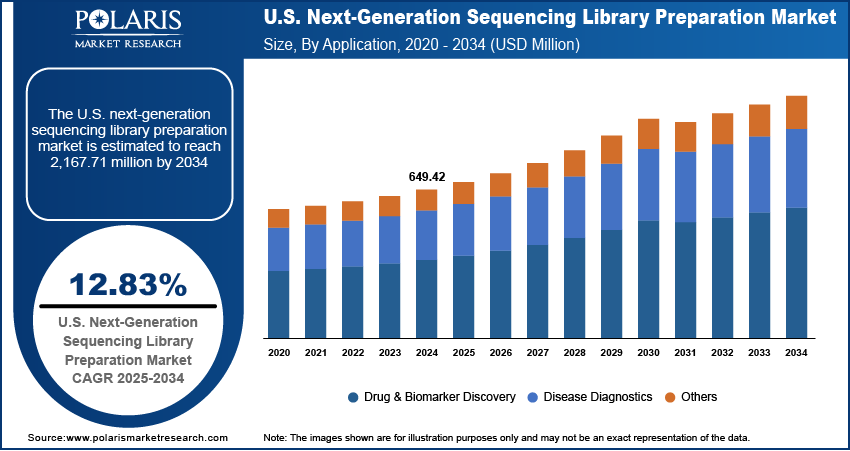

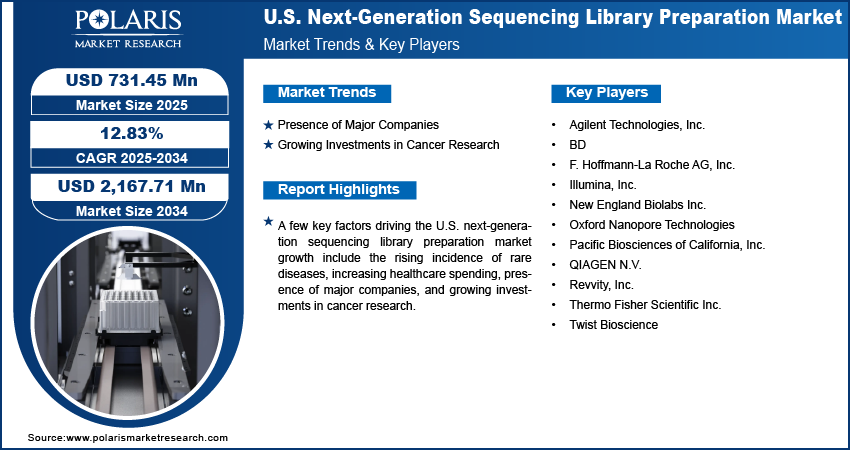

The U.S. next-generation sequencing library preparation market size was valued at USD 649.42 million in 2024, growing at a CAGR of 12.83% during 2025–2034. Key factors driving demand for next-generation sequencing library preparation in the U.S. include rising incidence of rare diseases, increasing healthcare spending, presence of major companies, and growing investments in cancer research.

Key Insight

- The targeted genome sequencing segment accounted for 63.37% of revenue market share in 2024.

- The whole genome sequencing segment is projected to hold a substantial share in the coming years.

- The reagents & consumables segment dominated the market share in 2024.

- The drug & biomarker discovery segment held the largest revenue share in 2024.

- The academic and research institutions segment accounted for 37.83% of revenue market share in 2024.

Next-generation sequencing library preparation is the essential step in transforming DNA or RNA samples into a format compatible with high-throughput sequencing technologies. It is base for a wide range of applications: in genomics, it enables whole genome and targeted sequencing for variant detection and population studies; in transcriptomics, it supports RNA sequencing for gene expression profiling; in epigenomics, it facilitates the study of DNA methylation and histone modifications; and in metagenomics, it allows for the analysis of complex microbial communities.

The rising incidence of rare diseases is driving the U.S. next-generation sequencing library preparation market growth. The United States Food and Drug Administration, in its report, stated that over 7,000 rare diseases affect more than 30 million people in the U.S. This is driving healthcare systems and biotech companies in the country to prioritize next-generation sequencing library preparation, which streamlines workflows, enhances sequencing efficiency, and supports personalized medicine approaches for patients affected by rare diseases. Therefore, the increasing incidence of rare diseases is driving the U.S. next-generation sequencing library preparation market expansion.

The U.S. next-generation sequencing library preparation market demand is driven by the increasing healthcare spending. The American Medical Association, in its article, stated that health spending in the U.S. increased by 7.5% and reached $4.9 trillion in 2023. This increasing funding enables healthcare providers to adopt next-generation sequencing for precision medicine, cancer profiling, and rare disease diagnosis, all of which require efficient library preparation for accurate sequencing. Additionally, rising healthcare spending is supporting biotech firms in developing cost-effective library prep kits, further fueling market growth.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

- The presence of major companies such as Illumina, Inc. and Thermo Fisher Scientific Inc. in the U.S. is driving the market growth by expanding their distribution networks.

