U.S. Nutrigenomics Market Size, Share, Trends, Industry Analysis Report

By Application (Obesity, Cardiovascular Diseases, Cancer Research, Others), By Product, By Technique, By End Use – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM5959

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

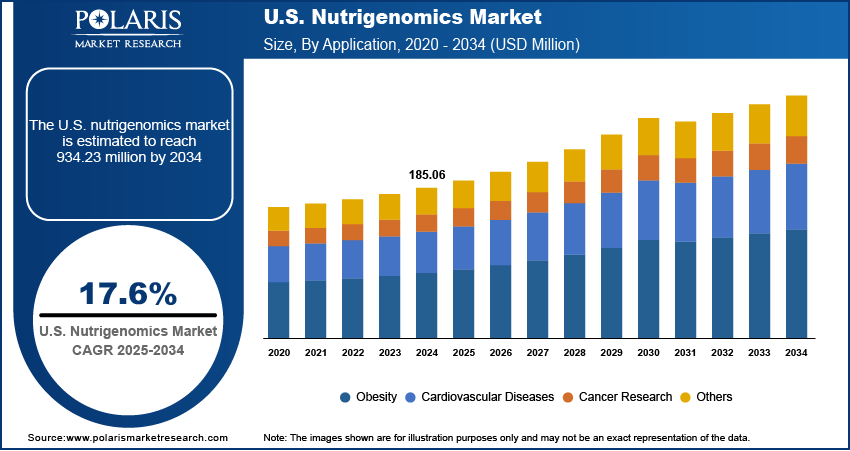

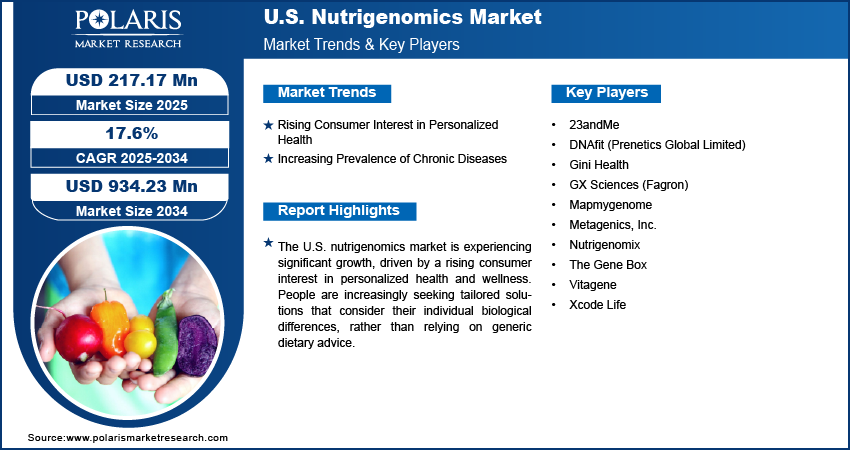

The U.S. nutrigenomics market size was valued at USD 185.06 million in 2024 and is anticipated to register a CAGR of 17.6% from 2025 to 2034. The U.S. nutrigenomics market is growing rapidly, driven by rising demand for personalized nutrition, increased consumer health awareness, advances in genetic testing technologies, and chronic disease prevention. Growing interest in gene-diet interactions fuels innovation in supplements, functional foods, and diagnostics.

Key Insights

- By application, the obesity segment held the largest share in 2024. This is driven by the widespread and increasing prevalence of obesity across the country, leading to strong consumer demand for personalized and effective weight management strategies that consider individual genetic variations.