- The growing investments in cancer research in the U.S. fuel the adoption of next-generation sequencing library preparation solutions.

- The expanding precision medicine initiatives are expected to create lucrative market opportunities during the forecast period.

- The high costs of library preparation kits, particularly for complex or high-throughput projects, are hindering market growth.

Presence of Major Companies:

Companies such as Illumina, Inc., Thermo Fisher Scientific Inc., Agilent Technologies, Inc., and others are investing heavily in R&D to develop advanced library preparation kits that enhance sequencing accuracy, speed, and cost-efficiency, making next-generation sequencing more attractive to laboratories and hospitals. These companies are also expanding their global distribution networks, ensuring easier access to high-quality reagents and automated systems, which, in turn, leads to market growth.

The strong brand recognition and established customer base of these companies further encourage wider adoption of next-generation sequencing library preparation, particularly in clinical diagnostics and pharmaceutical research. Additionally, these players continually engage in collaborations, and mergers and acquisitions to expand their product portfolios, further fueling the U.S. next-generation sequencing library preparation market growth.

Growing Investments in Cancer Research:

Researchers involved in cancer research increasingly rely on next-generation sequencing to uncover genetic drivers of cancer progression, which requires efficient library preparation solutions to ensure accurate and reproducible sequencing results. Funding from governments, private investors, and nonprofit organizations is supporting large-scale cancer research, expanding the adoption of NGS technologies and library preparation solutions. Therefore, as investments in cancer research increases, the demand for reliable, scalable library preparation grows, enabling breakthroughs in diagnostics and personalized cancer treatments.

Segmental Insights

Sequencing Type Analysis

Based on sequencing type, the segmentation includes targeted genome sequencing, whole genome sequencing, whole exome sequencing, and others. The targeted genome sequencing segment accounted for 63.37% of revenue market share in 2024. Clinical researchers and diagnostic laboratories favored this approach due to its cost-effectiveness, high accuracy, and efficiency in identifying specific genetic variants associated with inherited diseases and cancers. Targeted sequencing allowed them to focus on particular regions of interest within the genome, significantly reducing data analysis time and storage costs while enhancing sensitivity for rare mutations. The increasing adoption of precision medicine, coupled with the growing prevalence of cancer and rare genetic disorders, further supported demand for targeted genome sequencing. Moreover, the widespread use of gene panels in clinical diagnostics and the development of companion diagnostics by pharmaceutical companies propelled their dominance in 2024.

The whole genome sequencing segment is projected to hold a substantial share in the coming years, owing to advancements in sequencing technologies and declining costs. Unlike targeted approaches, WGS provides comprehensive insights into an individual’s entire genetic code, enabling broader discovery of mutations, structural variants, and epigenetic changes. This comprehensive nature supports its increasing application in personalized medicine, population genomics, and infectious disease surveillance. Government initiatives promoting large-scale genomic projects and increasing investments in translational research are further projected to propel the adoption of whole genome sequencing.

Product Analysis

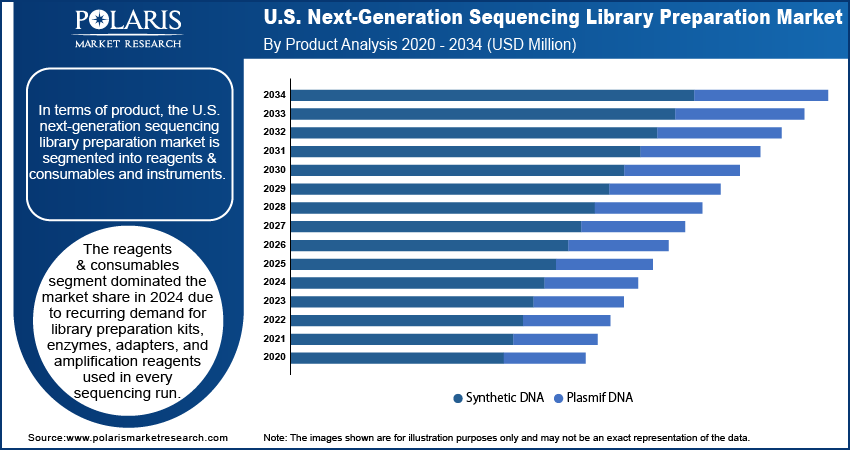

In terms of product, the segmentation includes reagents & consumables and instruments. The reagents & consumables segment dominated the market share in 2024 due to recurring demand for library preparation kits, enzymes, adapters, and amplification reagents used in every sequencing run. Researchers and clinical laboratories across the U.S. consistently utilized reagents & consumables for a wide range of genomic applications, including oncology, rare disease diagnostics, and infectious disease surveillance. Moreover, the increasing adoption of next-generation sequencing in the clinical space fueled the demand for specialized consumables made for clinical-grade library preparation.

Application Analysis

In terms of application, the segmentation includes drug & biomarker discovery, disease diagnostics, and others. The drug & biomarker discovery segment held the largest revenue share in 2024 due to the crucial role of next-generation sequencing library preparation in precision medicine and pharmaceutical research. Drug developers increasingly leveraged NGS technologies to identify novel biomarkers, stratify patient populations, and accelerate the development of targeted therapies. Moreover, the expansion of immuno-oncology and cell and gene therapy has intensified the need for high-throughput, accurate sequencing tools that enable comprehensive genomic profiling. Collaborations between biotech firms, research institutions, and sequencing technology providers further drove investments in biomarker discovery, securing the segment’s dominant position.

By End Use Analysis

In terms of end use, the segmentation includes hospitals and clinics, academic and research institutions, pharmaceutical and biotechnology companies, and others. The academic and research institutions segment accounted for 37.83% of revenue market share in 2024 due to strong federal and private funding for genomics research and large-scale sequencing projects. Universities and research centers across the U.S. continued to invest in next-generation sequencing to advance studies in oncology, rare genetic disorders, infectious diseases, and evolutionary biology. These institutions played a crucial role in developing novel sequencing techniques and optimizing library preparation protocols for diverse applications. The growing emphasis on translational research and multi-omics integration further propelled the demand for flexible, high-throughput library preparation workflows within academic research institutions.

Key Players and Competitive Analysis

The U.S. next-generation sequencing (NGS) library preparation market is highly competitive, driven by increasing demand for precision medicine, oncology research, and clinical diagnostics. Key players in this industry offer innovative solutions to improve workflow efficiency, reduce bias, and enhance sequencing accuracy. The competitive landscape is dominated by established life science companies, specialized sequencing firms, and emerging disruptors. Thermo Fisher Scientific Inc. and Illumina, Inc. lead the market with comprehensive NGS library prep solutions. Thermo Fisher’s Ion Torrent and Illumina’s Nextera kits are widely adopted due to their high-throughput capabilities and compatibility with their respective sequencing platforms. Both companies invest heavily in automation and streamlined workflows to maintain dominance. F. Hoffmann-La Roche AG competes through its acquisition of sequencing firm NimbleGen and offers robust library prep technologies, particularly in clinical applications. Similarly, Revvity, Inc. provides automated NGS library prep systems, catering to high-volume labs

A few major companies operating in the U.S. next-generation sequencing library preparation market include Agilent Technologies, Inc.; BD; F. Hoffmann-La Roche AG, Inc.; Illumina, Inc.; New England Biolabs Inc.; Oxford Nanopore Technologies; Pacific Biosciences of California, Inc.; QIAGEN N.V.; Revvity, Inc.; Thermo Fisher Scientific Inc.; and Twist Bioscience.

Key Players

- Agilent Technologies, Inc.

- BD

- F. Hoffmann-La Roche AG, Inc.

- Illumina, Inc.

- New England Biolabs Inc.

- Oxford Nanopore Technologies

- Pacific Biosciences of California, Inc.

- QIAGEN N.V.

- Revvity, Inc.

- Thermo Fisher Scientific Inc.

- Twist Bioscience

Industry Developments

April 2025: Watchmaker Genomics, in collaboration with Revvity, introduced fully automated and verified methods for all of its DNA and RNA library preparation kits on the Sciclone G3 NGSx liquid handling workstation.

February 2025: Twist Bioscience introduced the FlexPrep ultra-high-throughput library preparation kit for use in agrigenomics and population genomics.

U.S. Next-Generation Sequencing Library Preparation Market Segmentation

By Sequencing Type Outlook (Revenue, USD Million, 2020–2034)

- Targeted Genome Sequencing

- Whole Genome Sequencing

- Whole Exome Sequencing

- Other

By Product Outlook (Revenue, USD Million, 2020–2034)

- Reagents & Consumables

- DNA Library Preparation Kits

- RNA Library Preparation Kits

- Other

- Instruments

By Application Outlook (Revenue, USD Million, 2020–2034)

- Drug & Biomarker Discovery

- Disease Diagnostics

- Cancer Diagnostics

- Reproductive Health Diagnostics

- Infectious Disease Diagnostics

- Other

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals and Clinics

- Academic and Research Institutions

- Pharmaceutical and Biotechnology Companies

- Others

U.S. Next-Generation Sequencing Library Preparation Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 649.42 Million |

|

Market Size in 2025 |

USD 731.45 Million |

|

Revenue Forecast by 2034 |

USD 2,167.71 Million |

|

CAGR |

12.83% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 649.42 million in 2024 and is projected to grow to USD 2,167.71 million by 2034.

The market is projected to register a CAGR of 12.83% during the forecast period.

A few of the key players in the market are Agilent Technologies, Inc.; BD; F. Hoffmann-La Roche AG, Inc.; Illumina, Inc.; New England Biolabs Inc.; Oxford Nanopore Technologies; Pacific Biosciences of California, Inc.; QIAGEN N.V.; Revvity, Inc.; Thermo Fisher Scientific Inc.; and Twist Bioscience.

The reagents & consumables segment dominated the market share in 2024.

The whole genome sequencing segment is expected to witness the fastest growth during the forecast period.