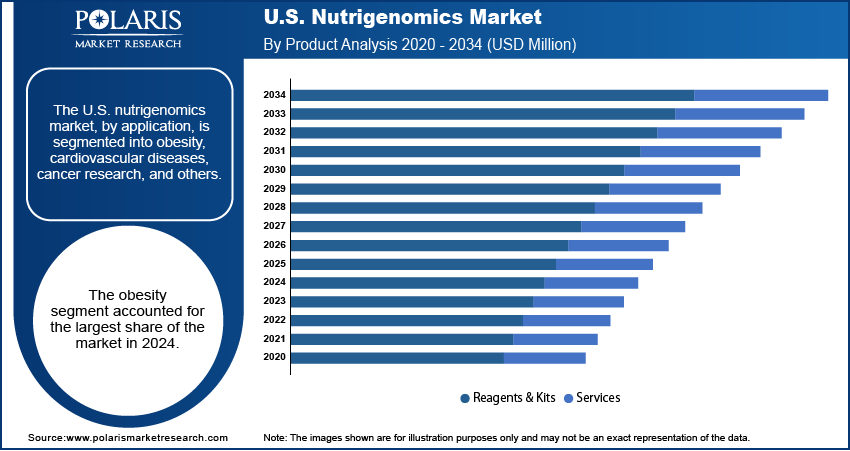

- By product, the reagents and kits segment held a larger share in 2024. These products are fundamental to performing genetic analysis, providing the necessary tools for extracting and preparing DNA samples, and are a crucial first step for any nutrigenomic study or personalized dietary recommendation.

- By technique, saliva collection held the largest share in 2024. Its noninvasive nature and ease of use, allowing for convenient at-home sample collection, have made it the preferred method for widespread genetic testing and accessibility for consumers.

- By end use, the hospitals and clinics segment held the largest share in 2024. These traditional healthcare settings provide a trusted environment for patients to receive personalized nutrition advice, integrating genetic insights with comprehensive medical histories and professional guidance.

The U.S. nutrigenomics sector focuses on how our genes and diet interact, aiming to create personalized nutritional advice for better health. This field uses genetic information to understand how a person's body responds to specific foods, supplements, and beverages.

Rapid progress in genetic testing technologies is a significant driver. Innovations such as next-generation sequencing (NGS) have made genetic analysis more efficient, accurate, and cost-effective. These advancements allow for comprehensive profiling of an individual's genetic makeup, providing a deeper understanding of how their genes interact with nutrients and influence health. The increasing accessibility of these technologies, including direct-to-consumer testing kits, is broadening the reach of nutrigenomics.

A steadily expanding base of scientific research and a deeper understanding of gene-nutrient interactions are also vital drivers for the market. As more studies are conducted, the scientific community gains clearer insights into how specific genes respond to dietary components, and how these interactions impact health and disease. It provides the necessary scientific validation for nutrigenomics, enhancing its credibility among healthcare professionals and consumers alike.

Industry Dynamics

- Rising consumer interest in personalized health and nutrition is a key factor driving demand for nutrigenomic-based products and services.

- The increasing prevalence of chronic diseases such as obesity, diabetes, and cardiovascular conditions is fueling the need for targeted dietary interventions.

- Advancements in genetic testing technologies have made it easier and more affordable for consumers to access DNA-based health insights.

- A growing body of scientific research and understanding in the field of nutrigenomics is strengthening its credibility and supporting market expansion.

Rising Consumer Interest in Personalized Health: There is a noticeable shift in consumer preferences toward health solutions that are tailored to their individual needs. People are becoming more proactive about their health and are seeking customized dietary advice rather than generic recommendations. This trend is fueled by a desire to optimize well-being and prevent health issues based on their unique biological makeup.

This growing demand is supported by studies highlighting the potential of personalized approaches. For example, a 2024 review titled "Personalized Nutrition: Tailoring Dietary Recommendations through Genetic Insights" published in PMC (PubMed Central) emphasizes how individual genetic profiles can guide tailored dietary recommendations, potentially optimizing health outcomes and managing chronic diseases more effectively. This strong interest in custom-fit health strategies propels the growth of the U.S. nutrigenomics market.

Increasing Prevalence of Chronic Diseases: The widespread prevalence of chronic diseases in the U.S. is a major factor boosting the U.S. nutrigenomics market expansion. Conditions such as heart disease, diabetes, chronic obstructive pulmonary disease, and obesity place a substantial burden on the healthcare system and individuals. There is a growing understanding that diet plays a critical role in the development and management of these long-term health issues. Nutrigenomics offers a promising avenue for prevention and personalized treatment by identifying gene-diet interactions that can influence disease risk.

According to data from the CDC, as reported in the Chronic Disease Indicators: 2022–2024 Refresh and Modernization of the Web Tool published in 2024, six out of 10 adults in the U.S. have one chronic disease, and four out of 10 have two or more. These chronic conditions account for a significant portion of the nation's annual healthcare costs. This alarming public health challenge underscores the critical need for advanced, personalized nutritional interventions, which are driving the expansion of the U.S. nutrigenomics market.

Segmental Insights

Application Analysis

Based on application, the U.S. nutrigenomics market segmentation includes obesity, cardiovascular diseases, cancer research, and others. The obesity segment held the largest share in 2024. Nutrigenomics offers a personalized approach to weight management by identifying how an individual's genetic makeup influences their metabolism, appetite, and response to different diets. This allows for the creation of highly customized nutrition plans that are more effective than generic advice. As people seek more effective and sustainable solutions for weight reduction, the application of nutrigenomics in addressing obesity continues to expand, contributing significantly to its dominant position.

The cancer research segment is anticipated to register the highest growth rate during the forecast period. This rapid expansion is driven by a growing understanding of the complex interplay between diet, genes, and cancer development. Researchers are increasingly using nutrigenomic principles to explore how specific nutrients or dietary patterns can influence gene expression related to cancer prevention, progression, and treatment outcomes. The immense potential for personalized dietary interventions to reduce cancer risk or support existing therapies is fueling substantial investments and innovation in this area. This focus on precision nutrition in oncology is poised to drive remarkable growth in the cancer research application of nutrigenomics.

Product Analysis

Based on product, the U.S. nutrigenomics market segmentation includes reagents & kits and services. The reagents & kits segment held a larger share in 2024. These products are essential for conducting the initial genetic tests required for nutrigenomic analysis. Reagents, such as DNA sequencing, extraction kits, and PCR reagents, and various testing kits are fundamental tools used by research institutions, diagnostic labs, and even direct-to-consumer companies to collect and process genetic samples. The increasing availability and ease of use of these kits, especially with the rise of at-home testing, contribute significantly to their dominant position. Consumers and healthcare providers rely on these foundational products to gather the genetic insights needed to develop personalized nutrition plans, thus solidifying their market share.

The services segment is anticipated to register a higher growth rate during the forecast period. This rapid expansion is driven by the growing need for expert interpretation of complex genetic data and the demand for personalized dietary counseling. While reagents and kits provide the raw genetic information, it's the services that translate this data into actionable, tailored nutrition plans and ongoing support. As the understanding of nutrigenomics becomes more sophisticated, so does the need for professional guidance, including genetic counseling, personalized diet planning, and long-term nutritional advice. This comprehensive support, which extends beyond just testing, is becoming increasingly valued by consumers seeking to truly integrate nutrigenomic insights into their health management, thereby propelling the services segment to strong growth.

Technique Analysis

Based on technique, the segmentation includes saliva, buccal swab, and blood. The saliva segment held the largest share in 2024. This method is highly preferred due to its noninvasive nature and ease of collection, making it a comfortable option for consumers. Individuals can often provide a saliva sample at home without needing a healthcare professional, which significantly increases accessibility and convenience. The simplicity of saliva collection also reduces logistical challenges for companies offering nutrigenomics services. The broad adoption of at-home genetic testing kits, which primarily rely on saliva samples, further solidifies its leading position in the market.

The blood sample collection technique segment is anticipated to register the highest growth rate during the forecast period. While blood collection is more invasive than saliva or buccal swabs, it provides a higher yield of high-quality DNA, which is often crucial for more comprehensive and in-depth genetic analysis. As nutrigenomics research advances and seeks more precise insights into gene-diet interactions, the need for robust and ample genetic material becomes more critical. This demand for detailed genomic information, especially for complex health conditions and advanced research, is driving the increased adoption of blood samples, positioning it as the fastest-growing segment in the coming years.

End Use Analysis

Based on end use, the segmentation includes hospitals & clinics and others. The hospitals & clinics segment held the largest share in 2024. This dominance stems from the fact that a significant portion of genetic testing and personalized nutrition counseling is integrated into traditional healthcare settings. Hospitals and clinics offer a trusted environment for patients seeking advice on their health and diet, often under the guidance of medical professionals. The ability to combine genetic insights with a patient's full medical history, along with access to specialized equipment and trained staff, makes these facilities a primary point of contact for nutrigenomics services. As awareness of nutrigenomics grows among healthcare providers, more conventional medical practices are incorporating these services, further solidifying the leading position of hospitals and clinics in the market.

The others segment, which primarily includes online platforms and direct-to-consumer services, is anticipated to grow at the highest growth rate during the forecast period. This rapid expansion is driven by the increasing consumer preference for convenience and accessibility in health-related services. Online platforms allow individuals to access genetic testing kits, receive personalized reports, and even connect with nutritionists remotely, all from the comfort of their homes. The ease of ordering tests online, coupled with competitive pricing and targeted marketing, appeals to a broad consumer base interested in personalized health insights without needing a traditional clinic visit. This shift toward digital healthcare solutions and self-empowered health management propels the rapid growth of the diverse segment.

Key Players and Competitive Insights

The U.S. nutrigenomics market is highly competitive, featuring both established biotechnology firms and agile startups. Key players such as Nutrigenomix, 23andMe, DNAfit, GX Sciences, Metagenics, Xcode Life, and Vitagene are actively shaping the landscape. Competition revolves around the accuracy and comprehensiveness of genetic tests, the actionable insights provided, and the level of personalized support offered. Companies are also competing on accessibility, with many offering direct-to-consumer services alongside partnerships with healthcare professionals. This dynamic environment encourages continuous innovation in testing methodologies and the development of more sophisticated personalized nutrition recommendations, pushing the boundaries of what nutrigenomics can offer to consumers and practitioners.

A few prominent companies in the industry include Nutrigenomix, 23andMe, DNAfit (Prenetics Global Limited), GX Sciences (Fagron), Metagenics, Inc., Xcode Life, Vitagene, Mapmygenome, Gini Health, and The Gene Box.

Key Players

- 23andMe

- DNAfit (Prenetics Global Limited)

- Gini Health

- GX Sciences (Fagron)

- Mapmygenome

- Metagenics (Metagenics, Inc.)

- Nutrigenomix

- The Gene Box

- Vitagene

- Xcode Life

Industry Developments

June 2025: 23andMe Holding Co. announced a definitive agreement for the sale of its business to TTAM Research Institute, a nonprofit public benefit corporation.

U.S. Nutrigenomics Market Segmentation

By Application Outlook (Revenue – USD Million, 2020–2034)

- Obesity

- Cardiovascular Diseases

- Cancer Research

- Others

By Product Outlook (Revenue – USD Million, 2020–2034)

- Reagents & Kits

- Services

By Technique Outlook (Revenue – USD Million, 2020–2034)

- Saliva

- Buccal Swab

- Blood

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Hospitals & Clinics

- Others

U.S. Nutrigenomics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 185.06 million |

|

Market Size in 2025 |

USD 217.17 million |

|

Revenue Forecast by 2034 |

USD 934.23 million |

|

CAGR |

17.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 185.06 million in 2024 and is projected to grow to USD 934.23 million by 2034.

The market is projected to register a CAGR of 17.6% during the forecast period.

A few key players in the market include Nutrigenomix, 23andMe, DNAfit (Prenetics Global Limited), GX Sciences (Fagron), Metagenics, Inc., Xcode Life, Vitagene, Mapmygenome, Gini Health, and The Gene Box.

The obesity segment accounted for the largest share of the market in 2024.

The services segment is expected to witness the fastest growth during the forecast period.